Credit Default Swaps: An Update

By: Arjyo Mitra

The CDS

A credit default swap (CDS) is a financial transaction that is based on the risk of a certain underlying event. It derives its value from its promise of protection from the debilitating effects of the event. However, its use in financial markets has evolved to serve more complex purposes than simply offering protection against risk.

Buyers and sellers are brought together in an arrangement in which the buyer of the CDS protection makes periodic payments (also known as “premiums” or “spreads”) to the seller. In exchange for these premiums, the seller makes a one-off payment to the buyer if a pre-specified credit event occurs before the arrangement reaches maturity.[1] Credit events include, but are not limited to, borrowers or corporations defaulting on debt, suffering credit rating downgrades or delaying due payments.[2] The subject of the transaction is usually a loan or a corporate entity and is referred to as the “reference entity.” The conditions under which the seller’s obligation is triggered are stipulated at the time of entering into the contract.

In the event that the reference entity defaults on its debt, the payoff to the buyer is usually equal to the face value of the bond and is made in exchange for the physical delivery of the failed bond (physical settlement) or cash delivery of the difference between the par value of the bond and the current market price to the seller of the instrument (cash settlement).[3] After this payoff is made, the transaction is terminated, and the two parties owe each other no further payments. If the credit event does not occur during the time period specified by the transaction, the borrower ceases to pay premiums upon the deal reaching maturity, and the seller is not required to make any payment.

This arrangement shifts the potential burden of the loss resulting from the underlying credit event from the buyer to the seller of the protection. In this way, a CDS works in much the same way as regular insurance facilities. An appropriate example is a family taking insurance on an automobile. From the time of entering into the deal, the family makes regular payments in the form of premiums to the insuring company. In the event that the automobile suffers a pre-specified amount of damage, the family receives compensation for its loss. Upon this payment, the insurance contract is terminated. However, transactions involving credit default swaps have many features that distinguish them from regular insurance services.

The invention of the credit default swap played a crucial role in build-up to the Credit Crisis of 2008 and contributed to the near-fatal destabilization of the American financial system and economy. Since the crisis, the securitization and trading of the instrument in international financial markets has come under intense regulatory scrutiny. This paper first describes the primary uses and characteristics of the credit default swap. It then provides a brief historical background, including the original rationale for its invention, before briefly elucidating upon the regulations that govern the instrument. The discussion on legislative reforms is contextualized by a brief summary of the Credit Crisis. Finally, it presents an update on the swap’s current presence in international financial markets.

Description and uses

The three primary uses of credit default swaps are speculation, hedging and arbitrage. These are explained in turn. The discussion of each aspect of the use of the derivative reveals a particular characteristic that enables the use.

Speculation

The Commodity Futures Trading Commission (CFTC), the US regulator of markets for derivative contracts such as futures and options, defines a speculator, and by extension the act of speculation, as “a trader who . . . trades with the objective of achieving profits through the successful anticipation of price movements.”[4]

One of the key features of the credit default swap that separates it from insurance is that, in most cases, a buyer of the former is not required to have an insurable interest in the reference entity. That is, buyers of most credit default swaps are not actually required to suffer losses as a direct result of the reference entity defaulting on its debt in order to receive the protection guaranteed by the seller. In contrast, only those policy holders who have suffered quantifiable losses on assets that represent a direct insurable interest qualify for the payment entailed by regular insurance contracts. The swaps that possess this feature are referred to as “naked” credit default swaps.[5]

The synthetic nature of naked credit default swaps allows them to be used as tools for speculation. Investors can make bets on the health of companies, as indicated by their current and predicted future share prices, without themselves owning stakes in them. Investors who expect companies to fail and hence default on their debt can buy naked credit default swaps. This enables them to earn profits (should the company actually fail) without experiencing the negative repercussions of the event. Similarly, investors with a positive outlook can sell protection in order to receive regular premiums from buyers without having to make compensatory payments (as long as the reference entity remains stable).[6]

Hedging

Hedging is the process by which investors take on investments or trading positions that offset potential gains or losses from existing positions in other transactions. It is a means of mitigating the effects of exposure to risk. Credit default swaps can be used to hedge against exposure to undesired risk.

A lender (a buyer of a bond) can hedge against the risk of the borrower failing to fulfil his obligation to repay by buying a CDS with the bond as the reference entity. Credit default swaps also allow portfolio managers to optimize the composition of portfolios across various industries and sectors; overexposure to a certain industry’s risks can be countered by entering into credit default swap arrangements to hedge the exposure.

