Finance Needs ‘Bilinguals’ Too

Andrea Roncella

Luca Roncella

We are pleased to republish “Finance Needs ‘Bilinguals Too”* by Andrea Roncella and Luca Roncella. The essay won first prize ex aequo in the 7th. edition (2018-2019) of the Global Prize “Ethics & Trust in Finance” organized by the Observatoire de la Finance, based in Geneva. Andrea is a Fellow of Seven Pillars Institute.

“It is, in fact, arguable that economics has had two rather different origins, both related to politics, but related in rather different ways, concerned respectively with ‘ethics’, on the one hand, and with what may be called ‘engineering’, on the other.” Sen (1988, p.2),

In celebrating the inauguration of the Schwarzman College of Computing, MIT’s new artificial intelligence hub, Rafael Raif, the president of the prestigious university, claimed the world needs bilinguals: engineers with better education in the liberal arts, able to build ethical products and platforms and who know how to interact with civil leaders and policy makers in order to develop responsible innovations. For this reason, MIT set up an interdisciplinary faculty that researches and teaches disciplines ranging from STEM (science, technology, engineering and mathematics) subjects to social sciences and humanities (Hao, 2019). This is an example of a concrete response to the modern problem of reductionist knowledge which sees the need for specialisation taking the form of solving complex problems through a single, and usually technical, lens.

A similar concern which to date is unresolved characterises the financial innovation process. In the aftermath of the great crisis of 2008 and the subsequent economic recession and suffering that it caused (Better Markets, 2015), there have been at least two positive consequences. The first is defined as institutional and concerns the regulatory side, which over the last 10 years has been strengthened with measures that have made the financial system as a whole more stable, and specifically, the banking sector. The second one is concerned with cultural aspects, which is the central theme of this article and is largely about various reflections on the relationship between ethics and finance that followed that terrible September of 2008.

This “ethical” wave has seemingly spared no sector related to finance. Many, including academics and practitioners alike, have raised their voices to highlight the need to deepen the ethical dimension of economics and finance as a safeguard against similar errors in the future. In this respect, a special effort has been made to include the teaching of ethics, which has seen “business ethics” courses added to the curricula of schools of economics, finance and management. Moreover, some of the most reliable finance professional associations such as the CFA have incorporated ethics and social responsibility into their programmes.

A Gap in Finance Ethics Education

These initiatives are definitely worthy of praise. However, this article asks whether the current debate about ethics and finance might be informed by a key point. The evolution of our economic system towards what is defined as financial capitalism has been and continues to be conveyed mostly by unprecedented technological advances in terms of speed and pervasive capacity. Consider, for example, the rapid spread of algorithmic trading, cryptocurrencies and structured finance, and it is evident that the world of financial innovation is largely underpinned by technological innovation. Financial institutions have adapted quickly to this environment, setting up entire units of quants and financial engineers[1] , with the aim of designing innovative products suited to their clients’ most demanding expectations. The purely computational and quantitative skills that these product development roles require means that the personnel selection process increasingly draws from the exact sciences, which in turn has seen universities create a proliferation of masters degrees in financial engineering and quantitative finance. Furthermore, ad hoc certifications have been designed and accredited, such as the Certificate in Quantitative Finance (CQF), as proof of quantitative and mathematical skills, a key requirement for these new positions.

While technical knowledge is absolutely central to the educational process of those who fill these roles, our research indicates that ethics education or a similar subject that might emphasise the financial sector’s social responsibilities, remains absent. We argue that this is a cause for concern. Even though at first glance it might seem that the task of financial engineers is purely technical, and that it requires only mathematical knowledge, this article highlights the need for a kind of education that takes into account a humanistic component in order to integrate the non-quantitative dimensions of finance, its products and its institutions. The overarching aim is to prevent financial engineers from acquiring a purely radical and abstract knowledge that would distance them from the potential societal consequences of their work.

