Ethics of US Student Loan Debt

By: Victoria Tse

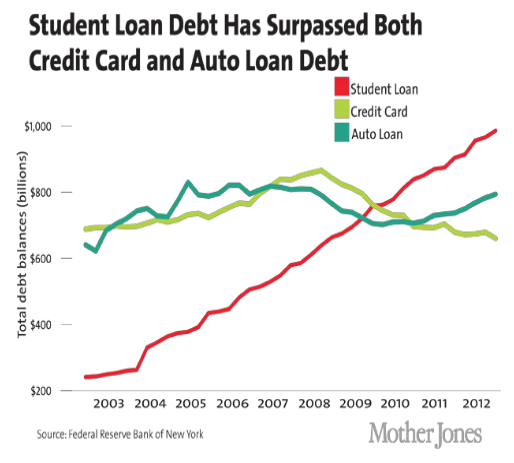

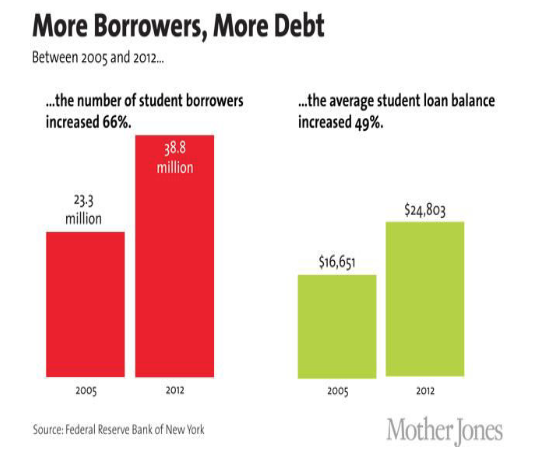

Americans owe nearly $1.3 trillion in student loan debt spread out among 43 million borrowers, putting it only second behind mortgage debt as the highest level of consumer debt. To illustrate the magnitude of the student loan debt crisis, consider the following. The average Class of 2016 graduate owes $37,172 in student loan debt, up six percent from the previous year (Student Loan Hero). That intimidating figure continues to rise with each graduating class incurring more debt than the preceding class. According to the Consumer Financial Protection Bureau, one in four student loan borrowers are either in delinquency or default on their loans (Market Watch).

Delinquency and Default

“The current national rate of ‘serious delinquencies’ for student loans — defined as 90 days or more overdue — is about 11 percent, nearly double where it was in 2003” (CNBC). Don Schlagenhauf and Lowell Ricketts of the St. Louis Fed’s Center for Household Financial Stability comment on the alarming rate of serious delinquencies noting the aforementioned “11 percent” is a generous and understated estimate considering “that many student loans are in deferment, grace periods or forebearance” (CNBC). The rate of serious delinquencies suggests the ability of young borrowers to pay back their education loans is diminishing. As of January 1, 2016, 43% of borrowers were behind in paying loans or received permission to postpone repayment due to economic hardship.

About $56 billion in student debt is a result of 1 in 6 borrowers defaulting on their loans, meaning these loans have been left unpaid for at least a year. Another 3 million borrowers who owe $66 billion of debt were at least a month behind in payments. “Meantime, another three million owing almost $110 billion were in ‘forbearance’ or ‘deferment’, meaning they had received permission to temporarily halt payments due to a financial emergency, such as unemployment” (WSJ). When a loan is delinquent for 270 days, it goes into default and the borrower must pay the entire unpaid balance including any and all accrued collection fees immediately (FedLoan). Consequences of defaulting involve damage to credit rating, garnishment of wages, and withheld tax refunds. A rise in delinquency rates imply that young borrowers will be economically disadvantaged, relative to previous generations, as their capacity to save and access to credit continues to be undermined by crippling interest rates.

