Necessity and Minimum Wage

By John Atherton

Compare someone’s choice to buy a luxurious decoration with the purchase of a prescription that staves off death. While one of these choices is an aesthetic preference the other is a necessity of survival. The distinction between these choices separates economic ‘wants’ and ‘needs’. A dependence on survival needs forces human behaviour through naturally imposed duress, compromising our freedom of choice. A moral right to freedom or existence argues for the removal of this duress in favour of a default state, where survivalist compulsion is made irrelevant.

A perfect default state would be a system where our freedom to choose a necessity is raised until it resembles our freedom to choose a luxury. To achieve this ideal, the mitigation of natural duress through a guarantee of survival is considered in the practical model of a minimum wage. At present, despite any choice we make, we cannot exist without the necessities. The ability to meet the costs of food, water and shelter are a start in delaying the repercussions of our natural shackles [1]. If we did not need these to survive, but regard them as optional, then our choice to buy them could certainly be considered more freely made. How does the conflict between compulsion to satisfy the needs of survival and freedom of choice factor into the economics of the minimum wage?

Self Sufficiency

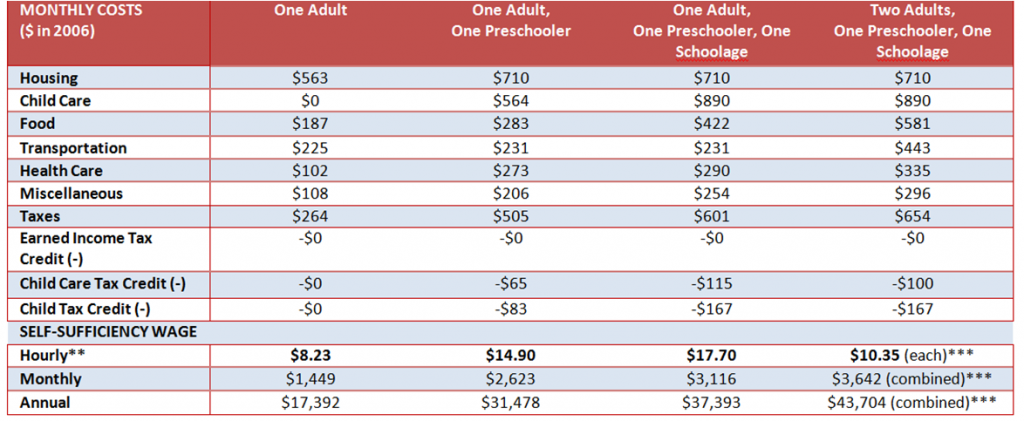

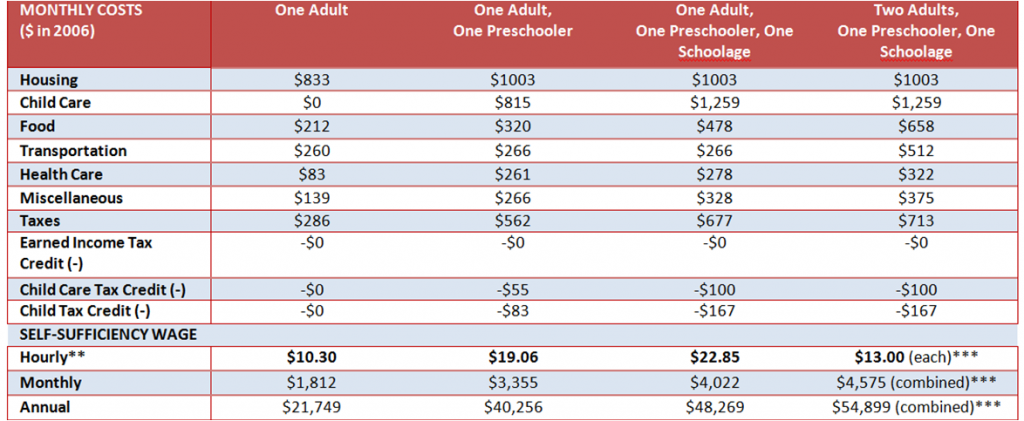

The 2006 self sufficiency standard used in The United States of America contains the major categories of housing, child care, food, transportation and healthcare [2]. We call the cost of these provisions the ‘cost of living’, though this amount varies both locally and abroad. Internationally, different nations use different standards; Canada, for example, assumes education is provided freely by the state to Canadian residents. Education assists all models, including those considered later in this article, and there is a valid case for it to be included as a need, though for this analysis current measurements and their respective assumptions are used. The cost of living in different counties also varies while within the same county the cost of having children is the final point of difference. Two examples from a standard researched in 2006 are listed below.

