The Case of Vijay Mallya and Kingfisher Airlines

Part of SPI’s India Series

By: Vilasini Pollisetty

Vijay Vital Mallya (VM) was born to industrialist and business tycoon Vital Mallya in 1955. He went on to take over his father’s business (UB Group) in 1983 at the young age of 28. VM had soaring ambition. He always looked for opportunities to expand his father’s existing business. He has been in the limelight recently as a result of financial crimes he committed before fleeing to the UK. The Indian government is working on the process of extraditing him from the UK.

Here is a timeline[1]of key events that show how VM went from being the most sought-after business man to a criminal:

2005: Vijay Mallya chairman of United Breweries (Holding) Limited, started the luxury airline: Kingfisher Airlines.

2007: Vijay Mallya acquires Air Deccan, which was a low-cost airline, from owner Capt. Gopinath.

2008: The Air Deccan takeover was formalized and UB group paid up Rs.550 crores (US$79 million) for its stake of 26% in the company.

Later that same year Kingfisher Airlines faced a loss of Rs934 crore (US$133 million) due to various reasons like oil price increases, acquisition of a financially unsound airline and other reasons.

2009: The consolidated debt of the airline accumulates to a massive Rs5,665 crore (US$810 million) that increases to Rs7,000 crores (US$1 billion). IDBI bank issues a loan of Rs900 crores (US$128 million) to the airline.

- Kingfisher’s board approves a resolution to raise $100 million by various instruments including Global Depository Receipts. This was in addition to raise capital for an amount not exceeding Rs500 crore (US$71 million)by a rights issue of equity shares.

- Kingfisher reports a net loss of Rs418.77 crores (US$59 million) during the second quarter of the fiscal year. Its income from operations also declines by 13.6 per cent during the quarter compared to the same period the previous year. In view of the huge losses and capacity reduction, Kingfisher decides to lay off nearly 100 pilots.

2010: Banks give the airline an ultimatum of nine months to pay back the entire loan amount that stands at $1.3 billion.

- Kingfisher Airlines Board approves debt recast package. The airline’s debt now stands at Rs6,000 crore (US$858 million).

- 2011-Mumbai International Airport Pvt. Ltd. sends a notice to the cash-strapped airline to pay Rs90 crore (US$12million)outstanding dues.

- The Income Tax Department freezes 11 accounts of Kingfisher Airlines for non-payment of tax.

2012: Kingfisher Airlines cancels several of its flights after the Income Tax Department froze some of its accounts.

- The carrier operates on a trimmed schedule and faces the prospect of losing a number of prime flying slots.

- International Air Transport Association asks travel agents to immediately stop booking tickets on Kingfisher’s behalf for failure to settle dues since February.

- Further trouble, as employees protest delays in salary payment.

- Kingfisher announces reduction of its international operations.

- Revenue department of India threatens to take Kingfisher Airlines to court over alleged tax evasion, claiming the company has not deposited taxes it collected from travelers.

- Lenders give two weeks to come up with a plan to improve operations. The airline had a total outstanding debt of around Rs.7,500 crore (US$1 billion)to a consortium of 17 banks led by State Bank of India(SBI).

- Unpaid staff protest in Delhi, Mumbai and other airports and almost all of Kingfisher’s flights from all stations were cancelled as engineers did not certify the planes to fly.

- A non-bailable arrest warrant issued against Vijay Mallya, and four other directors for non-appearance in cases relating to bouncing of cheques issued in favour of GMR Hyderabad International Airport Limited (GHIAL) towards user charges.

- The carrier loses its flying license as the DGCA refused to renew its Air Operator Permit (AOP).

2013: DGCA asks the carrier to clear all dues, including pending salaries of employees, before seeking license renewal.

2014: Kingfisher Airlines reported a net loss of Rs822.42 crore (US$117 million)for the third quarter ended December 31, 2013.

- United Bank of India declares Mallya and three directors of Kingfisher Airlines as willful defaulters.

2016: Banks move Supreme Court to ban Mallya’s overseas travel.

- Mallya leaves India on March 2, government tells court.