The article is structured as follows. The first part uses a “life history” methodology to reconstruct a typical narrative path of a financial engineer or quant. This narrative is based on our own research, with the results shown in the Annexe, which confirms the educational biases of this kind of profile while highlighting both the limits of the current financial innovation network as well as the university’s role in defining these limits. The second section focuses on the reasons why the role of the financial engineer is not just a technical one. The third section focuses on the critical issues related to the current educative process of a financial engineer. Lastly, we conclude with some proposals to improve the current situation.

A Financial Engineer’s Narrative

We start by analysing the educational route of a hypothetical financial engineer and show without oversimplifying, the most salient characteristics of such a profile. We also draw upon real narratives collected by Patterson (2010) and Lindsey & Schachter (2007). In order to illustrate better the specificity of a financial engineer’s education, we compare it with that of a financial advisor[2], as an example of a task that corresponds with the sell-side of a product. Although a financial advisor’s role is considered to be central in the financial sector, the greater complexity of financial products means that banks and investment funds have increased the number of quants and technicians they employ to address the technological challenges that they face and to gain a competitive advantage.

The stories collected clearly show the decided tendency towards a quantitative education of those who occupy these positions. An exemplary case is that of Edward Thorp, who is considered to be one of the quants’ founding fathers. Thorp has a PhD in physics from UCLA, is a professor at MIT and an expert in creating strategies to beat the casino at blackjack and the market on Wall Street (Patterson, 2010, p. 14). He was probably one of the most important quants during the1970sand1980s. His Princeton Newport Partners Fund, set up in 1969, is recognised as the first quant hedge fund. During a period of 18 years it turned $1.4 million into $273 million compounding at more than double the rate of the S&P 500 and did not suffer any losses during any quarter. (Authers,2017). His book Beat the Market is among the bestsellers for would-be quants. Through his ideas, Thorp inspired young talents and directed them toward a career in finance. Among these are Ken Griffin, founder of the financial giant Citadel, and Bill Gross, father of the investment fund PIMCO; both of them heeded Thorp’s recommendations to launch their respective careers.

There are also several cases of investors who followed in Thorp’s footsteps, leaving the world of physics and venturing into finance. One of them is Ronald N. Kahn, who has a PhD in physics from Harvard and who is the current Global Head of Scientific Equity Research at Black Rock. He famously started his career in the financial sector without even knowing the difference between a “share” and a “bond” (Lindey & Schachter, 2007, p. 32).

These stories, while exceptional, offer an insight into what constitutes a successful profile in the era of technological finance, and at the same time confirm that the financial sector has attracted talents that might otherwise have enriched fields such as physics and engineering.

