The Ethics of the Swiss National Bank’s Currency Intervention

By: Chloe Sevil

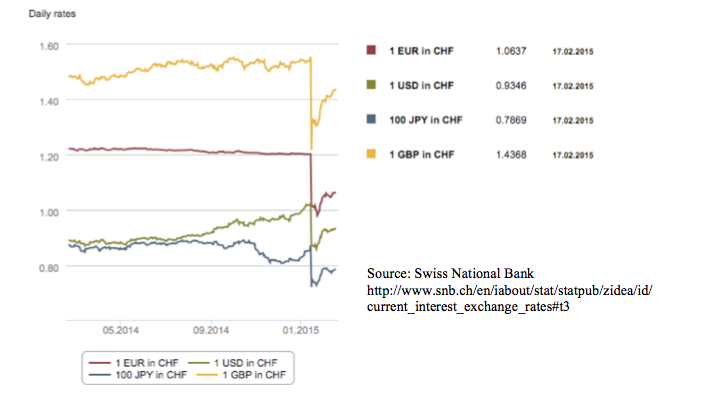

On Thursday, 15 January 2015 the Swiss National Bank (SNB) upset the fondue pot. The SNB unexpectedly announced it would end the Swiss Franc (the franc) peg to the Euro, three days after this policy had been reaffirmed. Many companies were adversely affected when the franc appreciated between 20-30% against major currencies (see diagram) and the Swiss stock market dropped by 14 percent.[1] The SNB originally intervened to avoid excessive overvaluation of the franc. There is a mix of economic, social and political rationales for currency manipulation. The reason for the Swiss National Bank’s currency intervention in 2011 is common to many central banks that choose to manipulate the value of their currencies. The central bank wanted to maintain Swiss economic stability. This article examines whether these motivations are ethically justifiable given the interconnectedness of the global economy and the externalities imposed on neighboring States.

Rationale for Central Bank Currency Intervention

In 2011, the euro area sovereign debt crisis metastasised from a problem affecting chronically troubled EU states to one that threatened the single currency itself.[1] Switzerland voted to not join the European Economic Area (now the EU) in 1992. Since that decision Switzerland has suffered the longest period of economic stagnation the second half of the twentieth century[2]. Yet during the Euro crisis of 2011, the vote looked prescient. The country remained an island of relative calm and stability amongst the soaring unemployment, debt crisis and turmoil of the euro area. Switzerland’s stability looked increasingly attractive investors looking for safe havens. The franc became a ‘safe asset’[3] and cash began flooding in, causing the already overvalued franc to appreciate. The concern of the SNB is seen in the increasingly strained tone of press releases issued in quick succession in August 2011, documenting attempts to constrain appreciation. The SNB ‘takes’, ‘expands’, then, ‘intensifies’ measures against the strong franc (emphasis added). Finally, on 6 September 2011 the SNB states it will ‘no longer tolerate’ a EUR/CHF exchange rate below a rate of CHF 1.20 and introduces a currency peg it will ‘enforce… with the utmost determination’, ‘prepared to buy foreign exchange in unlimited quantities.’[4]

Why was the SNB so concerned?

- Exports become uncompetitive

Like many other central banks that intervene in currency markets, the SNB was concerned the franc did not reflect the underlying fundamentals of the economy. Usually, the interaction of supply and demand (e.g. demand for the franc from foreign importers of Swiss goods who need to buy francs to pay for the goods) determines a floating exchange rate. However when investors are hyper nervous, as they were in the euro crisis, heightened speculation rather than fundamentals determine the equilibrium exchange rate. For an economy such as Switzerland’s, where exports constitute 50% of GDP,[5] currency appreciation can cause economic distress. In the year to 1 August 2011, the franc appreciated by around 20%.[6] Your favorite block of Swiss cheese goes from five euros to six and the wedge of Italian Parmesan on the next shelf starts to look more affordable. Sales of Swiss-made watches, pharmaceutical products and machinery (the bulk of Swiss exports) fell significantly in 2011. The SNB decided to intervene to prevent further damage to the economy.

