India’s DEMONetization: An Ethics Analysis

By: Vilasini Pollisetty

What is Demonetization?

Demonetization strips a currency of its status as legal tender. Government pulls the present form of notes or coins from circulation and replaces them with new ones. Any form of the old currency becomes invalid[1].

A government takes this step with an aim to correcting a specific unwanted economic condition. That condition may be corruption and excessive use of black money in the country, improper payment of taxes by citizens, or terror financing.

Demonetization In India:

1. Speech By Modi[2]

During the evening of November 8, 2016 Prime Minister Narendra Modi through his televised address[3]to the nation announced India’s demonetization move. In his speech Modi ji starts off by recalling the economic situation in India in May of 2014 and how it was said the “I” in BRICS was in a rather shaky position.

He praises the citizens of India for working hard and bringing India to a “bright spot” in the global economy in the two years (2014-2016) following these accusations. He reminds the citizens of the country his government’s motto has always been, “Sab ka Saath Sab ka Vikas[4]”, which translates to, “We are with all citizens and aim for development of all citizens”. Modi ji gives examples of the Pradhan Mantri Jan Dhan Yojana[5], the Jan Suraksha Yojana[6], the Pradhan Mantri Mudra Yojana[7](schemes introduced by the Modi government to benefit citizens) as small enterprises reflecting this approach.

He goes on to speak about the growth of black money in the country and how there has not been improvement in combatting this problem. In light of this, he states there will come a time in the history of every country’s development when there will be a need to take a strong and decisive step. After making this statement Modi ji announces that currency notes of Rupees Five Hundred (Rs.500 equivalent to about US$7) and Rupees Thousand (Rs.1000 equivalent to about US$14) shall no longer remain legal tender from midnight of 8 November 2016. These notes become worthless pieces of paper.

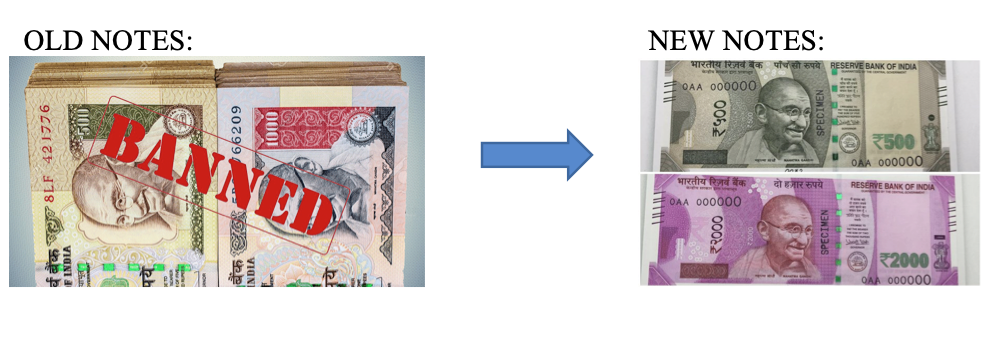

2. Currency Notes in India Before and After Demonetization

Before India’s demonetization:

Notes of Rupees: 1, 2, 5, 10, 20, 50, 100, 500, 1000

After India’s demonetization:

Notes of Rupees: 1, 2, 5, 10, 20, 50, 100, 200, new 500, 2000

There were no changes made to coins after India’s demonetization and all other notes remain valid.

3. Rationale for Demonetization

The primary reason the Modi government demonetized some notes was to curtail black money circulation. Corrupt individuals use hawala transactions to avoid paying tax, finance terror, counter effects of inflation, and pay bribes to government officials.

The country had taken steps earlier:

- A law passed in 2015 for disclosure of foreign money- The Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015[8].

- Agreements with many countries, including the United States of America, for sharing information and more transparency[9].

- A law from August 2016 to curb Benami transactions[10]-The Benami Transactions (Prohibition) Amendment Act,2016[11].

- An amnesty scheme for declaring black money after paying a penalty- Income declaration scheme, 2016[12].

However, these steps were not effective in fighting black money on a large-scale. In his speech Modi mentioned that since the implementation of new legislation and schemes the country managed to only move from 100 to 76 on the global corruption perception rankings.

4. Instant Effects of Demonetization in India

Modi’s announcement shook the entire nation. Turning on the 9PM news is routine for a majority of Indian citizens. A sudden declaration of demonetizing the currency notes of highest value in the country is not something anybody expects to hear. The Modi government had done an admirable job of keeping this change a secret until the formal announcement.

Modi declared that on November 9, 2016 banks would be closed, in preparation for the following days of currency exchange by citizens.

