Moral Cents: The Journal of Ethics in Finance (Summer/Fall 2019)

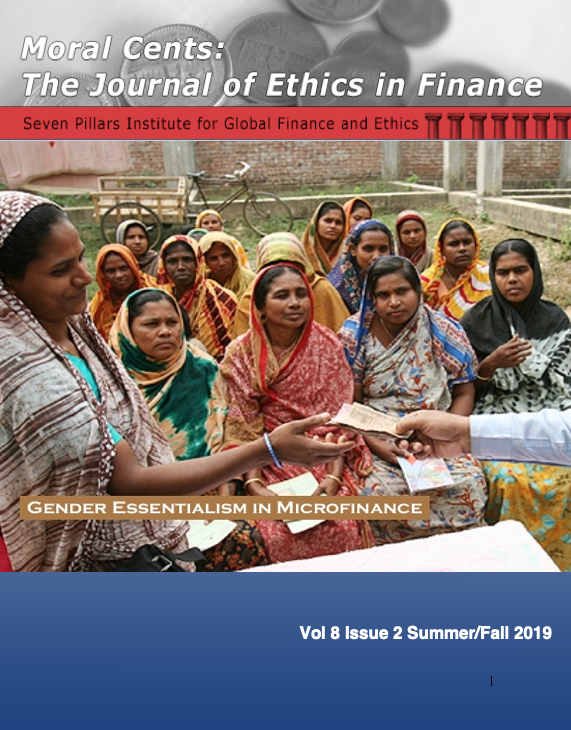

The general impression of microfinance or microcredit is as a positive force in alleviating poverty. Yet, the assumptions behind the lending practice are questionable, burdening women with more work, more social pressure, and more debt. Microcredit subscribes to an essentialist understanding of gender. Schemes target women as they are often seen as ‘better credit risks’ and are more manageable, unlike men. Sariththira Selvakumar shines a light on microcredit and asks if a lending model based on neoliberal ideology can solve a problem caused by that same approach and whether a lending system based on gender essentialism is fair.

It’s been 11 years since the Great Financial Crisis. Ludovico Picciotto investigates if banks have been successful in fostering an ethical culture across the industry in the ensuing years. Top-down regulation is unable to prescribe specific ethical conduct and is therefore, generic and ineffective. Yet, solely relying on voluntary commitments from banks does not ensure industry-wide cultural change. Picciotto recommends regulators focus on principle-based policy to create systemic incentives for banks to foster ethical culture.

When it comes to ethical culture, perhaps banks can benefit from the advice of moral philosophers. Andrea Roncella applies virtue ethics frameworks drawn from Aristotle, Alasdair MacIntyre, and Catholic Social Teaching. He applies natural and unnatural chrematistics (the study of wealth accumulation) to distinguish between the ethics of market-making versus that of high frequency trading. The failure of the Reserve Primary Fund is seen through the lens of MacIntyre’s external and internal goods. Finally, he weighs the ethics of Collateralized Debt Obligations using principles of Catholic Social Teaching.

Alex Zhihao Wang thinks government policy has something to do with ethical culture in finance. He posits the federal government’s goal of promoting homeownership since the Great Depression resulted in these homeownership goals ultimately spreading subprime mortgages throughout the overall economy. Thus, policy created the environment that allowed for a larger financial crisis in 2008. Wang combines an ethics analysis of these housing policies with an analysis of the financial implications of the policies. He conducts his analysis from a utilitarian point of view, examining the positive and negative externalities of homeownership.

This edition of Moral Cents ends with a brief historical review by Jumawan-Matero, Matero, and Diaz of the Dutch East India Company and its ethical failings. The type of corporate misconduct is not unfamiliar in a contemporary setting – conflicts of interest, abuse of monopolistic power, and poor treatment of staff being some of the major problems, which led to the demise of the once powerful Dutch East India Company.

Dr. Kara Tan Bhala

Editor-In-Chief

Moral Cents: The Journal of Ethics in Finance is published by

Seven Pillars Institute for Global Finance and Ethics

ISSN 2326-5663

Editor-in-Chief: Dr. Kara Tan Bhala

Editor: Eric Witmer