- Economic Uncertainty

Abnormal currency movements also damage the economy by creating an uncertain economic environment. When businesses face fluctuating prices (the Swiss cheese producer is unsure of its selling price of cheese) a ‘wait and see’ attitude sets in.[7] When businesses encounter an uncertain economic environment, they postpone investments and hiring until conditions stabilize have greater clarity on investment returns. Consequently, investment declines and the economy slows.

The cost of capital also increases, as lenders require a higher rate of return to compensate for increased lending risk. Therefore, a fluctuating currency causes instability and contributes towards an economic downturn.

- Protecting Infant Industries

Protection of exporters, a reduction in instability and protection of the broader economy are just three justifications for state sanctioned currency intervention. The protection of infant industries is another, first proposed by John Stuart Mill.[8] Tariffs and subsidies help but artificially appreciating the currency also makes infant industries more competitive by making their products cheaper on the world market. It has the added positive effect of boosting exports of other exporting industries.

- Instrument of Power

A fourth, and more sinister use of currency intervention is as an instrument of power. Currency intervention can be used to destabilize a state’s economy for a political motive. A look through history highlights multiple examples: Japan’s manipulation of China’s currency to consolidate power after its invasion of China in the late 1930s; Nigeria’s intervention to quash civil war in the 1970s; and Washington’s refusal to support the pound sterling in the 1956 Suez debacle.[9] This strategy is definitely not ‘playing nice’ in the playground of international diplomacy.

Clearly, states or their independent central banks intervene in currency markets for a variety of reasons – to stabilize excessive exchange rate volatility, protect infant industries, boost exports or to destabilize another State’s economy. The question is whether these rationales are ethically justifiable.

Generally, Is Currency Intervention Ethically Justified?

A consequentialist approach lends limited support to currency intervention. In a nutshell, consequentialism evaluates actions based solely on weighing the consequences of the action against a desired outcome. In general, in the case of currency intervention, the desired ends are: boosting exports, increasing competitiveness and others discussed above, and the action is currency intervention.

Firstly, the ends of currency intervention are rarely achieved. Despite the numerous times currency intervention has been used in an attempt by states to boost exports and competitiveness, the policy’s effectiveness is mixed or even negligible. When a state artificially suppresses its currency to make domestic products more globally competitive, the effect is at best, limited. Other states recognize the currency manipulation and in retaliation, suppress their currencies as well. The fact that any net positive benefit of currency manipulation is so fleeting means that manipulation cannot be ethically justified through a consequentialist viewpoint.

Not only are the positive benefits of manipulation fleeting there may actually be unintended negative effects of currency manipulation. States may use intervention to protect infant industries, reasoning that protection is necessary in the early stages of development, until an industry can gain economies of scale to be able to compete globally. This strategic reasoning is seductive but it rarely achieves the intended result. Instead, protected infant industries fail to grow up – they continue to rely on government aid and on protection to survive instead of benefiting from the fortifying lessons of a free market. Ongoing protection of an infant industry is a drag on state revenues – the government needs to keep buying foreign currency to continue to suppress a currency. This is a needless loss when funds can instead be used to invest in income generating projects or upgrading infrastructure. Related to this factor, an artificially depressed currency means imports are relatively more expensive. For consumers, the price increase limits the goods and services available to them and increases inflation, thus, lowering living standards. Effectively, suppressing the currency directly benefits a small industry group at the expense of wider society. These negative effects demonstrate the harmful results of currency intervention and indicate currency intervention is generally not ethically justifiable from a consequentialist viewpoint.

Additionally, the ends may be objectively bad in themselves. When a state intervenes in the currency market to further a political agenda, such as during the Nigerian civil war when Nigeria actively sought to bankrupt a secessionist state, the ends are objectively bad. Currency manipulation should not be used as an instrument to weaken the economy of another state. In a world where states are so closely connected, such malignant attacks not only directly weaken a state, it also may weaken the global economy.

But…Was Currency Pegging in Switzerland Ethically Justifiable?

