CliFin: Asset Management and Climate Change

By: Blythe Logan

Part of SPI’s series on CliFin (Climate Finance)

The coming few years will be a time of rapid change in asset management engagement in ESG climate change issues. Although many firms are adopting more progressive practices to address climate change, most of the largest groups are slow to act, despite experiencing pressure from their customers and campaigners. These firms still trail more progressive entities like Aviva Insurance, BNP Paribas, HSBC Global Asset Management and Walden Asset Management. As investment management companies with control over sizeable share holdings, the decisions of large firms like BlackRock and Vanguard are significant for future climate change developments because the carbon footprint of major corporations outstrip those of individuals.

Why Climate Change?

Evidence of human activity driving emissions of greenhouse gases, increases in global temperatures, rises in coastal sea levels and the frequency of severe weather events is indisputable (Tan Bhala and Wilkinson). For years the $85 trillion asset management industry did little to incorporate climate change into its assessments of risk, but a growing body of scientific research on the threat of climate change coupled with nearly 200 countries signing the 2015 Paris Climate Change Agreement, galvanized environmentally conscious customers and campaigners alike (Raval).

In February 2017, 700,000 individuals petitioned their banks to end their financing of the Dakota Access Pipeline because of concerns about the environmental effects of the transport and use of crude oil, and the disturbance of land for rural farmers and Native American populations, among other issues.

In December 2018, 30,000 Barclays customers petitioned to divest from oil pipelines from tar sands due to climate related concerns.

In May 2018, 30,000 account holders petitioned Vanguard to hold more companies accountable for political engagement following the firm’s failure to vote for Exxon to publicly disclose its lobbying activities in a shareholder meeting (Homanen). The petition stressed how the significant amount of support for climate related action merits better fiduciary duty, stating:

Vanguard claims to act solely in its clients’ best interest and to be guided by a simple statement: “Do the right thing.” The recent shareholder meeting was a chance for the company to hear from its investors: the Americans who trust Vanguard with their retirement savings and who are also the company’s shareholders. Vanguard should listen to the over 27,500 petition signers plus the 65,000 Americans who have written to the company in the past and change the way they vote. As the second largest mutual fund in the country and an entity responsible for the retirement savings of so many Americans, Vanguard should “do the right thing” and support political spending and lobbying disclosure.

Vanguard is not the only asset management firm to be called out on its climate related interests, as campaigners have put pressure on BlackRock for its voting practices and heavy investments in coal (Homanen). A coalition of activists protested outside the Lotte New York Palace Hotel, the venue of BlackRock’s annual shareholder meeting, on May 23, 2019 as a part of the BlackRock’s Big Problem campaign against asset managers driving the climate crisis. The protestors brandished signs reading, “BlackRock: Taking your money—investing in climate chaos” and “BlackRock is the biggest driver of climate destruction on the planet” (Dembicki). The group also released research showing that ETF funds BlackRock markets to their customers as “sustainable” actually contribute to climate change due to inconsistencies in standards for ESG criteria (“BlackRock’s Sustainable ETFs: Green business or greenwash?”).

A 2015 study from the Economist Intelligence Unit estimated that losses in global total stock of manageable assets at risk due to climate change could range from $4.2tn to $43tn between now and the end of the century (Economist Intelligence Unit). Large corporations and state enterprises are the main actors responsible for increased carbon emissions, yet those corporations and enterprises are funded by investments held by asset management firms (Tan Bhala and Wilkinson). Individual consumers shoulder comparatively insignificant carbon footprints, so they see their asset managers as avenues for change since firms like Vanguard have more power over large corporations. With sizeable stakes in many companies, major asset managers have sway over the economic and social decisions of those companies. Asset managers’ influence in shareholder meetings and even direct discussion with corporations make their opinions and action taken on Environmental, Social and Governance (ESG) issues significant for the future of the earth’s climate.

