Tax Systems: A Brief Ethical Discourse

By Nathaniel Crosser

While complaining about income tax is universal, there seems little doubt or disagreement about the importance of taxation for the functioning of a civil society. We are surely better off with the social contract that requires some form of taxation. The uber-wealthy and underprivileged alike benefit from public goods and services, such as roads, policing, firefighting, and the regulation of monopolies. Why then this distaste of income taxes?

Americans primarily (and historically) find issue not with the existence of taxation, but with the ways in which the government collects its money. This surely is true with the current income tax system. Many see the current income tax structure as an encroachment on personal liberty. Some see the 70,000-page code as an embodiment of government bureaucracy, and others decry the system as economically or morally perverse. An overhaul of the status quo tax code is a major topic of 2016 presidential campaigns. Now seems a particularly salient time for a critical and comparative evaluation of income tax systems.

This article establishes a framework for evaluating the current system against the two most prevalent alternatives: a flat-rate income tax system and a consumption-only system for generating revenue. It focuses on moral considerations, but will also highlight some economic implications of the three schemes.

The evaluations will include each of the following five components:

- A general overview of the structure of the system as well as a currently proposed/active method of implementation

- A basic economic analysis of the system’s implications

- A utilitarian analysis of the system

- A Rawlsian analysis of the system

- An analysis of the system through two virtue ethics values: autonomy and equality

Before proceeding, it is important to expressly define and explain utilitarianism, Rawls’ theory of distributive justice, and virtue ethics in context.

Utilitarianism

Utilitarianism is the moral philosophy that proposes an action is ethically correct, if it promotes the optimal amount of well-being, or utility, in society. For the purposes of this article, the agent is the legislative body of the United States federal government,[1] and utility can be best measured in economic well-being, such as access to good jobs, upward mobility, and adequate personal funds. Consequentialist ethics, of which utilitarian is a type, is the belief that only the outcome matters in determining the morality of an action. “Ends” are supreme, and “means” are irrelevant.

In context, “utilitarian” morality can be defined as acting in a way that maximizes the economic health of United States citizens, regardless of motive or nature of the act.

Rawls’ Theory of Justice

John Rawls is one of the most influential political philosophers of the 20th century. Rawls’ theory of distributive justice is based off a thought experiment wherein rational individuals are placed behind a “veil of ignorance” into a state he calls the “original position.” Those in the original position are asked to devise the basic structures of society according to their inherent self-interest – but there is a catch. The veil of ignorance precludes the individuals in the original position from knowing anything pertaining to their personal traits. The individuals do not know if they are rich, poor, black, white, male, female, intelligent, attractive, charming, urban, rural, or any other “particular facts” about their lives, such as personal values or social position. They do, however, have an understanding of psychology, sociology, and economics.

Rawls concludes the individuals will strive to create a system that maximizes “their” potential shares of “primary social goods” so that when they exit the original position and return to whatever lives they occupy, they will be as well off as possible. Primary social goods are resources anyone would prefer more of rather than less, such as income, leisure, upward mobility, access to education, health, and freedoms such as those defined in the U.S. Bill of Rights. A central implication of this thought experiment is the “difference principle.” The difference principle holds that it is in the best interest of those in the original position to create a just system that maximizes the availability of primary social goods to the least advantaged people of society. This increases the well being for those who are “born” into a life of poverty or oppression.

During his lifetime, Rawls never truly endorsed any certain tax scheme, so we must examine which of the three tax systems most justly applies the difference principle and would be generally agreed upon by those in the original position.

“All social values (resources) – liberty and opportunity, income and wealth, and the social bases of self-respect – are to be distributed equally unless an unequal distribution of any, or all, of these values is to everyone’s advantage.” –Rawls, A Theory of Justice, 1971

Virtue Ethics: Autonomy and Equality

Virtue ethics is the third major theory of contemporary moral philosophy. Virtue ethics focuses not on the consequences of an act or the act itself, but on the character of the actor and whether the actor is embodying or promoting a desired virtue. Two important virtues for a government to demonstrate are autonomy and equality.

- Autonomy is defined as the freedom of citizens from excessive or oppressive government or private intervention and the ability to make choices.

- Equality (of opportunity) is defined as the existence of a fair system where all people are treated equally and unhindered in their personal growth, unless there is a justifiable reason.