Business Schools in the Age of Financial Engineering

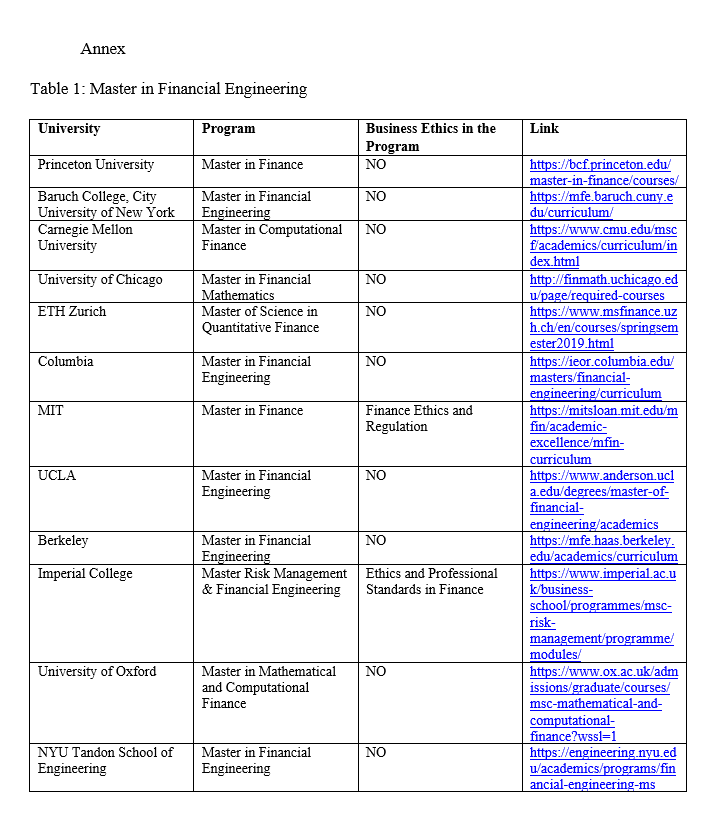

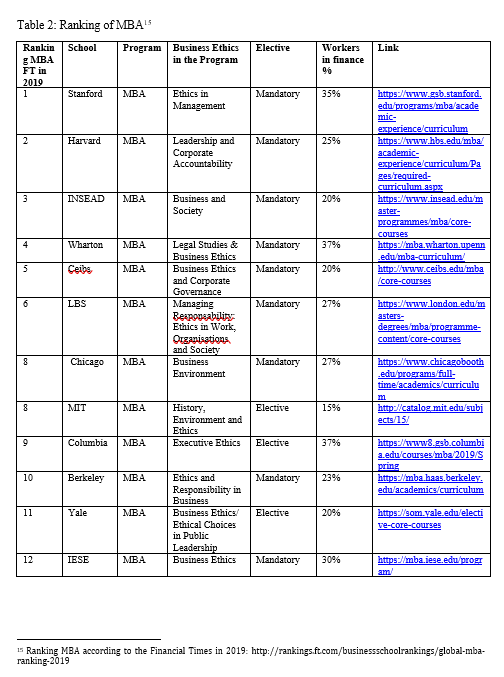

Even more rigorous statistics[3] suggest that an increasing number of students with technical backgrounds are turning their attention to professional careers in finance, making the transition to the financial world by an academic route such as a master degree in financial engineering.[4] The rankings offered by two of the main industry forums, QuantNet and Rank.net, allow us to observe the curricula that some of the best universities in financial engineering offer. As shown in Table 1 in the Annexe, all these masters degrees are highly specialised and apply mathematical and physical science models to disciplines such as financial risk management, financial model planning and derivatives structuring. Conspicuously, only Imperial College (UK) and MIT (US) offer a business ethics course. In contrast, a typical MBA programne, as a path to becoming a financial advisor[5] , is organised more holistically. Table 2 in the Annexe shows how business ethics courses are in fact present and considered central to the training of good professionals. All the MBAs covered by the research offer a course in business ethics, of which 75% are “mandatory”.

This empirical evidence is also reinforced by the importance that a prestigious finance association such as the Chartered Financial Analyst Institute (CFA) upholds ethical and professional standards through their investment analysis and portfolio management certification programmes. Candidates are required to meet three levels to obtain the CFA. The first is focused on the ethical behaviour and the standards of conduct of a financial manager. In an attempt to match the CFA, the quants sector is also developing its own certification. One example is the Certificate in Quantitative Finance (CQF) which unlike the equivalent CFA, does not have any ethical references[6]. Established by the quant guru Paul Wilmott, the CQF aims to certify a candidate’s knowledge of quantitative finance models such as Black-Scholes Theory and Credit Risk models; their knowledge of financial markets, including equities, fixed income and currency markets; and their knowledge of data science.

