Has bank culture changed to ensure ethical behavior?

By: David Trang

Bank Culture Since 2008

Since the Global Financial Crisis (GFC), the banking industry has been fined over $100 billion dollars for unethical and fraudulent practices (Childress 2014). Academics note this is not purely attributed to ethical lapses by a few individuals but also to how banks are operated, supervised and regulated (Wehinger 2013). In response, many banks worldwide have attempted to reshape their culture by revisiting their code of ethics, educating their employees on the importance of ethical behavior and forming committees to oversee the implementation of ethical programs.

Even though these initiatives are a step in the right direction, they deal with the surface of the problem. Banks must recognize cultural change takes precedence over their image and public perception. A cultural shift involves the replacement of one set of agreed and frequent work behaviors with another. Numerous studies support the relationship between corporate culture and performance as well as a culture being a detriment to business/strategic agendas (Childress 2011). Understanding the linkages between strategy, structure and culture is key to top performance. Everyone must be familiar with the company direction, who does what and where as well as the values and beliefs to which employees must stay true (Childress 2011). In light of technology and globalization, many banks implement new strategies and structures but ignore the cultural aspects, falsely believing culture will develop itself and align with business needs.

In examining regulatory reforms enacted by the US in response to the GFC and analyzing cultural shifts implemented at Citigroup, Barclays and AMP Limited, banks based in the US, UK and Australia respectively, unethical and risky behavior still is common in many banks.

Securities and Exchange Commission (SEC) Whistleblower program

In the biggest overhaul of the American financial regulatory system since the 1930s, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted in July 2010. A whistleblower program was created that instructed the SEC to pay rewards of 10 to 30 percent of the aggregate money over a $1 million threshold recovered in eligible actions resulting from original information provided to the SEC by the whistleblowers (Clark, Lese & Avett 2011). Large financial bounties have concerned listed entities, which believe individuals that become aware of a securities violation will approach the regulators instead of their internal securities compliance program (Uliassi 2011).

Therefore, the SEC has provided three provisions to encourage use of internal programs:

- Consideration of the whistleblower’s participation and interference in internal reporting as an element that can affect the amount rewarded (Berkenblit & Louizos 2011)

- The whistleblower will still be rewarded if she reports the violation internally so long as the company notifies the SEC of their findings (Berkenblit & Louizos 2011)

- Establishment of a ‘window of time’ meaning the whistleblower has 120 days after she reports the violation internally to notify the SEC in order to be eligible for the bounty (Berkenblit & Louizos 2011)

Banks can protect themselves in the long-term by efficiently maintaining internal compliance programs. These measures include:

- Emphasizing the importance of internal reporting and providing an assurance there will be not retaliation (McLucas et al. 2012).

- Continued awareness of corporate hotlines and internal reporting procedures so that employees understand these resources at their disposal (McLucas et al. 2012)

- Formation of an investigative response team comprised of individuals that review whistleblower complaints (McLucas et al. 2012)

- Keeping whistleblowers in the loop by for example, acknowledging the complaint, keeping them informed throughout the investigation and notifying them of the outcome (McLucas et al. 2012)

- Accurate maintenance of complaints and if necessary, a report on the findings and actions taken to rectify the situation (McLucas et al. 2012)

The final rules adopted in August 2011, raises the prospect of companies having to align their compliance procedures to administrate a high number of tips. Banks should be ready for the prospect that whistleblower tips will also go to the SEC, therefore any investigative action must be done in accordance with the program (Berkenblit & Louizos 2011). Generally speaking, if employees feel their company prioritizes compliance and investigates tip offs thoroughly, it is likely they will raise issues internally due to the potential rewards (Berkenblit & Louizos 2011).

Citigroup Inc.

Michael Corbat, CEO of Citigroup Inc. since October 2012, has placed a continual emphasis on ethics throughout his tenure. In a memo released last year, Corbat highlights a strong and stable institution is not merely attributable to financial performance but also to solid ethical standards (Gandel 2014). He acknowledges while most employees do the right thing, there is a small minority who “still don’t get it” (Gandel 2014). Ethical violations have negative consequences on Citigroup’s business partners, is financially costly and rock the foundations everyone strives to build (Gandel 2014). Turning a blind eye to unethical conduct not of your own doing is a violation of the Code of Conduct itself (Gandel 2014).

