Hong Kong: Economic Freedom Belies Crony Capitalism

By: Jackie Connor

Chinese Translation Here

Does empirical evidence support the perception that Hong Kong is a free market capitalistic economy or does it suggest pervasive crony capitalism?

Crony capitalism, which is not inherently criminal, largely replaces market economies with political markets, in which economic success depends on harnessing connections rather than creating valuable products and in which several players can successfully block out competitors. While Hong Kong’s capitalist reputation has historically been supported by Heritage Foundation’s Individual Economic Freedom Index (IEF), which bestowed world’s freest economy for the past 18 years on Hong Kong (2014 Index of Economic Freedom n.d.), Hong Kong also claimed first place in the Economist’s Crony Capitalism Index (CC) several times (Planet Plutocrat 2014).

To understand the seemingly contradictory results, this study investigates the methodologies of both indices and three tiers of Hong Kong society: families, industries, and government policies. The study then quantifies the influence of these categories through four family-to-GDP correlations. The results indicate that despite a low degree of government regulations, a traditional indicator of freedom, there also is evidence that Hong Kong has characteristics of a crony capitalistic economy.

(For a Chinese translation of Hong Kong: Economic Freedom Belies Crony Capitalism go HERE)

Part I: Methodologies

IEF:

The IEF’s approach involves determining the extent to which “individuals are free to work, produce, consume, and invest in any way they please” and whether “ governments allow labor, capital and goods to move freely, and refrain from coercion or constraint of liberty.” The index equally weights the scores (from 1 to 100, where 100 is the highest) of ten factors: property rights, freedom from corruption, fiscal freedom, government spending, business freedom, labor freedom, monetary freedom, trade freedom, investment freedom, and financial freedom (2014 Index of Economic Freedom n.d.).

CC:

The CC index is uses different inputs. To measure cronyism, the Economist compares GDP to wealth of billionaires in various industries, particularly those that are susceptible to monopoly, require licensing, or depend on the government: casinos; coal, palm oil and timber; defense; deposit-taking banking and investment banking; infrastructure and pipelines; ports; airports; real estate and construction; steel, other metals; mining and commodities; utilities and telecoms services. The higher the ratio, the more prevalent crony-capitalism is (Planet Plutocrat 2014).

Part II: Overview of Economic Structure of Hong Kong

Tier One: The Families

This first tier, does not reveal the whole picture, but sets the foundation by outlining core players. The Li, Kwok, Lee, and Cheng families are the primary focus of this study. The extent of the families’ power, in terms of dollars, rank in the industry, and connections, starts to emerge by examining this tier. Consequently, this tier lends legitimacy to the CC index. As families were not evaluated in the IFE, it is understandable why Hong Kong ranks first in the IFE.

The Families

| Li Family | Lee Family | Kwok Family | Cheung Family | |

| Notable Members | -Li Ka Shing-Sons Victor and Richard | -Lee Shau Kee-Sons Peter Lee K-kit and Martin Lee Ka Shing | -Kwok Tak-seng (Deceased)-Sons Walter, Thomas, and Raymond | -Cheng Yu-tung -Sons Henry and PeterSon-in-law William Doo |

| 2014 Rank in HK | 1 (Forbes India 2014) | 3 (Forbes India 2014) | 4 (Forbes India 2014) | 5 (Forbes India 2014) |

| 2014 Net Worth | 32 billion USD (Forbes India 2014) | 20 billion USD(Forbes India 2014) | 17.5 billion USD (Forbes India 2014) | 15.5 billion USD(Forbes India 2014) |

| Noteworthy Holdings | -Cheung Kong Holdings- Hutchison Whampoa-Hong Kong Electric-Tom.com- PCCW(Kong n.d.) | -Henderson Land-Henderson Investment-The Hong Kong and China Gas Company-Miramar Hotel | -Sun Hung Kai Properties-Transport International Holdings-Smartone Communications | -New World Development-NWS Holdings -New World China Land-Chow Tai Fook Jewellery-Mongolia Energy Corporation |

| HK Capitalization May 30, 2014Example | – Cheung Kong Holdings: 320.77 billion HKD (Yahoo Finance n.d.) | -Henderson Land: 136.30 billion HKD (Yahoo Finance n.d.) | -Sun Hung Kai Properties: 288.74 billion HKD (Yahoo Finance n.d.) | -New World Development: 77.11 billion HKD (Yahoo Finance n.d.)-Chow Tai Fook Jewellery: 101.60 billion HKD (Yahoo Finance n.d.) |

| Beginnings (for family leaders Li Ka Shing, Lee Shau Kee, Kwok Tak Seng, and Cheung Yu Tung) | -Fourth child in his family-Born Guangdong Province-Fled to Hong Kong during Sino-Japanese war-Father died from tuberculosis early in his childhood-Quit school age 12-Worked in a plastics company at age 14-First company made plastic items (Forbes Magazine n.d.) | -Born in Guangdong Province-Arrived in Hong Kong in 1948 before communism with 1,000 dollars-First worked in the import/export industry (The University of Hong Kong n.d.) | -Born in Guangdong Province-First businesses were a grocery store and a Japanese zips business (Liu 2012) | -Born in Guangdong Province-Merchant family-Worked at family friend’s jewelry shop at 15 years old-Immigrated to Hong Kong in 1945 (The 46th Congregation Conferment of the Degree of Doctor of Social Science, honoris causa n.d.) |

