Case Study: FTX and Sam Bankman-Fried

By Shanaya Kapoor

1. Introduction

On November 6th, 2022, shockwaves rippled across the crypto industry. What first appeared to be an accounting oversight turned out to be a multi billion dollar fraud. FTX, which stands for ‘Futures Exchange’, was found complicit in a nefarious scandal following the actions of Sam Bankman-Fried (SBF), the CEO. Over the past decade, the company experienced significant growth, solidifying its position as one of the leading digital currency exchange platforms. FTX’s popularity grew as cryptocurrency investments surged. Customers were attracted to the convenience of having a personal digital wallet to securely store digital assets. Alternatively, customers could opt to create their own crypto wallets using software or hardware outside the platform. This success did not go unnoticed, and soon prominent venture capital firms began investing in the company.

However, FTX’s reign came to an end in November 2022 when billions of dollars were lost by customers and investors in a defrauding scandal orchestrated by Bankman-Fried. Regulators discovered customer funds went to accounts controlled by Alameda Research — a cryptocurrency trading firm owned by Sam Bankman-Fried, instead of FTX. After this revelation, FTX unraveled.

This case study documents the rise and fall of FTX, while simultaneously highlighting how this collapse was more than a case of traditional financial fraud. It explores the wider legal and market implications of the collapse with a focus on regulation and litigation in the European Union and the United States. Upon evaluating the ethical implications of the FTX collapse, the case study provides an account of the ripple effect the scandal created on everyday human relationships, with a specific focus on interpersonal trust. The case study concludes by highlighting the unethical conduct of FTX, its obvious fraudulent practices, lack of respect for truth, and disregard for interpersonal trust.

2. Facts of the Case

In May 2019, former Wall Street trader Sam Bankman-Fried (“SBF”) and ex-Google employee Gary Wang founded the ‘Futures Exchange’ (FTX Ltd.). The crypto exchange platform rapidly gained popularity as a cryptocurrency exchange due to its user-friendly interface, advanced trading tools, and wide range of supported cryptocurrencies. It differentiated itself by offering leveraged trading, futures contracts, and unique trading products.

2a. The Legend of Sam

Amidst this success, SBF emerged as a new leader in centralised cryptocurrency exchange. Formerly a trader at Jane Street, this curly-haired 30-year-old was everywhere in the crypto industry (Ossinger, 2022). He was hailed as the ‘golden boy’ of the crypto industry (Flitter & Yaffe-Bellany, 2022)

In 2017, Bankman-Fried, the son of Stanford University professors and a Massachusetts Institute of Technology graduate, made an amusing discovery while browsing CoinMarketCap.com. Occasionally, he observed a substantial 60% gap in the listed bitcoin prices. Upon noticing these drastic changes, he felt a strong urge to exploit this opportunity through arbitrage trading (Sigalos, 2022). This involved purchasing bitcoin on one exchange, then selling it back on another exchange, ultimately earning a profit equal to the price difference.

Following a month of experimentation in the market, SBF established his own trading firm, Alameda Research, which he named after his hometown in California. This move allowed him to fully capitalise on the opportunity and devote himself entirely to the venture. He gained significant credibility for successfully implementing a rather simple trading strategy, primarily because executing it on crypto platforms five years ago was no walk in the park. Bitcoin arbitrage required establishing connections with numerous trading platforms and creating complex infrastructure to streamline the operational aspects of the trades. Under SBF’s leadership, Alameda excelled at this intricate process, and as a result the money began rolling in. This success spurred the launch of crypto exchange FTX in the spring of 2019.

In the years that followed, SBF managed to create a relatively flawless yet flamboyant image of his personal life. He made multimillion-dollar political donations to the Democratic Party, networking with the likes of Bill Clinton and Tony Blair at FTX conferences (Milmo, 2022). He was also known for his commitment to effective altruism, a charitable movement that urges adherents to give away their wealth in efficient and logical ways (Yaffe-Bellany, 2022). Through FTX’s charitable arm, Future Fund, SBF made lavish donations to non-profits and pledged over $160 million to various causes.

However, the summer of 2022 brought revelations that soon destroyed his once ‘picture-perfect’ persona.

2b. Alameda Research

Alameda Research was a Berkley-based crypto quantitative hedge fund founded by SBF in October 2017. Initially focused on arbitrage, the fund began minting a quick fortune by exploiting Bitcoin price differences between Asian markets and the rest of the world. In other words, Alameda bought Bitcoin and other cryptocurrencies in one part of the world and sold them in another, pocketing the difference (Goldstein et al, 2022).

Alameda’s need for funds to run its trading business appeared to be a big reason for FTX’s existence. After a move from Hong Kong to the Bahamas, SBF built his base of operations (Stevenson et al, 2022). In July 2019, FTX launched the FTT Exchange Token, a utility token “associated with a crypto trading platform” (SEC v Ellison, 2022). FTT soon became both FTX and Alameda’s primary asset (Breydo, 2023), with Alameda as the token’s primary market maker. The token attracted exchange investors through appealing trading discounts and facilitated more loans for trading by utilising its holdings as collateral.

The decline of FTX began when Alameda began borrowing money for various purposes, including to make venture investments, at a time when the price of crypto coins kept going up (Sigalos, 2022). In a climate where increasing token prices sucked liquidity out of the market, lenders began asking Alameda for their money back in June 2022. But Alameda was not able to repay the borrowed amount as it had deposited the money in venture investments that were no longer liquid. Due to the lack of capital to meet its debt obligations, SBF used FTX’s customer deposits to quietly bail out Alameda (Ehrlich, 2022). The line of credit ‘borrowed’ amounts to $65 billion. This culminated in the Securities and Exchange Commission (SEC) charging Caroline Ellison, former CEO of Alameda Research, and Wang with defrauding equity investors in FTX on December 21, 2022.