Asset Management Strategies to Address Climate Change

Voting for climate related shareholder resolutions

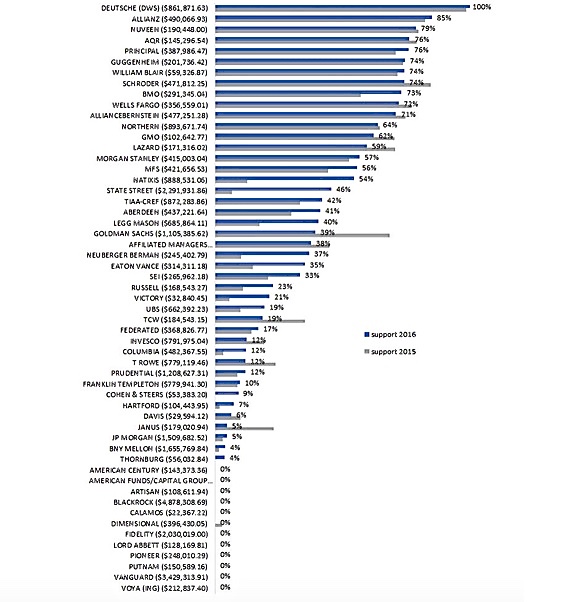

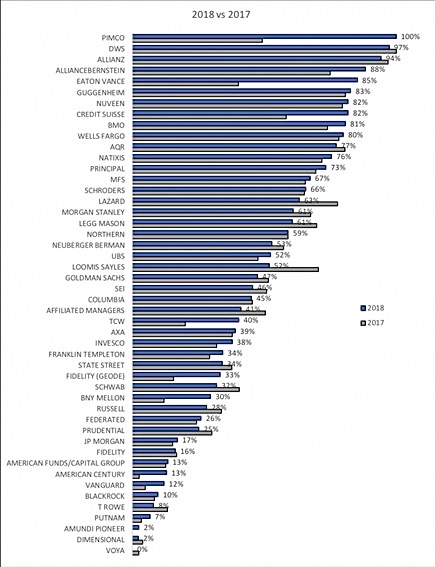

Pacific Investment Management Company, LLC (PIMCO), Deutsche Asset Management (now DWS) and Allianz are industry leaders in this initiative, each voting for 94+% of the proposals in 2018. These firms demonstrated awareness of customer climate related concerns with progressive proxy voting policies. Voting strategies have been effective in forcing companies to bring in more climate focused directors or disclose information on lobbying and carbon emissions when a shareholder majority overturns the board’s decisions (Raval).

Shareholder and public policy engagement

Of all asset management groups, Aviva, Walden, and BNP Paribas make the most efforts to discuss their climate concerns with companies, policymakers, trade associations and credit rating agencies. This engagement goes beyond proxy voting at shareholder meetings. The companies engage in direct dialogue with firms about specific climate related concerns. The Church of England, NY State comptroller, CalPERS and many pension funds also lead in engagement with corporations and often work with asset managers in initiatives like Climate Action 100+, a group of investors with $33 trillion under management. Action 100+ seeks to “engage systemically important greenhouse gas emitters and other companies across the global economy that have significant opportunities to drive the clean energy transition and achieve the goals of the Paris Agreement.” (McHale)

Providing green finance products and services

BNP Paribas, HSBC and Barclays are industry leaders in making green bonds and loans available to customers. According to a 2017 ShareAction study of European asset managers, BNP Paribas leads the field because of its green product offerings and engagement with external actors on climate related issues. The firm offers many Socially Responsible Investing (SRI) funds and a Parvest Climate Impact fund, the latter invests in companies finding solutions to global warming (“BNP Paribas Tops Survey on Climate Change”). HSBC launched a range of new green loans, leases, asset loans, hire purchases and revolving credit facility in July 2019, but has been involved in responsible investing initiatives since 2006 (Cuff, HSBC Global Asset Management (UK)). In 2017, Barclays became the first UK bank to launch a range of green finance products to help its corporate clients fund low-carbon projects and investments, including deposits, loans, and innovation finance (Cuff).

Divesting from high carbon assets

Aviva and Walden Asset Management are at the forefront of divestment among asset management groups. While wholesale divestment is not always the most straightforward strategy as oil and gas companies are large and widely held, Walden boasts over fifteen years of experience managing portfolios without exposure to coal, oil or natural gas companies (“Managing Climate Change Risk.”). Aviva has walked out on several companies unwilling to transition to a low carbon economy despite pressure from shareholders, such as Coal India, China Resources Power and China Coal Energy (Raval). Divestment, however, is most effective when done by many investors at the same time.

Investment in low-carbon infrastructure and renewable energy

Aviva targeted $780 million annual investment in low carbon infrastructure for five years and Allianz committed $2.72 billion to renewable energy investments in 2015 (The Economist Intelligence Unit). These strategies match divesting from fossil fuels and offering green financial products.