The Self-Sufficiency Standard for Selected Family Types* Harrisburg-Carlisle, PA MSA, 2006 Dauphin County Monthly Expenses and Shares of Total Budgets

Table 1: 2006, University of Washington for PathWaysPA [2].

The Self-Sufficiency Standard for Seattle-Bellevue*, WA HMFA, 2006 King County – Bellevue, Juanita, Kirkland and Redmond

Table 2: 2006, Washington University for the Workforce Development Council of Seattle-King County [3].

* The Standard is calculated by adding expenses and taxes and subtracting tax credits. Taxes include federal and state income taxes (including state tax credits except state IETC and CTC) and payroll taxes.

** The hourly wage is calculated by dividing the monthly wage by 176 hours (8 hours per day times 22 days per month).

*** The hourly wage for families with two adults represents the hourly wage that each adult would need to earn, while the monthly and annual wages represent both parents’ wages combined.

Taking the moral imperative of an inherent right to a default state, (a right to exist), into account where do these figures leave us? The beginning of this analysis resides in discussing merely the cost of living of a single adult verses the current minimum wage of $7.25; though the variation in cost of living figures makes this difficult. Given the difference between local self sufficiency wages we can first say the minimum wage should definitely be higher than the lowest living wage. If one said so relating to The United States as a whole then it would only be feasible for minimum wage workers to live in the cheapest county of the entire nation, a mildly impractical notion given the distribution of minimum wage jobs throughout the country. If we took the lowest self sufficiency wage from a state we would find ourselves with a reduced version of the same problem. There is presently no pervasive survey connecting minimum wage job locations to the cheapest nearby residencies so we will have to approximate.

Taking the United States’ GDP per capita, the International Monetary Fund, World Bank and Central Intelligence Agency would all quote a figure between $54,000-$55,000, though a great deal of income is unseen by the average American due to the extreme nature of wealth inequality making the $28,889 per capita income figure quoted by the United States Census Bureau paint a more realistic picture with regards to the scope of the minimum wage worker [4, 5, 6, 7].

If we made the approximation that a minimum wage worker should, if making purely survival based purchases (leaving no money for luxury or lifestyle), be able to live in neighbourhoods along people earning $28,889 or less, how effective would this be as a measure?

Even attempting to base a minimum wage off approximations of the survival wage in this manner is inadequate. In Bellevue, Juanita, Kirkland and Redmond – King County, Washington State, for example, where the survival wage for an adult individual is on the higher side at $41,767, it might seem unreasonable to say that it should be expected that a minimum wage worker should not be able to afford to live there [7]. That is, however, until you also consider that King County is by far the most populated county in Washington with over 2 million people (almost 30% of the state’s population).

Furthermore, though the survival wage drops to almost $8 for the 652,000 residents of Seattle, it is $9.49 in Renton, and higher still for all remaining fractions of King County up until the $10.30 hourly wage seen in Table 2 [3]. In Pennsylvania, residents of Dauphin County earn $30,491 per capita with a survival standard of $17,392 whilst back in Kitsap County, Washington, per capita income is a higher $32,340 while the annual survival wage is the lowest value of any recorded county in the state at a staggeringly low $13,807; requiring an hourly wage of $6.54 [2, 3, 7].

The conclusion of these widely varying survival and income figures is given all these counties employ minimum wage workers, if we do not want higher unemployment or increased transport costs the minimum wage must be above the survival wage in a given area for employment to truly be viable from the perspective of the employee. In analysing these differences one might also ponder the ethical positions posed by varying minimum wages and its varying effect on local employment, though this article will focus on the nation as a whole.

One national poverty model used by The Financial Times (US), calls three member households earning near or less than $31,402 a year “in or near to poverty”, with this affliction affecting one fifth of the American population [8]. Using the assumptions of the model above, if a single adult in these households worked, he would have to earn $14.87 an hour, or if two members worked full time then they would have to earn $7.43 an hour each. This poverty line is still a more conservative estimate than the local realities of Dauphin and King County, where a single adult living alone without any children at all would have to earn $8.23 and $8.06-$10.30 respectively. By all these standards a full time worker earning minimum wage may well be living in poverty.

Spending and Profitability

Employment is the next key issue when it comes to the minimum wage; specifically regarding what is practical for employers. Regardless of a wage based on the cost of living, if the value of a person’s employment is lower than their wage then their employer would incur a loss for hiring them. If this occurs a rational employer would not hire them in the first place, making the minimum wage’s equivocation with a survival wage irrelevant to those left unemployed. From a consequentialist standpoint, where practical feasibility is favoured over intangible principled motivation, employer incentives must be met for a minimum wage increase to be permissible. By extension, doing so must be economically advantageous for it to be affirmed. Consider these principled motivations followed by a more pragmatic, consequentialist approach in analysing the minimum wage.