I. Ethical Issues Raised by Factors Driving Student Loan Debt

Tuition Inflation

Key factors drive student loan debt nationally, making it an almost universal American experience. To start, government grants and aid have failed to keep pace with rising tuition costs. There is an uneven growth between college tuition and the amount of financial aid made available to students. Pell Grants now cover less than one third the cost of attending a four-year public school compared to the 1980s when it covered more than half the cost. In 2015, the New York Federal Reserve Bank conducted research in which they found that the “flood of easy federal money into higher education” predictably led to higher tuition and fees and “for every dollar of subsidized loans, tuition went up by 65 cents” (forbes.com). This is known as the “pass-through effect” which is prevalent in expensive private institutions where universities that serve a larger population of average students continuously raise tuition to “absorb as much of the new federal money as they can” (forbes.com).

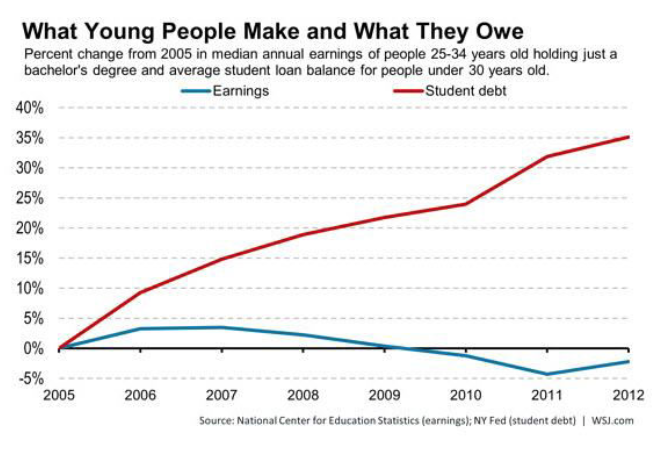

According to Sheila Bair, a former Chairperson of the FDIC, “one of the biggest causes of the student debt crisis is that Americans haven’t seen a raise in years” (MarketWatch). In other words, while real wages are declining, the need for a college degree continues to increase, resulting in “more and more young people applying to college with fewer families able to pay for it” (MarketWatch). The chart below demonstrates the stark disproportion between median annual earnings of young people and the average student loan balance.

For-Profit College Scams

Predatory Lending

For-profit colleges play a large role in the student loan debt crisis considering they account for 42% of postsecondary education enrollment growth in the past decade according to the National Bureau of Economic Research. “The amount of debt owed by those attending for-profit colleges has grown from $39 billion in 2000 to $229 billion in 2014—which is more attributable to the increases in the rate of borrowing at those schools than to increases in enrollment” (The Atlantic). For-profit colleges have come under scrutiny of lawmakers and consumer advocates for inflating job placement and graduation rates to lure vulnerable students, usually adults with families who neither have the time nor money to attend a traditional university, into enrolling and taking out hefty loans. In 2015, Corinthian Colleges, responsible for Everest Institute, Wyotech, and Heald College, faced a $530 million lawsuit filed by the Consumer Financial Protection Bureau (CFPB) for predatory lending, trapping students into private loans referred to as “Genesis Loans”, with interest rates as high as 15%. The CFPB also alleged Corinthian set tuition and fees for their bachelor’s degree programs at a whopping range of $60,000-$75,000, to force students to retrieve loans from a program in which Corinthian reaped a portion of that lender’s fees. Since the lawsuit, Corinthian Colleges has sold or closed most of its schools, leaving a large portion of students who attended any of their institutions to inquire about their eligibility for loan forgiveness.

Higher Risk of Defaults

The additional downside to for-profit colleges is the higher rate at which their students tend to default compared to students who attend traditional four-year universities. The default rate of for-profit students is nearly three times as high as for students who attend traditional colleges. A closer examination of this difference in default tendencies reveals that the type of attendees for-profit colleges attract have lower incomes and are at a higher risk of poverty, not to mention the struggle these graduates face when seeking employment with their for-profit degrees. Studies run by the National Bureau of Economic Research suggest “applicants with business bachelor’s degrees from large online for-profit institutions are about 22 percent less likely to hear back from employers than applicants with similar degrees from nonselective public schools” (US News).