Others:

- Lui Che-woo (2nd richest), Kadoorie (7th richest), Joseph Lau (#6) Stanley Ho family (Daughter Pansy Ho is 9th, son Lawrence Ho is 12th), Victor and William Fung (10th), (Forbes India 2014)

Observations:

There are several traits the families share in common, which help explain their economic rise.

1) Main/Initial Wealth Source: Property

- Li: Cheung Kong Holdings

- Kwok: Sun Hai Kung Properties, also called SHKP

- Lee: Henderson Land Development Company

- Cheng: New World Development

The families used property to gain their foothold in a market previously dominated by British businesses and as their source of funding for future expansion. Their property businesses are still core to their success today.

2) Wealth Diversification

- Li: Property, ports, retail (Fortress, ParknShop, Watsons), technology (through Horizons Ventures), etc.

- Kwok: Property, telecommunications, ports, buses, etc.

- Lee: Property, hotel, utilities, restaurants, internet services, etc.

- Cheng: Jewellery, property, buses, ferries, telecom, hotels, etc.

Their participation in multiple industries increases the likelihood and ability to form relationships and allows horizontal monopolization.

3) Inheritance

- Li: sons Victor Li (Vice Chairman and Managing Director of Cheung Kong, Executive Director of Hutchison Whampoa, etc.) and Richard Li (Chairman of PCCW)

- Kwok: sons Raymond (Joint-Chairman and Managing Director), Thomas (Joint-Chairman and Managing Director), Walter Kowk (former chairman and CEO)

- Lee Family: son Lee Ka Kit (HK China and Gas Director) and son Lee Ka-Shing (Henderson Land Director)

- Cheng: son Henry (New World Development Chairman), grandchildren Sonia Cheng and Adrian Cheng

The high prevalence of inheritance in Hong Kong businesses allows families to maintain control and also is a visible reminder of the connections needed to climb the social and corporate ladder in Hong Kong.

4) Government Positions, Titles and Contributions:

- Li: Victor Li is honorary consul to Barbados, member of the Standing Committee of the 10th National Committee of the Chinese People’s Political Consultative Conference, member of the HKSAR Commission on Strategic Development and the Business Advisory Group (BusinessWeek n.d.)

- Kwok: Corruption allegations against Thomas and Raymond Kwok involving former Chief Secretary Rafael Hui (ongoing)

- Lee Family: 3 personal land donations (in Shek Kip Mei, Tuen Mun, Yuen Long) to government (S. Li 2014)

- Cheng: Cheng Yu Tung Hong Kong honorary consul to Kingdom of Bhutan (BusinessWeek n.d.)

- Others: Government also confers honors such as the “The Honorable” title and the Grand Bauhinia Medal

The donations, titles, and positions underline the recognition of the billionaires by the government and billionaires’ efforts to establish connections with the government.

5) Personal Philanthropy

- Donations

- Example: donations to the University of Hong Kong:

- Li Ka shing Faculty of Medicine

- Lee Shau Kee Hall, Lee Shau Kee Grand Lecture Theatre

- Cheng Yu Tung Tower

- Foundations:

- Li: Li Ka Shing Foundation

- Kwok: TS Kwok Foundation

- Lee: Lee Shau Kee Foundation, Hong Kong Pei Hua Education Foundation

- Cheng: Cheng Yu Tung Foundation

- Example: donations to the University of Hong Kong:

Although philanthropy can benefit the general public, it often is practiced to further publicize individuals or companies and establish friendly relationships with other participations in the society, such as universities.

Tier 2: Industries

This second tier builds upon the first. This section describes the industries, with a focus on three major players that comprise a notable part of Hong Kong’s economy: real estate, banking, and public utilities. Additionally, this section elaborates on additional methods through which the families and their corporations extend their power through joint projects, financial prowess, etc, as well as on how the government and natural barriers aid their growth.

Ultimately, the strong relationships between the government, industries, firms, and families highlighted in this section contribute to Hong Kong’s high CC score through a combination of the industries’ characteristics and as a proportion of the whole economy. The Heritage Foundation’s IFE index puts relatively less weight on the industries. Its findings are reasonable in light of Hong Kong’s macro economic environment and laws, discussed in the next section.

Dominant Players:

First, we will discuss three industries: property, public utilities, and mobile phone operators. Afterwards, the banking industry will be separately mentioned as it is unique in nature. Then, several other industries will also be given as examples.