The difference between these two spheres of finance confirms what is claimed by West (2012, p.26): “Financiers and traders are subject to ethics oversight and professional codes of conduct; the quants are left to operate in a relative ethics vacuum”. However, events where financial technology played a key role such as Black Monday in 1987, the collapse of the hedge fund Long-Term Capital Management, and the Flash Crash of May 6, 2010, have highlighted that the lack of ethics in quantitative models and strategies cannot be justified, since the majority of risk models and the complex derivatives that quants create for customers, are not easily understood by front-office managers. Paul Wilmott warns about the limitations of the creators of certain financial products:

“Many of the people who produce mathematical models and write books know nothing about finance. You can see this in the abstractness of their writing and their voices when they lecture. Sometimes they are incapable of understanding the markets, mathematicians are not exactly famous for their interpersonal skills. And understanding human nature is very important in this business. It is not enough to say ‘all these interacting humans lead to Brownian Motion and efficient markets’. Baloney. Sometimes they don’t want to understand the markets, somehow they believe that pure mathematics for its own sake is better than mathematics that can actually be used. Sometimes they don’t know they don’t understand” (Wilmott, 2019).

A Goldman Sachs Story

Despite these warnings and as a result of the widespread use of these models, prominent roles in financial institutions are increasingly occupied by purely quantitative types. An illustrative example is Martin Chavez, the former head of Goldman Sachs’ Strats section (the R&D division in charge of creating customised financial products) and recently appointed Global Head of the Securities Division. Chavez’s personal history is emblematic of the new Wall Street leaders. He has a PhD in Medical Information Sciences from Stanford University and a masters in Computer Science from Harvard, and began his professional career by founding an energy software company. He then entered the financial sector, and specifically the Currency and Commodities division of Goldman Sachs. In 1997 he was hired by Credit Suisse as Global Head of the Energy derivatives division. In 2000 he founded Kiodex, a trading software company where he was CEO until 2004, when he returned to Goldman Sachs. He has since held a series of global positions at Goldman Sachs, including Head of the Strats section, Chief Information Officer, Chief Financial Officer, and finally his current position of Global Head of Securities Division.[7] This is just a more recent example of how to ascend to the highest ranks of one of the most important Wall Street investment banks without receiving any formal training in finance, let alone in business ethics. Yet his knowledge of computer science and his ability to solve quantitative problems has allowed him to achieve significant success in the era of quantitative finance.

As the data collected shows quants often do not have the opportunity during their university years to deal with issues related to the humanistic and social dimensions of economics and finance in order to gain a more integral perspective of their work. It is likely that a financial engineering graduate would not have a background in finance or business, but would have come from the fields of physics, mathematics or computer science, and would then learn how to apply the techniques studied during the undergraduate degree to the financial sector.[8]

Quants and financial advisors are two key roles in a properly functioning financial institution. Despite their distinct competences, both discharge important responsibilities. There are several routes one can take in managerial finance, including the CFA and an MBA, to learn about the human dimension of finance. This article argues that even the quantitative sector has to take into account what it contributes to the good of society. But why is such a claim relevant?

The Separation Thesis

In an essay published in 1959, the writer and scientist C. P. Snow used the University of Cambridge as an example to argue that Western intellectual life can be divided into two contrasting groups. On the one hand there are the “scientists”, exemplified in particular by the physicists, while on the other, there are the literati, who define themselves as the “intellectuals”. Between these two poles there lies an abyss of mutual incomprehension which sometimes is characterised by hostility and contempt. It is this polarisation which according to the author causes untold harm to both groups as well as to society in general (Snow, 1959/2012).

This divide that Snow portrays between the worlds of the humanities and science has gradually spread to individual disciplines, and is clearly manifested in the case of economics. Originally a branch of moral philosophy, a process of ongoing specialisation has seen economics transformed from “political economy” to an increasingly “mathematical economy”, giving rise to a new subject in the 1980s involving a fusion of statistics, mathematics and economics, and which later became known as finance (Fox & Sklar, 2009). Since quantitative analysis took root, finance has become even more intertwined with pure engineering models, fulfilling part of Amartya Sen’s epigraph which we quoted at the start of the article.

