NFTs: Risks, Rewards, Ethics

By Lucy Ingold

Despite the popularity of NFT (Non-Fungible Token) in the media and across pop culture, few can provide a comprehensive explanation of an NFT and whether these entities are a worthy investments. Fewer analyze their ethical impact. The market for NFTs was US$41 billion in 2021, nearly matching the value of the entire global fine art market. As the NFT market continues to expand, it becomes increasingly important for potential investors to develop keener awareness of the nature of NFTs. This knowledge must include NFT’s strengths and weaknesses as an asset. ESG (Environmental, Social, and Governance) leaning investors and sellers should be wary of the ethical issues of NFTs. While buying or selling an NFT may lucrative, profits and salability are unpredictable, buyers and sellers alike regularly fall victim to fraud, regulation is nonexistent, and most artists struggle to find any success. The risks may not be worth the potential reward.

What is an NFT?

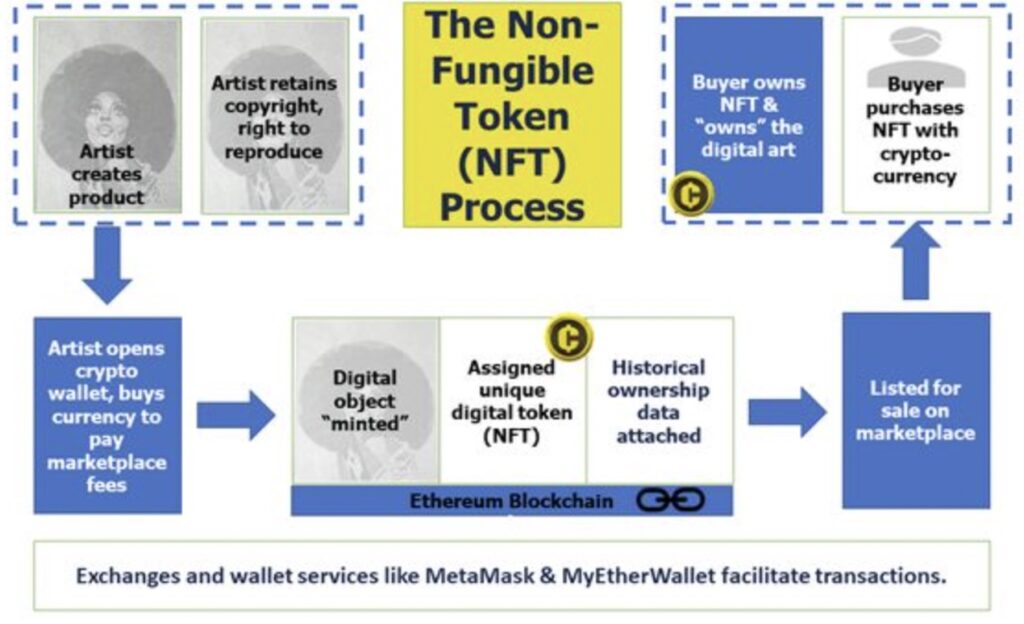

NFTs are digital assets bought and sold online, and frequently purchased with cryptocurrency. The most popular form of NFT is digital artwork, but NFTs can also be music, in-game items, virtual worlds, GIFs, videos, avatars, and virtual souvenirs and collectibles. Each NFT is embedded with a unique ID code identifying its owner. However, owning an NFT does not mean others cannot view, save, or screenshot an image of the NFT. Ownership simply means the owner has the original image. An NFT’s value lies in being the original asset in an internet full of copies.

Notably, NFTs are non-fungible. Physical money and cryptocurrencies are fungible, meaning they can be traded or exchanged for one another. A dollar will always be equal to another dollar, and one bitcoin will always be equal to another bitcoin. One NFT, however, is not equal to another NFT. Each NFT is a unique digital entity with its own digital signature and value – it can’t be traded for one another.

NFTs are typically created and stored on the Ethereum blockchain. A blockchain collects information, such as a record of transactions made with a cryptocurrency and places this information into electronic groups known as blocks. Blocks have certain storage capabilities and when one is filled, the block is permanently closed – the data inside is set in stone and is then linked to the previous block. This chain of blocks of data is the blockchain. The nature of the blocks being strung together means the data are stored in a completely chronological, permanent, and irreversible fashion, viewable to anyone. Thus, the blockchain makes a great ledger for crypto transactions. Its technology makes for easy verification of NFT ownership. Furthermore, once an NFT is created on the blockchain, its unique ID cannot be altered.

Acquiring NFTs is fairly simple, but requires some crypto savvy. Potential buyers should first set up a cryptocurrency wallet that supports the Ethereum blockchain and buy some ether. Investors then can start browsing for NFTs via NFT marketplaces, websites that can be accessed by anyone. Popular marketplaces include Opensea.io, FTX, Rarable, Superrare, and Nifty Gateway – to name a few. Most marketplaces function like auction houses, so once potential buyers like an NFT, they simply make a bid.