The Industries

| Property | Public Utilities | Mobile Phone Operators | |

| Li Family | -Cheung Kong Property Development | -Hongkong Electric-Hutchison Port Holdings | -3-PCCW-CSL |

| Lee Family | -Henderson Land Development | -Hong Kong & China Gas Company-Hong Kong Ferry | |

| Kwok Family | -Sun Hung Kai Properties | -Kowloon Motor Bus Company Limited | -SmarTone |

| Cheung Family | -New World Development | -Citybus, -NWFB-New Lantao Bus Company-New World First Ferry | |

| Other Players | -Wheelock Properties-Swire Properties- Hongkong Land (Jardine Matheson)-MTR Corporation (government owned)-Sino Group-Urban Renewal Authority (quasi-government) | -CLP Power (Kadoorie) | -China Mobile (government owned) |

Banking

There are two main types of banks:

- 1) Family Owned Banks: Bank of East Asia, Dah Sing Bank

- 2) Non Family Owned banks: HSBC, Bank of China, Standard Chartered, Hang Seng Bank, Citibank, DBS bank, CCB, and CITIC

The banking sector is unique. As their name suggests, family owned banks are directly controlled by various influential families. Families do not directly control the largest, non-family owned banks as they are quasi-governmental organizations or international. However, the major families still exercise significant control in other ways, which will be detailed later in the observations sections

Other Players

Families exercise influence in the previously mentioned sectors. Other players are involved in sectors dominated by the families. For instance, in the Supermarket market, there are two main players: ParknShop (Li) and Wellcome (Jardine Matheson). Jason’s Marketplace (Jardine Matheson), Vanguard (China Resources Holdings), and DCH Food Mart also operate in the market but are significantly less influential. With regards to convenience stores, there are two main players: 711 and Circle K (Li & Fung). The two primary drug stores in Hong Kong are Watsons (Li) and Mannings (Jardine Matheson). The catering and restaurant industry also experience dominance by a few groups such as Maxim’s Catering (Jardine Matheson) and Cafe de Coral Group.

Examples of Market Share and Customer Numbers

These examples serve to quantify the reach of the families and business. The results demonstrate a small handful of participants currently dominate multiple Hong Kong industries.

Market Share and Customer Numbers

| Property | Public Utilities | Mobile Phone Operators | Banking | Others | |

| Market ShareExamples | -Sun Hung Kai Properties (Kwok) + Cheung Kong Holdings, Ltd. (Li) = 70% 2010 (THE INTERNATIONAL FORUM ON GLOBALIZATION (IFG) 2011) | -KMB (Kwok) = 67.7% franchised bus market, 31.5% all public transport 2011(Reuters 2012) | -PCCW (Li) + “3” (Li) + Smartone (Kwok) = 84%-PCCW: 12% mobile (note: 68% share for fixed line) in 2008 (Case Study PCCW 2008) | –HSBC + BOC + SC + Hang Seng + BEA = 60% of deposits (K. Li 2014) | -Supermarket: ParknShop (Li) + Wellcome (Jardine Matheson) =80% in 2013 (Food Export Association of the Midwest USA n.d.)-Convenience Stores: 711= 70%, Circle K = 30%(Hong Kong General Market Overview/Exporter Guide 2013) |

| Number of Customers/Shop Examples | -CLIP = 2.43 million customers-HK Electric = 0.57 million customers (HKSAR, Water, Power and Gas Supplies 2014) | -PCCW: 1.176 million mobile (note: 2.6 million fixed line) (Case Study PCCW 2008) | -Supermarket-Wellcome: > 260 stores-ParknShop: > 260-Vanguard: 86 shops, 11 super stores-DCH: 80-CitySuper: 4(Li and Kuss 2013)-Convenience Stores-711: > 900-Circle K: > 400 stores (Li and Kuss 2013) |

Observations:

- 1) Government Influence

- Property:

- 1) Only large firms can afford large-lot auctions held by the government, which has a monopoly over land ownership

- 2) A far-reaching public housing program, which accommodates nearly half of all residents in 2012, contributes to low levels of competition

- Banking:

- 1) HKSAR restricts commercial banking licences

- 2) HK government created HKMA, Securities Future Commission, MPF, relatively late compared to other countries (in 1993, 1989, and 2000 respectively). Thus firms such as HSBC, BOC, and Standard Chartered have wielded significant influence (all are note issuers, all are clearing and settlement agents, HSBC previously acted as a quasi-central bank)

- Property:

The government’s policies have given larger corporations a comparative advantage, allowed corporations to establish relationships with the government, and to play valuable roles (for example, housing, issue notes) in society. These benefits give large businesses the power and ability to influence various aspects of society in their favor.

- 2) Economies of Scale:

- Property:

- 1) Only large firms can finance large-scale housing projects (Ching and Fu 2002)

- 2) Only large, diversified firms can withstand Hong Kong’s volatile prices (Ching and Fu 2002)

- Public Utilities:

- 1) Only large firms can afford high fixed initial costs

- 2) Low marginal variable revenue means firms require many customers to survive

- Property:

Scale-based limitations allow larger firms to maintain their commanding positions in several industries and enter similar markets.

