Chinese Investments in Africa: The Ethics of Transparency

By: Richard Hudson

China’s investments in Africa attract considerable interest as the Chinese government expands its diplomatic engagement with the rest of the developing world. In particular, this engagement has seen large amounts of money invested from the People’s Republic of China into some of the poorest countries in Africa; Angola, Ethiopia and Sudan to name just a few. There are questions about the ethical implications of this lending, especially considering the poor human rights record of many of these African states. One specific aspect is considered here: the lack of transparency of Chinese investment in Africa.

The analysis focuses on two different ethical considerations. The first is the role transparency ought to play in international development projects, specifically whether the merit of a project should be based on its results (consequentialism) or whether primary importance should be assigned to the methods used (deontological). The second part considers the origin of ethical standards and whether norms associated with Western development projects can be expected from states with different values and ethical traditions. While the arguments for cultural relativity and consequentialism both seem to offer compelling ethical reasons for a lack of transparency, the author concludes that transparency offers tangible ethical benefits and a lack of transparency within these deals is therefore, unethical.

What is Transparency?

Transparency usually refers to the degree of openness with which actors operate and the level of information made available to the public by a company or government. Transparency is considered a key factor in creating efficient markets, as it prevents distortions in supply and demand due to information asymmetry. In a political setting, transparency combats corruption and ensures the responsible allocation of resources. Within a democracy, transparency also allows citizens to be aware of the decisions made on their behalf which helps prevent abuses of power by elected officials. These are all beneficial effects if transparency. There are cases in which transparency is treated as unnecessary, or even an obstacle to achieving ethical outcomes.

Case study: China engages with Africa

While the Chinese government has had a long interest in Africa, dating back to the early years of the Cold War, it has only been in the last 20 years that economic engagement with Africa has been a key foreign policy objective in Beijing. In this time there has been a proliferation of bilateral investment agreements and trade deals signed between the Chinese government and African states. To support these deals, a number of multilateral organisations have emerged, the most notable being the Forum for Chinese-African Cooperation (FOCAC). Chinese foreign direct investment is directed into Africa through these organisations.[1] The recurring theme throughout these deals is China engages in ‘no strings attached’ economic diplomacy, including no strings in regards to transparency.

The main recipients of Chinese state funding have been some of Africa’s least developed countries which often are deprived of investment from other international sources. For states like Sudan and Zimbabwe, deprivation is the result of ongoing sanctions by Western states.[2] China represents one of the few countries still willing to invest on a large scale in these countries. Other states, like Angola, have struggled to attract investment from Western states because of their history of civil unrest and the government’s unwillingness to accept the regulations that accompany investment from the World Bank and IMF. Despite these variations between recipient states, the methods used by the Chinese government have been very consistent. The state plays a strong role in realising closer economic ties between China and Africa. As a result of this state-led investment strategy, Chinese firms are now active in forty eight African states, across a variety of industries.

Chinese Export Credit

While Chinese investments into Africa takes many forms, the largest source is China’s export credit programme. Export credit is a method of investing internationally. China lends money to a recipient government to finance exports from the lender i.e. China. For example, Chinese export credit is used to finance construction projects in African states using Chinese construction companies, workers and equipment. Export credit has proven to be a popular tool in Chinese overseas development policy. Export credit represents 92% of the Chinese government’s investment into Africa, with $1.2 billion lent to the continent in 2010 alone.[3] Because of the dominance of export credit within China’s lending to Africa, and the lack of transparency within these deals, it is the main financial tool analysed here.

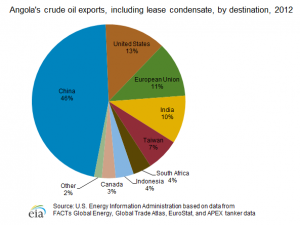

What makes Chinese export credit ethically questionable is the conditions under which it is extended to African states. Export credit from Europe and North America is industry-regulated and conforms to internationally established interest rates. The Chinese export credit programme lends on very different terms. The interest rates charged are often well below those offered by Western donors, often 1-3% below market rates. The length of the repayment terms is much longer; as many as 20 years, compared to 5-10 from other lenders. Chinese export credit is often repaid in resources, rather than US dollars, another deviation from Western lenders. For example, the majority of Angolan borrowing is repaid in oil, a trend which has made Angola the largest exporter of oil to China. Finally, the procurement requirements are much higher in Chinese export credit contracts than from other lenders. Chinese export credit deals require as much as 70% of the contracts and 50% of the associated procurement to be filled by Chinese firms. This is again a much higher percentage than required by Western donors. For these reasons, Chinese export credit is a useful entry point for analysing the ethics of Chinese investment in Africa.