Even though this evolution occurred primarily in academia, it soon found its way into the world of practitioners. Wall Street, once a kingdom of brokers and analysts who could read not only economic processes but also more human nuances of the markets (Abolafia, 2001), is nowadays the realm of quants, where the technical- engineering element is seen as fundamental, having displaced the more humanistic element, which is perhaps less apt at offering instant solutions. This is in line with what Whately defined as the non- overlapping magisteria (NOMA): the principle that the economy, and hence finance, is a free-value subject (Whately, 1831, p. 45). Even though finance fits the definition of an exact science, this article is based on the thesis that no technical analysis should be devoid of ethical considerations.

If Financial Engineers were just like Nuclear Physicists

An anecdotal analogy, concerning the great Russian physicist: Andrej D. Sacharov, supports our suggestion. In his book My Country and the World (Sacharov, 1975), the future Nobel Peace Prize winner recounted how in November 1955 he had started to participate in some groundbreaking experiments on thermonuclear weapons. On a specific occasion these led to two tragic events: the death of a young soldier and a two- year old child. The evening after the experiment, during a small banquet, Sacharov – plagued by the images of the day before – expressed the hope that Russian weapons would never explode on cities. The high official who ran the experiments replied that the task of the scientists was to improve the weapons; how they would be used was not their concern. Intellect alone was not qualified to deal with it.

Sacharov illustrated through this episode how no one can evade his or her share of the responsibility for actions on which the existence of humanity depends. Faced with the official’s denial of the existence of morality as a category in itself and insistence that there was only specialised scientific, political or military expertise, Sacharov argued that it was not possible to deny the existence of a common humanity, defined by some as conscience, that allows one to acknowledge that what concerns human beings takes precedence over any specialisation.

The history of Sacharov and the official underlines the moral responsibility that financial engineers also bear. The leading investor Warren Buffet has reflected metaphorically that certain financial products have the potential to be turned into weapons of mass destruction[9]. It does not therefore seem out of place to imagine the military personnel in our anecdote as a financial advisor ready to launch a market security product which might be as noxious as a time bomb designed by a nuclear physicist. In this context, the relevance of having quants with a moral awareness of their role is shown in all its urgency, alongside the concern that few people in academia are confronting this issue.

Reification and Practical Wisdom

We refer here to two major contributions regarding the ethical education of financial engineers: Rooney (2013) and West (2012). Rooney focuses on the composition and structures of the networks at the centre of financial innovation and emphasises the danger that a kind of abstract knowledge, typical of these processes, easily turn into reification. This concept is derived from Marxist philosophy and considers abstract knowledge as if it were true and concrete (Marx referred to the fetishism of commodities), eventually becoming more real than reality. Reification means that the facts – the real world – are secondary to theory and that if there is a discrepancy between theory and reality, it is reality that should step aside.

According to Rooney (2013, p. 452), the risk of reification is particularly vivid in the networks underlying the creation of financial products – see Willmott’s quote above – since these networks are generally shaped to generate private positive consequences rather than public benefits. At the root of this issue is the fact that the innovation processes are marked, on one side, by a lack of openness, which implies that they usually happen within the research units at private financial institutions while universities and research centers are oblivious to them; and on the other, by the homogeneity of the actors involved. Conversely, the university – hopefully free from that short-term focus that characterises business and able to focus on larger and more complex problems – could be the ideal place for critical thinkers to develop good financial technology and understand its implications beyond mere financial objectives.

Rooney’s proposal hinges on the need to rediscover the practical wisdom component within the technical processes. According to Aristotle, practical wisdom (phronesis or prudence) is the virtue of choosing the suitable means to the right ends (Aristotle, 1985, 1144a) and it refers to the right action in the moral things (to doing things). It implies an ethical approach, also defined as “first person account” (Abbà, 1996), according to which an action will be right if a virtuous agent would characteristically do it under similar circumstances. By contrast, our claim is that financial engineering education is exclusively focused on the “productive skill” (to make things), defined by Aristotle as techne (1985, 1140), and its criteria of success are as neutral as the standards utilised in the exact sciences.