As of today, Ellison has confirmed in court that when investors recalled loans to Alameda, she agreed with others to borrow billions of dollars in FTX customer funds to repay them. Ellison and Wang have pleaded guilty and are cooperating with prosecutors as part of their plea agreements (SEC v Ellison, 2022).

2c. Aggressive Marketing

Prior to the revelation of Alameda’s connection to FTX’s downfall, FTX experienced a period of rapid expansion. In 2021, millions of dollars were spent on branding deals with celebrity endorsers such as Tom Brady (Griffith et al, 2023) and a sponsorship deal with the Mercedes Formula 1 team (Baldwin, 2022).

FTX continued to grow its U.S. footprint with the acquisition of LedgerX in August 2021, the first regulated crypto derivatives exchange and clearinghouse approved by U.S. regulators (Nelson, 2023). By October, the company raised capital at a valuation of $25bn from investors, including global investment companies such as Singapore’s Temasek Holdings. This trend continued in the first six months of 2022 when FTX signed a $135 million sponsorship deal for naming rights of the NBA Miami Heat’s stadium the ‘FTX Arena’ (Ligon, 2022).

2d. Market Manipulation Allegations

During the latter half of 2022, FTX faced allegations of market manipulation as U.S. prosecutors in New York speculated about SBF’s control over the prices of two interlinked currencies, TerraUsd and Luna (Pisharody, 2022).

TerraUSD (also known as ‘UST’) functions as an ‘algorithmic stablecoin’, cryptocurrencies that automatically track the price of currencies or other assets (Rhinehart et al, 2022). UST retains its value at par with the U.S. dollar by utilising an arbitrage network involving the purchase and sale of Terra’s cryptocurrency, LUNA (Nelson, 2022). However, the UST-to-dollar peg fell when Terraform Labs, the platform producing UST, flooded the market with LUNA tokens. Such drastic action was prompted by an overflow of sell orders for TerraUSD from FTX. This apparent attempt by FTX to yield “a fat profit” led to a significant drop in the price of LUNA tokens, reducing it to a mere fraction of a cent (Nelson, 2022). With LUNA at an all-time low, FTX artificially inflated trading volumes to create a false impression of liquidity.

2f. The Binance Deal

Binance is the largest cryptocurrency exchange and blockchain ecosystem. It began its journey with FTX back in 2019 when it invested in the then derivatives exchange. The next year, Binance launched its own crypto derivatives, quickly becoming the leader in the field. As of 2021, Binance sold the stake it held in FTX back to Bankman-Fried, receiving a number of FTT tokens in exchange. Once allegations against FTX arose, SBF reached out to Mr. Zhao asking for help “for the sake of the industry and users.”

On November 8th, 2022, co-founder and CEO of Binance, Changpeng Zhao, announced its ‘strategic investment’ in buying both equity and FTT tokens (Lang, 2022). In other words, the company agreed to provide a loan and buy FTX to save it. But upon examining the extent of FTX’s financial troubles, Mr. Zhao changed his mind (Flitter & Yaffe-Bellany, 2022). The next day, Binance called off the deal based on its due diligence and “news reports regarding mishandled customer funds” (Yaffe-Bellany, 2022). Binance’s pull-out led to FTX unsuccessfully scrambling for rescue financing for a shortfall of around $8 billion. Shortly after, FTX filed for bankruptcy on November 11th.

The collapse of FTX has provided Binance an opportunity to enhance its credibility among investors and regulators on a more visible scale. To bolster its legitimacy in the United States, the exchange appointed a team of American executives for its subsidiary, Binance.US (Flitter & Yaffe-Bellany, 2022). Additionally, Binance escalated its marketing strategies by featuring renowned football star Cristiano Ronaldo wearing a Binance jersey in an advertisement.

In November 2023, Binance admitted it engaged in anti-money laundering, unlicensed money transmitting, and sanctions violations in the largest corporate resolution to include criminal charges for an executive (Zhao). The Justice Department is requiring Binance to pay $4.3 billion in penalties and forfeitures. Zhao agreed to pay a $50 million fine and step down as CEO of the company after pleading guilty to money laundering violations. Ronaldo faces a $1 billion class action lawsuit in the US over his promotion of Binance.

3. Regulation and Litigation

The failures of FTX have re-ignited the debate on the appropriate policy response to address crypto risks (Aquilina et al). This is accompanied by a renewed sense of urgency to govern the regulation-averse crypto space.

3a. Regulation

The European Union and the U.S. have already made proposals of their own to improve consumer protections in crypto.

The EU’s ‘MiCA’:

The European Commission’s Markets in Crypto-Assets (‘MiCA’) regulation is part of the broader “Digital Finance Package”, which seeks to identify a digital finance strategy that enables the EU to embrace the financial sector’s digital revolution (Ghiandai et al, 2022). By creating a harmonised legal framework across the EU, MiCA seeks to ‘fill the gap’ in existing EU financial services legislation whose scope has proven to be inadequate to address crypto activities (Ali & Piazzi, 2022).

Currently, security tokens are the only form of crypto-assets capable of being classified as financial instruments under MiFID II, the EU’s principal legislation on financial markets, products and services (Ali & Piazzi, 2022). Most other crypto assets are not easily captured under existing financial services regulatory frameworks. MiCA replaces national regulatory frameworks (Narain & Moretti, 2022) by effectively classifying crypto assets into e-money tokens (EMTs), asset-referenced tokens (ARTs), and crypto-assets that cannot be defined as EMTs or ARTs. This categorisation is based on whether the crypto assets stabilise their value by reference to other assets and the risk they entail (Ghiandai et al, 2022). The differentiation allows for increased transparency in digital finance by placing crypto assets under a ‘comprehensive’ regulatory framework (Recital no. 5, MiCA Proposal) that considers whether crypto assets stabilise their value by reference to other assets and the specific risk they entail (Ghiandai et al, 2022).

