Philosophical Foundations of Impact Investing

By: Georgette Fernandez Laris

As pointed in our earlier piece, impact investing is about good profits: making money while doing good. Impact investing reminds us sound monetary returns and positive socio-environmental impact returns are not mutually exclusive, but can be complementary and even mutually enhancing. Here are the philosophical reasons why.

1. Context: where the impact investment market stands

While financial initiatives in favour of investments for social good emerged in the 1980’s, the impact investing label gathered momentum in the early 2000’s, especially from the onset of the 2008 global financial crisis. Some analysts attribute the rising interest in impact investing to a generational shift in values. Generation X and Millennials hold business corporations and the financial sector more accountable for their role in society. Emerging generations of investors will likely see social justice and environmental objectives as parallel with financial returns (World Economic Forum & Deloitte, 2013). Others ascribe impact investment’s increasing popularity to the broad disappointment with traditional financial service providers arising from the latest crisis. Younger investors need to find instruments with a renewed purpose to fund shared collective social and environmental challenges.

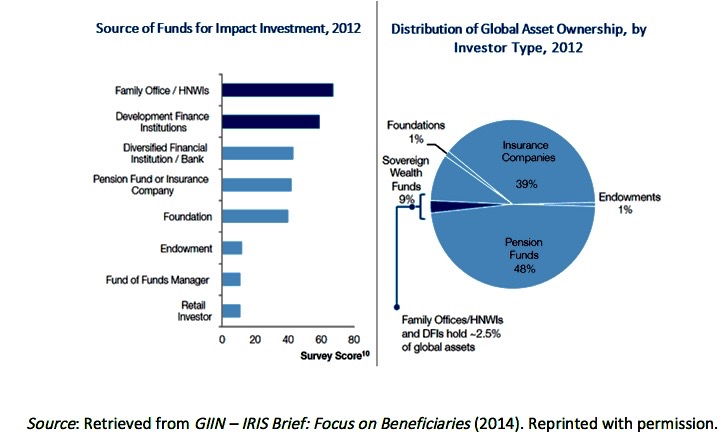

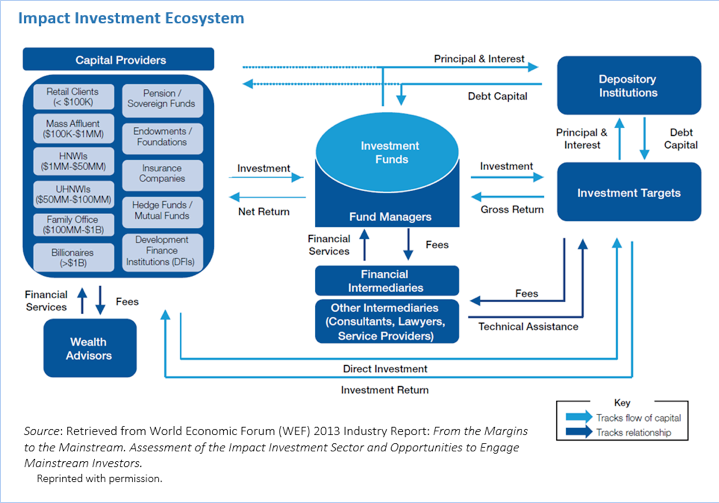

Recently, a concerted international effort has accelerated the development of a high-functioning impact investing market. For example, the Global Impact Investment Network (GIIN) was founded in 2007. Since 2009, GIIN has deployed its Impact Reporting and Investment Standards (IRIS) initiative to support transparency, credibility, and accountability in impact measurement practices. The initiative increases the scale and effectiveness of the market. Impact investing was the core topic of discussion at the 2013 World Economic Forum Annual Meeting in Davos, Switzerland. Similarly, it was a key area of focus for David Cameron, Prime Minister of the United Kingdom, at the G8 meetings throughout 2013. Despite on-going growth in the impact investment sector, the CEO of GIIN, Amit Bouri, recognizes it is still a young market. The available supply of impact capital and the existing demands are not clearing into deals efficiently yet. To date, niche players such as family offices, high-net-worth individuals (HNWI) and development finance institutions (DFI) are driving the capital development of the impact investment sector. These groups’ share of global asset ownership is relatively small. Hence, to fully develop into a mature investment sector, impact investing will rely on the collaboration between: mainstream liability-constrained investors (pension funds, insurance firms, etc.), asset-based investors (private equity firms, mutual funds, sovereign wealth funds, endowments), social impact enterprises, philanthropists and foundations, governments and financial intermediaries.