Rooney’s words echo West’s call for a “common sense” approach rather than a blind trust in mathematical models when designing new products (West, 2012). West points out that financial engineers are not exempt from the fiduciary duty and the responsibility to match the complexity of a product with the level of clients’ sophistication; nor from considering the implications of limited engineering models. In this context, he proposes intervening in the education of a financial engineer by identifying those moments in the decision-making process where ethical issues can emerge (West, 2012, p. 35).

Virtue Ethics in Financial Engineering

Both authors focus on the supposed role that the university should play in creating more integral financial innovations. At the same time, this proposal clashes with the financial engineering university curriculum, characterised by an evident reductionism as described previously. To solve this puzzle we found a useful contribution in Han (2015), which is relevant to understanding how ethics can effectively have a meaning in a quantitative curriculum beyond the fact of introducing specific humanistic classes.

Han’s proposal is the result of an original mixture of virtue ethics[10], in particular with regard to practical wisdom, with that of positive psychology. The author expresses the need to propose positive role models that can stimulate students’ aspirations, given the clash between personal values and those dictated by science or work which is typical of a Kantian morality focused on rules’ fulfilment. The positive effects of a moral education based on this theory have been confirmed by different social psychological studies (Han, 2015, p. 451) and real stories of exemplary models can be a source of moral inspiration.

A concrete way through which universities and educational institutions can improve the financial innovation process is by promoting new role models in finance which are able to transcend the technical aspects of financial innovation and foster a better comprehension of the ethical repercussions of their task and how they can be addressed. One trailblazing example concerns the former trader and risk analyst Nassim Taleb and his Real World Risk Institute, the “first quantitative program embedded in the real world”. Here again we can see a curriculum that is devoid of explicit ethics courses, yet the fact that the mission statement claims to “understand model error before you use a model” and declares that “when and if we model, we go from reality to models not from models to reality”, suggests that the Institute is a good antidote to the risk of reified abstract knowledge typical of financial innovation processes. More generally, we argue that Taleb’s intellectual project (contained in Taleb, 2016) is centred on the idea that financial operators should take risks to which they are also exposed, or where they have skin in the game (“Take risks you understand, don’t try to understand risks”)[11] 11

Another real case that could work for our aim is that of Markopolos, the quant who first exposed Bernard Madoff ’s Ponzi scheme. Markopolos’s case is recounted by De Bruin (2015, p. 143) in order to underline both his quantitative knowledge as financial mathematician and his epistemic virtues – in particular of courage and inquisitiveness – to ask questions where others kept silent. According to De Bruin it is the combination of traditional mathematical skills reinforced by epistemic virtue which explains Markopolos’s success.

The Case of Neurotechnology

Obviously, the ethical challenges posed by technology do not merely concern financial innovation. Another intricate area of science is that of neuroscience where the use of new technologies (such as artificial intelligence) is spurring important advances in the understanding of the functioning of the mind and in finding cures for diseases or dysfunctions related to the brain[12]. Innovation comes with threats here too, such as the ability to manipulate free will (Yuste et al., 2017). The science community is currently debating these risks across several disciplines, and it is noteworthy how they refer to a case study on past threats from nuclear physics. In particular, they emphasise the need to set up a body analogous to the UN Atomic Energy Commission “which was established to deal with the use of atomic energy for peaceful purposes and to control the spread of nuclear weapons” (Yuste et al., 2017). While Sacharov’s anecdote emphasized the cultural or ethical aspects of the individual agent, here it is worth dwelling on the institutional side, which is also important for facilitating ethical innovation processes.

Neuroscientists argue that “the mindsets behind technical innovation could be altered and the producers of devices better equipped by embedding an ethical code of conduct into industry and academia. A first step towards this would be to expose engineers, other tech developers and academic-research trainees to ethics as part of their standard training on joining a company or laboratory. Employees could be taught to think more deeply about how to pursue advances and deploy strategies that are likely to contribute constructively to society, rather than to fracture it” (Yuste et al., 2017). Lastly, they advance the idea of a Hippocratic Oath, analogous to the one taken by doctors, which commits neuroscientists to work for the good of human beings and to observe the highest professional standards.