Conducting research on climate related risk

Partnering with research group Rhodium in April 2019, BlackRock has made significant strides to better understand and quantify climate related risk.Brian Deese, head of sustainable investing at BlackRock, cited outdated climate-science models, which do not take into account the “recent acceleration in the frequency and severity of extreme weather events,” for the underpricing of the risk by many U.S. markets (Holder). Physical climate risk is difficult for investors to grasp given the unprecedented nature of so many unpredictable extreme weather events and dearth of available data from companies. Even so, BlackRock and Rhodium are finding ways to innovate climate models and analyze data with “recent advances in econometric research, data processing, and scalable cloud computing.” (“Clear, Present and Underpriced: The Physical Risks of Climate Change”)

Integrating climate risk more fully into risk management as a whole

Aviva and BlackRock consider climate risk as a main component of risk management. BlackRock plans to build the data from its study with Rhodium into investment and risk management processes used by its portfolio managers (Holder). Aviva was one of the earliest firms to measure climate risk embedded into its portfolios as it thought as early as 2015, ignoring the risk would be a breach of fiduciary duty (The Economist Intelligence Unit).

Non-Leaders

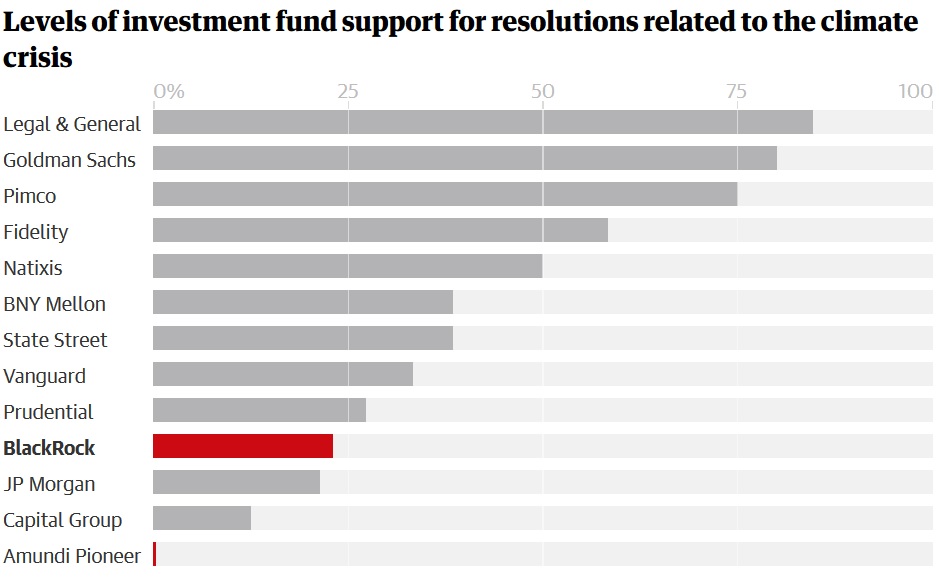

Asset Management groups have been trending towards making their assets greener (Homanen). In 2019, almost all firms offer green financial products, but many lag behind on changing their voting or engagement practices. BlackRock for example launched an array of sustainable equity exchange-traded funds a few years ago, but only voted for 10% of climate related resolutions in shareholder meetings in 2018 according to a study by Ceres and 23% of climate change reporting according to a study by Climate Majority Project (formerly 50/50 Climate Project), following 0% in 2017 (Kantchev and Kent, Berridge, Gladman).

Behavior Change Required of Large Firms

The leadership shown by small groups like Walden is positive for those concerned about the future of the earth’s climate, but the actions of large firms like BlackRock, Vanguard and Fidelity have far more impact. And unfortunately, their voting results and engagement efforts are not as encouraging. Though the percentage of votes for climate resolutions from BlackRock and Vanguard increased from 2016 to 2018, it is still far lower than competitors in the industry (Berridge). CEO of BlackRock Larry Fink, emphasized how important voting, engagement and assessing climate risk will be in the firm’s future in his 2018 letter to CEOs, yet also made clear the firm’s duty to make customers money when he expressed, “We often get approached by special interest groups who advocate for BlackRock to vote with them on a cause. In many cases, I or other senior managers might agree with that same cause – or we might strongly disagree – but our personal views on environmental or social issues don’t matter here. Our decisions are driven solely by our fiduciary duty to our clients” (Jolly).