- 3) Joint Ventures Examples:

- Sun Hung Kai Properties and Henderson Land: IFC (International Finance Center), Two IFC, Double Cove Starview

- New World Development and Wheelock: The Grand Austin

- New World Development and Sun Hung Kai Properties: Chatham Gate

- MTR and Sun Hung Kai Properties: International Commerce Centre

- Urban Renewal Authority and New World Development: The Masterpiece (GoHome.com.hk n.d.)

Joint ventures are the most visible type of interconnections between the strongest corporations, The system strengthens both the dominant positions of firm and provides opportunities for cronyism.

- 4) Inter-business Positions:

- Holding Shares

- Li Ka Shing’s foundation held 500 billion Bank of China shares before selling 200 billion in 2009 (Leow and Fitzpatrick 2009)

- Directorships

- Lee Shau Kee: director for Sun Hung Kai properties (Kwok family), independent non-executive director the Bank of East Asia until 2013 (Henderson Land Development Company Limited n.d.)

- Cheng Yu Tung: independent non-executive director in Hang Seng Bank (Hong Kong Exchanges and Clearing Limited n.d.)

- Victor Li (son of Li Ka Shing): non-executive director of HSBC Bank (BusinessWeek n.d.)

- Holding Shares

Inter-business positions is slightly different from joint ventures in that individuals, who may have other family or corporate interests, may use to influence the actions of other corporations. Nonetheless, these positions are also potential areas for cronyism.

- 5) Inter-business Financing:

- Property:

- Historical reputation allows large firms to get financing at lower costs and face fewer hurdles in the government approval process (Ching and Fu 2002)

- Underwriting shares

- g. Li, Lee Shau-kee, Joseph Lau and Cheng Yu-tung: HSBC in 2009 (Lee and Wong 2009)

- Sell part of companies or ownership to each other

- g. Cheng investment in Stanley Ho’s Sociedade de Jogos de Macau

- Property:

This type of relationship is financial in nature, but again allows for inter-industry and intra-industry relationships to flourish.

- 6) Industry Associations

- Example: HKMA fellows include Li Ka Shing, Thomas Kwok, Raymond Kwok, and Lee Shau Kee (HKMA n.d.)

Industry associations primarily aid intra-industry business relationships and allow individuals to heighten their own personal statuses as well as influence the business scene.

- 7) Others:

- Corporate CSR, like personal philanthropy, raises corporations’ profiles and extends their networks.

- Hong Kong’s lack of fully enforced anti-trust laws makes relationships particularly useful as they are used to make deals that allow players to wield enormous amounts of influence they otherwise would not be able to obtain.

- Hong Kong’s small population and markets makes it easier to acquire market share. Gaining one more customer from a smaller market represents a larger percentage gain than gaining one customer in a larger market.

Macro Benchmarks

This section is divided into two parts: rule of law and economic policies. The findings are accounted for in the IEF, but ignored in the CC, lend credence to both indices.

Rule of Law

Rule of law refers to the authority of the law within a society on behavior. The IEF accounts for rule of law, which supports long held beliefs that Hong Kong is free.

Several other indices such as the World Justice Project attempt to measure the rule of law. The latter concludes that Hong Kong has high levels of rule of law i.e., 16 out of 19 (World Justice Project 2014). In the IEF, Hong Kong likewise scores well with regards to property rights (score of 90), and limited government (2014 Index of Economic Freedom n.d.).

Although Hong Kong overall scores well, a closer examination of Hong Kong’s corruption score is warranted. In general, Hong Kong has less corruption compared to most countries. For example, Hong Kong’s score of 82.3 for freedom for corruption in the IEF is high compared to most countries (2014 Index of Economic Freedom n.d.). However, when we compare scores solely for Hong Kong, Hong Kong’s corruption score is relatively low. For most other freedoms, Hong Kong scored mostly 90 and above.

Hong Kong’s rule of law also can be observed in two other ways: its organization and status. The Basic Law, signed in 1984, serves as Hong Kong’s constitution and follows the principle of “One Country, Two Systems.” The law, as well as its implementation, enforces the separation of powers, especially the judiciary. Additionally, Hong Kong’s status as a leading international commercial and financial hub reflects the successful implementation of, and confidence in, Hong Kong’s governance model.

Economic Policies

Like rule of law, Hong Kong’s more general economic policies, included in the IEF and disregarded in the CC, also explain its high rankings on both indices.