While it is heartening to see how these scholars are dealing with purely ethical issues linked to technological development, this article wishes to show the deep “gap” that still characterises the world of financial innovation. We think that there are still many steps to take towards a socially responsible financial engineering process, even though the years since the financial crisis have seen an increased interest in issues related to the ethics of finance, including among practitioners (it is worth noting, for example, the Dutch “bankers’ oath”).

The Road Map for an Ethical Financial Engineering

In this article, we firstly took stock of this problem, underlining the philosophical and practical reasons why it is urgent to delve into the moral character of quants and financial engineers. Secondly, we briefly sketched some ideas that can hopefully contribute to defining the framework. In particular, the main insights can be summarised as follows:

1. Rethinking financial engineering education through the lens of virtue ethics and leveraging in particular practical wisdom. This virtue captures the moral side of an action, overcoming an exclusive focus on technical aspects. Moreover, virtue ethics is a first-person approach and as such fits particularly well with the “use” of role-models in order to take into account reality when designing products or strategies. As a result, the risks of a reified abstract knowledge would be reduced.

2. Involving universities and academic research centres in the processes of financial innovation which are currently the inaccessible domain of the research units of financial institutions. This would enrich the debate and the perspective, while limiting the damage that a reductionist approach could have on the financial world.

3. Adopting best practices and standards of conduct for financial engineers along the lines identified in the CFA. The experience accumulated over the years in facing the ethical challenges of financial advisors could work as a roadmap for similar strategies for quants and anyone else involved in the financial innovation process. This could eventually lead to a “Quants’ Oath” that underscored their responsibility towards their clients and society.

These are all initial cues that need to be explored in depth in any future research undertaking. The hope is that just like nuclear physicists and neuroscientists, men and women involved in financial innovation could be “bilinguals” too.

* This article was first published in Finance & the Common Good/Bien Common, no 46 &47, 2018/2019, pp 43-58, “Finance Needs Bilinguals Too” by Andrea Roncella & Luca Roncella, http://www.obsfin.ch/wp-content/uploads/Document/2019-Gl-Roncella.pdf. It is republished with the kind permission of Observatoire de la Finance.

References

Abbà, G. (1996). Quale impostazione per la filosofia morale?: Ricerche di filosofia morale. Roma: LAS, Libreria Ateneo Salesiano

Abolafia, M. Y. (2001). Making markets: Opportunism and restraint on Wall Street. Harvard University Press

Aristotle (1971). Aristotle’s Metaphysics, trans. and notes C. Kirwan, Oxford: Clarendon Press

Authers, J. (2017). Ed Thorp: the man who beat the casinos,

then the markets. Financial Times. Retrieved from https://www.ft.com/ content/e7898528-e897-11e6-967b- c88452263daf (Accessed March 2019)

Better Markets. (2015). The cost of the crisis. Retrieved from https:// bettermarkets.com/sites/default/ files/Better%20Markets%20-%20 Cost%20of%20the%20Crisis.pdf (Accessed March 2019)

De Bruin, B. (2015). Ethics and the global financial crisis. Cambridge University Press

Egan, M., Matvos, G., & Seru, A. (2019). The market for financial adviser misconduct. Journal of Political Economy, 127(1), 233-295

Fox, J., & Sklar, A. (2009). The myth of the rational market: A history of risk, reward, and delusion on Wall Street. New York: Harper Business.