2. Clarifying the terminology

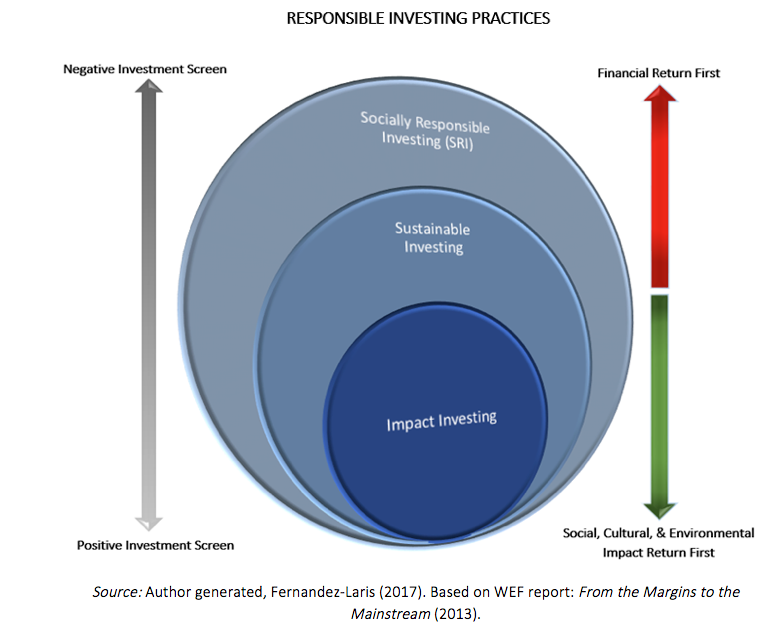

To understand the evolution of the impact investment sector, it is worthwhile clarifying the confusion over related concepts. The terms socially responsible investing, sustainable investing, and impact investing are often used interchangeably. Although the three are all responsible investing practices, they don’t refer to the same thing. Differences between them can be couched in terms of the motivations to invest, reliance on asset classes, degree of control, and range of expected returns. The extent to which elements such as control and expected returns are guaranteed can influence diverse growth dynamics across these three related, but different, types of investment practices.

As the figure shows, socially responsible investing (SRI) involves negative screening, that is, opting out of investments with a negative impact on society and the environment or avoiding companies judged to be doing harm. SRI is a soft ethical approach due to the inherent, subjective, moral relativism of evaluating what constitutes harm. For example, an investor committed to revitalizing urban neighborhoods plagued with unemployment might not exclude companies or enterprises within the casino industry from the portfolio of potential capital recipients. Without consideration of any other ethical prerogative to guide the investment decision, the investor could deem that the ancillary benefits (creation of jobs, tourism revenue) of casinos suffice to make them better or less harmful than the status quo of the impoverished neighborhoods.

Sustainable investing takes a step forward towards strengthening ethical considerations. It does more than shy away from companies and stocks engaged in ‘sin’ activities (alcohol, tobacco, gambling, sex-related industries, arms industry, etc.). Rather, sustainable investing pro-actively incorporates environmental, social, and governance criteria into the analysis of the investment decision and aims to positively screen for companies that can demonstrate affirmative leadership in these areas. While certainly impactful, sustainable investing gives priority to financial returns over social and/or environmental returns.

Impact investment, the focus of this article, goes even further along the ethical screening ladder by explicitly integrating intentionality into the positive screening of investments. From the onset (before the investment is made), impact investing deliberately and clearly sets out to deliver the dual objective of attaining specific social/environmental outcomes and financial returns simultaneously.

Impact investing is not a stand-alone asset class. It is not solely philanthropy either. It is an investment approach across a range of asset classes with a clear, transparent and distinctive intentionality.

Impact investing is a lens through which investment decisions are made deontologically, that is, responding to a moral sense of duty to give our capital resources a greater purpose. It is a teleological investment practice that invites us to redirect the use of our monetary resources so that the funds sustainably function as levers for social, humanitarian, and environmental transformation.