MiCA will provide regulatory certainty and stronger protections for consumers in the crypto market, while supporting innovation (Browne, 2022). The Union framework will enable cross-border scalability for cryptocurrency service and facilitate their access to banking services, allowing them to conduct business with ease (Di Palma, 2023).

The United States’ ‘RFIA’:

Calls for action in the U.S. have increased with several recommendations, proposals, initiatives, and strategies introduced by legislators following the SEC’s response (de Mortanges, 2023).

Senator Cynthia Lummis, a Republican from Wyoming, used the FTX debacle as an opportunity to explain how the Responsible Financial Innovation Act 2022 (‘RFIA’) would have banned several practices allegedly conducted at FTX (McCormack, 2023). According to Lummis, this crypto bill would ban the ‘commingling’ between consumer assets and investments belonging to an exchange — a practice which was at the heart of the losses at FTX (Franklin, 2022).

While far from concrete, these ‘recommendations’ have garnered much speculation about the Government’s discrete yet co-ordinated attempts to ban crypto (Carter, 2023). The White House’s blog post titled ‘Roadmap to Mitigate Cryptocurrencies’ Risks’, published in January 2023, has been dubbed as a crypto-unfriendly framework (de Mortanges, 2023). It highlights how some cryptocurrency entities ignore financial regulations and often mislead customers with inadequate disclosures or blatant fraud. Additionally, the blog by President Biden signals a redlight for mainstream institutions to not “dive headlong into cryptocurrency markets” (Anderson, 2023). While this does seem appropriate given the current crypto climate, to claim that limiting such actions has prevented the spread of the “turmoil in cryptocurrencies” to the broader financial system seems inaccurate given that such collapses virtually have no effect on the wider financial world (explored in Graph 1 below).

The White House has a sizable list of tasks for legislators (Anderson, 2023). Recommendations include expanding regulators’ powers, strengthening disclosure requirements and penalties for misconduct, increasing funding for law enforcement, and following the advice found in the Financial Stability Oversight Council report. The administration stressed, however, that further action is needed. The administration said that priorities for digital asset research and development will be unveiled in the coming months, adding that Congress should also step-up efforts in this space.

3b. Litigation

Legal Proceedings:

On December 12th, 2022, SBF was arrested in the Bahamas for lying to investors and committing fraud. He was later also accused of bribing a foreign official (Goldstein et al, 2022). The SEC’s complaint, launched on 13th December, charges SBF with violating the anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. The complaint also seeks injunctions against future securities law violations; thus prohibiting SBF from participating in the issuance, purchase, offer, or sale of any securities, except for his own personal account.

After his extradition to the U.S., the former billionaire was released on $250 million bond (Cohen & Godoy, 2023) to home detention at his parents’ California home. In January 2023, he was caught attempting to contact current executives at now-bankrupt FTX. While his lawyers claim that SBF was trying to help rather than interfere, his actions raised concerns about witness tampering. On March 28th, 2023, SBF’s lawyers claim that an agreement has been reached with U.S. prosecutors over revised bail conditions. Under the proposed conditions, SBF was prohibited from using all electronic communication excluding a new phone with no internet capability and a basic laptop with limited functions (Sharma & Cohen, 2023). On August 11, a U.S. judge revoked Bankman-Fried’s bail after finding probable cause that the founder of FTX tampered with witnesses at least twice.

SBF pleaded not guilty to eight criminal charges (Wright, 2023), including alleged violations of campaign finance laws and wire fraud. His trial is expected to begin in October 2023. Caroline Ellison and FTX co-founder Gary Wang already pleaded guilty to charges related to the case (Pereira, 2023).

Bankman-Fried was found guilty on November 2, 2023 of stealing from customers of FTX in one of the biggest financial frauds on record. The jury convicted Bankman-Fried on all seven counts he faced after a month long trial in which prosecutors made the case that he stole $8 billion from the exchange’s users from sheer greed.

Bankruptcy

Following revelations of fraudulent activities, FTX filed for bankruptcy to protect itself from creditor claims and a formal investigation. The bankruptcy proceedings were overseen by a court-appointed trustee, who worked towards recovering assets and compensating affected users.

On January 26, 2023, FTX opposed the U.S. Department of Justice (DOJ) request for an independent investigation due to the added cost and delay it would cause to the bankruptcy case. The company stated that it was already conducting a comprehensive probe that includes family members of SBF. FTX acknowledged past misconduct and said it was already being investigated by new management, creditors, and law enforcement.

U.S. Bankruptcy Judge John Dorsey is overseeing FTX’s Chapter 11 proceedings. The company has made a request to secure documents from SBF, members of his family, and other insiders with information about FTX transactions that used “misappropriated and stolen” funds. This includes a $16.7 million real estate purchase in the Bahamas under Bankman-Fried’s parents’ names.

FTX is also seeking information about political donations linked to SBF. These include ‘Mind the Gap’, a political action committee founded by his mother; and ‘Guarding Against Pandemics’, an advocacy organisation founded by SBF and his brother. FTX alleged that Guarding Against Pandemics’ Washington, D.C. headquarters was purchased with misappropriated funds.

FTX has recovered more than $7 billion in assets to repay customers, and is pursuing additional recoveries through lawsuits against FTX insiders and others who received money from FTX before it went bankrupt.