In context, virtue ethics is defined as the government acting in such a way that evidences it holds autonomy and equality among the highest virtues.

The Status Quo: The Progressive Income Tax

The current federal tax code contains several tax brackets wherein different income levels are taxed at different percentages. For example, a person earning $45,000[2] a year and filing individually (excluding deductions and exemptions) will pay approximately $7,044 in federal income tax, or 15.7% of their income. A person earning $200,000 a year will pay approximately $49,606, or 24.8%[3] of their income. As incomes become higher, so do tax rates – this is where the term “progressive” comes from. The American progressive income tax has its roots in the Revenue Act of 1862, which was used to fund the Civil War and taxed incomes at 0%, 3%, or 5%.

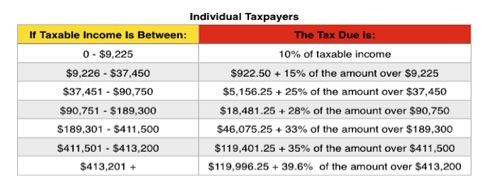

2015 U.S. federal tax brackets for those filing individually. Courtesy of Forbes.com.

Proponents see the current tax code as an important tool for reducing income inequality and allowing for adequate funding of transfer payments and safety nets while taxing the rich on their dollars of decreasing marginal utility[4]. Opponents of the system call it absurdly complex and unfair, claiming it disincentivizes hard work and earning.

Economic Implications:

Currently, federal income and payroll taxes combine for around $2.7 trillion of the federal government’s $3 trillion in yearly revenue. It is estimated federal deficit spending will exceed $580 billion for the fiscal year 2015, raising the national debt to nearly $19 trillion dollars, approximately 110% of projected GDP for 2015 – and close to $60,000 per citizen. Economists disagree over whether this debt will lead to another downgrade of America’s credit rating. According to the Bureau of Labor Statistics, the unemployment rate is at 5.5%, the lowest it has been since 2007. Yet, an October 2014 study shows that income inequality has reached its most drastic levels since the Great Depression, with the top 1% of families earning 20% of total national income. It is also worth noting that although tax brackets are adjusted yearly, they do not necessarily account for inflation. As inflation increases, many workers receive proportional compensation. Sometimes, this increase can push a taxpayer into a higher bracket, resulting in bracket creep and fiscal drag (depressed economic activity).

Utilitarian Analysis:

The consequences of the progressive income tax appear to be good. There is evidence the progressive income tax is a powerful tool for reducing income inequality. It compels the rich to more heavily subsidize social and government works that make life substantially better for the vast majority of Americans. The middle and especially the lower income classes benefit greatly from revenue generated, whereas those taxed at the highest rates experience relatively small changes in their standard of living. The dollars redistributed (in the form of government spending) from the rich are theorized to be of less marginal utility to them. Simply put, the one-millionth-and-first dollar of a successful banker is of less value to her than the five-thousandth-and-first dollar is to a person struggling to find work. Some opponents of the progressive tax argue it is arbitrary for the government to dictate how people value their money, but according to a utilitarian analysis, this argument is weak. The struggle to pay rent on a one-bedroom apartment is of greater utility than the struggle to finance another vacation home in the Caribbean. Another argument against taxing the rich is high progressive income taxes disincentivize earning and dampen economic growth. However, this argument is founded in neither sound empirics nor psychology. Syracuse professor Leonard Burman said to the Senate Finance Committee in a 2011 speech: “Empirically, the total response appears to be very small or even zero on average. Surely some people work or save less when taxes go up, but others choose to work or save more … As for those with very high incomes, their labor supply is unlikely to be very responsive to taxation. Otherwise, people earning millions of dollars a year would be working hundreds or thousands of times as hard as people with moderate incomes, which is implausible.” It appears to be better for the common good when those who get more from society also give more back.

Rawlsian Analysis:

Of the three tax plans we will evaluate, the status quo is the most highly redistributive. Although the redistribution of wealth via transfer payments to the poor does help satisfy the difference principle, the current income tax is more importantly an effective revenue-generating tool for the government. A progressive income tax collects the most money for education, health care, scientific research, housing, and other public institutions like the Department of Transportation and the EPA. Adequately funded government services add immeasurably to quality of life and the creation of opportunities for all Americans. Opportunities may be among the most important of primary social goods, and they can be denied to many without a strong central government to regulate the macro-economy and provide basic social services.