In pegging the franc, the SNB sought to reduce economic instability, protect Switzerland’s exporting industry and the economy as a whole. In an extremely unstable economic climate, the SNB’s currency intervention successfully reduced the level of uncertainty faced by Swiss businesses. Export industries, constituting a significant part of the economy, knew that an exchange rate of CHF 1.20 was guaranteed. This facilitated investment, hiring and economic growth. As a result, Switzerland’s economy grew by an average of 1.7%[10] – an impressive feat given the dismal performance of other economies in the euro zone. For the three-year period the SNB pegged the franc, the euro zone averaged economic growth of zero percent.[11]

The SNB successfully attained its desired outcomes in pegging the franc. The ends of reducing instability and protecting the economy were achieved. The SNB wished to ensure Switzerland’s economic growth and therefore, the welfare and standard of living of the Swiss. The motive of the central bank in protecting the interests of Swiss citizens was fundamental to its currency intervention. Analyzing the consequences of the SNP’s action, it appears as if the consequences met the desired outcomes – from the Swiss point of view.

In sum, central banks intervene in currency markets for a complex mix of political, social and economic reasons. Empirical analysis of the effects of currency intervention demonstrates that often, the intended aims of currency intervention are not achieved. In general, a consequentialist ethical philosophy does not support currency intervention, but perhaps the case of SNP currency manipulation may be an exception.

BIBLIOGRAPHY

Articles

Ahamed, Liaquat, ‘Currency Wars, Then and Now: How Policymakers Can Avoid the Perils of the 1930s’ (2011) 90 Foreign Affairs 92

Bachmann, Ruediger Elstner, Steffan and Sims, Eric ‘Uncertainty and Economic Activity: Evidence from Business Survey Data’ (Working Paper No 16143, National Bureau of Economic Research, 2010)

Baldwin, Robert ‘The Case Against Infant-Industry Tariff Protection’ 77 Journal of Political Economy 3

Cassidy, John, ‘Why Chaos in the Currency Markets Might be Good News’ The New Yorker (New York) 16 January 2015

‘Charting the Year’ The Economist 31 December 2011

‘Currency Risk’ The Economist (Warsaw) 18 January 2015

Dominguez, Kathryn and Frankel, Jeffrey, ‘Does Foreign Exchange Intervention Matter? The Portfolio Effect’ 83 The American Economic Review 5

Eichengreen, Barry and Sachs, Jeffrey, ‘Exchange Rates and Economic Recovery in the 1930s’ (1985) 45 The Journal of Economic History 925

Fang, Wenshwo , Lai, YiHao, and Miller, Stephen ‘Export Promotion Through Exchange Rate Changes: Exchange Rate Depreciation or Stabilisation’ 72 South Economic Journal 3

‘Going Cuckoo for the Swiss’ The Economist 15 January 2015

Liss, Jodi, ‘Making Monetary Mischief: Using Currency as a Weapon’ (2008) 24 World Policy Journal 4

O’Mahony, Angela ‘Engineering Good Times: Fiscal Manipulation in a Global Economy’ 41 British Journal of Political Science 2

Rajan, Raghuram ‘Currencies Aren’t the Problem: Fix Domestic Policy, Not Exchange Rates’ 90 Foreign Affairs 2

Sarno, Lucio and Taylor, Mark, ‘Official Intervention in the Foreign Exchange Market: is it Effective and, if so, How Does it Work?’ 39 Journal of Economic Literature 3

‘Setting monetary policy by unpopular vote’ The Economist (Switzerland) November 29 2014

Staiger, Robert, ‘”Currency Manipulation” and World Trade” (Working Paper No 14600, The National Bureau of Economic Research, 2008)

Stirbock, Claudia and Buscher, Herbet, ‘Exchange Rate Volatility Effects on Labour Markets’ (2000) 35 Intereconomics 1

‘Swiss Miss’ The Economist, 24 January 2015

‘Swiss National Bank Discontinues Minimum Exchange Rate and Lowers Interest Rate to -0.75%’ (Press Release, 15 January 2015)

‘Swiss National Bank Takes Measures Against Strong Swiss Franc’ (Press Release, 3 August 2011)

‘Swiss National Bank Intensifies Measures Against Strong Swiss Franc’ (Press Release, 17 August 2011)

‘Swiss National Bank Sets Minimum Exchange Rate at CHF 1.20 Per Euro’ (Press Release 6 September 2011)

‘Swiss National Bank Expands Measures Against Strong Swiss Franc’ (Press Release, 10 August 2011)

‘Swiss National Bank Expands Measures Against Strong Swiss Franc’ (Press Release, 10 August 2011)