If productivity exceeds income then employment is profitable. Additionally, if one supports the right of an individual to the ‘sweat of their brow’, or justice, then a wage nearing productivity and hence a minimum wage nearing minimum productivity would be supported morally, as a practical implementation of meritocracy. Furthermore, with relation to the moral concept of egalitarian redistribution, a moral argument independent of a right to existence can also be made. The first of these arguments is met in any system, with or without intervention, where the minimum wage is set near the productivity wage. The second is met where a minimum wage, (or similar scheme), is set higher than the cost of living such that a person might not merely survive but also develop. Finally, the imperative to be free of the coercion of the natural order requires a minimum wage, (or similar scheme), that is, at the very least, equal to the cost of living.

All three of these positions also overlap a position of Deontological Capitalism. From the employer’s standpoint a person should not be viewed as a resource or means, affirming their right to their own labour as stated by the first moral position. The facilitation for personal growth proposed by the second aligns with the portion of the Categorical Imperative where one is both subject and sovereign, as a world in which all workers were entrenched in the circumstances of the minimum wage worker would be vastly inferior [9]. The third of these positions finds comports with Kantian Ethics also, where someone’s survival may be seen as their responsibility as an independent rational agent. If a minimum wage is set above the cost of living, but not above the productivity wage, then all these positions are in agreement.

In contrast to this, however, a consequentialist might argue that the viability of any proposition is the most important consideration. A utilitarian, by extension, also favours an argument for redistribution given diminishing returns on happiness from wealth – provided practical viability is demonstrated [10]. Beyond a level of inequality required as incentive, if income distribution had no effect on spending habits, alongside an increase in happiness, then a utilitarian would affirm it [11]. Often, however, more equitable systems see improved economic conditions, affirming even a consequentialist position without happiness as a criterion. What are the practical benefits of an increased minimum wage?

The reason for this relates to spending behaviour. Someone whose wage equals survival wage, for example, cannot afford to save. His spending is continuously circulated throughout the economy, its effect in turn amplified by the multipliers of the sectors it is engaged in. If these sectors spend more, such as on wages, then their multiplier is also increased [12]. This increased rate of capital circulation promotes economic growth. A change in income of a set amount also has an increased effect on consumer behaviour for lower income earners, and hence promotes higher consumer confidence and spending behaviour [13].

There are further studies on the effects of minimum wage increases too, with a study from the CEPR noting that even if prices increase from a wage hike then the net effect recorded is still positive [14]. This means it may be the case that the cyclical effect noted earlier could compensate for a wage increase above current productivity, effectively increasing productivity provided the wage increase is minimal. Beyond the general wage figures discussed later in this article minor increases, if supported by specific case studies, indicates the minimum wage can be marginally higher.

With regard to competition and unemployment, negative effects to employment were not found in a study of two neighbouring states where one increased its minimum wage, but where the increased minimum wage was still below the productivity wage [15]. The most obvious positive effect of all this to a utilitarian, however, is not just the increase to happiness from wealth redistribution, but also the reduction of the suffering of poverty [16].

Returning to the potential conflict between the survival and productivity wages we find a similar consideration. In all places where the productivity wage exceeds ‘cost of living’ employment is profitable. In determining a viable minimum wage we should be aware that moderation is required. What is the viable minimum wage?

The Cost of Living and Productivity

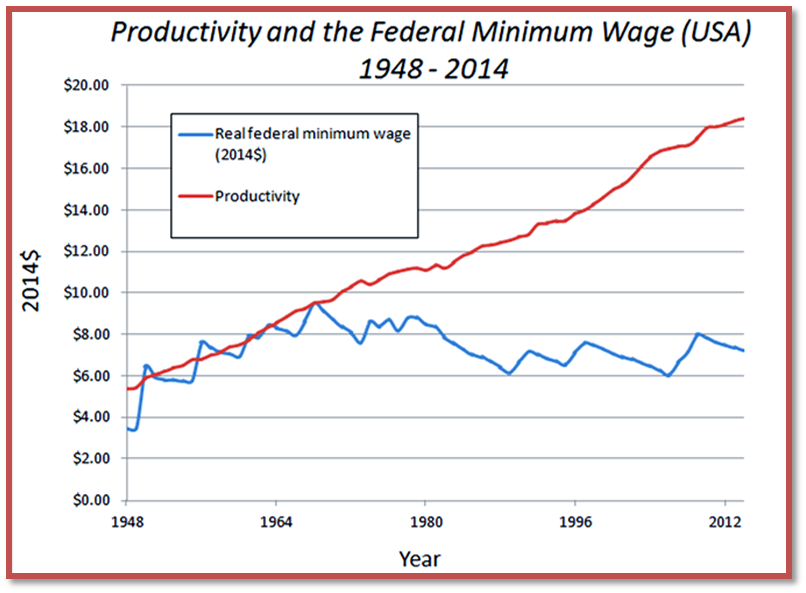

With the viable wage near or below productivity, while hopefully exceeding the cost of living, we need to find the productivity wage for minimum wage workers. Though specific figures are difficult to quantify we can judge the rate of growth in wages against the growth in productivity. The following graph was made using data from the economic policy institute, noting the value of the minimum wage against productivity when we factor out inflation.