BlackRock does boasts of 232 engagements with companies on climate concerns between July 2017 and June 2018. Only a fifth of the companies responded in a “substantive fashion” to BlackRock’s requests for disclosures of climate risk (Jolly). BlackRock has not provided any quantitative evidence that this engagement plan is working, despite arguing engagement strategies are more effective than challenging companies’ shareholder resolutions. This might be true if the firm united with other investors in Climate Action 100+ or signed letters like that presented at the COP24 global climate conference in December 2018 by 415 investors, including Allianz and HSBC, urging governments to phase out thermal coal, put a price on carbon emissions and end fossil fuel subsidies (Gilblom). Instead BlackRock and Vanguard’s negligence in voting has had a more significant impact as their votes could have swayed the majority in favor of imposing targets to reduce carbon emissions in proposal meetings with Royal Dutch Shell, Ford, GM and Chevron (Jolly, Gladman).

Ethics Considerations

The principle ethics consideration for asset management firms regarding climate change is their legal fiduciary duty to represent customers’ values (Berridge). Clients (or beneficiaries) trust the fiduciary to act on their behalf in ways that benefit them. In the case of asset management firms with clients that have demonstrated climate related interests in petitions, it is the firm’s duty to act in accordance with these interests whether it is voting in shareholder meetings, engaging with companies on climate concerns or collecting data on how to measure climate risk. The primary goal of asset managers is to deliver the best, risk-adjusted returns possible, but ignoring climate risk is a breach of their fiduciary duty. In the long-term interest of shareholders, asset managers should not only consider climate when assessing risk, but also consider the toll on the economy if financial institutions do not take action in shareholder meetings, engagement interactions and divestment efforts. BlackRock estimated that 58% of metropolitan areas would face climate related GDP hits of 1% or more by 2060 to 2080 unless decisive action is taken (Riding).

A secondary ethics consideration is asset managers’ roles as good corporate citizens in society. Similar to individuals’ growing concern about ESG issues like climate change, more asset managers’ customers are now placing importance on corporate citizenship and especially a given company’s responsibilities towards society. Beyond legal responsibilities, morally good firms will see to the goals of producing higher standards of living and quality of life while maintaining profitability for their stakeholders (Hayes). With abundant research tracking the catastrophes that might occur should climate change go unchecked, any firm turning a blind eye when it possesses substantial power over assets should be considered culpable.

Hurdles in Climate Endeavors for Asset Management Groups

Although there are established avenues for asset management groups to take when seeking to mitigate climate change, these endeavors are not without challenges. Advocacy groups and investment firms alike have expressed concerns over data quality and more specifically lack of clarity and expectations for asset owners. Data collection is often not standardized, whether it is measuring companies’ carbon emissions, climate related risk or which asset management firms are voting for climate related proposals. Data is often privately generated, conducted in self-assessments or performed with outdated models, and not all companies in each industry will disclose information collected (Holder).

Other challenges include tackling mistaken notions that climate change is a slow moving, long-term issue that need not be factored into risk assessments, an insistence that making profits for beneficiaries cannot be achieved while taking climate change into consideration, and difficulties collaborating with other firms on a large international scale as governments lag behind. However, just as changes to the climate are accelerating, so is the rate at which financial institutions are improving their climate related policies and moving past these outdated beliefs.

Recommendations

(1) Follow the methods of industry leaders in engagement and voting behavior, as a good start to asset management firms’ efforts on climate change.

(2) Follow the suggestions of reports from environmental advocacy groups ShareAction, Climate Majority Project, Ceres, FundVotes, and 350.org, among others. Committing a firm and companies in which it holds shares to net-zero carbon emissions by 2050 and voting against the Chair of the Board of Directors if companies do not make those commitments by the 2020 proxy voting season are a few of the common recommendations.

In a poll of 39 major asset management firms, 86% reported calling upon oil companies to adopt goals set out in the 2015 Paris Climate Change Agreement, but 57% of these asset managers did not have plans if the oil companies did not follow through (Ricketts). If companies continue to not meet deadlines, consider divesting entirely. Divesting from fossil fuel companies, which will likely be the least willing to budge on climate, may not cause a significant blow to portfolio returns, as energy was the worst performing sector of the S&P 500 in 2017 (Sanzillo).