From November 10, 2016 chaos ensued. There was a sudden standstill of all transactions involving the payment of money. People lined up outside banks in extensive queues, waiting for hours to get the initial few thousands they were allowed to exchange. ATMs kept running out of cash. Some even protested, but it would not make a difference. They too would soon have to line up outside a bank to exchange their currency.

5. How The Process Was Carried Out

In an attempt to minimise difficulties in the following days, the government ensured the following steps were taken. [15]

1. Persons holding old notes of 500 or 1000 rupees could deposit these notes in their bank or post office accounts from 10th November till close of banking hours on 30th December 2016 without any limit.

2. There were 50 days to deposit notes.

3. After depositing money in an account, the account holder could withdraw funds as needed.

4. Bearing in mind the supply of new notes in the first few days, the government allowed a limit of 10,000 rupees per day and 20,000 rupees per week to be exchanged at banks. This limit would subsequently be increased.

5. For immediate needs, people could go to any bank or post office, show proof of identity such as an Aadhaar card, voter card, ration card, passport, PAN (Permanent Account number) card or other approved IDs, and exchange old five hundred or thousand rupee notes for new notes.

6. From 10th November till 24th November the limit for such exchange was 4000 rupees. From 25th November till 30th December, the limit was then increased.

7. People who, for some reason, were not able to deposit their old 500 or 1000 rupee notes by 30th December 2016 could go to specified offices of the Reserve Bank of India up to 31st March 2017 and deposit the notes after submitting a declaration form.

8. For withdrawing money from the ATM in the first few days, there was a limit of 2000 rupees per day per card. This was raised to 4000 rupees later.

9. 500 and 1000 rupee notes would not be legal tender from midnight November 8, 2016. However for humanitarian reasons, to reduce hardship to citizens, some special arrangements were made for the first 72 hours, that is till midnight on 11th November:

- During this period, government hospitals continued to accept five hundred and thousand rupee notes as payment.

- Pharmacies in government hospitals accepted these notes for the purchase of medicines with a doctor’s prescription.

- Railway ticket booking counters, ticket counters of government buses and airline ticket counters at airports accepted the old notes for ticket purchases.

- 72 hour old notes would be accepted even at:

- Petrol, diesel and CNG gas stations authorised by public sector oil companies

- Consumer co-operative stores authorised by State or Central Government

- Milk booths authorised by State governments

- Crematoria and burial grounds.

10. Arrangements would be made at international airports for arriving and departing passengers who had five hundred or thousand rupee notes of not more than 5000 rupees (US$70), to exchange them for new notes or other legal tender.

11. Foreign tourists were able to exchange foreign currency or old notes of not more than 5000 rupees into legal tender.

12. Lastly, during this entire exercise, there was no restriction of any kind on non-cash payments by cheques, demand drafts, debit or credit cards and electronic fund transfer.

6. Outcomes

According to reports from the Reserve Bank of India[16]99.3% of the demonetized currency notes were deposited back into the banks. Currency notes of Rupees 15.41 trillion had been demonetized out of which Rupees 15.30 trillion had been deposited back into the banks. Currency notes of only Rupees 10,720 billion were not deposited back. This implied very little black money was present in the system. While this inference was not true, it made the people question Modi’s demonetization move.

Ethics Analysis

Fairness

- The question arises if this transition from old currency to new currency was carried out in a fair and transparent manner. With the second highest population in the world, the overall transition to a new currency was as organized as it could have been. Without doubt, this step by the government caused enormous trouble to citizens.

- The efforts made by the government are noteworthy. Citizens were allowed a period of 50 days, from 10 November, 2016- 31 December, 2016 to exchange their old currency notes for new ones. For those who could not exchange their notes within this period, an extension of time was given until 31 March 2017.

- The Prime Minister was strategic and ensured the majority of citizens had bank accounts open before implementing demonetization. The “Pradhan Mantri Jan Dhan Yojana” was launched in August of 2014.

- The objective of “Pradhan Mantri Jan-Dhan Yojana (PMJDY)[17]“ is to ensure access to various financial services like availability of basic savings bank account, access to need based credit, remittances facility, insurance and pension to the excluded sections i.e. weaker sections & low income groups. This deep reach at affordable cost is possible only with effective use of technology.

- The scheme is a National Mission on Financial Inclusion encompassing an integrated approach to bring about comprehensive financial inclusion of all Indian households. The plan envisages universal access to banking facilities with at least one basic banking account for every household, financial literacy, access to credit, insurance and pension facility.