Han, H. (2015). Virtue ethics, positive psychology, and a new model of science and engineering ethics education. Science and Engineering Ethics, 21(2), 441-460

Hao, K. (2019). There’s no such thing as a “tech person” in the

age of AI. MIT Technology Review. https://www.technologyreview. com/s/613063/ai-ethics-mit-college-of-computing-tech-humanities/ (Accessed March 2019)

Institute of Physics. (2012). The career paths of physics graduates. Retrieved from https://www.iop.org/ publications/iop/2012/file_55924. pdf (Accessed March 2019)

Lindsey, R. R., & Schachter, B. (Eds.). (2011). How I Became a Quant: Insights from 25 of Wall Street’s Elite. John Wiley & Sons

Patterson, S. (2010). The quants: How a small band of maths wizards took over Wall Street and nearly destroyed it. Random House

Roca, E. (2008). Introducing practical wisdom in business schools. Journal of Business Ethics, 82(3), 607-620

Rooney, D., Mandeville, T.,

& Kastelle, T. (2013). Abstract knowledge and reified financial innovation: Building wisdom and ethics into financial innovation networks. Journal of Business Ethics, 118(3), 447-459

Sacharov, A. D., (1975). My Country and the World. Transl. by Guy V. Daniels. Random House, Vintage Books

Sen, Amaryta, 1988. On Ethics & Economics. Oxford: Blackwell Publishers

Snow, C. P. (2012). The Two Cultures. Cambridge University Press.

Taleb, N. N. (2016). Incerto 4-Book Bundle: Fooled by Randomness, The Black Swan, The Bed of Procrustes, Antifragile. Random House

West, J. M. (2012). Money mathematics: Examining ethics education in quantitative finance. Journal of Business Ethics Education, 9 (Special Issue), 25-39

Whately, R. (1831). Introductory Lectures on Political Economy. London: Fellowes

Wilmott, P. (2008). This is no longer funny. Retrieved from https:// wilmott.com/this-is-no-longer- funny/ (Accessed March 2019)

Yuste, R., Goering, S., Bi,

G., Carmena, J. M., Carter, A., Fins, J.,.Kellmeyer, P., et al. (2017). Four ethical priorities for neurotechnologies and AI. Nature News, 551(7679), 159

Endnotes

[1] In this article we use the two terms analogously. In particular, quants – as those involved in investment strategies – can be categorised as financial engineers who are more concerned in structuring financial products, if we consider the investment strategy as a kind of financial product.

[2] We use the term ‘financial advisor’ throughout the paper to refer to investment professionals who are registered with FINRA in the US. We do not claim that financial advisors are devoid of misconduct, even though this paper compares quants’ lack of ethical education with financial advisors. (Egan et al., 2019).

[3] A report by the Institute of Physics (2012, p. 12) states: “Respondents in employment one year after graduation in Physics were working in a wide range of employment sectors with the largest numbers choosing jobs in education, finance or scientific and technical industries”.

[4] An example is provided by the Master of Financial Engineering Program at Berkeley University which reports that 39% of students have a background in mathematics/statistics and 27% in engineering. Only 16% have a background in economics/finance (https://mfe.haas.berkeley.edu/admissions/class-profile)

[5] As shown in Table 2, the financial sector, along with consulting, are the industries with the greatest work demand after an MBA. About a quarter of the best MBA students in the world end up working in this area.

[7] Goldman Sachs: https://www.goldmansachs.com/our-firm/leadership/management-committee/r-martin-chavez.html

[8] See the requirements of the University of Chicago http://finmath.uchicago.edu/page/ admission-requirements , and the University of California, Berkeley https://mfe.haas.berkeley.edu/admissions/requirements

[9] In his 2002 letter to shareholders (p.15) derivatives are defined as “financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal”. https://www.berkshirehathaway.com/letters/2002pdf Accessed March 2019.

[10] Virtue Ethics is one of the main approaches in normative ethics, along with deontology and utilitarianism. Its origins in Western culture can be traced back to Plato and Aristotle. It was revived in the twentieth century through the works of Anscombe and MacIntyre. The virtue ethics implies a ‘first person approach’ as the one previously underlined.

[11] See http://www.realworldrisk.com/

[12] We make reference to the BRAIN Initiative, the global project aimed at revolutionising our understanding of the human brain. https:// www.braininitiative.nih.gov/