Finally, investors can enter into CDS contracts with a particular company as the reference entity in order to hedge investments made in other companies that are expected to closely mirror the reference company’s market movements. This is an example of speculation in a company that also serves the purpose of hedging.

The use of credit default swaps as instruments for hedging is facilitated by the fact that counter-parties to the original debt arrangement are never direct party to the CDS arrangement. Thus, using the instrument to hedge against perceived risk or undesired exposure is strictly confidential and does not affect the buyer’s relationship with its clients and borrowers.

Arbitrage

Arbitrage is the process of taking advantage of temporary imbalances between prices in markets. It allows arbitrageurs to create risk-free profits (after transaction costs). Credit default swaps are used to exploit mispricings between a company’s debt and equity using a strategy known as capital structure arbitrage.

The periodic (annual) payments CDS buyers must make to sellers of protection are known as “CDS spreads.” They are measured as a percentage of the notional value of the swap transaction. They function as an important indicator of the probability of the reference entity defaulting on its debt.[7] Clearly, sellers of protection require higher spreads—usually measured in basis points, one-hundredth of a percentage point—in order to promise compensation in cases where the reference debt is more likely to default. Thus, in cases where two credit default swaps have the same maturity, the CDS linked to a company with a higher CDS spread can generally be considered more likely to require the one-off payment from seller to buyer. Clearly, a company’s stock price—which can be considered a reliable indicator of its financial health and short-term credit-worthiness—and its CDS spread are expected to show a negative correlation.

Capital structure arbitrage utilizes CDS transactions to exploit situations in which the above relationship is found not to hold. For example, assume a company’s share price increased by 10 percent after it announced some positive news to the markets. If its CDS spread remains unchanged, arbitrageurs can exploit this debt-equity pricing discrepancy by selling CDS protection and the stock of the company to hedge their exposure to market risk. This short position in CDS transaction benefits the arbitrageurs if the market’s valuation of the CDS spread tightens (reduces) relative to its equity. In this situation, the arbitrageur received a higher periodic spread than dictated by the revised-market CDS spread. Thus the arbitrage technique results in abnormal profits.

Invention and historical background

The credit default swap was invented by a J.P. Morgan team in 1994. The principle that governed the use of the transaction was an extension of that which had made currency swaps a profitable venture in the early 1980s. It allowed parties to trade risk instead of swapping currency, debt or interest rates, as was the norm.

The invention of the transaction was motivated by J.P. Morgan’s desire to reduce the amount of credit risk it held on its “books” (balance sheet). While the presence of credit risk made the firm liable to borrowers defaulting, it also restricted the amount of liquid capital available for lending. This was due to the stringent capital requirements imposed on banks’ lending facilities by the Basel Accord, which was enforced in 1992. This agreement stipulated that such institutions had to keep capital amounting to at least 8 percent of all risk-weighted assets in reserve against their outstanding loans.

Thus, selling credit default swaps with its outstanding loans as reference entities served two purposes for J.P. Morgan: It transferred credit risk away from its balance sheet and, importantly, granted the bank exemption from the scrutiny of the Basel Accord. Since the bank believed it accurately assessed the risk of the loans it granted, selling credit default swaps was a largely safe bet.

In 1994, Blythe Masters, then a member of J.P. Morgan’s swaps team, engineered the world’s first deal along these lines. When Exxon faced punitive damages potentially totalling $5 billion as a result of the 1989 Exxon Valdez oil spill, it approached J.P. Morgan, an old client, for a new $4.8 billion line of credit to cover the damages.[8] Unwilling to tie up a significant amount of capital in reserve, a Masters-led J.P. Morgan convinced the European Bank of Reconstruction and Development (EBRD) to buy the credit line and assume the risk associated with Exxon defaulting on its debt. In exchange, the EBRD would receive a fee from J.P. Morgan if Exxon were to default.[9] Thus, the interests of all three parties were met, and the deal became known as the world’s first “credit-default swap” transaction.

Regulations governing credit default swaps

By 2007, the proliferation of credit default swaps in financial markets played a crucial role in causing the Credit Crisis of 2008. A brief discussion of the reasons for this informs the subsequent section on regulatory restrictions that have been debated upon and implemented in the aftermath of the crisis.