In response to negative public perception of the financial services industry, Citigroup formed the Ethics and Culture Committee in April 2014. The committee plays a supervisory role in ensuring the management is successful in nurturing an ethical culture (Ethics and culture committee charter 2015). Both parties are aligned, with committee expected to report regularly to management. Citigroup itself will also provide any additional information the committee requires to carry out its duty. The committee is authorized to instigate investigations and call upon professional advisors if necessary into any matters within its scope (Ethics and culture committee charter 2015).

The committee is obliged to arrange quarterly meetings with the management and have the choice to meet certain individuals or entire teams. The board is regularly informed of the committee’s activities, its own performance and whether its objectives remain adequate (Ethics and culture committee charter 2015). The committee also strives to put forward Citi’s value proposition, which portrays a trusted financial services company that stimulates growth and economic development. Citigroup acknowledges as a result of the diverse range of services it provides, it is expected to act responsibly to produce the best outcomes and sufficiently manage risk (Our code of conduct 2014).

In making a decision, employees are expected to question whether the decision is:

- In the client’s interests

- Creates economic value

- Systematically responsible (Our code of conduct 2014).

Periodically, the committee may also provide its insight on Citi’s ethics and culture initiatives that can be improved. The same applies for the Code of Conduct and Code of Ethics. The committee will continually evaluate whether these codes along with internal ethical policies and guidelines will promote an ethical workplace (Ethics and committee charter 2015). In some cases, it will work closely with other committees for example, the personnel and compensation committee on incentives to promote ethical behavior and methods to discourage unethical behavior (Ethics and committee charter 2015).

As CEO, Corbat has used his influence and authority by clearly stating his position on what needs to be done to integrate ethics with culture. This can be enhanced by continually working on an individual level to ensure everyone adheres to ethics and compliance policies as they have with their case-based training. Employees should not have to hesitate if they feel they have to discuss how their actions comply with ethical standards as well as any ethical questions or concerns they may have. Another way to connect with individuals is to conduct culture engagement surveys, the results of which can be used to analyze issues that may need to be investigated and rectified (Embedding ethical values into the corporate culture 2013).

Concerns still linger as to whether Citigroup has truly recovered from its past misdeeds in light of new settlements and fines. In July 2015, Citigroup Inc. was asked to pay $700 million to customers and $70 million in federal fines for deceiving consumers about its credit card add-ons (Andriotis & Rexrode 2015). Clients were misled into purchasing add-ons that protected them from identity theft or in cases where they couldn’t pay their bills (Andriotis & Rexrode 2015). Earlier in May, six global banks (including Citigroup Inc.) were fined $6bn for their participation in rigging the foreign exchange market (Chon & Noonan 2015). A coordinated team of traders from these banks nicknamed themselves “the cartel”, used a chatroom and coded language to manipulate exchange rates in order to maximize their profits (Chon & Noonan 2015).

Barclays

The aftermath of the Libor rate-fixing scandal in 2012 saw Antony Jenkins step into the role of CEO where he introduced TRANSFORM as a means of restoring public confidence in banks. Dubbed “St. Antony” for his efforts in changing the corporate culture, Jenkins was replaced by Jes Staley in December 2015 over a row on the future of the investment banking division (Arnold 2015). Investors have expressed concerns over the company’s stock price and dividend along with continual regulatory investigations of possible misconduct by the bank (Bray 2015).

Like Jenkins, Staley is highly ethical and is keen to improve the level of integrity at Barclays. In a memo to employees, the former J.P Morgan banker has made it clear the cultural transformation of the group will continue (Hutchison 2015). Staley views trust as an essential element in all successful banks, the faith in customers and clients is reflected through Barclays’ continual commitment and service (Hutchison 2015). Staley has also indicated his willingness to restore cooperation with financial regulators and work towards the elimination rather than the avoidance of potential misconduct (Hutchison 2015).