(3) Work towards better ways of communicating with asset owners about their interests, as recommended by Ernst and Young (“Climate Change: The investment perspective,” 13). If asset managers have a better idea of what investment considerations their customers are concerned about (besides maximizing profits), they can take those thoughts forward to shareholder meetings. This would be an improvement on firms focusing solely on maximizing profits until customers feel compelled to petition or protest their asset managers’ actions.

(4) Pressure competitors to join campaigners and investor group initiatives that put stress on governments and policy makers to achieve the Paris Climate Change Agreement goals, accelerate private sector transition to lower carbon emissions, put a price on carbon, and phase out fossil fuel subsidies. (McHale).

(5) Integrate a climate assessment into internal rating methodologies of projects and investments at a group-wide scale, to eventually institute internal carbon prices within all company assessments like BNP Paribas (Silvent, Charrier). Firms can institute an internal carbon price by either introducing an internal carbon tax or a shadow price. With an internal carbon tax, the firm taxes itself on projects or investments involving carbon emissions by purchasing external offset credits or financing internal projects that work to reduce carbon emissions. Alternatively, BNP Paribas’ method of shadow pricing involves the firm implementing a carbon value on top of the actual price of investments to form a “real cost” of R&D projects, other companies it might buy, infrastructure, etc. This method serves as a climate focused form of risk management for the firm and steers company behavior towards projects and solutions that take climate change into account (Institute for Climate Economics, 18).

(6) If opposed to leaving out a particular sector of the economy when building a green portfolio, select the companies with the lowest carbon emissions in each sector (Silvent, Charrier).

(7) Use commercial climate risk assessment tools endorsed by the World Resources Institute and UNEP Finance Initiative if your firm is struggling to measure climate risk or integrate it into more general risk evaluations (Fulton and Weber).

Responsibility for Large Firms

BlackRock and Vanguard’s votes have already decided significant shareholder proposal decisions regarding climate, and although each firm’s voting record has improved over the past couple of years, they are far from progressive when compared with competitors (Homanen). BlackRock is the largest investor in coal worldwide and has by far the highest density of coal holdings of the world’s 10 largest investors (Jolly). Even if BlackRock and Vanguard’s CEOs feel their fiduciary duty requires they focus on making customers money, they can still employ strategies to address climate change (also in the longer term impact of unmitigated climate change will negatively affect returns). As leaders in the asset management industry, BlackRock and Vanguard have the power to set a high moral standard that changes all asset managers’ attitudes towards climate. If a major firm joins an investor group like Climate Project 100+, it will not only set a precedent for its competitors and serving the interests of its climate focused customers, but it will also be changing the future of the planet’s climate. BlackRock could facilitate the creation of a shared industry database of asset-level carbon risk data, and collaborate with other asset managers, investment banks and the government since it has an important data collection study with Rhodium (“Climate Change: The investment perspective.”).

European banks make up the majority of the industry leaders in addressing climate change since more regulatory and legislative measures are in place in Europe that require financial institutions to strengthen disclosure requirements and other climate risk (“BNP Paribas Tops Survey on Climate Change,”Cuff). With President Trump pulling out of the 2015 Paris Climate Change Agreement, it is not surprising that U.S. companies lag behind; however, the Trump administration’s neglect of climate should be seen by institutions in the private sector as more reason to address climate seriously. If asset management giants continue to ignore their clients’ pleas to take a firmer stance on climate, they may lose those customers to the smaller but more progressive firms like Walden.

Works Cited:

Berridge, Rob. “As Climate Change Causes a Maelstrom of Financial Risks and Opportunities, is Your Money Manager Prepared to Weather the Storm?” Ceres, 3 March, 2019.https://www.ceres.org/news-center/blog/climate-change-causes-maelstrom-financial-risks-and-opportunities-your-money.

“BlackRock’s Sustainable ETFs: Green business or greenwash?”BlackRock’s Big Problem, 21 May, 2019. https://www.blackrocksbigproblem.com/updates/blackrock-s-sustainable-etfs-green-business-or-greenwash.

Breeden, Sarah. “Avoiding the storm: climate change and the financial system.” Official Monetary & Financial Institutions Forum, Bank of England, 15 April, 2019. https://www.bankofengland.co.uk/-/media/boe/files/speech/2019/avoiding-the-storm-climate-change-and-the-financial-system-speech-by-sarah-breeden.pdf.