- In addition, the beneficiaries would get a RuPay Debit card having inbuilt accident insurance cover of Rupees onelakh. The plan also envisages channelling all Government benefits (from Centre / State / Local Body) to the beneficiaries accounts and pushing the Direct Benefits Transfer scheme[18]of the Union Government. Mobile transactions through telecom operators and their established centres as Cash Out Points are also planned for Financial Inclusion under the Scheme.

Survey of Two Individuals

A survey of two people, one in a lower income group (category 1) and another from an upper middle income group (category 2) helps in understanding perspectives on the ground.

- Individual in Category 1

This person spoke passionately against the entire process. He complained about the struggles of lining up outside the banks and waiting patiently for his turn to exchange currency. He pointed out that citizens were allowed to deposit any amount of money, but in exchange received only the permitted limit of new currency for that particular day. He felt the permitted limit was not sufficient for his family’s daily needs.

He was allowed to withdraw a maximum of 6,000 rupees a month, which was not enough. According to him there was another struggle that this category of people often faced: helping their friends and relatives who had no bank accounts. Friends and family without bank accounts often asked him to deposit their money in his account and later withdraw the money for them.

When asked if he saw any positives in this process, he said the only thing that made him feel happy was the lack of discrimination between people. Regardless of income group, an individual stood in the same queue, subject to the same rules.

- Individual in Category 2

As a professional in the manufacturing and development sector, this person said he faced struggles due to a shortage of cash, as he could not pay his daily wage labourers on time. He was most annoyed by the need to show proof for any money deposited in the bank. This category of person however, understood the reason for this move by the government and appreciated the benefits to the country over the long term.

India can be divided into different categories of people based on income. As with the person from category 1, the lower the income group the greater the difficulties. A question arises on whether their answers were influenced by the political party they supported.

The Super Wealthy Class and the JIO Conspiracy Theory

During this entire process, there was one group of people not significantly affected and who praised the move to demonetize. These people belonged to the extremely wealthy class. Speculations arose claiming the government had informed this category of people earlier about demonetization. This is where the “JIO” frenzy comes in play.

Reliance Jio network[19]was the new mobile network operator launched by Mukesh Ambani, chairman and managing director of Reliance Industries Limited, a Fortune Global 500 company and India’s most valuable company by market value. In an “off the record” conversation[20]secretly taped by the media, BJP MLA Bhawani Singh Rajawat revealed the big families of India like the Ambanis and many others were given hints of the demonetization earlier, so they could plan accordingly.

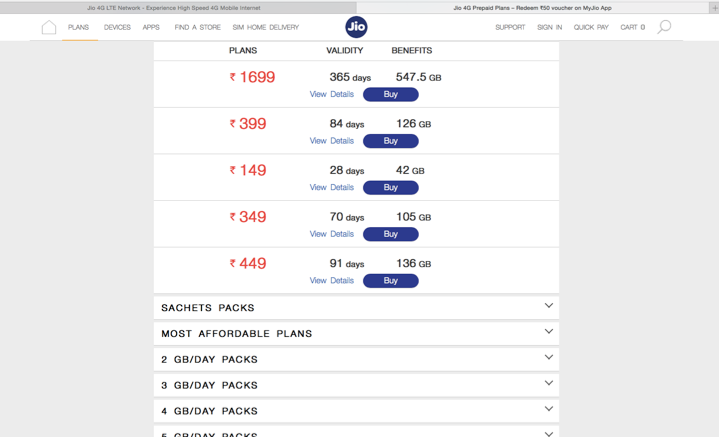

The launch of Jio was scheduled to be in 2015, but was postponed to 2016[21], a few months before the government announced demonetization. Jio offered affordable prices to its subscribers with a range of packages with unlimited talk time and significant amount of 4G data allowance.

People from around the country started switching to Jio. In a short span of time it became one of the largest network operators in India.

Social networking sites were filled with speculations that “Jio” was Ambani’s move to convert his black money before demonetization was announced. No significant people were questioned about this accusation but it remains a question in the minds of many.

Comments From Political Parties [22]:

India currently has a coalition government. Hence, when any kind of analysis is made regarding an issue, the comments and opinions from different political parties and leaders are significant.

Parties in Favor of India’s Demonetization Move

- BJP(Bhartiya Janata Party): Party president Amit Shah says the scheme will greatly benefit the economy, questions opposition motives.

- JD (U) (Janata Dal United): Bihar CM Nitish Kumar has “welcomed and supported” the decision.

- BJD(Biju Janata Dal): Odisha CM Naveen Patnaik has lauded the move calling it a ‘bold step’.