Graph 1: Productivity and Minimum Wage (Economic Policy Institute [17])

These figures suggest that if the minimum wage kept pace with productivity it would soon reach $20, well exceeding the $15 hourly minimum wage some people are suggesting. Furthermore, these results, along with general results about average worker compensation, (which also have lost pace with productivity to a huge extent since the 1970s much like the minimum wage [18]), were noted in an article by the Economic Policy Institute discussing a $12 minimum wage, (by 2020, or $10.58 in 2014$), noting how it would only be just above the $9.54, (in 2014$), minimum wage from 1968 before the decline in the wage’s real value due to inflation [17].

Though a $12 minimum wage would account for inflation, given the increase of productivity, minimum wage workers are performing a far more productive service today, so their minimum wage should not be merely indexed, but increased to account for the fact that they are more productive today. According to this graph, their productivity wage in 2014 was $18.42 [17]. Setting this as a minimum wage, or just the $15 minimum wage some politicians are suggesting, should account for the difference in living costs while keeping minimum wage work profitable. An $18.42 wage would go further morally, though an increase to the minimum wage would certainly be advised.

Wage stagnation in general also entails further consequentialist harms from lowered general spending behaviour mentioned earlier, decreasing confidence, increasing inequity, increasing reliance on debt and instability [19]. Present levels of inequality have been linked to greatly more financially difficult college years, making it more difficult for people to increase human capital through education, thereby slowing economic growth [12, 19].

All of this, however, is assuming the data are accurate. There is also some criticism that should be considered in evaluating this data. The first is that the data for productivity relate to the whole economy, rather than just minimum wage work. Although the minimum wage seemed to keep pace with productivity until 1968 we cannot assume it continued to increase as quickly. One way to gauge the productivity increase of minimum wage work more accurately is to use percentage growth figures released by the Bureau of Labor Statistics in specific industries, and analyse sectors with more minimum wage workers such as the ‘Fast Food Industry’, (Accommodation and Food Services – Limited Service Restaurants). This approach was used by the Heritage Foundation in criticism of a minimum wage rise.

In doing so it noted that the percentage growth in wages seemed similar to the percentage growth in productivity, though there is a huge fault in this method. That flaw is that these percentage growth figures only date back in the Labor Department’s records to 1987, while the source of the disparity dates to 1968 [20, 21]. After 1968 productivity began to rise far more quickly than wages. In the graph using figures from the Economic Policy Institute the real value of the minimum wage actually declined.

This means if we use percentage change figures from 1987 they will fail to reflect the initial disparity. For example in 1987 a 20% increase to the minimum wage would be an estimated $1.34 (2014$), while a 20% increase to productivity would be an estimated increase of $2.47 (2014$). Although this method is preferable, as figures for specific industries are only available from 1987, this method cannot be used without reference to an initial disparity estimated by the negative redistribution of wealth in the general economy.

Using this approach, wages in the ‘Accommodation and Food Services – Limited Service Restaurants’ sector would be 13.5% up from the $12.35 1987 productivity wage, placing it at around $14 as opposed to the approximately $8 minimum wage suggested by the article’s mathematics [22]. This $14 figure, however, is still an important tool for the specific consideration of this industry, though it too comes with its reduced generalisations and the enhanced potential for distortion from both historic and current tipping practices.