There are several policies that illustrate its capitalistic nature. For instance, there are virtually no restrictions on foreign investment. Foreigners can invest in all businesses and for most, with a couple exceptions, they can own up to 100% of shares. Hong Kong provides free port status and imposes no foreign exchange controls. Hong Kong’s tax system has no capital gains tax and only a 16.5% corporate income tax, significantly lower and simpler than countries such as the United States (Deloitte 2013). In the IEF index, Hong Kong received high scores in 2014 for trade freedom (score of 90), investment freedom (90), financial freedom (90), business freedom (98.9) and labor freedom (95.5) (2014 Index of Economic Freedom n.d.). Ultimately, the government’s policies encourage business and are indicative of its freedom on a broader scale.

Observations:

An examination of this top tier level of economic policies reveals that individuals and firms, as suggested by the IEF, are not restricted by improper governance or burdensome policies. These policies give little indication regarding the influence of various interests, with the exception of Hong Kong’s corruption scores.

Conclusion

An analysis of the three tiers, family, industry and government, support the conclusions of both the IEF and CC indices. However, the study’s observations show neither index is holistic. Rather, a combination of the two paints a clearer picture of Hong Kong as a city that does not put official limits on freedom, but one where firms and families have tremendous clout.

Part III: Quantification

The previous conclusion confirms that cronyism persists. However it also raises a question: to what extent does cronyism affect Hong Kong?

Methodology

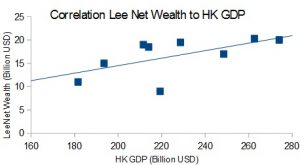

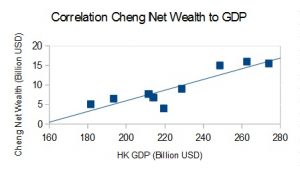

A correlation analysis between billionaire’s net wealth and Hong Kong’s GDP will seek to answer this question. There will be four correlations in total for the 2006-2014 time period: 1) Li family and GDP, 2) Kwok family and GDP, 3) Lee family and GDP, and 4) Cheng family and GDP.

We use billionaires’ net wealth, the value of their accumulated assets minus the value of accumulated liabilities, as it accounts for both their own personal wealth as well as their business’ might. This effectively takes into consideration the relationships between families and businesses. The data for the billionaire’s wealth derives from Forbes Magazine’s The World’s Billionaires List, Asia-Pacific Billionaires, and Hong Kong’s 50 Richest lists from 2006 to 2014 (Forbes Magazine 2014; Forbes Magazine 2013; Forbes Magazine 2012; Forbes 2011; Forbes Magazine 2010; Forbes Magazine 2009; Forbes Magazine 2008; Forbes Magazine 2007; Forbes Magazine 2006).

GDP is used as it is the broadest macroeconomic factor. GDP is frequently used to show the effects of certain people such as presidents, laws such as USA’s 700 billion USD bailout, and or disasters. The four correlations are more comparable as the billionaires and their businesses may affect different aspects of the economy unequally. GDP may also take into account the effects of any governmental policies the billionaires have influenced. Trading Economics provides the Hong Kong GDP data, which is in billions of US dollars (Trading Economics n.d.).

Results:

Li: 0.7040537678

Kwok: 0.472456686

Lee: 0.603158258

Cheng: 0.892544812

Analysis

The study reviews the four results together due to the similarities of their outcomes.

Based on Dancey and Reidy’s 2004 categorizations, the correlation between Li and Cheng and GDP, which fall between 0.7 and 0.9, are strong positive correlations. The correlations between Kwok, Lee, and GDP, are moderately strong and positive. After averaging the four correlations, we arrive at 0.668050881, which may be taken as the overall correlation between the billionaires’ actions and their impact on Hong Kong.

The strength of these correlations is likely due in part to the wide diversity of the four billionaires’ investments. It also makes their performances representative of the market. Another contributing factor to the correlation results is that the core industries in which the billionaires invested make up a significant proportion of the economy. For instance, in 2012, “Real estate, professional and business services” accounted for 11.5% and “Ownership of premises” accounted for 10.3% of Hong Kong’s GDP.

It should be noted that although Li Ka Shing is the wealthiest of the four Hong Kong tycoons, his correlation may be lower than Cheng’s because he also has invested overseas, which does not directly affect Hong Kong’s GDP as strongly as local investments. Additionally, the Kwok correlation may be lower due to Thomas and Raymond Kwok’s ongoing corruption case, which may have affected their personal wealth.

Nevertheless, the strength, direction, and similarities across the 4-person sample, clearly suggests the billionaires’ fate is closely intertwined with the fate of Hong Kong. The strength of the relationship implies the billionaires and their businesses wield a significant amount of power in Hong Kong. These findings confirm the observations in the first section: cronyism persists in Hong Kong.

Part IV: Ethics: Positive & Negative Liberty

The debate surrounding crony capitalism is not limited to whether or not Hong Kong exhibits cronyism, but its impact on liberties and the standard of living of citizens. Due to the nature of the methodologies and perspectives of the IEF and CC, a useful way to analyze the ethics of cronyism is by its implications on positive and negative liberty. The question is: does cronyism reduce liberties?