- TRS(Telangana Rashtra Samithi): Telangana CM KCR reportedly said that demonetisation is “a great thing” but is concerned about its impact on state revenue

- DMK(Dravida Munnetra Kazhagam): Party treasurer M K Stalin has welcomed the announcement but urged the central government to take immediate measures to offer relief to the common man

- NCP(Nationalist Congress Party): Party President Sharad Pawar said that the move will curb Black money and terror financing

Parties Against India’s Demonetization Move

- TMC(All India Trinamool Congress): West Bengal CM Mamata Banerjee calls the scheme a ‘big black scandal’.

- AAP(Aam Admi Party): Delhi CM Kejriwal has demanded a roll back of the scheme alleging that Modi’s friends knew of the scheme in advance

- Bahujan Samajh Party: Party chief Mayawati has accused Modi of indulging in “emotional blackmail” and termed the decision “immature” and “hurried”.

- The Indian National Congress is not completely against the move, but expressed its dislike towards the chaotic and hurried way it was implemented.

Utilitarian Approach

Utilitarianism is an ethical theory that determines right from wrong by focusing on outcomes. It is a form of consequentialism. Utilitarianism holds that the most ethical choice is the one that will produce the greatest good for the greatest number[23]. In a utilitarian approach it is possible for a positive outcome to be accepted even if an action is done with a bad motive.

Here are some of the short-term and long-term effects of India’s demonetization on various sectors in the economy:

Negative Outcomes

- Shortage of cash supply in the economy until the new currency notes are widely circulated in the market.

- Change in consumption behaviour due to reduction in disposable income. This causes the rate of capital growth formation to decrease, as no investments are taking place.

- Sections of society like households, daily wage earners, farmers, small scale industries, handicrafts, suffer because their day to day activities require liquid cash.

- Honest citizens had to stand in long lines repeatedly to collect their own hard earned money.

Positive Outcomes

- Less currency circulation brings inflation under control.

- The longer run impact on formal domestic remittances could be significant. Following up on major financial inclusion initiative (Jan Dhan Yojana) , this move is likely to drive a large segment of domestic remittances into formal channels. Estimates suggest that 70 percent of Indian domestic remittances were made through informal channels[24].

- The use of electronic payments is likely to increase. This helps to keep track of transactions by customers. This also helps reach the ultimate goal of a cashless economy.

- Accountability amongst citizens increases. For the first time people with undeclared cash face difficulties. To avoid punishment, citizens will become more diligent in declaring their assets and paying tax on them.

- Government revenue increases with more earnings being declared. This helps boost India’s development of infrastructure building, construction of roads, transportation facilities etc. This in turn gives rise to more employment.

In sum, the immediate consequences of India’s demonetization process were chaos, confusion, and hardship. Over the long run, positive outcomes of the scheme become more apparent. Thus, a rough calculation using the utilitarian approach suggests that Modi’s demonetization move was ethical.

[1]https://www.investopedia.com/terms/d/demonetization.asp

[3]https://www.youtube.com/watch?v=rn64Vf6GEoo&t=957s

[4]https://www.narendramodi.in/sabka-saath-sabkavikas-collective-efforts-inclusive-growth-3159

[5]https://www.pmjdy.gov.in/about

[6]http://www.jansuraksha.gov.in

[7]http://pmjandhanyojana.co.in/pradhan-mantri-mudra-yojana-bank/

[8]http://legislative.gov.in/sites/default/files/A2015-22.pdf

[10]Benami is essentially an Indian origin word which means holding in someone else’s or a fictitious name to cover up the identity of the beneficial owner. (http://www.arthapedia.in/index.php?title=Benami_Property).

Defined under Section 2(9) of the Benami Transactions (Prohibition) Amendment Act,2016

[11]http://www.prsindia.org/uploads/media/Benami/Benami%20Transactions%20Act,%202016.pdf

[12]https://incometaxindia.gov.in/booklets%20%20pamphlets/income-declaration-scheme-2016-english.pdf

[15]Supra note 2

[16]https://www.ndtv.com/india-news/over-99-per-cent-banned-notes-back-in-system-says-rbi-report-top-10-1908096

[17]https://www.pmjdy.gov.in/about

[19]https://economictimes.indiatimes.com/industry/telecom/reliance-jio-to-launch-commercial-operations-by-december-to-alter-telecom-industry-landscape-say-experts/articleshow/47649795.cms

[22]https://www.news18.com/news/india/demonetisation-move-here-are-the-parties-for-and-against-it-1311865.html

[23]https://ethicsunwrapped.utexas.edu/glossary/utilitarianism

[24]http://blogs.worldbank.org/peoplemove/demonetization-india-short-and-long-term-impact-remittances