“BNP Paribas Tops Survey on Climate Change.” BNPP AM – Luxembourg – Professional Investor, 29 Dec. 2017, https://www.bnpparibas-am.lu/intermediary-fund-selector/bnp-paribas-tops-survey-on-climate-change/.

“Climate Change and Asset Management.” BC Ministry of Municipal Affairs and Housing, 2018. https://www.assetmanagementbc.ca/wp-content/uploads/The-BC-Framework_Primer-on-Climate-Change-and-Asset-Management.pdf.

Climate Change | HSBC Global Asset Management. https://www.global.assetmanagement.hsbc.com/about-us/responsible-investing/climate-change. Accessed 9 July 2019.

“Climate-Change Tests Voted Down — WSJ.”Dow Jones Institutional News, May 26, 2016. ProQuest, https://search-proquest-com.ezproxy.wellesley.edu/docview/2016202044?accountid=14953.

“Climate Change: The investment perspective.” EYGM Limited, 2016. https://www.ey.com/Publication/vwLUAssets/EY-climate-change-and-investment/$FILE/EY-climate-change-and-investment.pdf.

Climate Science Special Report: Fourth National Climate Assessment, Volume I, edited by D.J.Wuebbles, D.W. Fahey, K.A. Hibbard, D.J. Dokken, B.C. Stewart, and T.K. Maycock. U.S. Global Change Research Program, 2017. doi:10.7930/J0J964J6.

Crooks, Ed. “Investors Push Exxon to List Emissions Targets in Annual Reports.”FT.Com, 2018. ProQuest,https://search-proquest-com.ezproxy.wellesley.edu/docview/2157696463?accountid=14953.

Cuff, Madeleine. “’Tipping point?’ HSBC launches green finance range for businesses.” BusinessGreen, 3 July, 2019. https://www.businessgreen.com/bg/news-analysis/3078319/hsbc-launches-green-finance-range-for-businesses.

Dembicki, Geoff. “Wall Street’s Sustainable Darling Is Profiting from Climate Change.” Vice, 24 May, 2019. https://www.vice.com/en_us/article/j5wdvg/blackrock-profiting-from-climate-change.

Fink, Larry. “Larry Fink’s Letter to the CEOs: A Sense of Purpose.” BlackRock, 2018. https://www.blackrock.com/corporate/investor-relations/2018-larry-fink-ceo-letter.

Flood, Chris. “Vanguard Defies Companies to Back Climate Change Resolutions.”FT.Com, 2017. ProQuest. https://search-proquest-com.ezproxy.wellesley.edu/docview/1944741019?accountid=14953.

Gilblom, Kelly. “Asset Managers Team Up to Pressure Governments on Climate Change.” Bloomberg, 9 December, 2019. https://www.bloomberg.com/news/articles/2018-12-09/asset-managers-team-up-to-pressure-governments-on-climate-change.

Gladman, Kimberly. “Asset Manager Climate Scorecard 2018.” 50/50 Climate Project, 2018. https://5050climate.org/wp-content/uploads/2018/09/FINAL-2018-Climate-Scorecard-1.pdf.

Gosden, Emily. “Exxon Fights Off Church’s Climate Bid.”The Times, May 30, 2019, pp. 40. ProQuest. https://search-proquest-com.ezproxy.wellesley.edu/docview/2231762559?accountid=14953.

Guay, Terrence, and others. “Non-Governmental Organizations, Shareholder Activism, and Socially Responsible Investments: Ethical, Strategic, and Governance Implications.” Journal of Business Ethics, vol. 52, no. 1, 2004, pp. 125-139. ProQuest. https://search-proquest-com.ezproxy.wellesley.edu/docview/58845470?accountid=14953.

Hildebrand, Philipp and Deborah Winshel. “Adapting Portfolios to Climate Change.” BlackRock, 2016. https://www.blackrock.com/us/individual/literature/whitepaper/bii-climate-change-2016-us.pdf.

Hirtenstein, Anna. “Europe’s Largest Asset Manager Sees ‘Tipping Point’ on Climate.” Bloomberg, 31 May, 2018. https://www.bloomberg.com/news/articles/2018-05-31/europe-s-largest-asset-manager-sees-tipping-point-on-climate.

Holder, Michael. “’Get ahead of these risks’: BlackRock issues climate risk warning to investors.” BusinessGreen, 5 April, 2019. https://www.businessgreen.com/bg/news-analysis/3073716/get-ahead-of-these-risks-blackrock-issues-climate-risk-warning-to-investors.