With false promises and skewed data used in the recruitment process, for-profit colleges advertise themselves as a second chance for older students to pursue a degree. The demographic of for-profit colleges tend to be older than the traditional student and these students have lower incomes. Furthermore, as the demographic of for-profit schools are older and thus considered to be more financially independent, it means they are qualified to borrow more money, putting these individuals at an even higher risk of defaulting on their loans. Tuition and fees at for-profit colleges average $15,130 compared to fees at two-year public colleges ($3,264) and four-year public universities for in-state students ($8,893).

Financial Illiteracy

Financial illiteracy seems to be more universal than one would think given that when surveyed, borrowers claim they took on student loans without getting a true sense of whether they would be able to repay their loans with their degrees. Such a response given by young debtors is an unsurprising reflection of the lack of finance education available to graduating high school seniors who, when applying for financial aid through FAFSA prior to their entrance as college freshman, may not understand the gravity of owing thousands of dollars in loans after they graduate from college. Carlo Salerno, an economist who has consulted for a private student-lending industry, indicates the government does not impose credit checks on borrowers and taking out a loan does not require cosigners as with most other loans. The government may have good intentions when making it easier for students to borrow money to pay for a postsecondary education, but easy doesn’t necessarily suggest ethical. Insofar as the government truly believes making it easier for students to borrow money is not risking other aspects of the economy should defaults occur, then its laxness would not qualify as being ethically wrong.

Prioritization of Payments Other than Student Loans

The average monthly student loan payment for borrowers between the ages 20 and 30 is $351, while the median monthly student loan payment is $203. There are other bills college graduates are prioritizing over their unpaid student loans such as car loans, mortgages, rent, and monthly utilities, which are all equally as pressing, if not more urgent than making a payment on a degree that is failing to help land a well-paying job. This prioritization is justified given that failure to pay an auto loan might result in the repossession of a car or failure to meet monthly rent and utilities poses the threat of homelessness. While those bills imply imminent consequences if left unpaid or ignored, the same cannot be said for student loans. Although having bad credit is not any more desirable than not having a place to live, borrowers operate under the economic logic that the former has less immediate consequences than the latter. Therefore, when only able to afford to pay one bill, borrowers prioritize the one that will at least provide shelter.

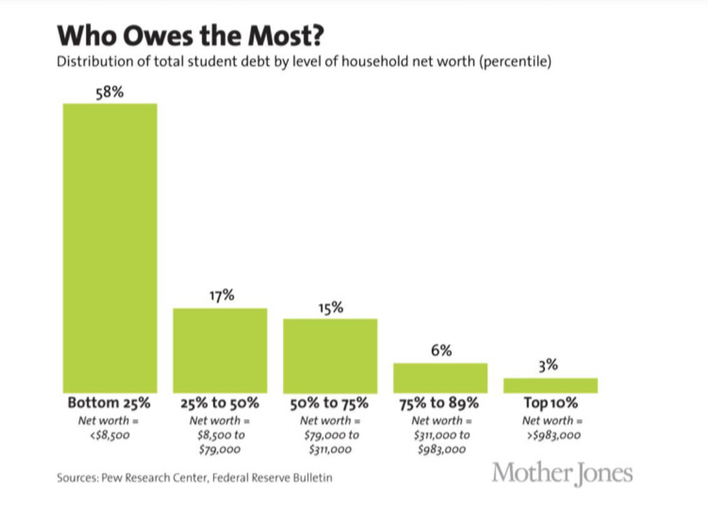

Student Debt in the Context of Race

African American students are more likely to take out loans for college and tend to borrow more than their Caucasian counterparts, chiefly because minorities have fewer resources to draw from, a wealth disparity influenced by racial bias. Findings from research conducted by Demos, a think tank, reveal that “at 80 percent, the vast majority of Black graduates take on debt, compared to 63 percent of White graduates” (Diverse Education). This finding is justified in that minority families were the most adversely affected in terms of household wealth following the Great Recession, further illuminating the racial disparities inherent in our flawed social system. Even more revealing are the statistics from the Center for Social Development at Brown School of Social Work in which it was reported “at the undergraduate level, enrolled black students have, on average, $1,808 more in student loan debt than their white peers do [and] by the time these two groups graduate with their bachelor’s degrees, the gap widens to $3,427.” Author of the new book, “The Debt Divide,” policy analyst Mark Huelsman notes that the debt-financed system is “pushing students of color and low-income students even farther down the ladder…and saddling them with additional disadvantages as they enter the workforce.”