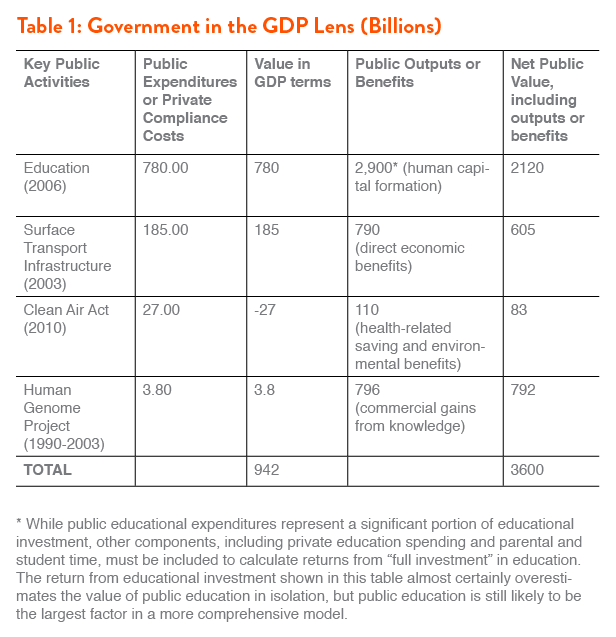

This chart shows how significantly government investment benefits the economy.

For example, it is estimated the $780 billion spent on education will lead to $2.12 trillion in overall GDP over the life of the investment.

Courtesy of demos.org

In A Theory Of Justice Rawls states: “Steeply progressive income taxes [can be] justified when all things are considered.” Although a progressive income tax is not a prerequisite for achieving distributive justice, in our reality it is the best option available.

Virtue Ethics Analysis:

Autonomy: Freedom rests on the availability of options. Given the current tax arrangement, it is very difficult for any person to “opt out” of the system. Nearly every American will need to earn an income at some point, and the government will be there to collect its due. The status quo provides two options. First, one can earn an income and buy into the government’s social contract. Second, one can abstain from the market and earn no income. The second option is unrealistic for most families. However, under the current system, there are numerous exemptions (e.g. charity deduction) and methods available to Americans when it comes to filing their taxes. Innumerable tax strategies allow for many choices on the individual level. The same complexity that opponents balk at allows the tax code to act less like a “tax on living” and more like a tax on behavior. It is worth noting the Alternative Minimum Tax (AMT)[5] reduces the flexibility of many Americans to restructure their incomes and capital for tax efficiency purposes.

Equality: The government taxing different people at different levels is considered inherently unequal treatment by some. However, this argument against progressive taxation does not hold up to the scrutiny of reality. There are an immense variety of tax preparation methods not typically available to those in the lower income brackets. Low-income households that do not benefit from accountants, tax lawyers, foreign bank accounts, capital gains, or even a basic understanding of deductions are likely paying proportionally more than it would seem at first glance. Additionally, grouping individuals by income should not be considered a discriminatory practice. Earning a higher income is almost always the choice of the individual, unlike gender or race – it is a behavior, not a trait. As a society, we seem to have no issue in taxing the behavior of others, such as non-smokers pushing through heavy taxes on tobacco consumers, for the assumed benefit of the public. Furthermore, a common misunderstanding of the tax code fuels some rhetoric against it. The way the tax brackets work, someone earning $45,000/year would pay the same amount as a multimillionaire would pay on her first $45,000 of income. The millionaire pays higher tax rates only on the portions of income that are greater than the total amount earned by the person receiving $45,000/year. Moreover, the government does this in order to create a more equitable society. Without government intervention, the system would be substantially less fair. The rich would likely monopolize access to good education and could unintentionally stifle the ability of others for social mobility, creating an unfair system and perpetual poverty for some groups. Given our definition of equality, it appears the government is justified in its actions to promote a more balanced system where there is a truer equality of opportunity.