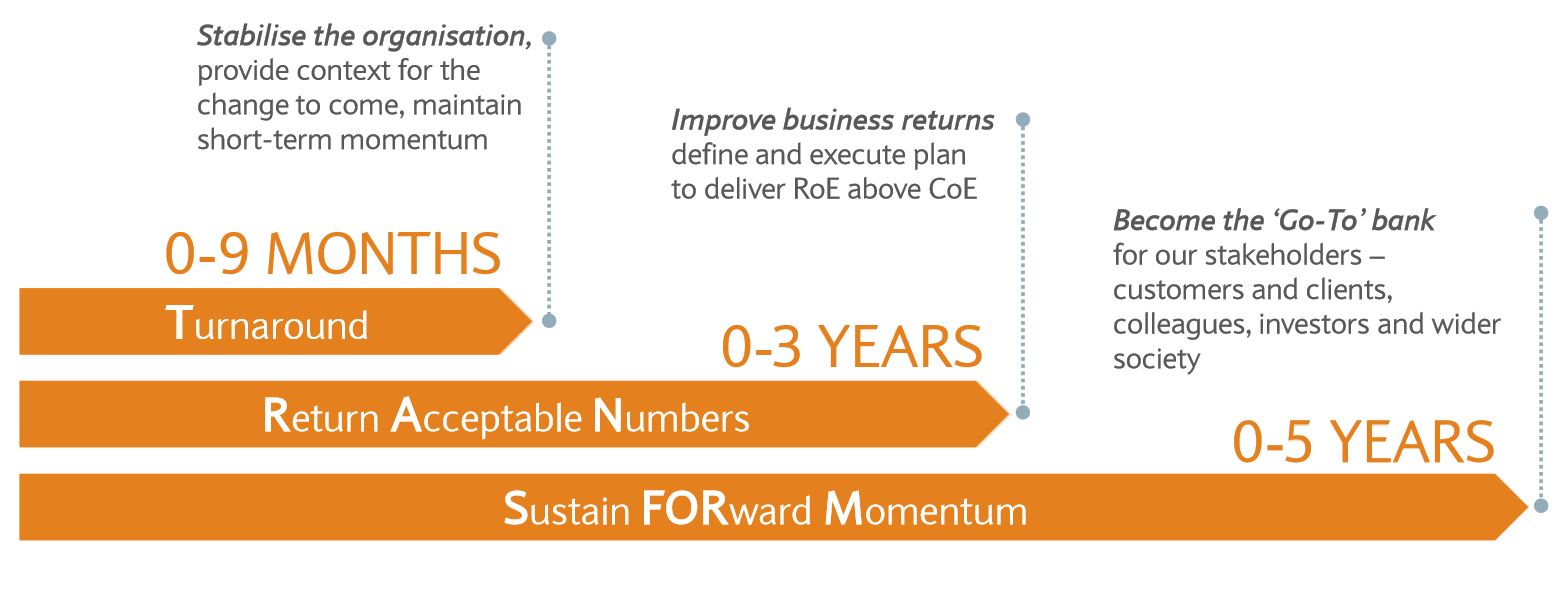

In a remarkable step, the institution acknowledged banking has “lost its way” and seeks to rebuild trust and reputation. For too long, short-term profits were prioritized over long-term interests (Barclays: he says he gets it 2013). Customers were forced into buying products that would boost company profits. In five years, Barclays hopes to change that mindset by making the company the “go to” bank with high levels of customer service, employee engagement and stakeholder satisfaction (Treanor 2013).

Figure 1: Transform Overview (Barclays PLC: Becoming the “Go-To” Bank 2013)

Turnaround

In January 2013, newly defined purpose and values were introduced to safeguard Barclays’ long-term prospects and provide a set of standards each employee works towards.

Purpose: Helping people achieve their ambitions – in the right away (Becoming the ‘Go-To’ bank 2013)

Values (Becoming the ‘Go-To’ bank 2013)

- Respect: Demonstrating respect and value for our clients as well as their contribution

- Integrity: Acting fairly, ethically and openly in all business activities

- Service: A customer/consumer centric culture

- Excellence: Combination of energy, skills and resources to deliver the best possible outcome

- Stewardship: Leaving things better than they were originally discovered

Return Acceptable Numbers

The investment bank division remains the largest business in the group and has demonstrated the potential to be a global full-service investment bank due to its influence in the US and UK (Becoming the ‘Go-To’ bank 2013). The corporate banking division is in the midst of a successful turnaround with the intention of building a global cash management platform and expanding the product offering to Africa. Locally, the retail and business banking platform has embraced technology in a bid to improve customer service, controls and costs. Barclaycard is one the largest consumer payment businesses which hopes to expand its geographical reach to evolve into a full service payments business. In terms of wealth management, Barclays remains a leader and strives to consolidate on high return areas and nurture those with low returns (Becoming the ‘Go-To’ bank 2013).