Homanen, Mikael. Making Your Vote Count: Does the Voting Behavior of Asset Managers Truly Reflect Their Clients’ Interests? –. 14 Jan. 2019. https://promarket.org/asset-managers-clients-interests/.

Institute for Climate Economics. “Internal Carbon Pricing: A Growing Corporate Practice.” Institute for Climate Economics, November 2016. https://www.i4ce.org/wp-core/wp-content/uploads/2016/09/internal-carbon-pricing-november-2016-ENG.pdf.

Jolly, Jasper. “World’s biggest investor accused of dragging feet on climate crisis.” TheGuardian, 21 May, 2019. https://www.theguardian.com/business/2019/may/21/blackrock-investor-climate-crisis-blackrock-assets.

Kantchev, Georgi, and Sarah Kent. “Funds Say Climate Change is Now Part of their InvestingEquation.” The Wall Street Journal, Jun 11, 2019. ProQuest. https://search-proquest-com.ezproxy.wellesley.edu/docview/2237712121?accountid=14953.

Landberg, Reed, Annie Massa and Demetrios Pogkas. “Green Finance is now $31 Trillion and Growing.” Bloomberg, 7 June, 2019. https://www.bloomberg.com/graphics/2019-green-finance/.

“Managing Climate Change Risk.” Walden Asset Management, https://waldenassetmgmt.com/climate-change-risk/. Accessed 9 July 2019.

McCracken, Rosemary. “An Ethical Choice; Socially Responsible Investing is Surging in Popularity, Thanks to Public Awareness of Issues Like Corporate Governance: Final Edition].”The Gazette, Feb 06, 2008. ProQuest. https://search-proquest-com.ezproxy.wellesley.edu/docview/434613880?accountid=14953.

Proxy Information – J.P. Morgan Asset Management. https://am.jpmorgan.com/us/en/asset-management/gim/adv/proxy-information. Accessed 9 July 2019.

Raval, Anjli, and Attracta Mooney. “Money Managers: The New Warriors of Climate Change.” FT.Com, 2018. ProQuest, https://search-proquest-com.ezproxy.wellesley.edu/docview/2160973638?accountid=14953.

Rayner, Ralph. “Incorporating Climate Change within Asset Management.” Asset Management: Whole-life Management of Physical Assets, edited by Chris Lloyd, Thomas Telford, 2010.

Ricketts, David. “Asset Managers ‘lack a plan’ for tackling climate-change laggards.” Financial News, 29 April, 2019. https://www.fnlondon.com/articles/asset-managers-lack-a-plan-for-tackling-climate-change-laggards-20190429.

Riding, Siobhan. “BlackRock analysis helps define climate-change risk.” Financial Times, 4 April, 2018. https://www.ft.com/content/2350de58-7236-3593-ad79-16bfa6ecea8d.

Rudebusch, Glenn D. “Climate Change and the Federal Reserve.” Federal Reserve Bank of San Francisco, 25 March, 2019.

Sanzillo, Tom. “Stop Reasoning with the Oil Majors and Sell their Shares Instead.”FT.Com,2018. ProQuest. https://search-proquest-com.ezproxy.wellesley.edu/docview/2122376522?accountid=14953.

Silvent, Franck and Helena Charrier. “Climate Change in Asset Management.” Paris Innovation Review, 20 November 2015. http://parisinnovationreview.com/articles-en/climate-change-in-asset-management.

The Economist Intelligence Unit. “The cost of inaction: recognizing the value at risk from climate change.” The Economist, sponsored by Aviva, 2015. https://eiuperspectives.economist.com/sites/default/files/The%20cost%20of%20inaction_0.pdf.

Thompson, Jennifer. “Larry Fink Urged to make BlackRock Tougher on Climate Change.” FT.Com, 2019. ProQuest. https://search-proquest-com.ezproxy.wellesley.edu/docview/2166881732?accountid=14953.

“Winning Climate Strategies.” Asset Owners Disclosure Project, https://aodproject.net/best-practice/. Accessed 9 July 2019.

Wilkinson, Tom and Kara Tan Bhala. “CliFin: Climate Finance to Avoid Climategeddon.” The Seven Pillars Institute, 9 July, 2019. https://sevenpillarsinstitute.org/clifin-climate-finance-to-avoid-climategeddon/.

Photo: Courtesy of pixabay.com