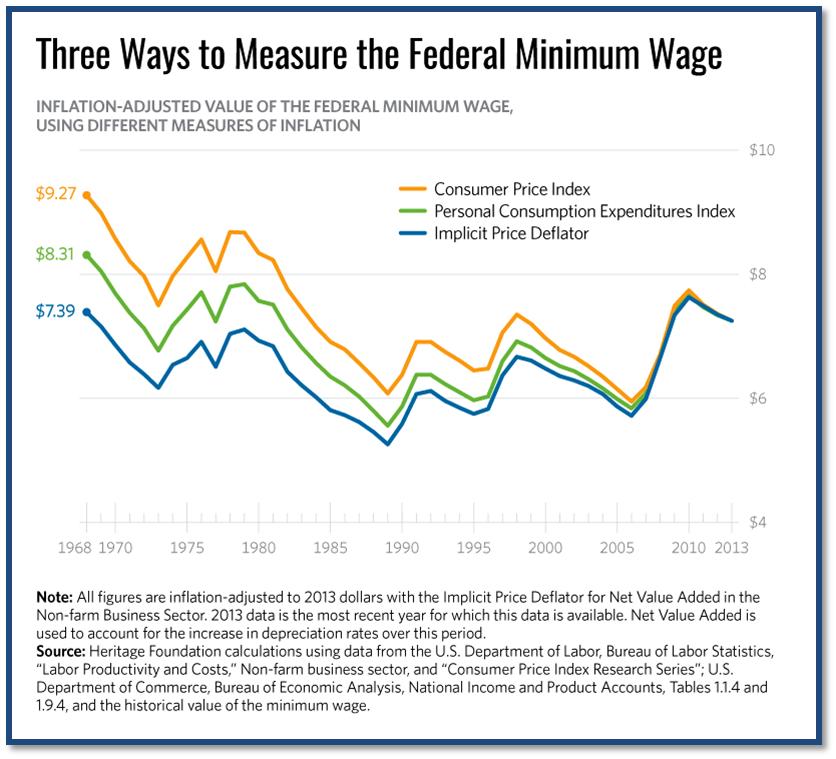

An additional disagreement with the validity of the graph is also raised by critics regarding how it accounts for inflation. On this account we have data back to 1968. The inflation figures given can be seen in the graph below.

Graph 2: Heritage Foundation calculations using Labor Department Figures [22].

There are three main methods of accounting for inflation. The Institute of Economic Policy used the Implicit Price Deflator (IPD) for productivity and the Consumer Price Index (CPI) for wages. By all three measures the real value of the minimum wage, ($7.25), has dropped, though by different amounts. Remember also that the real value should not just be constant, but increase with respect to workplace productivity and so be notably higher than any of these three figures making this more than a matter of a $0.14 difference if we take the most pessimistic projection for a minimum wage supporter.

Regardless, The Institute of Economic Policy did use the two methods which made the divide between productivity and wages appear the largest. If we were to use the same deflation method then the productivity wage is 22% lower, making deflation calculation an important factor. What is the difference between the CPI and the IPD?

Put simply the IPD relates to the economy overall while the CPI relates to a ‘basket of goods’ and is more a reflection of the part of the economy a minimum wage worker would likely make purchases in than the economy as a whole [12, 23]. Some measures of the IPD also exclude certain activity a minimum wage worker is likely to be affected by, such as transfer payments, (welfare), and household to household payments [24]. Effectively, both measures are designed for different things, with the CPI relating more to individuals while the IPD relates more to the economy generally. It is due to this difference that the Economic Policy Institute, (and other governments taking the same approach), would defend their method as most applicable to the measures of productivity and wages specifically while critics would claim the same measure should be used regardless to perform a fair test.

Knowing that the $18.42 wage would easily cover an individual’s cost of living and hence align rights based and consequentialist moral interests, is the same possible if you use the same deflator? In 2014$ it would be approximately $14.40, (taking the scaled deflator difference assuming productivity kept pace with average productivity growth) [25]. In expensive cities like San Francisco $18.42 would be insufficient for single parent families and $14.40 would be insufficient altogether, though both figures would allow single adult workers in Jersey City, Washington D.C., Phoenix, Denver, Tacoma, Philadelphia, Indianapolis, Hartford and Charleston to now afford the self-sufficiency standard [3]. Even this significantly reduced figure would still cover the cost of living in many counties, sustaining survival, profits and growth; though there are alternatives to the minimum wage, some of which argue profits aren’t enough motivation.

Alternatives to the Minimum Wage

Besides the minimum wage there are two common counter-models, the Income Earned Tax Credit, (also referred to as negative tax), and the complete abolition of any government intervention. An Income Earned Tax Credit is effectively a means tested and bureaucratically implemented payment from the government to anyone making below a certain wage, so the economy is taxed and a payment given to those earning the lowest income earners. Though it may involve the inefficiencies and costs of bureaucracy, the means testing capability becomes more important if you want to specifically target certain family structures, providing the argumentative basis for the similar programs of the Child Care Tax Credit and the Child Tax Credit, (also listed in Tables 1 & 2).

The Income Earned Tax Credit (IETC), in its current form, is considered by some studies to be ineffective without a significant increase in size [26]. This same study also makes note of the greater capacity for fraud opened by such a program. Of the information in Tables 1 and 2 none of the listed family structures would receive an Income Earned Tax Credit, though, a ‘one adult, one infant family’ in Dauphin County, Pennsylvania, would receive a payment of $34 from the program every month, covering 1% of the cost of living [2]. Practically, although we have cases of states as well as countries with higher minimum wages, we do not have the same range of information relating to the Income Earned Tax Credit making discussion around it speculative.