Alternative: The Flat Income Tax

A flat income tax eliminates tax brackets and taxes every individual at a constant rate. Kentucky Senator and erstwhile GOP hopeful Dr. Rand Paul has reinvigorated the debate over a flat income tax. He proposes a “Fair and Flat Tax” that taxes personal, corporate, and investment incomes at 14.5% alike. Payroll taxes also are eliminated. His plan shortens the current tax code by about 70,000 pages, eliminating many exemptions and loopholes such as the one on carried interest for capital gains by private equity managers. However, the proposal calls for some notable exemptions, such as complete tax exclusion on the first $50,000 of income for a family of four. It keeps the earned-income tax credit for low-income families. Under the proposed arrangement, an individual making $45,000 a year is taxed $3,625,[6] and an individual making $200,000 a year would be taxed $26,100. Note that under this proposal, both individuals pay less than they currently are. Unfortunately, there are no free lunches. Over the first ten years following implementation, the federal government loses approximately $2 trillion in revenue. Alternatively, a different proposal with a substantially higher percentage can potentially be revenue neutral.

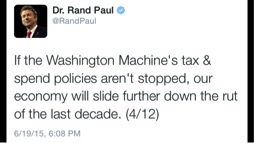

Rand Paul markets his flat tax plan to his 652,000 followers on Twitter

Economic Implications:

Paul argues this historic cut (the largest in U.S. history) would save the economy from an overly ambitious government. Supporters claim such a tax cut stimulates the economy, as the business-owning class will have substantially more capital to invest for hiring and growth. The Tax Foundation estimates in the first ten years, the new code will lead to a 10% increase in GDP and net at least 1.4 million new jobs. Flat-taxers contend the private sector will grow to more than offset jobs lost in a government scale back and the broadened tax base allows the government to actually reduce the national debt.

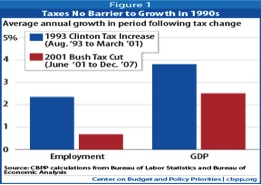

Paul says this pro-business stance will incentivize companies to incorporate and stay incorporated in America. In a television interview in 2015 he stated: “Our tax code has been chasing companies and jobs overseas for years now.” There are mixed feelings among economists about whether tax cuts lead to real increases in GDP. Detractors point out GDP grew and unemployment dropped more following the Clinton tax increases than after the Bush tax cuts. Furthermore, a multi-billion dollar injection of capital into the economy will likely increase aggregate demand before supply can meet it, leading to overall price increases. This inflation will hurt the real buying power of many people and actually leave the poor with even less than they had before. Regardless of commercial euphoria, a starvation diet for the government could have chilling implications outside of the corporate world.

Growth during the Bush II era was sluggish compared to the Clinton administration.

These figures do not attempt to control for variables such as

wars or new techonology. Courtesy of cbpp.org

Utilitarian Analysis:

The 14.5% flat tax as currently proposed seems to be a utilitarian loser. For the majority of Americans who are already paying approximately the same percentage, their incomes would not immediately change. The true beneficiary of such a tax would not be the middle class, but the ultra-wealthy, who stand to gain substantial amounts. Under such a proposal, an anemic government would struggle to meet the needs of everyday Americans. Those relying on government assistance to survive may find themselves without recourse. Surely it benefits most Americans to remove some of obscurity from the tax system, but simplicity may not be worth this cost. Should the plan be as wildly successful as Paul claims, perhaps it would be a winner, but trickle-down economics has empirically been proven more fantasy than actuality.

Rawlsian Analysis:

Rand Paul’s tax plan is openly revenue-negative. A multi-trillion dollar tax cut may make the United States a better place to conduct business, but it will also become a much harsher place for the least advantaged among us. Not only would the system be less redistributive, but it also would starve much-needed government infrastructure and programs. The issue with government budget cuts is public goods and services are often the main source of primary social goods to the poor. Additionally, the flat tax essentially allows the unlimited accumulation and transfer of wealth and therefore political clout – creating a distorted and unfair political system that puts corporate good in front of public good. A somewhat redeeming quality of the “Fair and Flat Tax” is that it keeps the earned-income tax credit – if the government can afford to continue it.

Virtue Ethics Analysis:

Autonomy: This proposal appears to be slightly worse for autonomy than the status quo. It drastically diminishes an individual’s opportunity to restructure his or her income for tax purposes. However, Paul’s tax plan keeps certain deductions intact, such as the tax exclusion for workplace benefits, charitable deductions, earned-income credit, mortgage-interest deduction, and child credit, allowing individuals to make lifestyle choices and change their tax obligations.