Money Laundering

Allegations of money laundering were first made when it was speculated that Mallya had used loan money received from the banks and diverted them overseas to various tax havens. Mallya laundered the money with the help of shell companies with dummy directors that were controlled by him. The shell companies were located in seven countries, including the United Kingdom , USA, Ireland and France[2]. These companies did not have any activity and independent source of income. Mallya was controlling the companies through his office personnel. The directors in said companies acted on directions of UB Group at the command of Mallya[3].

Classified As a “Proclaimed Offender”

In order to understand why Vijay Mallya was labelled a “proclaimed offender”, it is important to know the exact meaning of this term:

According to section 82(1) of the Criminal Procedure Code,1973(CrPc) if any Court in India has any reason to believe a person against whom a warrant has been issued has absconded or is concealing himself in such a manner that the warrant cannot be executed, then such court can publish a written proclamation requiring him to appear at a specified place and specified time. The person is required to appear in not less than thirty days of the publishing of the written proclamation by the court. Section 82(2) provides the various ways in which the court can publish the written proclamation.

Section 82(4) mentions that any person who does not comply with provisions mentioned in Section 82(1), the Court may after making inquiry as it thinks fit, pronounce him a “proclaimed offender” and issue a declaration to that effect.

In the case of VM, he fled the country on March 2, 2016 after a consortium of banks moved the Supreme Court to recover Rs.9,000 crores (US$1.3 billion) they claimed he owed them. On April 18, 2016, the Enforcement Directorate (ED) issued a non-bailable warrant against VM to appear in court after rejecting his plea that all allegations against his company were ‘false and incorrect’[4].

The ED summoned VM thrice to appear in the court and testify, but he failed to do so. This behavior caused him to be termed as a “proclaimed offender”.

Ethics Analysis

As per Section 166 of the Companies Act, 2013[5], the director of any company incorporated under the Act has certain duties.

Firstly, the director has the duty to act in good faith to achieve the overall objectives of the company and to act in the best interest of all its members, employees, shareholders, community and environment.

Next, he is required to exercise his duties with due and reasonable care, skill and diligence and exercise his own independent judgements.

He must not be involved in situations that may directly or indirectly be in conflict with the interests of the company. Lastly, he must never achieve or try to achieve any kind of unjustified gains for himself or for a person of his choice and if he does so can be liable for fine equal to the amount of the undue gain.

1. Failing in his fiduciary duty to shareholders, employees, and investors:

- A director of a company is expected to always put the interests of the corporation and all the people involved with it above his own personal interests. He is expected to remain loyal and ensure to maintain the trust of shareholders, employees and investors. Any kind of conflict of interest, such as earning a secret profit, unknown/undisclosed business dealings show disloyalty on the part of the director.

- The director of Kingfisher Airlines, Vijay Mallya resorted to such practices for his own gains.

- Kingfisher airlines, the second largest airlines in India, did not generate profits for 8 years.[6]

- Mallya did not stop operations in spite of making only losses and allowed shareholders and customers to be under the illusion the airline was functioning properly.

- In 2012, the losses of the airline were publicly discussed when Mallya failed to pay the salaries of his employees. When asked about this, Mallya made statements about not having enough money to pay the salaries due to reported losses.

- Soon in 2013, Diageo acquired a 27% stake in United Spirits Limited for Rs.6,500 crores (US$902 million). However, not a single lender or employee was paid.

- There was speculation that Mallya had his own agenda and invested the money in his IPL (Indian Premier League) cricket team. A few years later he spent a lot of the funds for his elaborate birthday bash which featured renowned singer Enrique Iglesias[7].

- Such instances are clear examples of Mallya violating his fiduciary duties as a director of a company.

2. Non-Disclosure of Non-Compete Clause

- A probe by the Serious Fraud Investigation Office (SFIO) in India found that corporate ethics were compromised in the merger between Kingfisher Airlines and Deccan Aviation Limited[8].

- Kingfisher Airlines had created three new departments in the airline to avoid paying capital gains tax.

- In addition, a non-compete fee of Rs.30 Crores (US$4 million) was paid to the owner of Deccan Aviation, Captain Gopinath, which was not disclosed to shareholders.

- Transparency is vital in a listed business. Full disclosure of information must be provided to the shareholders, so they can make informed decisions.