David Stockman, a proponent of the IETC, notes that minimum wage workers should also see machinery as competition to their employment. It is not enough for them to be profitable but for them to be more profitable than mechanical replacement [27]. Though the long term effects of this are inconclusive, the general trend of mechanical replacement does provide an analogy [28]. In a way, the IETC is the welfare equivalent of raising the minimum wage along greater restrictions on technological replacement, so a comparison could also be made between such a proposition and the IETC as it stands for those wanting to consider this further.

Beyond a comparison of the minimum wage and IETC, however, this discussion also raises general questions about technological growth. Technology is a major driver of economic growth, with machines ideally replacing the most primitive tasks while the human population becomes more productive through educational specialisation. If education is not sufficiently supported, however, a number of people might find themselves unskilled and unemployed. Historically, the former has been the most prevalent in the long term while the latter is the case in the short term.

Compared to increasing the IETC or minimum wage which both, either independently or combined, fulfils the moral right to a default state of choice, the position of laissez faire economics does not necessarily do so.

Laissez faire supporters claim the market equilibrium is the best measure of employment; however, this is based on free choice and high competition. With 4 million jobs available for 9 million unemployed, (discounting discouraged workers), the market may appear more evenly balanced than it actually is [29, 30, 31]. While anyone without disability can perform the mostly unskilled labour of minimum wage work, many of those 4 million jobs require technical skills a minimum wage worker may have financial difficulty obtaining [32, 33]. A sizable surplus in unemployed, unskilled labour and the lower bargaining power this creates, amidst the choice compromising coercion of necessity, are the main arguments against a laissez faire approach’s assumption of near-perfect competition.

In a typical supply-demand scenario the gradient of a curve relates to elasticity, (an elasticity of labour supply from employees and an elasticity of labour demand from employers respectively). Generally, elasticity is increased by every alternative choice an individual has. Elasticity, therefore, acts as a practical measure for choice in the market and hence, in the context of the aforementioned notion of meritocratic fairness, reflects both a practical and ethical reality. If workers are under the threat of poverty, they are more pressured into finding a job and their elasticity is decreased. Low labour supply elasticity means that if wages were cut by a given amount then the number of people who continue seeking employment decline by a far smaller margin. Given the surplus of people seeking employment, companies hardly have to compete with one another for unskilled workers as they might have to in technical fields [34]. In addition, there is little perception of competition for the most elite of the unskilled employees.

Although the best and brightest of software engineers might see exceptional offers due to their even more limited number, there is no such opportunity for the savant cashier, mitigating pressures from internal competition or an efficiency wage motive towards increasing minimum wage worker pay naturally. Combining these factors with an inelastic labour supply, many companies might prefer to lower their employees’ pay in spite of a relatively trivial decrease in the number of unskilled workers who would seek employment with them. The implication of this is imperfect competition, placing doubt upon simplified supply-demand model analysis [35, 36].

Elasticity also exists for employers; with technological alternatives to workers acting as an extra choice for employers. Therefore, reductions to their access to technological replacement either through direct regulation or indirectly through the IETC could be seen as a decrease to the long term elasticity of labour demand. Elasticity is often regarded as positive, as it permits natural market forces of change to change behaviour to more efficient practices for both the employer and employee. To this end, a consequentialist may view free choice in a marketplace positively beyond its perception either as a right or as distributive justice. It should also be noted that although most critics of meritocracy condemn its propensity for inequality and reliance on the natural state in the case of the minimum wage, its interests align with the egalitarian against survivalist compulsion.

Beyond technological replacement, under deregulation, offshore jobs could also pose a similar threat though national interests in this matter aren’t necessarily a moral priority [37]. Supporters of deregulation might also make the claim that despite any regulation multinational migration is a phenomenon too powerful to be combated, with regulation only worsening the phenomenon.

Of the three alternatives minimum wage advocates should aim to set a wage near where a hypothetically ideal equilibrium would place it if there was high elasticity or a lack of survival pressure allowing for exploitation. With this minimum wage nearing the productivity wage and conveniently exceeding the living wage, the moral obligation to remove the survivalist restriction to choice as well as the consequentialist consideration of the aggregate economy will both be satisfied.

The IETC would counteract the pressure of necessity in a more indirect manner, also potentially steepening employee elasticity alongside an already steep elasticity for employees. While if advocates for this model are right it will also fulfil our initial moral dilemmas, less practical studies exist on the IETC than the minimum wage; though there is little mutually exclusive territory between the two. Finally, laissez faire positions generally neglect the practical manifestation of these moral hurdles and their effect on imperfect competition. Although the laissez faire model is more ineffective in the unskilled labour market, advocates still claim it is preferable to government intervention.

Verdict

There is sound reason to consider an increase to the minimum wage. With productivity estimates exceeding the living wage despite its variation, not only is a rights or justice based analysis satisfied by such a policy but so too is the position of a consequentialist concerned for the aggregate economy.