Positive liberty is the possibility of acting in such a way as to take control of one’s life and realize one’s fundamental purposes. Negative liberty is the absence of obstacles, barriers or constraints. One has negative liberty to the extent that actions are available in this negative sense (Stanford Encyclopedia of Philosophy 2012).

As cronyism concerns the power difference between the elite and the rest of society, positive and negative liberties will be divided as such in this analysis.

IEF:

The IEF considers which “individuals are free to work, consume, and invest in any way they please” and whether “ governments …refrain from coercion or constraint of liberty (2014 Index of Economic Freedom n.d.).” In this sense, the IEF considers both positive and negative liberties. Hong Kong’s high scores suggest that all Hongkongers of various socioeconomic status have high levels of each liberty.

CC:

The focus of the CC is smaller. It is clear the CC does not focus on positive liberties as it considers billionaire wealth as a proportion of GDP. However, it only directly considers one type of liberty. The CC states that it particularly focuses on industries that “are susceptible to monopoly, require licensing, or depend on the government (Planet Plutocrat 2014).” In this sense, the CC looks at negative liberty for the elites. Hong Kong’s high score suggests that elites exercise high levels of negative social liberty.

While the CC does not directly mention the general population, it does through logical inference, give additional insight into other liberties: positive liberty for elites and negative liberty for the rest of society.

Considering how the elites have been able to expand into different sectors from their initial successes in property and their wealth levels, the CC suggests high levels of positive liberty for the elite.

However, the CC suggests the billionaires have been able to out compete or block small players from growing. As mentioned earlier, larger companies may have additional influence and financing. Therefore, an implication of the CC is that there is some degree of negative social liberty for the general populace. (Although the study observes the families had humble beginnings, their success took place in a different time.) This conclusion is supported by Hong Kong’s GINI index of 53.7, which is much higher than European countries, where GINI’s are between 20 and 30 (Central Intelligence Agency n.d.). It is also supported by the fact the average gross household income of the poorest 10 percent of Hong Kong’s population fell to HK$2,170 ($280) in 2011 from HK$2,590 in 2001 (Lui and Boehler 2012).

We thus arrive at the following results:

Liberties

| Liberties | IEF | CC |

| Elite | Positive: HighNegative: High | Positive: HighNegative: High |

| Rest of Society | Positive: HighNegative: High | Positive: N/ANegative: Low |

When these findings are combined, the conclusion is that Hong Kong’s elite exercise all types of liberty, while economic freedoms of the average citizen are limited.

Part V: Propositions for Combating Cronyism

Although the Hong Kong political scene is polarized, the territory had budget surpluses of 64.9 billion HKD in 2012-2013. Funds make changes possible.

Antitrust Laws

As outlined previously, Hong Kong currently lacks fully enforced anti-trust laws. However, Hong Kong’s Competition Ordinance, which was passed on June 14th, 2012, is expected to come into full force in 2015. The government is recruiting staff , establishing a tribunal with the Judiciary, and preparing regulation guidelines. The Ordinance, in its three conduct rules, prohibits: 1) certain agreements and decisions, 2) certain actions by companies with market power, and 3) mergers of carrier licenses under the Telecommunications Ordinance, whose purpose is to, or outcome will, substantially lessen competition (Hong Kong Competition Commission n.d.).

Although the law represents progress and sets the foundation of competition law in Hong Kong, the actual effectiveness of the law is questionable considering its content. Foremost, the Merger Rule only prohibits the anti-competitive mergers of telecommunications. There is no regulation on mergers and acquisitions in other industries. Although the Commission is technically allowed to conduct market studies, Hong Kong’s Ordinance does not directly authorize market investigation. This severely handicaps the commission’s enforcement abilities by forcing it to rely primarily on complaints. With regards to the second rule, the ordinance does not specify the term “substantial market power.” Without setting a clear bar, enforcement may be difficult, subject to corruption, and applied unequally. Exemptions are allowed by the Ordinance. These exemptions can be given to a group of companies or an individual company considered as commercial entities that enhance Hong Kong’s efficiency or advance its interest. The exemptions are therefore, susceptible to abuse. Additionally, the tribunal is only allowed to act if the commission brings cases to it. Should the Commission fail to do so, the Ordinance is rendered useless. Other pitfalls may be revealed when the government finalizes its guidelines (DiBiasio 2013). To better reduce the incidence of cronyism, the HKSAR should approve further legislation to address these concerns.

Corruption

As noted earlier, corruption is Hong Kong’s weakest point even though it has generally strong rule of law and legislation. Because cronyism is associated with corruption, measures to reduce the latter can reduce the former.

There are currently three main anti-corruption laws: Prevention of Bribery Ordinance, the Independent Commission Against Commission Ordinance, and the Elections (Corrupt and Illegal Conduct) Ordinance. The Independent Commission against Corruption, also known as the ICAC, has been leading the effort to reduce corruption. Costs for the agency represent 0.3% of the entire Government budget or 0.05% of Hong Kong Gross Domestic Product (KWOK n.d.).