Wider Consequences

FTX’s Chapter 11 filings in the U.S. have paved the way for intricate cross-border procedures, giving rise to enforcement challenges spanning multiple jurisdictions (Brown, 2023). As these complex cross-border proceedings unfold rapidly, insolvency officials are racing to locate and safeguard assets. It is expected these proceedings will continue for a considerable period and result in additional legal disputes concerning specific assets or groups of creditors. Furthermore, there might be claims against auditors of insolvent entities, as greater scrutiny is now being applied to proof of reserves reports and other aspects of audits and annual accounts (Ng, 2023).

4. Market Implications

Hostility and unrest in the legal domain have been complemented by market fluctuations. The Bank for International Settlements (BIS) highlights an increase in crypto trading activity post the FTX bankruptcy, with large and sophisticated investors selling and smaller retail investors buying (Cornelli et al., 2023).

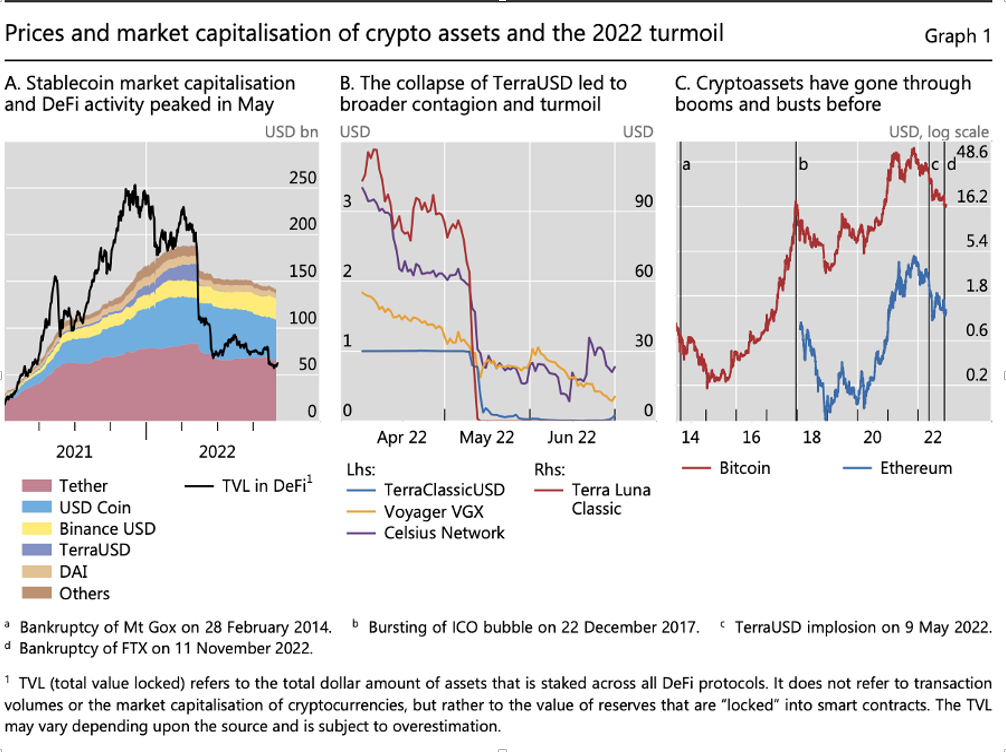

Graph 1 highlights the high and lows of the crypto industry from 2021 onwards. In 2021, crypto asset prices, stablecoin volumes, and DeFi activity reached all-time highs (left-hand panel). This was followed by a period of turmoil in 2022. Problems became acute in May when TerraUSD (UST) – a large stablecoin which relied on an algorithm to maintain its peg to the US dollar – collapsed, causing contagion in crypto markets (Graph 1, centre panel). After a short-lived period of calm, crypto markets were plunged into stress in November 2022, when the FTX crypto trading platform declared bankruptcy (Aquilina et al., 2023).

Graph 1. Sources: Bloomberg, CoinGecko, DefiLlama and BIS

Despite past turmoil, the crypto ecosystem has survived, and prices often recovered (Graph 1, right-hand panel). This, accompanied by the ideological pursuit of a decentralised system as an alternative to traditional finance (Frost et al, 2023), suggests that crypto may not fade away on its own. Amidst the failure of Centralised Finance (CeFi) entities like FTX, proponents argue Decentralised Finance (DeFi) is the future: only “true” DeFi can be resilient (Aquilina et al., 2023).

5. The Battle of the Finances: DeFi vs CeFi vs TradFi

Alternatively, recent developments suggest decentralisation in crypto and DeFi markets is illusory (Aramonte et al, 2021; BIS, 2022). The vision of crypto proponents is to do away with financial intermediaries, yet to function and achieve a meaningful scale, crypto markets rely heavily on centralised entities (or centralised finance, ‘CeFi) for several reasons.

Firstly, governance in DeFi protocols tends to be concentrated, with the founding team often holding a significant number of governance tokens. Since these tokens are tradable, anyone can potentially acquire a controlling stake in the protocol. Additionally, centralised exchanges and stablecoins also play a crucial role in the crypto ecosystem. When investors enter the crypto space, they typically convert their funds into stablecoins deposited on centralised platforms (Frost et al, 2023). These stablecoins facilitate transactions within the crypto system. Without such gateways, users have to handle their funds through digital wallets using private keys. This comes with significant risks, making mainstream adoption unlikely. While TradFi does share similar vulnerabilities, it does so to a much lesser extent.

5a. A Drop in the Ocean or Ripples of Change?

Despite these deficiencies in digital finance, the FTX collapse has shown the sector has not grown large enough or sufficiently interconnected with TradFi to threaten financial stability. This is because of DeFi’s limited interconnections with the real economy and TradFi (Schrimpf et al, 2023).