- Any kind of non-disclosure of important details points to the dishonesty of the company director and shows how little he cares about his shareholders.

3. Misuse of Power[9]

- There is a celebrated quote, “With great power comes great responsibility[10]”.

- The primary responsibility that arises with power is the responsibility not to misuse such power.

- In 2010 Mallya was selected to be an MP of the Rajya Sabha (Upper House), in the Indian Parliament and used his position for his personal use.

- He misused his position as a Member of Parliament to ensure he was put in the civil aviation committee. He did so to speed up the approval of Foreign Direct Investment (FDI) into the aviation sector. This expedited approval assured that foreign investors could invest in Kingfisher Airlines when the airlines was hitting its lowest point[11].

- VM took advantage of access to Parliament. He discussed informally with Union Finance Minister Arun Jaitley, within the corridors of Parliament, the possibility of convincing banks to settle with Kingfisher Airlines. The Finance Minister claims to have denied his request as it was not made according to formal protocols. Immediately after this, Mallya fled the country. The following statement was made by the Finance Minister in response to the allegations:

Statement from Mr. Jaitley[12]:

“My attention has been drawn to a statement made to the media by Vijay Mallya on having met me with an offer of settlement.

The statement is factually false in as much as it does not reflect the truth. Since 2014, I have never given him any appointment to meet me and the question of his having met me does not arise. However, since he was a Member of Rajya Sabha and he occasionally attended the House, he misused that privilege on one occasion while I was walking out of the House to go to my room. He paced up to catch up with me and while walking uttered a sentence that “I am making an offer of settlement”. Having been fully briefed about his earlier “bluff offers”, without allowing him to proceed with the conversation, I curtly told him “there was no point talking to me and he must make offers to his bankers.” I did not even receive the papers that he was holding in his hand. Besides this one sentence exchange where he misused his privilege as a Rajya Sabha Member, in order to further his commercial interest as a bank debtor, there is no question of my having ever given him an appointment to meet me.”

The above instances reflect Mallya’s leadership qualities. He appears to be disconnected from the situation facing his employees, shareholders and other persons dependant on the company and its reputation. Though he is not legally liable to pay salaries to employees from his personal wealth, he could have taken moral responsibility for his actions that caused suffering in the lives of people whose livelihoods were dependent on Kingfisher Airlines. Mallya was an inspiration to many. His wealthy way of living fascinated them but some personal austerity wassurely required.

Yet in an interview, Vijay Mallya made the following statement and refused to take responsibility for the financial mess:

“In a Public Limited Company where is one man, who might be the chairman, responsible for the finances of the entire Company? And what has it got to do with all my other businesses? I have built up and run the largest spirits company in the world in this country.”

Recently Forbes Magazine dropped Mallya from their Billionaire list and stated his current net worth is only USD 800 million . He made a satirical comment on twitter:

Vijay Mallya @TheVijayMallya:

“Thanks to the Almighty that Forbes has removed me from the so called Billionaires list. Less jealousy, less frenzy and wrongful attacks.”

Present Standing of the Case[13]

Understandably, India wants Mallya to face criminal action relating to loans taken out by his defunct Kingfisher Airlines and Indian authorities want to recover about $1.3 billion they say Kingfisher owes.

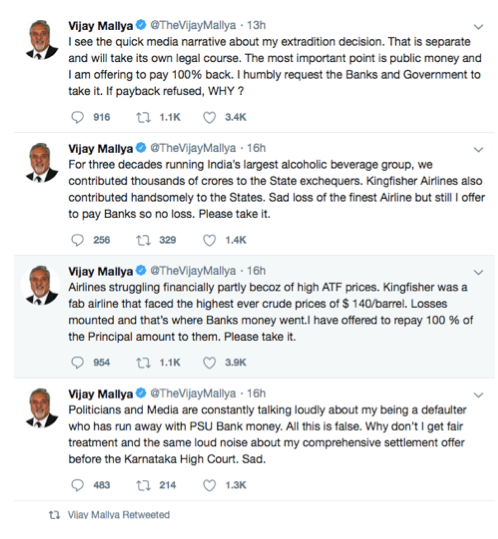

On December 5, 2018, five days before the decision of Mallya’s extradition case, he further appeals to the banks to accept his settlement offer and also agrees to pay 100% of the principal loan amount he owes to them. He further justifies his actions in a series of tweets:

December 10, 2018[14]: The Westminster Magistrates’ Court in London on Monday orders United Breweries chairman Vijay Mallya’s extradition to India. Indian finance minister Arun Jaitley welcoms the court’s decision on Mallya.