Although the ICAC has generally been praised, there are several areas in which it can focus on. Based on the ICAC’s cases and public opinion, two main areas are highlighted: enforcement and publicity.

Enforcement

In total, the ICAC ultimately prosecuted 245 persons in 111 cases in 2012, for a conviction rate of 78% for people and 84% for cases. The ICAC had a 2,470 caseload by the end of 2012 (HKSAR 2013). Although the ICAC has been successful with the cases it did prosecute, it has many outstanding cases. Without additional cases, the ICAC would take multiple years to settle its current cases. However, lax enforcement undermines deterrence. The government should focus on developing prosecution, especially since many, such as the 2011 election cases, are multiple years old. This aligns with the public’s desires. In a recent ICAC survey, 20.9% of the respondents mentioned “law enforcement work” needs improving (ICAC 2013).

Publicity

The ICAC currently has education programs – talks, courses, guidelines, and media publicity – in place through its Community Relations Division. The division works with other governmental departments (80 bureaus), schools (11 tertiary institutions), private organizations (70 business chambers and trade associations, 80 banks), and other institutions (HKSAR 2013). The success of these programs is seen in the increasing number of reported cases over time. Even so, as the public has indicated, half of the respondents (46.7%) mentioned the ICAC should increase its “publicity and education work for anti-corruption”. Further expanding the ICAC’s network is likely to help further reduce corruption (ICAC 2013).

Conclusion

The findings in this study indicate crony capitalism is more prevalent than Hong Kong’s sterling reputation suggests. Happily, Hong Kong can implement new policies to improve the situation because it has the financial wherewithal. It remains to be seen if Hong Kong has the will.

—–xxx—–

Works Cited

2014 Index of Economic Freedom. n.d. http://www.heritage.org/index/.

BusinessWeek. Executive Profile. n.d. http://investing.businessweek.com/research/stocks/people/person.asp?personId=8078495&ticker=13:HK.

—. Executive Profile. n.d. http://investing.businessweek.com/research/stocks/people/person.asp?personId=8442389&ticker=17:HK.

Case Study PCCW. 2008. http://c541678.r78.cf2.rackcdn.com/case-studies/cs-pccw.pdf.

Central Intelligence Agency. DISTRIBUTION OF FAMILY INCOME – GINI INDEX. n.d. https://www.cia.gov/library/publications/the-world-factbook/fields/2172.html .

Ching, Stephen, and Yuming Fu. Contestability of the urban land market: an event study of Hong Kong land actions. 2002. http://www.hiebs.hku.hk/working_paper_updates/pdf/wp1046a.pdf.

Deloitte. Taxation and Investment in Hong Kong. 2013. http://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-hongkongguide-2013.pdf.

DiBiasio, Jame. Will Hong Kong’s New Competition Law Have Teeth. December 9, 2013. http://www.financeasia.com/News/367022,will-hong-kongs-new-competition-law-have-teeth.aspx.

Food Export Association of the Midwest USA. Hong Kong Market Profile. n.d. https://www.foodexport.org/Resources/CountryProfileDetail.cfm?ItemNumber=1014.

Forbes India. Hong Kong’s Richest. February 22, 2014. http://forbesindia.com/article/checkin/hong-kongs-richest/37245/1.

Forbes Magazine. Asia Pacific Billionaires List. 2013. http://www.forbes.com/sites/naazneenkarmali/2013/03/06/full-list-asia-pacific-billionaires-2013/.

—. Hong Kong’s Richest. 2014. http://www.forbes.com/hong-kong-billionaires/.

—. The World’s Billionaires. n.d. http://www.forbes.com/profile/li-ka-shing/#.

—. The World’s Billionaires List. 2009. http://www.forbes.com/lists/2009/10/billionaires-2009-richest-people_The-Worlds-Billionaires_Rank_6.html.

—. The World’s Billionaires List. 2008. http://www.forbes.com/lists/2008/10/billionaires08_The-Worlds-Billionaires_Rank.html.

—. The World’s Billionaires List. 2007. http://www.forbes.com/lists/2007/10/07billionaires_The-Worlds-Billionaires_Rank_2.html.

—. The World’s Billionaries List. 2010. http://www.forbes.com/lists/2010/10/billionaires-2010_The-Worlds-Billionaires_Rank.html.

—. The World’s Richest People. 2006. http://www.forbes.com/lists/2006/10/Rank_1.html.

—. World’s Billionaire List . 2012. http://www.forbes.com/lists/2012/82/hongkong-billionaires-12_rank.html.

—. World’s Billionaire List . 2011. http://www.forbes.com/lists/2011/82/hongkong-billionaires-11_land.html.

GoHome.com.hk. n.d. http://www.gohome.com.hk/new-property/en/ .

Henderson Land Development Company Limited. Executive Directors. n.d. http://www.hld.com/en/about/director_excutive_leeshaukee.shtml.