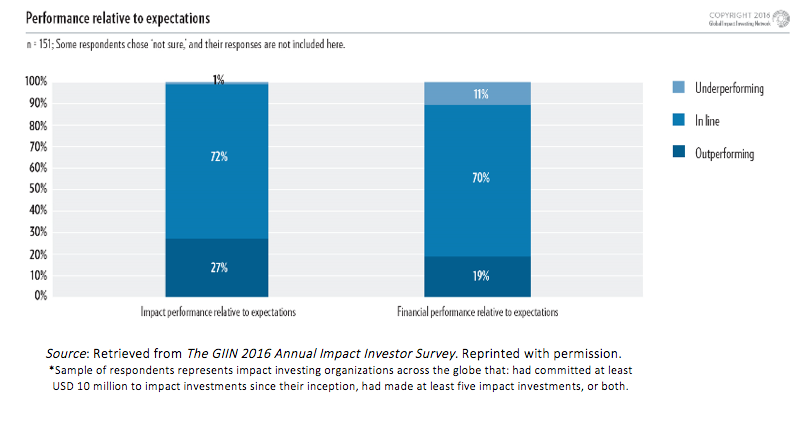

Results from the GIIN 2016 Annual Impact Investing Survey defy sceptics who contend that impact investments always generate below-market returns. According to the GIIN survey, more than 70% of their 2016 respondents observed that impact performance and financial returns were at least as high as expected.

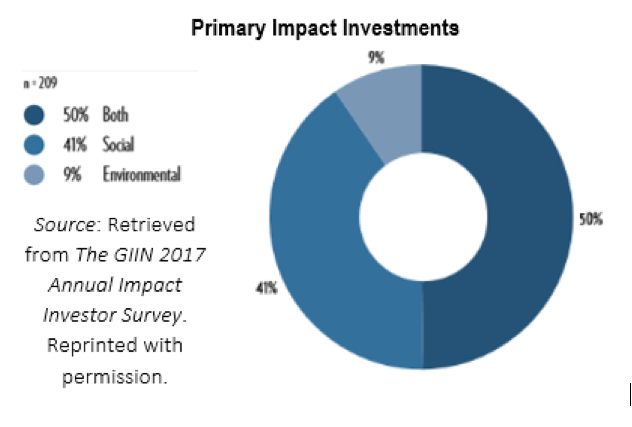

In these surveys, as in its 2017 GIIN edition, half of respondents engaged in impact investing had both social and environmental impact objectives, about 41% of respondents primarily targeted social justice impact objectives and roughly 9% focused on environmental objectives exclusively. Respondents from developed countries tended to target environmental outcomes much more than those in emerging markets. The best-performing impact investing recipients or investees (normally social enterprises, start-ups, or public initiatives), are those who make their social justice or environmental objectives intrinsic to their business model.

This type of business model allows them to avoid conflicts of interest between socio-environmental and financial returns because their business indicators coincide with their impact indicators. Ultimately, this strategy fosters a harmonious balance through which specific economic activity drives socio-environmental impact.

Many analysts still consider the impact investment market an early-stage ecosystem. The market has sustained year-over-year growth with, for example, impact investing organizations repeatedly reporting to GIIN a 15% increase in the total amount of capital invested and a 3% increase in the number of investments made. But a couple of challenges discourage larger institutionalized investors from entering the market. These include: the ambiguity with which investors differentiate impact investing from other forms of responsible investing, and the lack of widely agreed-upon standards to measure and report social and environmental outcomes so as to compare the impact and performance of investment portfolios. The improvement of impact measurement practices has been a top priority for institutions such as the GIIN, the World Economic Forum (WEF), the Organisation for Economic Co-operation and Development (OECD), the Global Association for Banking on Values (GABV), and several non-profits. However, the absence of commonly accepted measurement standards across regions and participants in the impact investing ecosystem constrains its evolution into a more mature system. The market is currently segmented in terms of financial return philosophies, motivations for engaging in the sector, and impact themes pursued. Uncertainty regarding uniformity and comparability of impact evaluations maintains this segmentation.

The consensus is that for impact investing to mature, investors need to be able to categorize and compare the social and financial impacts of diverse investments. This leads us to one of the most natural hesitations regarding impact investing, namely the acknowledgement of the (at times instrumental) wide range of ultimately relativist opinions of what constitutes “impact”.

3. Philosophical foundations of impact investing

A categorization of impact investment as yet another investing possibility with a benevolent slant is simplistic. As a subset of investment opportunities within the universe of responsible investing practices, impact investing entails an endogenous, self-reinforcing vision regarding the purposeful use and allocation of capital resources. It is more than a benign investment asset class. Impact investing involves a process scrutinizing the motivations to invest, the nature of the funded project, the choice of the investment instrument used, its expected return, and its guarantees. Impact investment’s emphasis on a double-bottom line of measurable impact and financial returns aligns it with aspects of utilitarian and deontological moral philosophies.