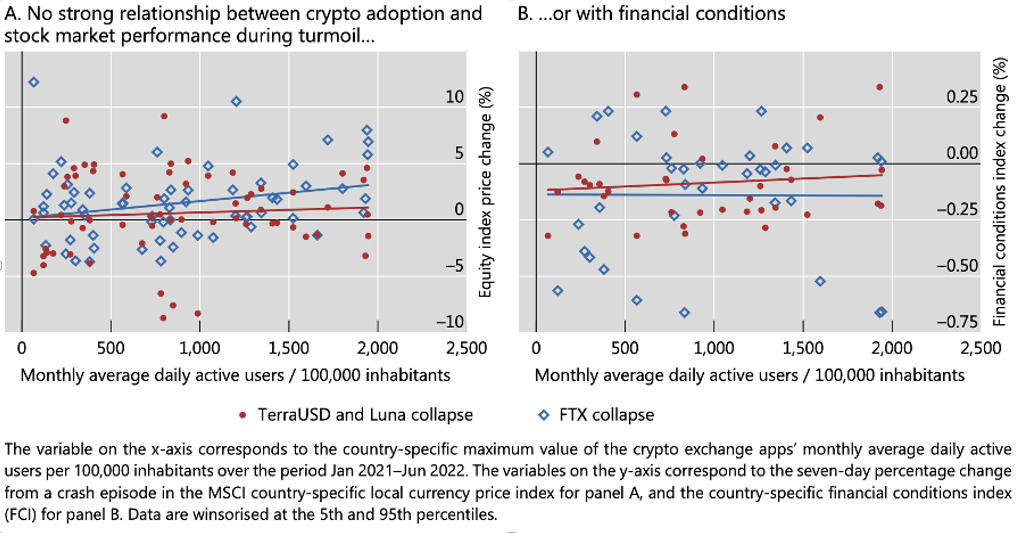

Evidence suggests crypto shocks have a limited impact on equity prices or broader financial conditions (Cornelli et al, 2023). While the crypto collapse may have affected individual investors, the aggregate impact on the broader system is limited. These patterns underline the largely self-referential nature of DeFi and crypto (Aramonte et al, 2022), suggesting the stress in the crypto system caused by the bankruptcy of FTX has not spilled over to the wider financial system.

Graph 2: Sources: Bloomberg; Refinitiv Eikon; Sensor Tower; Cornelli et al

This is represented in Graph 2. According to Graph 2, there is at best a weak correlation between broader stress and crypto losses for either metric during the two crypto stress episodes. The horizontal axis plots the timeline, and the vertical axis plots the change in local equity prices (Graph 2.A) or financial conditions (Graph 2.B). The red and blue dots represent the Terra/Luna shock and FTX collapse respectively. Each dot represents a country, and the lines show the estimated relationship between crypto usage and conditions in the wider financial system.

By focusing on two shock episodes, it investigates the relationship between crypto adoption and the broader financial system. The data plotted is country-specific and limited to a period of January 2021 and June 2022. However, this measure serves as a proxy for the losses subsequently incurred during the Terra/Luna crash by crypto investors.

6. A Virtue Ethics Analysis

Virtue ethics is the system of morality traced back to Plato and Aristotle in the West, and Mencius and Confucius in the East (Rosalind et al, 2022). It is agent based, meaning it evaluates the virtue or moral character of the person carrying out an action, rather than the ethical duties or consequences of particular actions.

Heralded by Anscombe’s “Modern Moral Philosophy” (Anscombe, 1958), virtue ethics highlight the increasing dissatisfaction with deontology and utilitarianism (Rosalind et al, 2022). Neither paid attention to topics accounted for in the virtue ethics tradition — virtues, vices, motives, moral character, and the fundamental question of who we should be and how we should live. Considering these theories of ethics provides a more comprehensive understanding of the wider behavioural and social impact of the FTX scandal.

6a. Trust and Transactions

Trustworthiness is a virtue. It is a state or disposition of a person (Annas, 2007) to rely on someone or something. To possess this virtue is to be a person with a certain complex mindset. Unlike a habit, a virtue to trust one-another (i.e. ‘interpersonal trust’) is a disposition exercised through the agent’s practical reasoning; built up by making choices and exercised in the making of further choices.

Interpersonal trust plays a central role in economic exchanges (Arrow, 1972; Williamson, 1993). It is characterised as the “voluntary transfer of a good or favour to someone else, with future reciprocation expected but not guaranteed” (Gunnthorsdottir et al. 2002: 50). Research finds that interpersonal trust facilitates economic growth (Knack & Keefer, 1997), international trade (Guiso et al. 2009), financial development (Guiso et al., 2004) and financial inclusion (Xu, 2020).

In financial investments, interpersonal trust determines the level of market participation by influencing an individual’s perceived risk of being cheated in an investment. Using a sample of 1,943 households, Guiso et al. (2008) find the higher the perceived risk of being cheated the lower the return on the investment, suggesting that less trusting individuals are less likely to buy stock as participation becomes less attractive. Similarly, viewing trust in conjunction with sociability, Georgarakos & Pasini (2009) conclude that more sociable households living in areas with higher trust are more likely to invest in stocks in European countries. Although the two studies focus only on the household level and fail to control for the effect of confounding variables of trust (e.g. race and marital status), they provide a consistency that higher interpersonal trust leads to more monetary investment in the financial market.

From a social constructivist angle, trust emerges from and maintains itself within the interactions between people (Berger & Luckmann, 1966; Weber & Carter, 2003). For instance, investors spend their leisure time discussing investments and the market with their friends, family, and neighbours (Shiller, 1989; Becker, 1991; Hong et al., 2004). In addition to reinforcing interactions in existing connections, financial investments foster social interactions by creating new social networks, as demonstrated by the emergence of social sites specifically for traders and investors, such as Xueqiu (Zhang et al. 2018), and Stocktwits (Cookson & Niessner, 2019). These sites have attracted millions of users. Repeated social interactions deepen interpersonal trust (Glanville et al., 2013; Sutcliffe et al., 2012), suggesting financial investment has great potential to increase interpersonal trust.