II. Policy Recommendations, Congressional Efforts, and Obama’s Student Loan Forgiveness Policies

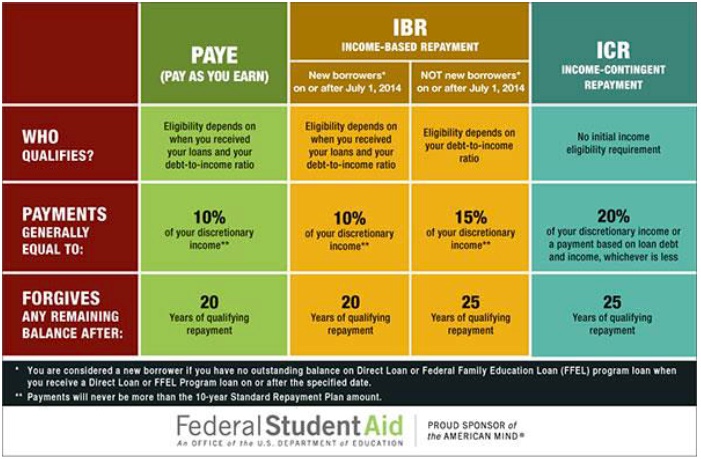

In 2012, President Obama passed the first of his legislations, known as the PAYE, or Pay As You Earn Repayment Plan, to alleviate student loan debt. Progressive as it is, the PAYE has restrictions in that the program only applies to federal student loans disbursed on or after October 1 of 2007 and to students who do not have a remaining balance on a Direct Loan when they received the loan after October 1, 2007 (studentdebtrelief.us). As of 2014, President Obama signed executive orders to expand the PAYE program to make it available to more federal student loan borrowers. The plan caps monthly payments at 10 percent of a borrower’s disposable income and forgives the balance after 20 years of payments. In 2015, borrowers who took out loans before October 2007 or stopped borrowing by October 2011 were eligible for the new and extended plan.

Refinance Student Debt and Lower Interest Rates

In 2014, Massachusetts Senator Elizabeth Warren and her fellow Senate colleagues received endorsements in support of the Bank on Students Emergency Loan Refinancing Act, which was introduced on May 6. The act allows those with outstanding student loan debt to refinance at lower interest rates offered to new borrowers. “Many borrowers with outstanding student loans have interest rates of nearly 7 percent or higher for undergraduate loans, while students who took out loans in the 2013-2014 school year pay a rate of 3.86 percent under the Bipartisan Student Loan Certainty Act passed by Congress in 2013” (warren.senate.gov). The idea behind the legislation is to give students the same low interest rates offered to current borrowers. The act would allow more than 25 million debtors to refinance their student loans to current lower interest rates of less than 4 percent. The efforts to reform student loan debts put forth by Warren and fellow Democrats have been blocked by the GOP, with Republicans justifying their opposition that the bill would raise taxes for the wealthy under the “Buffet Rule”– “a minimum 30 percent income tax payment from people who earn between $1 million and $2 million” (The Hill).

‘Debt-Free’ College

Another Democratic variation of Senator Warren’s refinance plan is the idea of ‘debt-free’ college, which attacks tuition fees more directly to alleviate student debt, and was endorsed by both Senator Bernie Sanders and Hillary Clinton in the recent presidential election. Clinton’s ambitious plan entails offering free tuition at public colleges to middle-class and low-income families who meet the $125,000 or less income bracket. The plan will first start with families at the $85,000 threshold and will eventually include families who make up to $125,000 in 2021.