Benefits of NFTs

Secure Ownership

Though a relatively new investment option, investors already recognize various positive attributes of NFTs. First, NFT ownership is extremely secure. Because NFTs are created on the blockchain, each NFT has an individual, unchangeable ID and each purchase is permanently recorded. Though anyone can have an image of an NFT, the blockchain makes it unquestionable who owns the original asset. Second, NFTs are also easily transferable and cannot be lost or stolen. NFT investing does not require a supply chain, lessening the need for intermediaries, and increasing security. Artists can communicate directly with buyers and carry out all transactions online, eliminating the need for agents and time-consuming buying processes. Third, NFTs allow for more diversified financial portfolios. Investors who do not want to directly purchase these digital assets can still get involved in the NFT sphere. Accredited investors can invest in venture capital funds that invest in NFTs or cryptocurrency infrastructure. Non-accredited investors can purchase NFT focused exchange-traded funds.

Creator Autonomy

NFT’s main ethical strength is the opportunity for artists and digital content creators to take full ownership over their work. Mainstream publishing models like art galleries and auction houses typically capture large amounts of profit from artists when selling an item. NFTs, on the other hand, allow creators to directly sell their creative content to buyers and maximize profits. Artists and content creators can also program royalties into their NFTs to receive a percentage of future sales. NFTs should be celebrated for the power and freedom they place in the creator’s hands: never have artists been able to sell to such a wide market without giving up control over their work. It is exciting to see a technology that properly rewards artists for their work.

Source: Time

Risks of Investing in NFTs

Price Volatility

As with all investments, potential NFT buyers should become familiar with the risks. There is not a lot of history to judge NFT’s overall performance; the first NFT was recently sold in 2014. They could remain an exciting, profitable asset, or could completely fall off the grid. The NFT marketplace appears to currently be experiencing a correction. In quarter 2 of the 2022 fiscal year, the volume of USD traded in NFTs decreased 25% from quarter 1 and the volume of sales decreased by 20%. Future profits are incalculable and NFT prices change every minute. An NFT’s value is completely determined by what another buyer is willing to pay for it, so it’s entirely possible for an NFT to resell for less than its previous price or to not even resell at all. Transaction data from OpenSea marketplace indicates only 28.5% of newly minted NFTs resell with a profit. However, NFTs are certainly not consistently sold without profit; the same data indicate buying an NFT that has already been owned by another investor and then reselling it results in a profit 65.1% of the time. NFTs are highly illiquid, so if no one wants to purchase a seller’s NFT, the seller must hold on to it.

Transactions have gas fees, which is money paid to complete the transaction. However, gas fees vary and rise or decrease at unpredictable rates. It is plausible a buyer could pay more in gas fees than they do for the actual NFT. Like traditional investments, profits are subject to capital gains tax, so investors are sure to give up some of their profits once they sell their NFT. If an NFT meets the definition of a “collectible,” it is taxed at an even higher collectibles tax rate. Attributing numerous risks with an investment is par for the course. However, one ethical issue of NFTs is their newness may mean most potential buyers are not aware of the risks accompanying NFTs. To counter this knowledge lacuna, research explaining the potential downsides of NFT investment should be more prevalent in the media, rather than solely hype for NFTs.

Fraud: Wash Trading, Impersonations, and Rug Pulling

The largest ethical problem for NFT buyers is the significant presence of fraud within the crypto world. One well-known form of fraud is called “wash trading,” when an NFT creator or seller inflates the price of their NFT. The fraudster creates a false appearance of demand through selling and buying the NFT from multiple fake accounts with price increases through each transaction. Sellers have also tricked buyers into paying for NFTs they don’t have rights to. Since transactions are irreversible buyers never get their money back. Similarly, fake NFT stores sell NFTs that do not even technically exist. People have impersonated famous artists. These impersonators sell their own art as the work of the famous artist. Another common form of fraud is called “rug pulling”: an NFT seller announces a new NFT project that is supposed to come with future features, to appeal to investors. The seller then closes the project and takes off with the money once the first element of the supposed project is sold. NFT sellers and buyers use “smart contracts” during NFT sales, which are self-executing contracts that dispel the need for an intermediary to facilitate NFT purchases. This makes NFTs part of Decentralized Finance (DeFi), a financial system utilizing technology to remove the need for traditional banks and financial institutions to facilitate financial transactions. Although DeFi appeals to many, hackers do find their way into DeFi networks and steal crypto by finding flaws in smart contracts. Poly, a crypto transferring platform, was recently hacked and $600 million of NFTs were stolen. A major ethical issue with DeFi arises from the lack of intermediaries. This absence of intermediaries makes it significantly easier for ill-intentioned NFT sellers to commit wrongdoing. Without an institution or regulatory body in place to protect buyers, there is little confidence that buyers, particularly those new to the NFT game, will not become victims of one of the many forms of fraud cited above.

