Financial Ethics in Catholic Social Justice

By: Ryan Jang

Pope Francis’s document “Considerations for an ethical discernment regarding some aspects of the present economic-financial system,” (Document) from the Congregation for the Doctrine of the Faith and the Dicastery for Promoting Integral Human Development, lays out problems of the current economic-financial system and prescribes ways to fix them. The upshot of the Document is not markedly different from the position Seven Pillars Institute has always advocated. This perspective – putting purpose before profits, is increasingly popular in the market, and the subject of a recent report by Andrew Edgecliffe-Johnson in the Financial Times.

The Document suggests enhancement of numerous systems and methods now being used. For instance, to fix the favoring of capital dispersion, it suggests microcredit, public credit and cooperative credits. The Document touches upon the correct ways to use some of the current systems and regulations already in place. However, the main point this reading makes is ultimately, it is the morality of the people in the market that molds the system. Time and time again, readers are reminded of the “universal sacrament of salvation,” or “adequate ethics,” as they hold to the ideal system of regulations this publication provides.

Systematic Regulations

What is market power?

The Document presents the readers with a goal regarding power in the market: distribution of this power and its influence. There must be awareness that financial institutions have potential to harm the community if they pursue selfish goals and abuse power. The bad conduct to be aware of especially is proximate immortality, where one abuses the unfair advantage one has over the other. Thus, in the idealistic sense of the Document’s vision, every corporation should be on equal ground to a certain degree, to prevent one from overwhelming the other. This vision is not so distant from today’s standards, as it paraphrases Article 82 of the Treaty of the European Community (EC Treaty). In the treaty, it is stated that “any abuse by one or more undertakings of a dominant positionwithin the common market… shall be prohibited as incompatible with the common market.” The dominant position refers to the “position of economic strength enjoyed by an undertaking which enables it to prevent effective competition.”[1]

While not as thoroughly discussed, the Document concerns itself with not only market competition, but also the relationship between consumer and seller. It describes the vision to be one that surpasses and “surmounts” the “traditional principle of caveat emptor, the tendency to leave the responsibility of the quality of the product solely to the buyer.” The circumstance that this happens the most would be in the case of monopolies. The risk is in the “inferior quality” of a product, or reduction in the “rate of innovation”, and those harmed the most are the buyers.[2]

How to Prevent Dominant Positions

There is a need of good measurement in market power. Previously, in the U.S., there have been attempts to achieve this goal “through Horizontal Merger Guideline and indicia that roughly correspond to those identified in Brown Shoe.”[3] However, these are outdated sources of measurement, as the latest revision took place in 1997. For instance, in Christopher Pleatsikas and David Teece’s “The Analysis of Market Definition and Market Power in the Context of Rapid Innovation,” there are discussions of the limitations of such measurements. This is one of the examples of the lack of flexibility within regulations. In Pope Francis’s writing, there is a list of characteristics that regulations must follow to be “macro-prudential.” Simply having to follow a system when the markets are changing in unprecedented speed is not efficient. Not only would the regulations have to be updated as much as possible, but they also must be transparent to all consumers and competitors, adding on another reason to have a better standard of measurement of dominant positions.

Human Relations in Financial Industries

As important as regulations are, Pope Francis brings up a matter of human relations and human behavior as a catalyst for setting up the right kind of market. He also uses the analogy of a giant organism. With the right system and with fewer unreliable economic-financial instruments, a healthy economic organism that respects and promotes the human person leads to the common good. Thus, the right economic industry for the Pope is not the one with the most profits, but a more humanitarian one. First comes the correct attitude people must have in a market industry and then comes the right laws. For instance, even if regulations are set, if companies within the industry have negative judgement, they will simply try to bypass laws. However, with a positive perspective, companies would seek to “verify their effective correspondence with the principles that inform the current norms.” The question the Pope asks is what is immoral.

An immoral act is not one that pursues profit, but one with a tendency to “disregard an unfair advantage one has over others to abuse it.” In today’s society, words such as “competition”, “leadership” and “merit” have much stronger impact on people, than “common good”, “coexistence,” and “reciprocity.” As it is, the only way of looking at profit is through its numeric value. Naturally such a society is less likely to focus on the morality of its action than the easily calculated numeric coefficient. The Pope’s vision is to create a system beyond pure profit maximization and to have an environment that considers an individual more than as just a “consumer”.