Specifically for the cases of Dauphin County and the whole of King County, a suggested $12 minimum wage would cover the costs of an individual while a $15 minimum wage would also cover costs for most two income households and some single income households while the productivity wage projection of $18.42 would cover costs for more, but still not all, remaining single income families. Even if we accept some critics’ claims about the Economic Policy Institute’s deflation methods, a productivity wage of $14.40 is supported, with these productivity wages marking the highest minimum wages which remain profitable for employers.

Alongside the proposition of a minimum wage increase are alternative arguments suggested for the IETC and deregulation, (with consideration of an increase in education holding no direct conflict to any of these). In analysing these models, some theorise profitability is not enough, raising further avenues for moral inquiry.

xxx

References

- Denton, J.A. 1990, Society and the Official World: A Reintroduction to Sociology, Rowman & Littlefield Publishers.

- Pearce, Diana M. 2006, The Self-Sufficiency Standard for Pennsylvania, PathWaysPA, May 2006, <http://www.wowonline.org/ourprograms/fess/state-resources/SSS/The%20Self-Sufficiency%20Standard%20for%20Pennsylvania%202006.pdf>.

- Pearce, Diana M. 2006, The Self-Sufficiency Standard for Washington State, University of Washington, <http://www.wowonline.org/ourprograms/fess/state-resources/documents/WASSSfullreport6-29-07.pdf>.

- International Monetary Fund 2015, “Gross domestic product based on purchasing-power-parity (PPP) per capita GDP”, IMF, <http://www.imf.org/external/pubs/ft/weo/2015/02/weodata/weorept.aspx?sy=2013&ey=2020&scsm=1&ssd=1&sort=country&ds=.&br=1&pr1.x=66&pr1.y=4&c=111&s=PPPPC&grp=0&a=>.

- The World Bank 2015, “GDP per capita, PPP”, current international $, The World Bank, <http://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD?order=wbapi_data_value_2014+wbapi_data_value+wbapi_data_value-last&sort=desc>.

- Central Intelligence Agency (USA) 2015, “The World Factbook”, GDP – Per Capita (PPP), CIA, <https://www.cia.gov/library/publications/the-world-factbook/rankorder/2004rank.html>.

- United States Census Bureau 2015, “American Fact Finder”, U.S. Department of Commerce, <http://factfinder.census.gov/faces/nav/jsf/pages/searchresults.xhtml?refresh=t>.

- Donnan, Shawn & Fleming, Sam 2015, “America’s Middle-class Meltdown”, Fifth of US adults live in or near to poverty, The Financial Times (US), <http://www.ft.com/intl/cms/s/0/c3de7f66-9f96-11e5-beba-5e33e2b79e46.html#axzz3u44xHCvc>.

- Bowie, Norman E. 2015, Kantian Capitalism, Published Online: January 21, <http://onlinelibrary.wiley.com/doi/10.1002/9781118785317.weom020134/abstract>.

- Encyclopaedia Britannica 2014, Economics: Diminishing Returns, School and Library Subscribers, <http://www.britannica.com/topic/diminishing-returns>.

- R.A. 2015, How inequality affects growth, The Economist, <http://www.economist.com/blogs/economist-explains/2015/06/economist-explains-11>.

- Hubbard, Glenn, Garnett, Anne, Lewis, Philip, O’Brien, Tony 2013, Macroeconomics: 3, Pearson, NSW, Australia.

- Littleboy, Bruce & Taylor, John B. & Weerapana, Akila 2012, Macroeconomics: Principles and Practice, Asia-Pacific Edition, Cengage Learning.

- Schmitt, John 2013, Why Does the Minimum Wage Have No Discernible Effect on Employment?, Center for Economic and Policy Research, Washington D.C., <http://www.cepr.net/documents/publications/min-wage-2013-02.pdf>.

- Card, David & Krueger, Alan B. 1994, Minimum Wages and Employment: A Case Study for the Fast-Food Industry in New Jersey and Pennsylvania, pp. 772-793, Volume 84, No. 4, American Economic Association.

- Konczal, Mike 2014, “Raising the minimum wage reduces poverty”, The Washington Post, <https://www.washingtonpost.com/news/wonk/wp/2014/01/04/economists-agree-raising-the-minimum-wage-reduces-poverty/>.

- Cooper, David 2014, “Raising the Minimum Wage to $12 by 2020 Would Lift Wages for 35 Million American Workers, Economic Policy Institute, <http://www.epi.org/publication/raising-the-minimum-wage-to-12-by-2020-would-lift-wages-for-35-million-american-workers/#the-minimum-wage-in-context>.