Mallya Redux

It is not easy to manage so many different companies at once and ensure they are all successful. Mallya had taken lot of risks and made new investments that his father had never made. An in depth study of the case shows that a majority of Mallya’s dealings were done for his own personal gains and not for the overall benefit of his employees, shareholders and investors. Mallya committed financial fraud and most importantly ethical violations by breaking the trust of the people who were not only dependant on his company but who even looked up to him as a role model. Mallya explains himself through his tweets, sitting in a far off country and communicating through social and other media. Instead of acting in this pathetically unethical way, he should return India and agree to trial in court as a virtuous person would do. Another aspect of this case most people tend to overlook is the mistake committed by the Indian Banks. It is their duty to conduct proper credit checks before sanctioning loans of such a large amounts to one company. Apparently, certain procedures and processes were omitted in order to grant loans to Kingfisher Airlines. The government of re-elected Narendra Modi should take note of this high profile case and put efforts into preventing similar behaviour in the future. A change in existing laws or introduction of a new law seems appropriate. Then again, the Indian government seems to be failing to keep a check on unethical and illegal behavior by tycoons, as the recent scam of renowned businessman and jeweller Nirav Modi[15]has once again shaken the nation.

REFERENCES:

http://www.enforcementdirectorate.gov.in/faqs_on_pmla.pdf

http://theproofofguilt.blogspot.com/2015/06/section-82-crpc-and-proclaimed-offenders.html

https://www.ft.com/content/b0072e74-0d3d-11e6-b41f-0beb7e589515

http://www.saravade.in/Downloads/PMLA_A_Critical_Appraisal.pdf

http://www.mca.gov.in/Ministry/pdf/CompaniesAct2013.pdf

https://www.nolo.com/legal-encyclopedia/fiduciary-responsibility-corporations.html

https://www.entrepreneur.com/article/272322

[1]https://www.indiainfoline.com/article/news-top-story/vijay-mallya-s-timeline-curse-of-good-times-116031000523_1.html

https://www.zawya.com/mena/en/business/story/Timeline_The_rise_and_fall_of_Vijay_Mallya-GN_18042017_190453/

https://www.livemint.com/Object/G1YWR33VqEAfHN9Bh1gBuL/vijay-mallya-timeline.html

[2]https://timesofindia.indiatimes.com/india/mallya-diverted-most-of-rs-6000-crore-loan-to-shell-companies/articleshow/60820678.cms

[5]http://www.mca.gov.in/Ministry/pdf/CompaniesAct2013.pdf

[6]https://www.entrepreneur.com/article/272322

[7]https://timesofindia.indiatimes.com/city/goa/Enrique-to-be-Mallyas-Hero-on-60th-birthday/articleshow/50193822.cms

[9]https://www.theweek.in/news/india/2018/09/14/Guilty-of-conflict-of-interest-Mallya-and-the-curious-case-of-businessmen-MPs.html

[10]http://www.inspirational-motivational-success-quotes.com/winstonchurchillquotes.html

[11]https://www.firstpost.com/business/mallya-meets-sharma-on-aviation-fdi-273000.html

[13]https://www.livemint.com/Companies/nLyNim2xqg5lgGLeYkB4PO/Vijay-Mallya-in-UK-court-for-extradition-case-hearing.html?utm_source=scroll&utm_medium=referral&utm_campaign=scroll

[14]https://www.livemint.com/Companies/4XSaTzCOY1zQbbzKhpSl2K/London-court-orders-Vijay-Mallya-extradition.html

https://edition.cnn.com/2018/12/10/business/vijay-mallya-extradition-india-uk/index.html

[15]https://www.businesstoday.in/sectors/banks/nirav-modi-case-pnb-fraud-11400-crore-scam-ed-cbi-raid/story/270708.html

Photo: Courtesy of Business Insider