Equality: On a superficial level, the flat tax appears to champion equality. Nearly everyone being taxed at the same percentage seems perfectly equalitarian. Upon further reflection, this does not seem to be the case. The existence of a progressive tax is a conscious effort by the government to construct a more fair system where everyone theoretically has the same equality of opportunity. If the government decides to go with a flat tax, it will be a conscious abandonment of the system of fairness it has been striving to forge. Many of the most basic social welfare programs as well as the education system would be harmed by the drastic reduction in taxes on the most wealthy. Without access to these programs, many of the nation’s most underprivileged will suffer. The “American Dream” does not entail the ability to accumulate infinite sums of money. The American Dream is for a man or a woman to be able to find a career and create a life, even if they come from humble beginnings, as with many of our immigrant ancestors. It is equality of opportunity that makes the American Dream possible for most but that aspiration cannot exist for many without some assistance from the government.

Alternative: Consumption Taxes

The most drastic departure from the status quo, a consumption-based system completely eliminates all income taxes. The most popular of such proposals is “FairTax”. The federal legislature has tried to install a FairTax several times since its inception in 1999. It calls for a removal of personal income taxes, payroll taxes, gift taxes, and estate taxes to be replaced with a single sales tax on all new goods and services. Business transactions are not taxed. The IRS will be eliminated and replaced with two new bureaus. In order for FairTax to be revenue neutral (which is the goal), the national traditional[7] sales tax would likely need to be 30-34%, but with some estimates over 50%.

The system also calls for a “prebate” check sent to every household, regardless of income. The “prebate” is intended to guarantee no one is taxed below the poverty line. For example, married couples with two children would automatically receive 12 monthly checks totaling $7,238 per year. The Treasury Department estimates such a “prebate” will cost the government over $600 billion annually. The most interesting aspect of the FairTax is how each individual chooses his or her own effective tax rate, depending on consumption preferences. A millionaire who behaves frugally and saves instead of spends may pay only a few percentage points of his income to the federal government. However, a millionaire who spends a larger portion of his income can end up paying 30% towards the new tax. Taxing spending instead of earning is the basis of all claims of fairness and efficiency for FairTax supporters.

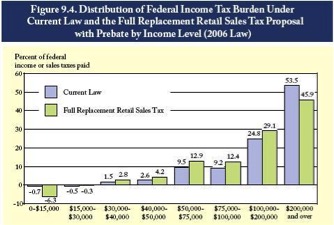

FairTax would essentially raise the proportion of taxes paid by those earning

between $15,000 and $200,000/year. Courtesy of FactCheck.org

Economic Implications:

With such a fundamental change, estimates of the overall economic impact are all over the place. There is little doubt such a tax code would make America a corporate safe haven. The elimination of nearly all taxes on businesses would surely lead to substantial increases in job growth and attract investment. Of 500 companies in Europe and Asia surveyed about FairTax, 400 stated that under the system they would build their next plant in America. Another 100 companies responded they likely would reincorporate in the United States.

The main issues with FairTax lie at the government and consumer levels. An immediately revenue-neutral system seems unrealistic. The most feasible way for the government to avoid revenue losses would be a major increase in the tax base, which would take time. Additionally, a national sales tax would be substantially harder to enforce than an income tax, and it is probable tax evasion will rise steeply. It is unclear how consumers will react to the FairTax. The proposal incentivizes savings and investment by purging taxes on interest and capital gains. However, this incentive is a double-edged sword. FairTax simultaneously disincentivizes consumption and can therefore, slow GDP growth. The effect on the purchasing power of consumers is an even more convoluted issue.

The proposal’s main advocacy group, Americans for Fair Taxation, points out that corporate expenses such as payroll taxes get passed on to the consumer and contribute to a “hidden tax” of approximately 20% on all goods and services. The group contends the elimination of those corporate taxes reduces prices and augments the purchasing power of the consumer. Although these claims are true, they are likely exaggerated, as the cost of intermediate inputs will also rise drastically. Opponents’ greatest fear is a kind of corporate anarchy would result as a side effect of the FairTax, leaving the wealthiest better off and sticking the middle class with a disproportionate burden of the tax and a failing central government.

Utilitarian Analysis:

A utilitarian exploration boils down to how true the claim is that the status quo is “cutting down the tree to get to the fruit.” We can assume business will flourish under FairTax. Should the plan work exactly as hoped, more jobs will be created, and that is surely good for social utility. However, for the majority of Americans, this proposal leans towards “risk” on the risk-reward scale. There are several worrying implications of the FairTax that cause it to fail a utilitarian examination.