Figure 2: Analysis of Business Units

(Barclays PLC: Becoming the “Go-To” Bank 2013)

Sustain Forward Momentum

Within the set time period, the challenge is to weave Barclays’ purpose and values into its day-to-day operations. A balanced scorecard was introduced to monitor this effort, and described as the final piece of the plan to make Barclays the “go to” bank (Becoming the ‘Go-To’ bank 2013). Performance is assessed in five areas: customer & client, colleague, citizenship, conduct and company. An integrated report card has also been developed for the company that will outline values and financial performance (Becoming the ‘Go-To’ bank 2013).

In terms of Barclays reward structure, performance is no longer plainly judged on what employees do but also how they do it. Competitive pay packages will continue in order to recruit the best talent (Becoming the ‘Go-To’ bank 2013).

World-class controls systems have been introduced to help meet societal expectations of a multinational company that learns from mistakes, complies with regulation and stays true to its purpose and values. All compliance staff will now report to a single global function head and will be independent from business/regional management teams (Becoming the ‘Go-To’ bank 2013).

Barclays has embraced technology to help reduce costs for example, self-service technology has decreased processing volumes and complaints (Becoming the ‘Go-To’ bank 2013). These resources provide the opportunity to improve customer interaction in other sectors. Cloud-based platforms assist in reducing headcount, physical IT infrastructure and data centers (Becoming the ‘Go-To’ bank 2013).

During his tenure, Jenkins revamped the ethical code of conduct and made it clear those who object should leave, a powerful deterrent to those who wish to commit wrongdoing. To Barclays’ credit, it has done much work on an individual level. Every current and incoming employee has been on a value training course that highlights her importance and how it applies individually. Ambassadors were recruited as “values leaders” to help assist in this effort (Banking on change for the better 2014). A code of conduct has also been adopted on a global scale and applied consistently to all divisions. This encourages employees to speak out if they witness anything that is not in accordance with the code (Banking on change for the better 2014).

Despite the restructuring program, Barclays has forecasted its conduct and litigation costs to remain “elevated” when cutting its profitability target for 2016 (Partington & Morris 2015). In November 2015, regulators fined the bank $2.38bn for misconduct in foreign exchange trading. Super-fast trading systems were used to reject unprofitable client orders and customers were misled as to why their trades were unsuccessful (Barclays pays extra $150m penalty for forex misconduct 2015). In another sign that any attempted cultural changes were ineffective, the British multinational company was fined $109m by the UK Financial Conduct Authority for breaching its own internal controls to safeguard against the risk of financial crime and ignored red flags in order to win new business and generate significant revenue (Treanor 2015).

Jenkins’ dismissal indicates that bottom line profits are prioritized over positive cultural change. This is reflected by John McFarlane’s statement, current chairman of Barclays as to why the former retail banker was let go:

His skill set was suited to what we needed to get done and he did that superbly well. What we really need is profit improvement and returns improvement and that is a different skill.

When Jenkins was appointed in 2012, he was tasked with rectifying Barclays’ “toxic culture”, downsizing the investment bank and concentrating more on retail operations (Brinded 2015). Unfortunately, by implementing restructuring programs and dismantling the most profitable division in the investment bank, profit has been negatively impacted (Brinded 2015). Consequently, the challenge for Staley is how he intends to balance cultural reform and making the investment bank less “capital intensive (Morris 2015).”

AMP Limited

In 2007, AMP was rocked by a financial planning scandal thought to have affected 35,000 of its customers (John 2007). A subsequent investigation by the Australian Securities and Investments Commission (ASIC) discovered that AMP’s financial planners used dodgy advice to coerce people into changing superannuation funds to increase company profits and drive up commissions received. Inadequate disclosures were made in regards to the cost of changing to the new recommended products as well as the entry and exit fees and the commissions customers have to pay (AMP caught out by regulators 2006).