While these conditions are interesting in themselves, the most relevant factor in the analysis is the lack of transparency of these deals. While these export credit agreements have strict quotas regarding procurement and the allocation of contracts, there is very little evidence that these quotas are met. Neither the Angolan nor Chinese governments publish information on the allocation of these contracts or the procurement conditions that accompany them. As a result, there is no way to be sure that 50% of the procurement is being sourced locally. Likewise, there is no published information on whether the domestic portions of the contract have been assigned to the African subsidiaries of Chinese firms, a tactic which has been used to subvert the local content requirements of these loans. Finally the exact details of Chinese export credit to Africa are difficult to ascertain from the outside. There is disagreement on the exact scope of Chinese lending in Africa even in reports from the Chinese government. Depending on the source, Chinese lending varies between US$11.32 Billion and US$23 Billion.[4] What emerges from these inconsistencies is the little credible data on China’s export credit programme in Africa. Instead the whole process is deeply opaque, with low transparency and little public information. Is this lack of transparency ethical?

Transparency: What is it good for?

What utilitarianism tells us

Unsurprisingly, the Chinese government is one of the strongest supporters of its current investment strategies in Africa. The Chinese government justifies the export credit programme using a broadly utilitarian argument. Utilitarianism argues that an action is good i.e. ethical, if it creates the greatest aggregate happiness in the world. Utilitarianism is a branch of consequentialist ethical reasoning which emphasises the outcomes of an action, rather than the principles underlying the actions. The analysis requires a teleological view of morality, where the moral content of a specific action is judged by the long and short term consequences of that action. In short, utilitarian logic argues that the ends justify the means, so long as the ends involves the greatest positive result.

From this basic utilitarian perspective, the status quo for Chinese investments in Africa may seem ethically justified at first glance. The end result of Chinese export credit is African states see greater investment and job opportunities and can then provide more extensive public goods for citizens. When these loans are repaid in resources, the recipient state doesn’t even have the burden of repaying the loan from its own income, avoiding a greater debt burden. The only price that is paid for this increase in investment is the lack of transparency mentioned earlier. While this does result in the occasional misappropriation of funds and allows Chinese firms to undercut Western competitors bidding for contracts, these are trivial compared to the benefits that result for some of the poorest countries in the world. If our paramount goal is realising the greatest aggregate happiness then a lack of transparency is justified. The losers are few while the benefits flow into some of the world’s poorest communities. This line of logic is advanced in support of China’s current investment strategies; the need for transparency and accountability is dwarfed by the greater need for financial aid to very poor states.

However, this line of argument is a not a full or comprehensive utilitarian calculation. While utilitarianism is concerned with the consequences of an action, there are other factors which must be factored into that calculation, beyond simply the good that an action produces. As De George (2006) points out, utilitarian analyses also require two further steps to determine the justness of an action.[5] The first is to consider the alternative actions which can be pursued. The second is to compare the results of these alternative actions with the actions in question to determine which produces the most good. Only by following these further steps can we establish the morally correct course of action.

Following these two further steps begins to show the weakness of the initial utilitarian position adopted by supporters of this investment. Following De George’s framework, the alternative course of action is to invest with transparency. The original course of action is to invest without transparency. Given these two options, the one which produces the most good is clearly the former, as preventing even one case of corruption through greater transparency is a better outcome. Even if we assume there are greater administrative costs associated with ensuring transparency, it is difficult to argue convincingly this outweighs the much greater cost incurred by corruption. This comprehensive and more complete utilitarian calculation shows clearly that investment with transparency is a greater good than investing without it.

What deontology tells us

While the utilitarian position provides a clear answer to the relevance of transparency, there are other ethical theories which offer a different approach to understanding the ethics of an action. In contrast to the consequentialist logic of utilitarianism is the deontological school of thought. Deontology refers to a group of duty based theories. As a result, it is not the consequences which determine whether an action is ethical, but rather the motivations of the person undertaking the action. Immanuel Kant stands out as the most widely known deontological theorist. Kant emphasises the importance of certain categorical imperatives which he saw as “moral laws” that guide ethical behaviour.[6] These categorical imperatives are concerned with ensuring that an act is ethical and at no time is an individual treated as a means to an end (the third imperative). It is this line of argument which begins to address the intuitive worth that transparency holds.