First, the system is effectually a regressive tax. The wealthiest Americans spend a smaller proportion of their money on consumption and a larger proportion on growing their wealth than the middle and lower classes. The wealthier the consumer, the smaller her effective tax rate is potentially. This, in addition to the elimination of the estate tax, will allow the rich to grow much richer and worsen economic inequality.

Second, in order for the FairTax to be revenue-neutral and not necessitate government cuts, the tax rate needs to be devastatingly high. Either the middle class will be forced to bear the weight of a punishing sales tax, or changes will have to be made to the welfare system to maintain the budget.

Third, the FairTax eradicates the tax incentive for charitable donations, hurting those who rely on private aid. Finally, the transition from the income tax to the consumption tax could be harmful to many people, especially as the Baby Boomers approach retirement. Retirees, for example, paid into the income tax system (FICA) for decades and are typically on fixed incomes. If they are suddenly faced with drastically higher market prices, they may suffer for it.

Claims that increasing GDP benefits the poor seem to be empirically unsupported.

Courtesy of demos.org

Rawlsian Analysis:

Rawls’ opinion on the consumption tax is somewhat cryptic, and his texts are far from prescriptive. Rawls has acknowledged the potential merits of a consumption tax and has a few sentences later praising the progressive income tax. The FairTax forecasts decently well in a redistributive sense. The major benefit of FairTax comes in the form of the “prebate,” which could essentially guarantee all Americans a basic income. A married couple with two children automatically receives monthly checks from the government totaling $7,238/year[8] under FairTax.

In the status quo, the same family would receive $5,548 in the form of the earned-income tax credit. However, the latter tax credit is sent to the family if they had earned an income during that year and does not help the most indigent citizens. In light of this, it is still unclear whether the least-advantaged individuals in America benefit from the system. The troubling implication is the most affluent will likely end up paying a fraction of the taxes they are currently paying, so it seems unlikely the government will be able to maintain revenues, at least in the short run. There are many moving parts and an utter lack of empirics and precedent. As with the flat tax, those at the bottom rungs of society have more to lose than gain. Would we, taking Rawls’ original position take the gamble? Most likely not.

Virtue Ethics Analysis:

Autonomy: A federal commitment to FairTax is a strong indication of a pledge to autonomy. As an arrangement that taxes things and not people, a consumption toll allows individuals to choose how much they would like to be involved in the system – weighed against how much they desire to consume. Additionally, a consumption tax allows consumers to choose alternative markets in which to use their capital. An individual is free to use her funds in financial markets, used good markets, or international markets.

Equality: FairTax is a mixed bag in this regard. The FairTax has numerous notable supporters, including technology giant Bill Gates, who in an interview with the American Enterprise Institute said: “Inequality of consumption is more of an injustice than a number in a book is.” Gates makes a good point. Many millionaires and even billionaires live very modest lives, such as Warren Buffett, who has lived in the same home in Omaha since 1958. Another plus of the FairTax is that it gives individuals more nominal dollars to spend on education, which is classified as an investment and federally tax-exempt. This increases opportunities for personal growth. For someone spending money on education as opposed to personal consumption, her effective tax rate can be drastically reduced. However, the system also has the potential to severely reduce purchasing power for lower-income Americans when the prices of daily necessities disproportionately rise.

Which Tax?

We have compared three tax systems: current federal progressive income tax system, a flat-rate income tax code and a consumption-only tax system. We examined the schemes using utilitarian, Rawls’ distributive justice, and virtue ethics frameworks. The progressive income tax appears to be superior to the others from utilitarian, Rawlsian and equality perspectives. The FairTax consumption system fares best in regards to autonomy. Rand Paul’s “Fair and Flat Tax” earns little applause. In this analysis, the progressive income tax is the winner.

It is easy to whine about the status quo. Finding a better alternative is often a greater challenge. Although the current income tax system is certainly imperfect, the potential replacements seem ethically and economically problematic. Ultimately, it makes more sense to attempt to fix the flaws in the tax code as opposed to scrapping it in favor of a conceivably worse system.

xxx

Tax Systems: A Brief Ethical Discourse

Works Cited

Amadeo, Kimberly. “U.S. Annual Federal Tax Revenue: Past and Present.” About News, 2015. Web. July 2015.

Ballard, Charles L. A General Equilibrium Model for Tax Policy Evaluation. Chicago: U of Chicago, 1985. 171-87. Replacing the Personal Income Tax with a Progressive Consumption Tax. The National Bureau of Economic Research. Web.