Superannuation in Australia, also known as super, is money put aside for an employee by her employer over her working career and will be retirement income (Your superannuation basics 2016). The law states employers must pay “superannuation guarantee” contribution amounts to a super fund nominated by their employees at 9.5% of their wages and salaries (Your superannuation basics 2016). Money in the super fund account is invested by the super fund. Most super funds have various investment options for example, the value of super in a market-linked investment is proportional to market movements (How super works 2015).

A conflict of interest arises with this kind of commission-based structure because planners have an incentive to sell products rather than to provide the best advice. Consequently, it is difficult for planners to provide independent and objective advice (AMP caught out by regulators 2006). In response to the crisis, AMP has contacted customers to see if they want their superannuation plans reviewed. Some will be given the option to switch back to their original fund, others will be given the choice to switch their investments or be given a refund (John 2007).

More significantly, AMP has revamped their training, disclosure and compliance policies in order to avoid a recurrence (John 2007). All new and existing advisors now have to complete post-graduate qualifications by a certain time frame to continue practicing. In 2014, an AMP Customer Advice Review Panel was established to review any complaints a customer may have when given advice through AMP’s normal channels. If the panel finds that the inappropriate advice was given, the customer will be restored to the state where she would be if the appropriate advice were provided (AMP lifts adviser education standards and launches customer panel 2014).

In collaboration with St. James Ethics Centre, an ethics and responsible decision making program has been developed and will be available to all financial advisors. It comprises of four weeks of online and face-to-face training, two full day workshops and one-on-one sessions with members of the center (Millan 2015). This program will provide the necessary background for advisers to make ethically sound decisions. Contemporary research in philosophy, moral psychology, behavioral ethics and neuroscience will be drawn upon to help advisers understand how it relates to their daily activities (Millan 2015).

AMP recognizes the bottom line is to retrain individuals to lift the quality of advice. But preceding that, the company must foster an ethical culture that will mitigate any risk factors. One way this can be achieved is considering adherence to ethical values when hiring and promoting employees. Once in, they are consistently mentored on organizational values and treated well when they leave/retire. Another method is for supervisors to turn principles into practice by using stories and symbols to promote ethical behavior. These measures will help develop a strong and ethical culture (Corporate Culture 2015).

Some change, more work needed

There is no doubt that financial services firms have made a conscious effort to change their culture. However, a study by the University of Notre Dame and Labaton Sucharow LLP uncovers an industry that is still filled with greed and temptation (Tenbrunsel & Thomas 2015). Most troubling is that many still believe in order to get ahead, one must be unethical (Tenbrunsel & Thomas 2015). Seasoned professionals have a duty of care to protect newcomers who are more susceptible to peer pressure and monetary inducements arising from illegal activities if there is no chance of getting caught. Encouragingly, many people are willing to report corporate wrongdoing thanks to the incentives and protections provided by the SEC Whistleblower program (Tenbrunsel & Thomas 2015).

Citigroup, Barclays and AMP Limited need to further address the individual, organizational and industrial level factors coupled with new laws and regulation to make an impact (Alton 2015). A grass roots approach is needed, which starts from the incoming generation of financial leaders. It is not too late to rebuild trust and restore reputations if banks enact new policies and procedures that include refreshed training procedures and third-party accountability (Alton 2015). On an individual level, employees need to work in the best interests of clients, report those who participate in illegal activities and consumers/clients need to speak out to make their voice heard (Alton 2015).

These efforts are part of developing a corporate culture indicative of performance. Internal business processes and leadership behaviors are the biggest drivers of corporate culture. Business processes, like budgeting, initially shape the individual, impact collective behavior and eventually the culture. Whether they like it not, all employees must comply with business processes if they are to act ethically (Childress 2011). Alternatively, all employees look to their leaders as examples on how to behave. Any actions that differ from professed words will cascade down the line. The core values and business mechanisms that drive ethical behavior can only be influenced at the top of the organization (Childress 2011).