‘The Plan Worked’, The Economist (Washington) 22 October 2012

Wang, Kai-Li and Barrett, Christopher ‘Estimating the Effects of Exchange Rate Volatility on Export Volumes’ 32 Journal of Agricultural and Resource Economics 2

‘Why the Swiss Unpegged the Franc’ The Economist 18 January 2015

Other sources

Frankel, Jeffrey, Foreign Exchange (2005) The Concise Encyclopedia of Economics http://www.econlib.org/library/Enc/ForeignExchange.html accessed at 18 February 2015

Ghosh, Atish, Turning Currencies Around (2008) Finance & Development A Quarterly Magazine of the IMF http://www.imf.org/external/pubs/ft/fandd/2008/06/ghosh.htm accessed at 18 February 2015

Historic Lookup, X-Rates http://www.x-rates.com/historical/?from=CHF&amount=1.00&date=2010-08-01 accessed at 18 February 2015

Hutchinson, Michael, Is Official Foreign Exchange Intervention Effective? (2008) Federal Reserve Bank of San Francisco http://www.frbsf.org/economic-research/publications/economic-letter/2003/july/is-official-foreign-exchange-intervention-effective/ accessed at 16 February 2015

Hunter, William, Government Intervention and Exchange Rates, The ABC Group http://theabcgroupllc.com/gov-intervention-and-exchange-rates.html accessed at 16 February 2015

Irwin, Douglas, A Brief History of International Trade Policy (2001) The Library of Economics and Liberty http://www.econlib.org/library/Columns/Irwintrade.html accessed at 17 February 2015

Mcleod, Darryl, Capital Flight The Concise Encyclopedia of Economics http://www.econlib.org/library/Enc1/CapitalFlight.html accessed at 18 February 2015

SMI, (2015) Swiss Exchange http://www.six-swiss-exchange.com/news/overview_en.html at 6 February 2015

Switzerland (2014) The CIA World Factbook https://www.cia.gov/library/publications/the-world-factbook/geos/sz.html accessed at 18 February 2015

Switzerland’s GDP Annual Growth Rate, (2015) Trading Economics http://www.tradingeconomics.com/switzerland/gdp-growth-annual at 6 February 2015

Notes

[1] ‘Charting the Year’ The Economist 31 December 2011

[2] Marc-Andre Miserez Switzerland Poised to Keep EU at Arm’s Length (2012) Swissinfo http://www.swissinfo.ch/eng/switzerland-poised-to-keep-eu-at-arm-s-length/34083578 at 6 February 2015

[3] ‘Why the Swiss Unpegged the Franc’ The Economist 18 January 2015

[4] ‘Swiss National Bank Sets Minimum Exchange Rate at CHF 1.20 Per Euro’ (Press Release 6 September 2011)

[5] Switzerland (2014) The CIA World Factbook https://www.cia.gov/library/publications/the-world-factbook/geos/sz.html accessed at 18 January 2015

[6] Historic Lookup, X-Rates http://www.x-rates.com/historical/?from=CHF&amount=1.00&date=2010-08-01 accessed at 18 February 2015

[7] Ruediger Bachmann, Steffan Elstner and Eric Sims, ‘Uncertainty and Economic Activity: Evidence from Business Survey Data’ (Working Paper No 16143, National Bureau of Economic Research, 2010) 2.

[8] John Stuart Mill, Principles of Political Economy with some of their Applications to Social Philosophy. William J. Ashley, ed. 1909. Library of Economics and Liberty. 4 March 2015. <http://www.econlib.org/library/Mill/mlP.html>.

[9] Jodi Liss, ‘Making Monetary Mischief: Using Currency as a Weapon’ (2008) 24 World Policy Journal 4, 29.

[10] Switzerland’s GDP Annual Growth Rate, (2015) Trading Economics http://www.tradingeconomics.com/switzerland/gdp-growth-annual at 6 February 2015.

[11] Euro Area GDP Growth Rate, (2015) Trading Economics http://www.tradingeconomics.com/euro-area/gdp-growth at 6 February 2015.

[1] SMI, (2015) Swiss Exchange http://www.six-swiss-exchange.com/news/overview_en.html at 6 February 2015