6b. Is Crypto Crippling Trust?

As a new and distinct class of asset, cryptocurrency has drawn significant attention from researchers and the market (Corbet et al. 2018). Like general financial investment literature, research on the cryptocurrency investment market has established those positing higher trust tend to be quicker in adopting cryptocurrency investment. For instance, using the World Value Survey and Twitter data, Jalan et al. (2023) find that trust significantly contributes to whether one invests in the cryptocurrency market. This is replicated in the Malaysian market, where Miraz (2021) suggests interpersonal trust remains a significant contributor to the adoption of cryptocurrency investment after controlling for the effect of multiple variables, such as transaction transparency and expected investment performance. Conceptually, scholars hypothesise the decentralised nature of cryptocurrency can enhance interpersonal trust by establishing self-regulated, direct peer-to-peer transactions and networks without the need for a third party (Tello et al. 2018; Spithoven, 2019; Jalan et al. 2023).

This allows us to derive a correlation between the FTX Collapse and interpersonal trust. As stated by Lefebvre et al. (2020), sustainable investment and economic generation from investment require sustainable trust amongst the investor and returner. Studies show fluctuation of trust signified by economic values is a determining factor in whether the investor is willing to sustain their current investment in the future (MaxWell & Levesque, 2014).

Given the highly volatile nature of the cryptocurrency investment market, there is a possibility for a correlation between how financial investment in cryptocurrency influences interpersonal trust. While some studies explore this relationship by controlling for interpersonal preferences such as risk aversion and altruism (Houser, 2010; Cox, 2004); others such as Glaeser et al. (2000) only controlled for certain demographic factors. Either way, conceptually it can be argued the decentralised characteristics and peer-to-peer mode of transaction of cryptocurrency might influence interpersonal trust (Tello et al. 2018; Spithoven, 2019; Jalan et al. 2023).

Virtue ethics is not directly linked to the collapse of a financial institution like FTX, but it does form an important part of the aftermath. As an ethical theory that focuses on cultivating virtues and moral character in individuals to lead a good and fulfilling life, virtue ethics emphasises qualities such as trust. Having derived a possible correlation between the role of interpersonal trust in cryptocurrency investment, it can be argued FTX’s downfall has shaken the foundation of interpersonal trust. Since trustworthiness is a virtue that can be cultivated, it can be deduced that the FTX scandal has a wider impact on virtue ethics.

Bibliography

Addressing the Risks in Crypto: Laying out the Options, www.bis.org/publ/bisbull66.pdf.

Afp. “US SEC Charges ex-FTX Boss Sam Bankman-Fried With Defrauding Investors of $1.8 Billion.” The Economic Times, 13 Dec. 2022, economictimes.indiatimes.com/tech/technology/us-sec-charges-ex-ftx-boss-sam-bankman-fried-with-defrauding-investors/articleshow/96200642.cms?from=mdr.

Akyildirim, Erdinc, et al. “Understanding the FTX Exchange Collapse: A Dynamic Connectedness Approach.” Finance Research Letters, vol. 103643, Elsevier BV, 1 May 2023, doi:10.1016/j.frl.2023.103643.

Alloway, Tracy, and Joe Weisenthal. “Odd Lots Full Transcript: Sam Bankman-Fried and Matt Levine on Crypto.” Bloomberg.Com, Bloomberg, 25 Apr. 2022, www.bloomberg.com/news/articles/2022-04-25/odd-lots-full-transcript-sam-bankman-fried-and-matt-levine-on-crypto.

Analysing the Value, Function, and Regulation of Cryptocurrency, digitalcommons.liberty.edu/cgi/viewcontent.cgi?article=2374&context=honors.

“Blockchain: What It Is, Why It Matters and Whether It Will Change Everything.” NBC News, 21 Nov. 2022, www.nbcnews.com/think/opinion/bitcoin-vs-ftx-crypto-king-sam-bankman-fried-problem-rcna57964.

Bloomberg. “How Binance, FTX Deal Rocked the Crypto World and Then Collapsed.” The Economic Times, 10 Nov. 2022, economictimes.indiatimes.com/markets/cryptocurrency/how-binance-ftx-deal-rocked-the-crypto-world-and-then-collapsed/articleshow/95428769.cms?from=mdr.

Browne, Ryan. “EU Agrees on Landmark Regulation to Clean up Crypto ‘Wild West.’” CNBC, 1 July 2022, www.cnbc.com/2022/06/30/eu-agrees-to-deal-on-landmark-mica-cryptocurrency-regulation.html.

Carter, Nic. Operation Choke Point 2.0 Is Underway, and Crypto Is in Its Crosshairs. 9 Feb. 2023, www.piratewires.com/p/crypto-choke-point.

Cassatt, Amanda. FTX Showed the Problems of Centralised Finance, and Proved the Need for DeFi. 11 Nov. 2022, www.coindesk.com/layer2/2022/11/11/ftx-showed-the-problems-of-centralized-finance-and-proved-the-need-for-defi.

Cohen, Luc, and Jody Godoy. “FTX’s Bankman-Fried, Charged With ‘epic’ Fraud, Released on $250 Million Bond.” Reuters, 24 Dec. 2022, www.reuters.com/legal/ftx-founder-bankman-fried-make-us-court-appearance-after-extradition-2022-12-22.