-x-

References

Alton, L 2015, ‘Unethical behavior continues to plague financial services industry’, Business Ethics, viewed 25 December 2015, <http://business-ethics.com/2015/05/28/0920-survey-unethical-behavior-continues-to-plague-financial-services-industry/>

‘AMP caught out by regulators’ 2006, ABC Local Radio, radio program transcript, ABC, Sydney, 27 July, viewed 20 December 2015, <http://www.abc.net.au/pm/content/2006/s1698909.htm>

‘AMP Lifts adviser education standards and launches customer panel’ 2014, AMP Limited, viewed 19 December 2015, <http://media.amp.com.au/phoenix.zhtml?c=219073&p=irol-newsArticle&ID=1959641>

Andriotis, A, Rexrode, C 2015, ‘Citigroup to pay $770 million over credit card add-ons’, The Wall Street Journal, viewed 13 January 2016, <https://global-factiva-com.simsrad.net.ocs.mq.edu.au /redir/default.aspx?P=sa&NS=18&AID=9MAC001300&an=WSJO000020150721eb7l0050n&cat=a&ep=ASI>

Arnold, M 2015, ‘Barclays fires Jenkins after clash with head of investment bank on its future, Financial Times, viewed 16 January 2015, <https://global-factiva-com.simsrad.net.ocs.mq.edu.au /redir/default.aspx?P=sa&NS=18&AID=9MAC001300&an=FTFT000020150709eb790002h&cat=a&ep=ASI>

Banking on change for the better 2014, Best Practice, viewed 16 December 2015, <http://www.ethic alperformance.com/PDFs/422f767fb15cc697f66b32ca95919434792281dc.pdf>

‘Barclays: he says he gets it’ 2013, The Guardian, viewed 17 December 2015, <http://www.the guardian.com/commentisfree/2013/feb/12/barclays-he-says-he-gets-it-editorial>

‘Barclays pays extra $150m penalty for forex misconduct’ 2015, BBC News, viewed 7 January 2016, <http://www.bbc.com/news/business-34859185>

‘Barclays PLC: Becoming the ‘Go-To’ bank 2013’, Barclays, viewed 19 December 2015, <https://www.home.barclays/content/dam/barclayspublic/docs/InvestorRelations/IRNewsPresentations/2012News/antony-jenkins-presentation-to-investors-12-february-2012.pdf>

‘Becoming the ‘Go-To’ bank’ 2013, Barclays, viewed 19 December 2015, <https://www.home .barclays /content/dam/barclayspublic/docs/Microsites/Transform/barclays-strategic-review-executive-summary.pdf>

Berkenblit, HE, Louizos, SH 2011, ‘Keeping current: securities: SEC’s whistleblower program finalized’, Business Law Today, LegalTrac, viewed 20 December 2015

Bray, C 2015, ‘Antony Jenkins ousted as Barclays Chief Executive’, The New York Times, viewed 10 January 2016, <http://www.nytimes.com/2015/07/09/business/dealbook/antony-jenkins-to-step-down-as-barclays-chief-executive.html>

Brinded, L 2015, ‘Barclays staff are happy that Antony Jenkins, ‘Mr Nice’, was finally fired, Business Insider, viewed 14 January 2016, <http://www.businessinsider.com.au/barclays-ceo-antony-jenkins-left-because-of-his-lack-of-investment-banking-understanding-2015-7?r=UK&IR=T>

Childress, JR 2014, ‘The challenge of managing ethical behavior in banking’, FT IE CLA, viewed 19 December 2015, <http://www.ftiecla.com/wp-content/uploads/2015/09/Banking_Behaviour _change_v4.pdf>

Childress, JR 2011, ‘Why banks should focus on culture, now more than ever’, The Principia Group, viewed 19 December 2015, <http://www.theprincipiagroup.com/downloads/Why-Banks-Should-Focus-On-Culture-v2.pdf>

Chon, G, Noonan L 2015, ‘Six banks fined $5.6bn over rigging of foreign exchange markets’, Financial Times, viewed 13 January 2015, <https://global-factiva-com.simsrad.net.ocs.mq.edu.au /redir/default.aspx?P=sa&NS=18&AID=9MAC001300&an=FTCOM00020150520eb5k004s9&cat=a&ep=ASI>

Clark, MC, Lese LS, Avett FR 2011, ‘SEC adopts final rules on Dodd-Frank Whistleblower Program’, Journal of Investment Compliance, vol. 12, no. 3, pp. 33-38, viewed 19 December 2015, Emerald Insight, DOI 10.1108/15285811111172286

Corporate Culture: the second ingredient in a world-class ethics and compliance program 2015, Deloitte, viewed 29 December 2015, <http://www2.deloitte.com/content/dam/Deloitte/us/ Documents/risk/us-aers-corporate-culture-112514.pdf>