Credit Default Swaps and the Credit Crisis

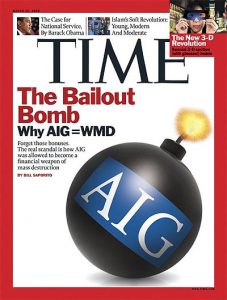

Beginning in the early 21st century, investment banks began searching for ways to remove credit risk from their balance sheets. They did this using a process known as securitization. Banks would collect the different kinds of loans on their books and package them to form huge portfolios, which were divided into slices, or “tranches,” based on their risk-and-return characteristics. These complex pools of assets and derivatives were called Collateralized Debt Obligations (CDOs). Investors and financial institutions bought large amounts of these CDOs owing to the high levels of return they offered. This prompted monolines (insurance) and insurers such as The American International Group (AIG), to sell CDSs to these investors in abundance, thus assuming the credit risk they bore due to their purchases of the instruments, which depended on their constituent loans for the revenue streams they generated.

The protection offered to investors by the CDSs created a perceived notion of safety against borrowers defaulting. Additionally, it was believed that CDOs consisting of thousands of loans effectively removed the possibility of investors suffering from defaults on individual loans. This dramatically increased the demand for CDOs in the markets and made the securitization process immensely lucrative. Since banks could quickly—and profitably–transfer the credit risk of the loans they made to willing investors, they no longer needed to worry about the quality of the loans. Thus, the safety against potential credit risk offered to lenders by the securitization process contributed to lenders issuing substandard mortgages to poorly qualified homeowners across the US. These shaky loans were called “sub-prime” mortgages.

Once the domestic housing market turned and homeowners began to default on their mortgages en masse, the value of CDOs rapidly vanished. Investors and institutions whose balance sheets plummeted in value claimed their CDS protection, but the insurance industry could not meet the immense demand. Thus, the parties that had enormous amounts of sub-prime mortgages on their books or had taken on the risk of CDOs suffered huge losses and in some cases were forced to declare bankruptcy and insolvency. Other institutions required federal bailouts to maintain solvency. The global economy was sent into a devastating and long-lasting recession.

4.2 Regulation of Credit Default Swaps

CDSs were instrumental in creating a proclivity for excessive and aggressive risk-taking without consideration for negative repercussions during the build up to the Credit Crisis. By effectively guaranteeing investors protection, they fueled the securitization process, which in turn erased the notion of prudent lending and rational investments that had maintained solvency in financial markets for decades. The use of the contracts for speculative purposes also contributed to excessive risk-taking in the market. This prompted widespread demands for stringent regulatory supervision to be imposed upon the derivative. This section discusses some of the most important regulations that have been enacted since the crisis.

4.2.1 Calls for increased transparency

The move to regulate the trading of credit default swaps has been part of a larger push by US regulatory and supervisory entities such as the Federal Reserve, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to bring transparency to the market for derivatives such as options, futures and swaps following the financial crisis. Much of the institutions’ focus has been on improving their ability to supervise the trading of these contracts by creating transparent, centralized clearinghouses in which all trading activity can take place.

Before the post-crisis wave of regulation, most derivative contracts were traded in opaque over-the-counter (OTC) markets. The provisions of the Commodity Futures Modernization Act of 2000 (CFMA) prohibited authorities such as the SEC and CFTC from regulating these OTC markets and the instruments traded on them. However, OTC trading raised serious questions regarding the ease of monitoring risk; the global distribution of risk across buyers and sellers and the lack of transparency meant that the trading of credit default swaps on OTC markets could not be monitored or controlled. Additionally, the systemic risk created by the size and complexity of the CDS market and the instrument’s sensitivity to global economic conditions could not be detected or mitigated easily.[10] It was suggested clearinghouses would centralize the market for derivatives such as credit default swaps, thus facilitating supervision and regulatory oversight. Furthermore, the clearinghouse would take up the opposite end of each CDS transaction, thereby reducing counterparty risk faced by buyers and sellers of the instruments and preventing the risk of individual defaults propagating into the market at large.[11]