“Crypto Litigation and Arbitration Trends to Watch in 2023 | Clifford Chance.” Clifford Chance,www.cliffordchance.com/insights/resources/blogs/talking-tech/en/articles/2023/01/crypto-litigation-arbitration-trends-to-watch-in-2023.html.

Crypto Shocks and Retail Losses – Bank for International Settlements, www.bis.org/publ/bisbull69.pdf.

Ehrlich, Steven. “Alameda and FTX May Have Taken Advantage of Customers From the Start.” Forbes, 17 Nov. 2022, www.forbes.com/sites/stevenehrlich/2022/11/17/alameda-and-ftx-may-have-taken-advantage-of-customers-from-the-start/?sh=3404818a563b.

EU’s Proposed Legislation Regulating Crypto Assets, MiCA, Heralds New Era Of Regulatory Scrutiny | Skadden, Arps, Slate, Meagher and Flom LLP. 23 Nov. 2022, www.skadden.com/insights/publications/2022/11/eus-proposed-legislation#ftn2.

“Explained: Why Did Binance Walk Away From FTX Deal and What It Means for Cryptocurrencies.” The Times of India, 10 Nov. 2022, timesofindia.indiatimes.com/business/india-business/explained-why-did-binance-walk-away-from-ftx-deal-and-what-it-means-for-cryptocurrencies/articleshow/95433362.cms.

Franklin, Joshua. “US Lawmaker Pushes Bipartisan Bill to Regulate Crypto.” Financial Times, 28 Nov. 2022, www.ft.com/content/7a8e4c6e-f93b-4111-8b03-de8a2e464819.

“Global Weekly Fintech Update 22-02-23.” Clifford Chance, 23 Feb. 2023,www.cliffordchance.com/insights/resources/blogs/talking-tech/en/articles/2023/02/globa-weekly-fintech-update-22-02-23.html.

Goldstein, Matthew, et al. “What Is the Relationship Between Almeda Research and FTX?” The New York Times, 30 Nov. 2022, www.nytimes.com/2022/11/30/business/dealbook/ftx-almeda-research-sam-bankman-fried.html#:~:text=The%20relationship%20between%20FTX%20and,selling%20a%20majority%20of%20FTT.

Goldstein, Matthew. “FTX Founder Faces Market Manipulation Inquiry.” The Seattle Times, 8 Dec. 2022, www.seattletimes.com/business/ftx-founder-faces-market-manipulation-inquiry.

Griffith, Erin, and David Yaffe-Bellany. “How Tom Brady’s Crypto Ambitions Collided With Reality.” The New York Times, 6 July 2023, www.nytimes.com/2023/07/06/technology/tom-brady-crypto-ftx.html.

Hern, Alex. “TechScape: Inside the $8bn FTX Crypto Scandal – and Its Real-world Impact.” The Guardian, 13 Dec. 2022, www.theguardian.com/technology/2022/nov/15/inside-the-8bn-ftx-crypto-scandal-and-its-real-world-impact.

Hetler, Amanda. “FTX Scam Explained: Everything You Need to Know.” WhatIs.com, 17 Apr. 2023, www.techtarget.com/whatis/feature/FTX-scam-explained-Everything-you-need-to-know#:~:text=FTX%20investors%20filed%20a%20class,move%20customer%20money%20between%20entities.

House, White. “The Administration’s Roadmap to Mitigate Cryptocurrencies’ Risks.” The White House, 27 Jan. 2023, www.whitehouse.gov/nec/briefing-room/2023/01/27/the-administrations-roadmap-to-mitigate-cryptocurrencies-risks.

“How The Responsible Financial Innovation Act Proposes to Regulate Cryptocurrencies and Other Digital Assets – Commodities Perspective | DLA Piper.” DLA Piper,www.dlapiper.com/en/insights/publications/2022/06/how-the-responsible-financial-innovation-act-proposes.

Illien, Noele, et al. “FTX Opposes New Bankruptcy Investigation as It Probes Bankman-Fried Connections.” Reuters, 27 Jan. 2023, www.reuters.com/business/finance/us-treasury-financial-watchdogs-companies-among-ftx-creditors-filing-shows-2023-01-26.

“Inside the EU’s Ground-breaking Law to Regulate Crypto-assets.” Allen Overy, 21 Dec. 2022, www.allenovery.com/en-gb/global/news-and-insights/publications/the-mica-proposal-at-a-glance-the-key-takeaway-of-a-ground-breaking-law-to-regulate-the-crypto-assets-space-in-europe.

Kerr, David, et al. “Cryptocurrency Risks, Fraud Cases, and Financial Performance.” Risks, vol. 51, no. 3, Multidisciplinary Digital Publishing Institute, 23 Feb. 2023, doi:10.3390/risks11030051.

Kpfingsten. An Overview of the EU Crypto-Asset Regulatory Framework (MiCA). 6 Feb. 2023, news.law.fordham.edu/jcfl/2023/02/06/an-overview-of-the-eu-crypto-asset-regulatory-framework-mica.

Lang, Hannah, and Elizabeth Howcroft. “FTX’s Founder Dismisses Balance Sheet Concerns as ‘false Rumors.’” Reuters, 7 Nov. 2022, www.reuters.com/technology/ftxs-founder-dismisses-balance-sheet-concerns-false-rumors-2022-11-07.

Magazine, Bitcoin. “Biden Administration Releases Roadmap to Mitigate Cryptocurrency Risks.” Nasdaq,www.nasdaq.com/articles/biden-administration-releases-roadmap-to-mitigate-cryptocurrency-risks.

“Mercedes F1 Team Suspends Partnership With FTX.” Reuters, 11 Nov. 2022, www.reuters.com/lifestyle/sports/mercedes-f1-team-suspends-partnership-with-ftx-2022-11-11.