Burman, Len. “The Trouble with the FairTax.” Forbes. Forbes Magazine, 27 May 2015. Web. July 2015.

Burman, Leonard E. “How Big Are Total Individual Income Tax Expenditures, and Who Benefits from Them?” The American Economic Review 98.2, Papers and Proceedings of the One Hundred Twentieth Annual Meeting of the American Economic Association (2008): 79-83. Urban.org. Sept. 2011. Web.

Chamberlain, John. “The Progressive Income Tax.” Foundation for Economic Education. The Freeman, n.d. Web. July 2015.

Clancy, Dean. “The Ups and Downs of Rand Paul’s Tax Plan.” US News. U.S.News & World Report, 29 June 2015. Web. July 2015.

Cocozzelli, Frank L. “Refuting the Reagan Legacy: Progressive Taxation Is the Key to Prosperity.” Roosevelt Institute, n.d. Web. July 2015.

Dorn, James A. “Ending Tax Socialism.” Cato Institute, 13 Sept. 1996. Web. July 2015.

“How FAIRtax Works | FAIRtax.org.” FAIRtax.org. N.p., n.d. Web. July 2015.

Johnston, Kevin. “Pros & Cons of a Flat Tax.” Opposing Views, n.d. Web. July 2015.

Kroeger, James J. “The Progressive Income Tax: Theoretical Foundations.” Nontrivial Pursuits. N.p., 2004. Web. July 2015.

Mangan, Holly. “What Is the Fair Tax Act Explained – Pros and Cons.” Money Crashers. Sparkcharge Media, 06 Dec. 2011. Web. July 2015.

Matthews, Chris. “Wealth Inequality Is 10 times Worse than Income Inequality |.” Fortune Wealth Inequality in America Its Worse than You Think Comments. Forbes, 31 Oct. 2014. Web. July 2015.

Phillips Erb, Kelly. “2015 Tax Rates, Standard Deductions, Personal Exemptions, Credit Amounts & More.” Forbes. Forbes Magazine, 14 May 2015. Web. July 2015.

Sugin, Linda. “Theories of Distributive Justice and Limitations on Taxation: What Rawls Demands from Tax Systems”, 72 Fordham L. Rev. 1991 (2004).

“Social Security.” National Average Wage Index. N.p., n.d. Web. July 2015.

Thorndike, Joseph. “Rand Paul’s Tax Plan May Be Radical, But It’s Not Impossible.” Forbes. Forbes Magazine, 26 June 2015. Web. July 2015.

Ulbrich, Holley. U.S.News & World Report, 12 Apr. 2010. Web. 25 July 2015.

“Unspinning the FairTax.” FactCheck.org. Fact Check, 2007. Web. July 2015.

[1] We assume the government is the moral agent because the United States is a legislative republic and not a democracy, in the sense that the power to enact change rests outside the hands of ordinary citizens, even when exercising their voting rights. The legislature is a living, relatively autonomous body that largely does not act according to the wishes of their constituents.

[2] $45,000 is the average individual income in the United States in 2013.

[3] We assume here that the Alternative Minimum Tax is lower than what is calculated here and therefore this is the percentage paid.

[4] Theoretically, every additional dollar earned by an individual is slightly less valuable than the previous dollar. Therefore a dollar is “worth” less to a more wealthy person compared to a less wealthy person, on average.

[5] In order to maintain its revenue streams the U.S. Federal Government introduced the AMT in 2012. The AMT sets a minimum total percentage that must be paid on income, regardless of exemptions and deductions. In 2015, an individual will be able to file for a maximum of $53,600 in tax exemptions.

[6] Paul’s plan calls for a $15,000 standard deduction per filer and $5,000 deduction per person. In this example the taxable income of the individual earning $45,000/yr would be $25,000. The same deduction would apply to the individual earning $200,000/yr, making her taxable income $180,000.

[7] FairTax literature calls for a 23% “inclusive” tax rate. That means for every $100 spent, $23 dollars would be sent to the federal government. However, if you view the tax in the traditional way we look at sales tax – as an “exclusive” tax – the true rate is closer to 30%. $23 is 29.9% of $77.

[8] Keep in mind that prices of new goods and services would spike under FairTax, so $7,238 in the status quo is more valuable than would be under a consumption-tax system.