Utilitarian review

Impact investing, sustainable investing, and SRI follow the consequentialist moral tradition. All three, either via negative or positive screening of corporations and social enterprises in which to invest, gauge their moral character based on the consequences of the main activities, services, and products of targeted capital recipients. Moreover, these three types of responsible investing approaches are utilitarian, the most widespread form of consequentialism. In making investment decisions, all three deem the investment opportunities that maximize welfare (understood as monetary utility or any other measure of social value) for the greatest number as the most morally right options.

Although ‘sin’ activities are dealt with via negative investment screening, under utilitarianism rogue corporate and governance behaviours can still be justified as long as the resulting aggregate social welfare is maximized. Thus, it is perfectly possible for asset managers of socially responsible funds to include in a positively screened portfolio the stocks of companies considered best-in-class under a highly profitable leadership criterion while failing other non-pecuniary, social well-being norms. For example, an ethical investor would be disappointed to learn his money goes to support companies such as Volkswagen. In 2014, the car company deliberately set out strategies to circumvent emissions control, giving it an unfair advantage over competitors. It became the world’s number one carmaker, on the basis of its “environmentally friendly” cars (Forbes, 2015). The utilitarian objective to maximize the sum-total of utilities (welfare) irrespective of distribution tends to incentivize this and other corporate and financial responsibility problems. Under utilitarian logic, even the smallest gain in the total utility sum can outweigh the most blatant distributional welfare and social inequalities.

Of the three responsible investing practices, impact investing is the least susceptible to the pitfalls of utilitarianism. Impact investing associations such as GIIN, supranational bodies including the ONU, OECD and WEF, and other impact investing market participants including ethical banks have devised thorough metrics and standards of impact that help represent the multidimensionality of investment portfolios claiming to be socially responsible. The detailed and more encompassing measures (which track a company’s impact on its workers, community, and the environment) enhance the transparency of the sector to guide more ethical investing decisions. Some impact investing associations are starting to include stipulations on the full disclosure of the range of corporate activities conducted. Enforcement of these disclosures also keeps the sector transparent and aids ethical investments.

Utilitarian viewpoints also encourage companies and potential investees to use corporate social responsibility, social justice, and environmental sustainability labels as marketing and public relations tools. An investor seeking ‘good profits’ would hence be surprised to learn his capital was allocated to giants such as Unilever. Even though its CEO declared it was his “personal mission to galvanize the company to be an effective force for good,” under his leadership Unilever has been implicated in numerous environmental and sexual harassment controversies in Africa and India (Forbes, 2017). Appearing good sells roughly as well as actually being good. The stronger ethical criteria of impact investing cannot change that unfortunate maxim until shared metrics of impact evaluation are uniformly understood and used.

Deontological review

Some critics believe that impact investing’s dual-bottom-line objective dilutes its ‘good-investing side.’ They argue the selfless, virtuous value of altruistic social justice and environmental conservation is corrupted when integrated with financial profit motives. Some investment managers hesitate to fully disclose the financial performance of portfolios, fearing it would be interpreted as a promotional gimmick using other’s misfortune. This reveals they indirectly rely on Kantian deontological ethics, by trying to respect the categorical imperative of “treating others never merely as a means to an end but always at the same time as an end.”

Impact investing practices not only follow utilitarian ethics but they also respond to a sense of duty (deontological view). For example, niche impact investors might be willing to provide seed capital to launch a social initiative out of their desire to support an enterprise, which conforms to their values and norms, even if it entails financial uncertainty and could lead to financial loss. These impact-first investors rely on the alignment of investment options with their personal moral code when judging ventures, rather than on the expected financial consequences. Ceteris paribus, under this specific aspect of impact investment, an altruistic investor may decide to finance research and development (R&D) of affordable treatments that improve the life-quality of people with incurable diseases that receive little attention and funding because of fatal prognoses and the rarity of cases. The investor might not expect to recoup any financial gain from this endeavor and perhaps she acknowledges the spread of its impact would be highly localized. However, her decision to invest in this way is founded on the intrinsic belief that everyone deserves an equal, fair, and enabling life-quality regardless of diagnosis.

Impact investing’s characteristic double-bottom-line prerogative, consisting of rendering both financial returns and tangible positive impacts, allows it to bypass some of the criticisms faced by responsible investing practices solely relying on deontological ethics or on utilitarianism. The dual objective helps investors and advisers to consider simultaneously the intrinsic morality of the activities financed as well as the magnitude and spread of their consequences. Thus, considering maximization of social welfare (utilitarian motive) as well as the intrinsic value of life (deontological motive), an investor would decide to place her capital in an impact investment fund specializing in pooling resources to finding the most efficient allocation of funds to support the R&D of treatments for multiple serious diseases that can reach the most individuals.