To this end, President Barack Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act on 21 July, 2010. The Dodd-Frank Act contains a provision requiring most derivatives (including credit default swaps) to be cleared by and traded on centralized, third-party exchanges such as the Intercontinental Exchange and Chicago Mercantile Exchange.[12] It also requires the trades to be sufficiently and uniformly collateralized.[13] Several other bills have been introduced in the Senate and the House of Representatives to begin regulation of credit default swaps and other standardized OTC derivatives. While not all passed, the majority of the bills required these instruments to be cleared and traded through exchanges regulated by either the SEC or the CFTC. Additionally, they advocated increasing margin and capital requirements on non-standardized OTC derivatives in order to incentivize the use of standardized instruments and regulated exchanges.[14]

4.2.2 Detailed outlining of regulatory jurisdiction

The extent of regulatory oversight applicable to the trading of credit default swaps has also been revised by the Dodd-Frank Act. Previously, the CFMA granted the SEC antifraud authority over “security-based swap agreements,” such as credit default swaps, but imposed several other prohibitions that reduced the regulator’s ability to prevent fraud and misuse of the swaps.[15] Foremost among these was its mandate to prevent swaps from being categorized as “securities,” thus placing them beyond the regulatory reach of the SEC and CFTC.

However, Title VII of the Dodd Frank Act details the respective jurisdictions of the SEC and CFTC in regulating swaps: The CFTC is authorized to regulate “swaps,” the SEC “security-based swaps,” and both jointly regulate “mixed swaps,”[16] which are based on securities but with commodity-based components as well.[17] The CFTC is also responsible for the regulation of “security-based swap agreements,” but the SEC has antifraud and other authority over the agreements.[18]

Furthermore, the SEC is given access to information on security-based swap agreements traded on CFTC-operated derivatives clearinghouses. It can also impose stringent record-keeping requirements for entities trading in these swap arrangements.[19] Thus, these provisions of Title VII of the Dodd-Frank Act attempt to overturn many of the hurdles to regulatory supervision of swaps previously imposed by the CFMA.

Title VII also stipulates that both institutions shall continue to refine such definitions pertaining to their regulatory jurisdictions through joint rulemakings in order to comprehensively and collectively ensure regulation of every aspect of the market for swaps.[20] These regulations shall likely pave the path for further provisions that seek to improve transparency in the market for credit default swaps and remove any threats to systemic stability.

4.2.3 Regulation in Europe

Naked credit default swaps were widely used by investors to speculate on the health of European countries (that is, their ability to pay off outstanding debt) during the European sovereign debt crisis. In 2011, European Parliament passed legislation enforcing outright bans against the use of the instruments for the sole purpose of speculation on national debt. The rationale behind this decision was that market speculation generated by the trading of naked CDS instruments had “incalculable effects” on the perceived wellbeing of governments and therefore needed to be contained.[21]

In 2012, European Parliament also introduced the legislative ruling titled “Regulation (EU) No. 236/2012 of the European Parliament and of the Council of 14 March 2012 on short selling and certain aspects of credit default swaps.” Fully enforced by Nov. 1, 2012, it sought to “increase transparency of short positions held by investors in certain EU securities, reduce . . . risks linked with uncovered or naked short selling and create a harmonised framework for coordinated action at European level.”[22]

Market data (pre- and post-crisis)

Following the invention of the modern credit default swap and its widespread adoption for hedging purposes by banks, the global market for the instrument quickly expanded to reach an estimated size of $300 billion by March 1998. However, as the use of the instrument for speculative purposes became popular, the notional size of the market grew to $2.2 trillion.[23]

The notional amount of traded swaps reached a peak of more than $62 trillion in 2007.[24] It is estimated that naked CDS constituted as much as 80 percent of this amount.[25] In the wake of the financial crisis and the spate of regulations that followed, the net amount of credit default swaps outstanding globally fell 20 percent between October 2008 and November 2010 as investors sought to wait until the full extent of the impact of regulatory restrictions on markets became clear.[26] The International Swaps and Derivatives Association estimated the total amount of outstanding credit default swaps in 2009 to be $30.4 trillion.[27] This fall in value coincided with measures taken to cancel contracts that offset each other.

The Depository Trust & Clearing Corporation (DTCC) website publishes data on the outstanding notional amount of CDS trades on on a weekly basis. According to the information warehouse accessible on the site, the value of dollar-denominated trades outstanding (referred to as “open interest”) as of Aug. 1, 2014 is almost $10 trillion, down from $13.6 trillion in August 2013.[28]

xxx

[1]Michael Simkovic, “Leveraged Buyout Bankruptcies, the Problem of Hindsight Bias, and the Credit Default Swap Solution,” (Columbia Business Law Review 2011 No 1), 118.