HKMA. Fellows. n.d. http://www.hkma.org.hk/web_info.asp?info_no=110000011&ver_type=E.

HKSAR. ICAC . September 2013. http://www.gov.hk/en/about/abouthk/factsheets/docs/icac.pdf.

—. Implementation of the Competition Ordinance. 2013. http://www.info.gov.hk/gia/general/201310/23/P201310230305.htm.

—. Water, Power and Gas Supplies . June 2014. http://www.gov.hk/en/about/abouthk/factsheets/docs/wp&g_supplies.pdf.

Hong Kong Competition Commission. Competition Ordinance. n.d. http://compcomm.hk/en/competition_ordinance.html.

Hong Kong Exchanges and Clearing Limited. Directors’ Profile. n.d. http://www.hkexnews.hk/listedco/listconews/SEHK/2007/1030/00017_241162/E122.pdf.

Hong Kong General Market Overview/Exporter Guide. 2013. http://www.usfoods-hongkong.net/res/pdf/HK1317.pdf (accessed 2014).

ICAC. ICAC Annual Survey 2013. 2013. http://www.icac.org.hk/filemanager/en/Content_1283/2013surveysummary.pdf.

Kong, Cheung. Group Structure. n.d. http://www.ckh.com.hk/eng/about_groupstructure.html.

KWOK, Tony. Formulating an Effective Anti-Corruption Strategy-The Experience of Hong Kong ICAC. n.d. http://www.unafei.or.jp/english/pdf/PDF_rms/no69/16_P196-201.pdf.

Lee, Mark, and Chia-Peck Wong. Hong Kong’s Richest to Underwrite $1.1 Billion of HSBC’s Offer. March 3, 2009. http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aIPehzecKqA0.

Leow, Jason, and Dan Fitzpatrick. As Foreigners Pull Up Stakes, China Reassesses Banks’ Path. January 8, 2009. http://online.wsj.com/news/articles/SB123135303986861431 .

Li, Chris, and Erich Kuss. Hong Kong Retail Foods 2013. 2013. http://gain.fas.usda.gov/Recent%20GAIN%20Publications/Retail%20Foods_Hong%20Kong_Hong%20Kong_5-1-2013.pdf.

Li, Kanis. Citi chief shrugs off entry of newcomers in Hong Kong banking sector. January 20, 2014. http://www.scmp.com/business/banking-finance/article/1409340/citi-chief-shrugs-entry-newcomers-hong-kong-banking-sector.

Li, Sandy. Lee Shau-kee proposes donating Shek Kip Mei site for low-cost housing. June 2014. http://www.scmp.com/property/hong-kong-china/article/1528958/lee-shau-kee-proposes-donating-shek-kip-mei-site-low-cost.

Liu, Juliana. “Who are the Kwok brothers?” BBC. April 18, 2012. http://www.bbc.com/news/business-17752115.

Lui, Marco, and Patrick Boehler. Hong Kong’s Wealth Gap Widens as City Ages, Industries Fade. June 2012. http://www.bloomberg.com/news/2012-06-18/hong-kong-s-wealth-gap-widens-amid-aging-population-inflation.html.

Planet Plutocrat. March 15, 2014. http://www.economist.com/news/international/21599041-countries-where-politically-connected-businessmen-are-most-likely-prosper-planet.

Reuters. TEXT-S&P summary: Kowloon Motor Bus Co. (1933) Ltd. 2012. http://www.reuters.com/article/2012/12/10/idUSWLB202020121210.

Stanford Encyclopedia of Philosophy. Positive and Negative Liberty. March 5, 2012. http://plato.stanford.edu/entries/liberty-positive-negative/.

“The 46th Congregation Conferment of the Degree of Doctor of Social Science, honoris causa.” The Chinese University of Hong Kong. n.d. http://www.cpr.cuhk.edu.hk/cong/sites/default/files/46th_Cheng_Eng.pdf.

THE INTERNATIONAL FORUM ON GLOBALIZATION (IFG). “Outing the Oligarchy.” San Francisco, 2011.

The University of Hong Kong. 155th Congregation (1998). n.d. http://www4.hku.hk/hongrads/index.php/archive/graduate_detail/77.

Trading Economics. Hong Kong GDP. n.d. http://www.tradingeconomics.com/hong-kong/gdp.

World Justice Project. WJP Rule of Law Index 2014. 2014. http://data.worldjusticeproject.org/.

Yahoo Finance. n.d. https://finance.yahoo.com/q?s=1929.HK (accessed May 2014, 30).

Yahoo Finance. n.d. http://finance.yahoo.com/q?s=0017.HK (accessed May 30, 2014).

Yahoo Finance. n.d. https://finance.yahoo.com/q?s=0012.HK (accessed May 30, 2014).

Yahoo Finance. n.d. https://sg.finance.yahoo.com/q?s=0016.HK (accessed May 30, 2014).

Yahoo Finance. n.d. https://finance.yahoo.com/q?s=0001.HK (accessed May 30, 2014).