Skepticism & cultural relativism

Confusion over the terminology of impact investing, sustainable investing, and SRI partly emerges from culturally relativistic interpretations of what constitutes harm (in the case of negative screening of investments) or of what constitutes impact (in the case of positive screening). Above, we used casinos to exemplify relativism regarding negative screening. However, critics analyzing the limitations of the responsible investing marketplace also argue there are no objective standards by which to define positive ethical investments. For moral skeptics, what is “impactful” is a matter of perception, not a matter of objective universal truth. Similarly, for moral relativists, parameters determining what is (or is not) of significant social or environmental benefit (impact) are not only considered lacking universal objectivity but they are understood as conventions shaped by context and subjected to evolving socio-historical, cultural and psychological frameworks. Defenders of cultural relativism warn us that our preferences over investees and choice of investing instruments can reflect the values, priorities and prejudices of our society. Thus, whether impact investors of a certain area or geopolitical region focus more on social justice, cultural, or environmental issues when allocating capital across investees could be partly culturally conditioned.

For moral relativists, all investors’ judgments and observations (and those of their advisors) regarding the degree of impact generated through invested capital are equally valid. Thus, how can we ascertain whether an investment leading to increase schooling in rural, indigenous, Latin American communities outperforms an investment that helps supply green energy and reduce emissions in Asian cities? Likewise, through utilitarian welfare maximization considerations, how would we establish whether an investment with a significant direct impact on the lives of a few individuals is be more valuable than a slight indirect impact on the lives of many more?

Relativism does more than question the nature of what normatively is the most beneficial social justice, cultural, or environmental imprint of a project in need of capital. Since metrics can be value-laden, the choice of impact measure used in investments’ evaluation can leave room for relativism regarding the scope of impact of social enterprises and initiatives[i]. Different metrics used to monitor the impact of the same social enterprise could yield diverse depictions of its impact return.

Moreover, the impact investment marketplace has tried to start harmonizing the set of metrics suitable to assess enterprises’ social or environmental performance through the Global Impact Investment Network’s Rating System (GIIRS) and its Impact Reporting and Investment Standards (IRIS). For cultural relativists, both fall short of providing absolute objectivity in measurement. For one, these initiatives focus more on measuring outputs of impact investments (product or service produced by the investee enterprise) rather than on outcomes (specific effect of the output in improving people’s lives). For example, GIIRS and IRIS help to measure the reach of invested capital (how many social or environmental interventions are achieved with impact investing capital flows) but fail to provide in-depth, comparable descriptions of the social value of the specific interventions.

Challenges to the continued growth of impact investing vary according to investment practices, regulatory environments, and culture. Nonetheless, investors still have an imperfectly met need to categorize and compare the social impact of diverse investments. This imperfection is a core constraint to the growth of the sector across the globe.

Metrics must help establish the causation between invested capital and the socio-environmental outcomes generated with it. Metrics that can show this link are essential in aiding investment managers to compare the true impact of portfolio options. Analysts seem to agree that steps towards building broadly accepted systems of investments’ impact evaluation would attract more mainstream institutional investors and allow impact investing to grow by making the understanding of what is (or is not) significantly impactful more objectively reliable.

The role of agency

From its beginning, the core impact investing capital providers have been asset owners with a relatively small share of global asset holdings (family offices, HNWI, and some diversified financial institutions and development banks). Analysts and current impact investment landscape participants concur that, to mature, a greater involvement of mainstream investors is needed, including liability-constrained asset owners such as pension funds, and insurance firms as well as of asset managers such as private equity firms and mutual funds. A variety of impact investment funds have provided a route for mainstream investors to become more engaged in impact investing. Differentiated by their target investee sector or geography, institutional structure as non-profits, use of subsidies and diverse return expectations; impact investment funds pool individual investor capital resources to make, primarily, debt and equity investments into impact enterprises.

Some critics argue that reliance on impact investment fund managers (or other wealth advisors) dilutes the moral agency of the principal investor who hires the services of such intermediaries. The rationale behind this critique is that, given the relativism found across guidelines that define what an affirmative ethical investment consists of, fund managers or wealth advisors’ (agents) evaluations of an ethically positive investment may be different from those of the asset owners providing the capital (principal).