[2] Christian Weistroffer, “Credit default swaps: Heading towards a more stable system,” Deutsche Bank Research 21 December 2009, 03 August 2014 <http://www.dbresearch.com/PROD/DBR_INTERNET_EN-PROD/PROD0000000000252032.pdf>.

[3] Weistroffer.

[4] “CFTC Glossary: A Guide to the Language of the Futures Industry,” US Commodity Futures Trading Commission 04 August 2014 <http://www.cftc.gov/consumerprotection/educationcenter/cftcglossary/glossary_s>.

[5]Dawn Kopecki and Shannon D. Harrington, “Banning ‘naked’ default swaps may raise corporate funding costs,” Bloomberg 24 July 2009, 03 August 2014

<http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a0W1VTiv9q2A>.

[6] Wayne Pinsent, “Credit default swaps: An introduction,” Investopedia 01 August 2014<http://www.investopedia.com/articles/optioninvestor/08/cds.asp>.

[7]Weistroffer.

[8] John Lanchester, “Outsmarted: High finance vs human nature,” The New Yorker 1 June 2009, 03 August 2014 <http://www.newyorker.com/magazine/2009/06/01/outsmarted>.

[9]Lanchester.

[10] Squam Lake Working Group on Financial Regulation “Credit Default Swaps, Clearinghouses and Exchanges,” Council on Foreign Relations July 2009, 07 August 2014 <http://www.cfr.org/financial-regulation/credit-default-swaps-clearinghouses-exchanges/p19756>.

[11] Squam Lake Working Group on Financial Regulation.

[12] Cad Terhune “ICE’s Jeffrey Sprecher: The Sultan of Swaps,” Bloomberg Businessweek 29 July 2010, 7 August 2014 <http://www.businessweek.com/magazine/content/10_32/b4190056333791.htm>.

[13] Christine Harper and Shannon D. Harrington, “Wall Street shrinks from Credit Default Swaps before rules hit” Bloomberg 29 November 2010, 06 August 2014 <http://www.bloomberg.com/news/2010-11-29/wall-street-shrinks-from-default-swaps-as-dodd-frank-rules-hit-speculators.html>.

[14] Nicole S. Frank “Proposed Legislation to Regulate Credit Default Swaps and Other OTC Derivatives: Who does Greater Market Transparency Benefit?” Robin, Kaplan, Miller & Ciresi L.L.P. February 2010, 7 August 2014 <http://www.rkmc.com/resources/articles/proposed-legislation-to-regulate-credit-default-swaps-and-other-otc-derivatives-who-does-greater-market-transparency-benefit#_ftn17>.

[15] U.S Securities and Exchange Commission “Derivatives” 06 August 2014 <http://www.sec.gov/spotlight/dodd-frank/derivatives.shtml>.

[16] U.S. Securities and Exchange Commission “Statement of General Policy,” 07 August 2014 <http://www.sec.gov/rules/policy/2012/34-67177.pdf>.

[17] U.S. SEC “Derivatives”.

[18] U.S. Securities and Exchange Commission “SEC Approves Rules and Interpretations on Key Terms for Regulating Derivatives,” 9 July 2012 6 August 2014 <http://www.sec.gov/News/PressRelease/Detail/PressRelease/1365171483092#.U-aIofmSxsk>.

[19] U.S. SEC “Derivatives”.

[20] U.S. SEC “Derivatives”.

[21] “Euro-Parliament bans ‘naked’ credit default swaps,” EU Business 16 November 2011, 7 August 2014 < http://www.eubusiness.com/news-eu/finance-economy-cds.dij>.

[22] “Questions and Answers: Implementation of the Regulation on short selling and certain aspects of credit default swaps,” European Securities and Markets Authority 13 September 2012, 08 August 2014 <http://www.esma.europa.eu/system/files/2012-572.pdf>.

[23] “ISDA Market Survey,” International Swaps and Derivatives Association 07 August 2014 <http://www.isda.org/statistics/pdf/ISDA-Market-Survey-annual-data.pdf>.

[24] ISDA.

[25] Kopecki and Harrington.

[26] Harper and Harrington.

[27] ISDA.

[28] “Trade Information Warehouse,” DTCC 06 August 2013 <http://www.dtcc.com/market-data/section-1/table-1a.aspx>.

Editor: Angela Lutz