Policy Recommendations

Improve Financial Literacy and Increase Funding for Federal Work Study Programs

As mentioned earlier, financial illiteracy is a contributing factor to the student loan debt crisis. Young adults applying to college their senior year of high school have little to no formal or basic education on taking out loans for school and do not understand the economic or social implications of student debt after graduation. When loan education is given, if it is given at all, it is usually presented at a time in the student’s college career when it is already too late for the student to reduce the amount in the loans she has borrowed. If college tuition cannot be free as proposed by Clinton or loans refinanced as advocated by Warren, policymakers should consider extending federal work study programs to reach more students to reduce their needs of taking out enormous amounts of loans. The eligibility for work-study is determined by a student’s EFC, or Estimated Family Contribution, as indicated on his or her FAFSA. In order to be eligible, a student must demonstrate outstanding financial need and the cutoff point is relatively low, therefore excluding middle-income families from the aid and leaving them with loans as an only option.

Implied Economic Consequences of Student Debt

The $1.3 trillion in student loan debt may be crippling Americans and preventing them from making big purchases, like houses and cars, which contribute to economic growth. Unless we adopt new policies or make strides towards reforming policies that perpetuate the crisis, we can expect to see an upward trend in student loan debt. Evidently, the statistics of growing student loan debt suggest that the cost of attending college is becoming an increasingly stressful burden for a huge portion of Americans seeking higher education. The debt-for-diploma system has dangerously become the new status quo and places unyielding limitations on economic and social mobility for working-class youth, and especially impacts young people of color.

Editor: Eric Witmer

Works Cited

The Atlantic. Atlantic Media Company, n.d. Web. 24 July 2016.

Berman, Jillian. “What’s Really Causing the Student Debt Crisis, According to Sheila Bair.” MarketWatch. N.p., 2015. Web. 24 July 2016.

Berman, Jillian. “America’s Growing Student-loan-debt Crisis.” MarketWatch. N.p., 2016. Web. 26 July 2016.

“Congratulations to Class of 2014, Most Indebted Ever.” WSJ. N.p., n.d. Web. 25 July 2016.

Cox, Ramsey. “GOP Blocks Warren’s Student Loan Bill.” Thehill.com. The Hill, 16 Sept. 2014. Web. 25 July 2016.

“Delinquency and Default.” – FedLoan Servicing. N.p., n.d. Web. 24 July 2016.

“Elizabeth Warren | U.S. Senator for Massachusetts.” Elizabeth Warren | U.S. Senator for Massachusetts. N.p., n.d. Web. 24 July 2016.

Forbes. Forbes Magazine, n.d. Web. 25 July 2016.

“Government Watchdog Wins $530 Million Lawsuit against For-profit Corinthian Colleges. Too Bad It Will Never See a Dime.” Washington Post. The Washington Post, n.d. Web. 24 July 2016.

“Information About Debt Relief for Corinthian Colleges Students.” Federal Student Aid. N.p., 2016. Web. 25 July 2016.

Mitchell, Josh. “More Than 40% of Student Borrowers Aren’t Making Payments.” WSJ. N.p., n.d. Web. 25 July 2016.

“Obama Student Loan Forgiveness – Student Debt Relief.” Student Debt Relief Student Loan Forgiveness. N.p., n.d. Web. 29 July 2016.

“Report: Student Loan Debt Stratified by Race, Class.” Diverse. N.p., 2015. Web. 25 July 2016.

“Student Debt Load Growing, so Are Delinquencies.” CNBC. N.p., 2016. Web. 25 July 2016.

Taylor, Samuel H., Dana C. Perantie, Nava Kantor, Michal Grinstein-Weiss, Shenyang Guo, and Ramesh Raghavan. “Racial Disparities in Student Debt: Evidence from the Refund to Savings Initiative.” CSD Research Brief (2016): n. pag. Web. 25 July 2016.

“U.S. Student Loan Debt Statistics for 2016 | Student Loan Hero.” Student Loan Hero. N.p., n.d. Web. 25 July 2016.