Agency theory, which explains the relationship between a party hired to act on behalf of another during business and financial transactions, assumes that both the financial wealth managers (agents) and their investor clients (principals) are self-interested. Even if the double bottom line motivates both sides, it is possible for conflicts of interest to emerge. Whenever investment managers do not place the impact priority over and above financial returns, but their clients do, the strength of the ultimate social impact attained could be less than the one initially sought by principal capital providers. For example, a certain principal could be interested in investing her capital to alleviate one consequence of poverty in a specific region, but she relinquishes control of her capital resources to an investment fund manager. The latter could decide to go after much more profitable humanitarian organizations in more affluent markets, arguing that she will try to move down-market, to the real target population, when the numbers are right, and yet never do so. The demands of the investment manager pull the funds away from the principal’s target population toward those able to guarantee a larger financial return while the principal’s initial intentionality is eroded through its concession of agency.

Therefore, to minimize any type of loss due to the principal-agent problem, it is useful to ensure the fund managers (or other wealth advisor intermediaries) share the same commitment to impact generation and intentionality as their asset-owning clients. It is also very helpful to create frameworks of disclosure and transparency that make the principal knowledgeable about the consequences of the agent’s activities, motivations, and whether these factors ultimately serve the principal’s best interests.

Some ethical banks pursue these principal-agent loss-minimizer conditions in their practices. For example, the French ethical bank La Nef (Nouvelle Economie Fraternelle – the New Fraternal Economy) only finances social justice and environmental impact projects by allocating the funds of its depositors. Moreover, it reports precisely on all the companies it finances and why it does so. La Nef presents its transparency as a means for savers and depositors to exercise their own responsibility over the use of their money, strengthening the moral agency of both La Nef and its clients. The pioneer Netherlands-based Triodos Bank (also active in the UK, Belgium, Spain and Denmark) likewise follows full transparency practices with its clients that help counteract claims on the diminished moral agency of capital providers using financial intermediaries to engage in impact investing.

4. Future directions and concluding thoughts

Recognizing the need to continue improving measurement standards of impact enterprises, in 2016 the OECD launched a working group dedicated to set out agreed-upon impact investing principles and create a roadmap for a comprehensive global reporting system. Likewise, the GIIN is perfecting its rating and impact reporting standards (IRIS and GIIRS). Of course, none of these efforts seek to establish absolutist metric standards. Rather, the goal is to spur the objectivity, precision, transparency, and comparability of measures to better inform impact investing decisions and help the sector grow. Better measures are expected to attract large-scale financial firms and to expand the horizon of impact investing instruments, fueling much more capital into a sector ripe for growth.

Bibliography/references

Born, Kelly & Paul Brest. (2013) Unpacking the Impact in Impact Investing. Stanford Social Innovation Review.

Emerson, Jed & Lindsay Smalling. (2016) Understanding Impact: The Current and Future State of Impact Investing Research. Impact Assets Issue Brief (No. 14).

Global Impact Investing Network (GIIN) 2016 Annual Impact Investor Survey. (2016).

Global Impact Investing Network (GIIN) 2017 Annual Impact Investor Survey. (2017).

Hart, Oliver & Luigi Zingales. (2017). Companies Should Maximize Shareholder Welfare Not Market Value. University of Chicago Booth School of Business and Stigler Center Working Paper Series (No. 12).

Monitor Institute. (2009) Investing for Social & Environmental Impact. A Design for Catalyzing an Emerging Industry.

Staskevicius, Alina & Ivy So. (2014) Measuring the “Impact” in Impact Investing. Harvard Business School Social Enterprise Initiative Report.

World Economic Forum (WEF) Investors Industries & Deloitte Touche Tohmatsu. (2013) From the Margins to the Mainstream Assessment of the Impact Investment Sector and Opportunities to Engage Mainstream Investors. Industry Agenda Report.

Press Articles:

- Volkswagen and the Failure of Corporate Social Responsibility. Forbes (2015). Retrieved in June, 2017 from: https://www.forbes.com/sites/enriquedans/2015/09/27/volkswagen-and-the-failure-of-corporate-social-responsibility/#67a8531b4405

- Unilever and the Failure of Corporate Social Responsibility. Forbes (2017). Retrieved in June, 2017 from: https://www.forbes.com/sites/econostats/2017/03/15/unilever-and-the-failure-of-corporate-social-responsibility/#13385a84498d

[i] Metrics are also driven by the demands of institutional investors. Their level and type of interest, concern for comparability, and willingness to pay for measurement and assurance tends to determine the choice of specific metrics.

Editor: Eric Witmer

-x-