Despite ownership of an NFT, it can still be viewed, copied, screenshot, and downloaded by just about anyone on the internet.

Furthermore, some may argue the benefits of owning an NFT are limited. NFT owners don’t control the copyright; the artist continues to control this. Despite ownership of an NFT, it can still be viewed, copied, screenshot, and downloaded by just about anyone on the internet. Unlike a traditional asset like property, owning an NFT doesn’t keep others from using it, which could be a downside for many. Essentially all an NFT owner can do with an NFT is sell it to someone else.

Risks of Creating NFTs

Although many art supporters and tech enthusiasts initially praised NFTs for being the most ethical way to buy artwork, a closer observation into what it is like to be an NFT creator may suggest differently. Most of the revenue from NFT sales has gone to a small percentage of popular NFT creators. It is incredibly difficult for a new artist to find a market of buyers in the vast NFT marketplace. Name recognition is essential. As a result, an ethical issue with NFTs is they have concentrated wealth in the hands of a few famous artists/creators and investors. Artists must also pay blockchain processing fees to create NFTs on the Ethereum network. These fees can cost a few hundred dollars. If the NFT doesn’t sell, the money ends up completely lost.

…an ethical issue with NFTs is they have concentrated wealth in the hands of a few famous artists/creators and investors.

Just as NFT investors can become victims of fraud, artists can as well. Some artists have had NFTs of their artwork created and sold for large amounts of money without the artist being aware of or receiving any profits. As example, in January of 2022, an NFT trading platform announced that around 80% of the NFTs on their platform had been plagiarized. As discussed, the NFT marketplace has few protections in place to guard artists and buyers alike from such exploits. If an auction house had no way to protect its artists and buyers from such scams, it would certainly be shut down by regulators.

Energy Consumption

Completely independent of the risk NFTs pose to buyers and sellers, but an important ethical issue is the disastrous environmental footprint of NFTs. Most Blockchains consume an immense amount of energy because they require numerous computers across the globe to support each transaction. Previously, every time someone made a transaction on the Ethereum network, which includes buying or selling an NFT, 128 kilograms of carbon dioxide were generated. This is the same amount of energy consumed by the average home over two weeks. However, as of September 2022, the Ethereum blockchain has adopted a new “proof of stake” consensus mechanism which reduces Ethereum’s energy consumption by over 99%. Consensus mechanisms are what secure the blockchain; the previous consensus mechanism, “proof of work”, can largely be blamed for Ethereum’s extensive energy emissions. This change, known as “The Merge”, means NFTs no longer use as much energy as they did in the past.

In sum, though NFTs are an inventive and completely new investment option, anyone who wants to enter the NFT sphere, either as an investor or creator, should familiarize themselves with the risks and ethical downsides of NFTs. However, it could be argued that NFT’s most hopeful future involves the implementation of some sort of regulatory agency. A regulatory agency would strongly mitigate one major ethical problem of NFTs: fraud. Supporters of DeFi might put up a fight, but regulations may be necessary for the common good. Though certain ethical concerns regarding NFTs will still exist even with regulation, the elimination of scams that regularly hit NFT buyers and sellers will make the NFT marketplace a far more just environment.

Sources

Conti, Robyn and John Schmidt, “What is an NFT? Non-Fungible Tokens Explained”. Forbes Advisor, April 2022.https://www.forbes.com/advisor/investing/cryptocurrency/nft-non-fungible-token/

Dean, Tim, “ Hype and hypocrisy: The high ethical cost of NFTs”. Ethics.org, May 2022. https://ethics.org.au/hype-and-hypocrisy-the-high-ethical-cost-of-nfts/

Hayes, Adam, “What Is a Blockchain?” Investopedia, June 2022. https://www.investopedia.com/terms/b/blockchain.asp

Joshi, Naveen, “7 Risks Investors Need To Know Before Jumping Headfirst Into The NFT Bandwagon”. Forbes, April 2022.

“NFT Investment: A Beginner’s Guide to the Risks and Returns of NFTs”. Cointelegraph. https://cointelegraph.com/nonfungible-tokens-for-beginners/nft-investment-a-beginners-guide-to-the-risks-and-returns-of-nfts

“NFT Market Report Q2 2022: A Massive 25% USD Traded Drop”. NonFungible, July 2022.https://nonfungible.com/news/corporate/nft-market-report-q2-2022

“Pros and Cons of NFTs: Everything You Need to Know”. Cryptonews, June 2022. https://cryptonews.com/news/pros-cons-of-nfts-everything-you-need-know.htm

Takahashi, Dean, “Chainalysis: After $26.9B in trading, are NFTs poised for a boom or crash?” Venture Beat, December 2021.https://venturebeat.com/commerce/chainalysis-after-26-9b-in-trading-are-nfts-poised-for-a-boom-or-crash/

Image Courtesy of: https://www.kiplinger.com/investing/602743/nfts-what-are-they-and-how-do-they-work