Embedding ethical values into the corporate culture 2013, The Malaysian Institute of Integrity (IIM) and Chartered Institute of Management (CIMA), viewed 18 December 2015, <http://www.cima global.com/Documents/Professional%20ethics%20docs/Embedding_ethical_values_into_the_corporate_culture_report.pdf>

‘Ethics and culture charter’ 2015, Citigroup Inc., viewed 15 December 2015, <http://www.citigro up.com /citi/investor/data/ethicsculturecharter.pdf>

Gandel, S 2014, ‘Citi CEI says employees broke the rules’, Fortune, viewed 17 December 2015, <http://fortune.com/2014/02/28/citi-ceo-says-employees-broke-the-rules/>

‘How super works’ 2015, Moneysmart, viewed 10 January 2016, <https://www.money smart.gov.au/superannuation-and-retirement/how-super-works>

Hutchison, C 2015, ‘Barclays’ new boss Jes Staley sends memo to staff pledging to restore banking to its ‘rightful standing’’, Evening Standard, viewed 9 January 2016, <http://www.standard.co.uk /business/barclays-new-boss-jes-staley-sends-memo-to-staff-pledging-to-restore-bank-to-its-rightful-standing-a3101141.html>

John, D 2007, ‘Thousands more snared in superannuation scandal’, The Sydney Morning Herald, viewed 21 December 2015, < http://www.smh.com.au/news/business/thousands-more-snared-in-superannuation-scandal/2007/02/15/1171405369454.html>

McLucas, WR, Wertheimer, LS, Robinson, AJ, Johnson, MJ, White, TW, Rosenfeld, JD 2012 et al. ‘SEC whistleblower bounties: ten things companies can do right now to stay ahead’, Journal of Investment Compliance, vol. 13, no. 1, pp. 39-40, viewed 19 December 2015, Emerald Insight, DOI 10.1108/15285811211216709

Millan, L 2015, ‘Industry giants ramp up adviser ethics training’, Financial Standard, viewed 21 December 2015, <http://www.financialstandard.com.au/news/view/51797259>

Morris, S 2015, ‘Staley says Barclays must complete investment bank repositioning’, Bloomberg Business, viewed 10 January 2016, <http://www.bloomberg.com/news/articles/2015-10-28/barclays-hires-former-jpmorgan-banker-jes-staley-as-new-ceo>

‘Our code of conduct’ 2014, Citi, viewed 22 December 2015, <http://www.citigroup.com/citi /investor/data/codeconduct_en.pdf>

Partington, R, Morris, R 2015, ‘RBS echoes Barclays’s warning of persistent misconduct costs’, Bloomberg Business, viewed 8 January 2016 <http://www.bloomberg.com/news/articles/2015-10-30/rbs-echoes-barclays-s-warning-of-persistent-misconduct-costs>

Tenbrunsel, A, Thomas, J 2015, ‘The Street, The Bull and The Crisis: A Survey of the US & UK Financial Services Industry’, The University of Notre Dame & Labaton Sucharow LLP, viewed 14 December 2015

Treanor, J 2013, ‘Barclays’ Antony Jenkins: the man with transformation on his mind’, The Guardian, viewed 18 December 2015, <http://www.theguardian.com/business/2013/feb/13/barclays-antony-jenkins-reputation>

Treanor, J 2015, ‘Barclays fined £72m over ‘elephant deal’’ 2015, The Guardian, viewed 8 January 2016, <http://www.theguardian.com/business/2015/nov/26/barclays-fined-72m-elephant-deal-fca>

Uliassi, T 2011, ‘Addressing the unintended consequences of an enhanced SEC whistleblower bounty program’, Administrative Law Review, LegalTrac, viewed 20 December 2015

Wehinger, G 2013, ‘Banking in a challenging environment: Business models, ethics and approaches towards risks’, OECD Journal: Financial Market Trends, viewed 20 December 2015

‘Your superannuation basics’ 2016, Australian Taxation Office (ATO), viewed 10 January 2016, <https://www.ato.gov.au/General/Other-languages/In-detail/Information-in-other-languages/Your-superannuation-basics/>

Photo: Assessing Performance (Barclays PLC: Becoming the “Go-To” Bank 2013)