Communion

To create such an economic system, we return to the origin of human interaction. Every human being is born into a familial environment with positive impacts. Applying the Christian idea of Communion, this environment causes people to not look at others as “competitors” but as possible allies. With this anthropological origin, a new definition of Profit arises, a Profit that does not fall short of the “common good” and integral wellbeing of the “entire person and every person.” Thus, this Profit does not look at trading as a purely materialistic action, but an action that consists of non-material things, such as “trust”, “equity”, and “cooperation.” One is not simply trading things, but also that which is Good.

Statistics of Ethics in Business Today

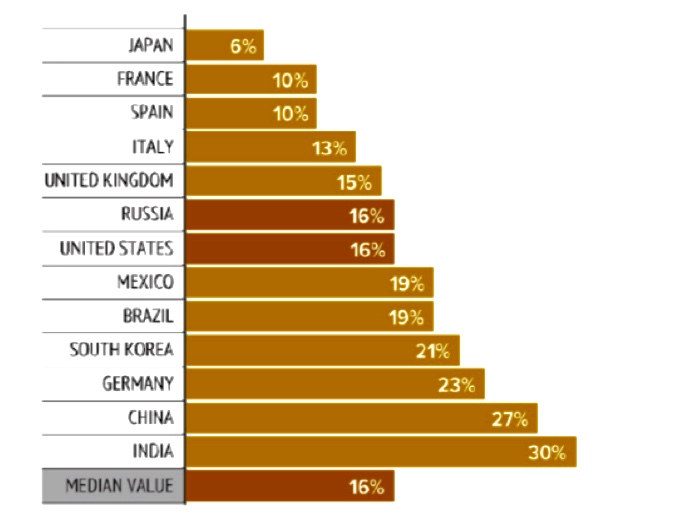

The first form of integrity in the market to be concerned about is the ethics of corporations themselves because “ad extra is congruent with ad intra.” Observing the ethics in corporations is a key way of analyzing the market itself. According to the “Ethics and Compliance Initiative (US)- 2016 Global Business Ethics Survey,” around 22% of companies feel the pressure to compromise organizational standards, 33% observed misconduct, 59% reported misconduct and 36% retaliated against reporters. In figure 1, the indication of misconduct within a company is listed globally, with India having the highest rate of 30% and Japan with the lowest rate of 5%.

Source: IBE

In the same survey, 39% of the respondents believe bribery takes place in their own country. Many also mention that justifying unethical behaviors is acceptable in an economic downturn.[4] In fact compared to the survey of 2014, there was an increase in companies doing less due diligence in 2016.

Relating such statistics to the Pope’s writing, a major fraction of the population agrees with the Pope’s views. 82% of respondents from the same survey agree that “human rights issues must be included strategically within their organization’s core business model.” Also, anti-corruption programs and policies are continuing to grow. Anti-corruption policies instituted by companies went up to 92% from 82% in 2014. The Foreign Corrupt Practices Act and Foreign Account Tax Compliance Act are reported to have influenced the behavior of corporations.

Purpose Before Profits

According to the Document, the duty of the people is to create and develop “well-being in all social, civil, and political realms.” Every human activity consists of potential to bear fruit and through this fruit, one recognizes the “divine invitation” to do good. Many will say this vision of an economic system is too idealistic. Numeric values are still considered more important than the well-being of others and dominant positions still do exist. However, as Edgecliffe-Johnson’s Financial Times piece points out, the Friedmanite world view is eroding, and corporations are more willing to put purpose before profits.

Editor: Dr. Kara Tan Bhala

Endnotes

[1] Massimiliano Vatiero, http://ec.europa.eu/competition/antitrust/art82/005.pdf

[2] Concurrences, https://www.concurrences.com/en/glossary-of-competition-terms/Dominant-position

[3] Christopher Pleatsikas and David Teece, http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.536.6281&rep=rep1&type=pdf

[4] Surveys on Business Ethics 2016 ( https://www.ibe.org.uk/userassets/briefings/b56_surveys2016.pdf