Nelson, Jason. “FTX Finalizes $50 Million Sale of LedgerX Crypto Derivatives Exchange.” Decrypt, 25 Apr. 2023, decrypt.co/137943/ftx-finalizes-50-million-sale-of-its-crypto-derivatives-exchange-ledgerx.

Nelson, Jason. “NYC Prosecutors Probing Sam Bankman-Fried’s Role in TerraUSD Collapse: Report.” Decrypt, 8 Dec. 2022, decrypt.co/116727/nyc-prosecutors-probing-sam-bankman-frieds-role-in-terrausd-collapse-report.

O'Brien, Christopher R., et al. “DAO or Dare: The Implications of Sarcuni V. bZx DAO for DAO Member Liability.” Lexology, 29 Mar. 2023, www.lexology.com/library/detail.aspx?g=85a2301c-4d9f-4a42-a8b6-4ef933dd83e2.

Pereira, Ana Paula. “Alameda Research Had a $65B Secret Line of Credit With FTX: Report.” Cointelegraph, 14 Jan. 2023, cointelegraph.com/news/alameda-research-had-a-65b-secret-line-of-credit-with-ftx-report.

Peterson-Withorn, Chase. “Exclusive: These FTX Investors Stand to Lose the Most From the Crypto Exchange’s Implosion.” Forbes, 11 Nov. 2022, www.forbes.com/sites/chasewithorn/2022/11/10/exclusive-these-investors-stand-to-lose-the-most-from-ftxs-implosion/?sh=53f6bcb52670.

Peterson-Withorn, Chase. “Exclusive: These FTX Investors Stand to Lose the Most From the Crypto Exchange’s Implosion.” Forbes, 11 Nov. 2022, www.forbes.com/sites/chasewithorn/2022/11/10/exclusive-these-investors-stand-to-lose-the-most-from-ftxs-implosion/?sh=53f6bcb52670.

“Sam Bankman-Fried, FTX Execs Received Billions in Hidden Loans, Says ex-Alameda CEO.” The Economic Times, 24 Dec. 2022, economictimes.indiatimes.com/tech/technology/sam-bankman-fried-ftx-execs-received-billions-in-hidden-loans-says-ex-alameda-ceo/articleshow/96469301.cms.

“Sam Bankman-Fried, Prosecutors Reach New Bail Agreement.” Reuters, 28 Mar. 2023, www.reuters.com/legal/sam-bankman-fried-prosecutors-reach-new-bail-agreement-2023-03-28.

SEC.gov | SEC Charges Caroline Ellison And Gary Wang With Defrauding Investors in Crypto Asset Trading Platform FTX. 22 Dec. 2022, www.sec.gov/news/press-release/2022-234.

SEC.gov | SEC Charges Samuel Bankman-Fried With Defrauding Investors in Crypto Asset Trading Platform FTX. 13 Dec. 2022, www.sec.gov/news/press-release/2022-219.

Schulz, Bailey, and Riley Gutiérrez McDermid. “What Is the FTX Scandal? How the Celebrity-Endorsed Crypto Giant Collapsed into Chaos.” USA Today, Gannett Satellite Information Network, 22 Nov. 2022,www.usatoday.com/story/money/2022/11/16/ftx-bankman-frieds-crypto-bankruptcy/10710734002/.

Sigalos, MacKenzie. “From $32 Billion to Criminal Investigations: How Sam Bankman-Fried’s Crypto Empire Vanished Overnight.” CNBC, 16 Nov. 2022, www.cnbc.com/2022/11/15/how-sam-bankman-frieds-ftx-alameda-empire-vanished-overnight.html.

“The Effects of FTX’s Collapse on the Cryptocurrency Industry.” PBS NewsHour, 17 Dec. 2022, www.pbs.org/newshour/show/the-effects-of-ftxs-collapse-on-the-cryptocurrency-industry.

“The Impact of the FTX Bankruptcy on Global Regulatory Efforts | State Street.” State Street,www.statestreet.com/in/en/individual/insights/ftx-bankruptcy-regulation.

The Lummis-Gillibrand Responsible Financial Innovation Act: What to Know | Perspectives and Events | Mayer Brown.www.mayerbrown.com/en/perspectives-events/publications/2022/06/the-lummisgillibrand-responsible-financial-innovation-act-what-to-know.

“The Responsible Financial Innovation Act – a Bullet Point Summary.” Akin Gump Strauss Hauer & Feld LLP – the Responsible Financial Innovation Act – a Bullet Point Summary, www.akingump.com/en/insights/alerts/client-alert-the-responsible-financial-innovation-act-a-bullet-point-summary.

Virtue Ethics (Stanford Encyclopedia of Philosophy/Winter 2022 Edition). 11 Oct. 2022, plato.stanford.edu/archives/win2022/entries/ethics-virtue.

Wright, Turner. “Sam Bankman-Fried Enters Not Guilty Plea for All Counts in Federal Court.” Cointelegraph, 3 Jan. 2023, cointelegraph.com/news/sam-bankman-fried-enters-not-guilty-plea-for-all-counts-in-federal-court.

Yaffe-Bellany, David, et al. “Sam Bankman-Fried and FTX Engaged in Fraud for Years, Prosecutors Say.” The New York Times, 14 Dec. 2022, www.nytimes.com/2022/12/13/business/ftx-sam-bankman-fried-fraud-charges.html?auth=login-email&login=email.

Yosefi, Ariel, et al. “The New EU Crypto Regulatory Framework (MiCA Regulation).” Lexology, 2 May 2023, www.lexology.com/library/detail.aspx?g=be8e69d8-3ee7-49c3-9f88-2c5cbee71ce3.

Image courtesy of Analytics Insight