- Reber, Gary & Johnson, Dave 2013, “40 Percent of Americans Now Make Less Than in 1968 Minimum Wage”, Growth of real hourly compensation for production/nonsupervisory workers and productivity 1948-2011, For Economic Justice, < http://www.foreconomicjustice.org/6772/40-percent-of-americans-now-make-less-than-1968-minimum-wage>.

- Bivens, Josh & Gould, Elise & Mishel, Lawrence 2015, “Wage Stagnation in Nine Charts”, Raising America’s Pay, Economic Policy Institute, <http://www.epi.org/publication/charting-wage-stagnation/>.

- Bureau of Labor Statistics, Labor Productivity and Costs, United States Department of Labor, <http://www.bls.gov/lpc/tables.htm>.

- Fleck, Susan & Glaser, John & Sprague, “The compensation-productivity gap”, a visual essay, United States Department of Labor, <http://www.bls.gov/opub/mlr/2011/01/art3full.pdf >.

- Sherk, James 2015, “How Liberals Manipulate Data About the Minimum Wage”, Heritage Foundation, <http://dailysignal.com/2015/06/20/how-liberals-manipulate-data-about-the-minimum-wage/>.

- EconPort 2006, “Differences Between the GDP Deflator and CPI”, Experimental Economics Centre, <http://www.econport.org/content/handbook/Inflation/Price-Index/CPI/Differences.html>.

- Liyange, Piyasena 2007, The Difference between the CPI and the HCE – IPD: A Preliminary Analysis, New Zealand Association of Economists, <http://www.ottawagroup.org/Ottawa/ottawagroup.nsf/4a256353001af3ed4b2562bb00121564/ca8009e582a0c66dca257577007fbcd0/$FILE/2007%2010th%20meeting%20-%20Piyasena%20Liyange%20(Statistics%20New%20Zealand)_The%20Difference%20between%20the%20Consumers%20Price%20Index%20and%20the%20Household%20Consumption%20Expenditure%20%C2%AD%20Implicit%20Price%20Deflator_A%20Preliminary%20%20Analysis.pdf>.

- US Inflation Calculator 2015, Inflation Calculator, US Inflation Calculator, <http://www.usinflationcalculator.com/>.

- Alstott, Anne L. & Hudson, Manley 2009, “Why the EITC Doesn’t Make Work Pay”, Harvard Law School, <http://scholarship.law.duke.edu/cgi/viewcontent.cgi?article=1562&context=lcp>.

- Stockman, David 2014, David Stockman’s alternative to the minimum wage hike, David Stockman’s Contra Corner, <http://davidstockmanscontracorner.com/david-stockman-offers-alternative-to-raising-minimum-wage/>.

- Rotman, David 2013, “How Technology Is Destroying Jobs”, MIT Technology Review, <http://www.technologyreview.com/featuredstory/515926/how-technology-is-destroying-jobs/>.

- Lewis, Adam 2013, There are 4 Million U.S. Job Openings: Why are the positions unfilled?, Forbes, <http://www.forbes.com/sites/realspin/2013/05/31/there-are-4-million-u-s-job-openings-why-are-the-positions-unfilled/>.

- Bureau of Labor Statistics 2015, “Databases, Tables & Calculators by Subject”, United States Department of Labor, <http://data.bls.gov/timeseries/LNS14000000>.

- The World Bank 2015, “Labour Force”, total, The World Bank, <http://data.worldbank.org/indicator/SL.TLF.TOTL.IN>.

- Lerman, Robert I. & Schmidt, Stefanie R. 1999, “The Low-Skilled Labor Market”, The Demand for Skills, The Urban Institute, Washington, D.C. & The United States Department of Labor, < http://www.dol.gov/oasam/programs/history/herman/reports/futurework/conference/trends/trendsvii.htm>.

- Gillespie, Patrick 2015, “America’s persistent problem”, Unskilled workers, CNN Money, < http://money.cnn.com/2015/08/07/news/economy/us-economy-job-skills-gap/>.

- Anderson, Cushing & Gantz, John F. 2013, Stills Requirements for Tomorrow’s Best Jobs Helping Educators Provide Students with Skills and Tools They Need, Microsoft, <https://news.microsoft.com/download/presskits/education/docs/idc_101513.pdf>.

- Kaufman, Bruce E., Institutional Economics and the Minimum Wage: Broadening the Theoretical and Policy Debate, Cornell & Griffith Universities, <http://www98.griffith.edu.au/dspace/bitstream/handle/10072/35628/66037_1.pdf?sequence=1>.

- Investopedia 2015, “Imperfect Competition”, Investopedia, <http://www.investopedia.com/terms/i/imperfect_competition.asp>.

- S.N. 2015, What’s driving American firms overseas, The Economist, <http://www.economist.com/blogs/economist-explains/2015/08/economist-explains-9>.