If transparency is a means of ensuring the motivations of those engaging in African development projects accord with the moral principle that an individual is is not treated as a means to an end, then again we have further evidence that the status quo is unethical. In the Chinese investment example, when the details of Chinese export credit investments into Africa are not disclosed to the public, then the public is treated as means to an end. Without proper oversight of these financial deals there is no way to assure that the outcome has not been manipulated and that those in positions of power have not profited at the expense of the public good. In other words, transparency ensures that the public has not been used as a means to advance the position of those making these investment deals, but have instead been treated as a means in themselves. What this line of analysis reveals is that, even when we consider a non-consequentialist approach to this case study, the conclusion is the same; that transparency does offer a tangible ethical value and ought to be included within these export credit agreements.

Transparency as an assurance of ethical outcomes

A third analysis where both the outcomes and means are considered is the Turilli and Floridi (2009) approach. Their research argues that transparency is valuable because it assures ethical outcomes. This approach addresses both the consequences and the principles underlying the action, by locating transparency as a crucial ingredient in achieving an ethical end. If we analyse Chinese export credit to Africa using this framework, then we see that transparency has value because it ensures that the outcome is as good as possible. Therefore, these deals are ethically dubious because the lack of transparency means there is no assurance that the outcomes are creating the greatest possible good.

Western ideology or universal norm?

The previous discussion established the importance of transparency and how opaque investments into the developing world compromises their ethical standing. However this analysis may be applied to any government or company investing in a developing country. What makes the Chinese example especially important is that it also raises questions about the origins of transparency as an ethical good.

The demand for transparency emerged from the West, which endorses the view that corruption is bad for economic growth and transparency is an important tool for combatting corruption. However, many other countries do not share this same view of transparency. China stands out as a country which has achieved very high levels of economic growth despite having a notoriously non-transparent domestic business environment. In China, corruption has not been an impediment to growth, despite its pervasive presence within the country. While there are certainly questions about whether Chinese growth could have been higher with greater transparency, and whether the environmental harms of industrialisation have been exacerbated by corruption, no one denies that Chinese industrial growth has been impressive in spite of pervasive corruption. Chinese growth seems to question whether preventing corruption is as universally important as the West makes it out to be.

At the same time, there is a continued criticism that modern ethical standards do not reflect global norms, but rather the intellectual traditions of Western moral theories forced onto the rest of the world. To use a parallel example, many East Asian states began questioning the basis of international human rights documents in the mid 1990’s as being rooted too heavily in a Western, universalist tradition. This developed into the so-called ‘Asian values’ debate over whether ethical standards can be applied to countries with very different ethical traditions and which do not place the same emphasis on universal, objective moral truths, such as transparency.

The Asian values debate was primarily a question of human rights, however the same critique can be applied to the issue of transparency. It seems unreasonable to expect Chinese firms and government agencies operating in Africa to conform to the ethical standards of a third party observer. African companies which are partnered with Chinese firms have their own ethical traditions which may or may not value transparency. This is especially relevant when you consider that Chinese firms operating in Africa continue the same business practices which they pursue domestically, rather than conforming to international norms.[7] It is problematic to argue that these companies ought to abide by a different set of transparency norms when operating internationally and that these norms should be derived from a Western ethical tradition, rather than acting in the same manner that they are used to within China. What complicates this position further is that there is no internationally agreed guidelines for transparency in international aid packages, in the same way that there are agreed human rights guidelines for example. While there are some guidelines for the management of export credits these are largely industry-led and, as discussed earlier, have not been endorsed by Chinese export credit agencies or the Chinese government.

The answer to this challenge lies in the same analysis already provided for the ethical value of transparency in general. While there is certainly some value in the objection on the basis of “Asian values”, these cannot be used to justify corruption. If we treat transparency as a means to ensure ethical outcomes, then there is no cultural reason not to be committed to transparency. Every ethical tradition agrees that economic development in impoverished states is good. The assurance that transparency offers has cross-cultural value. There is no reason to assume that different countries, even those that have seen impressive economic growth coupled with high levels of corruption, should not conduct transparent financial lending.

Likewise, it is possible to argue that some ethical traditions are not specifically Western ethical constructions. Utilitarianism, as a consequence-based moral theory is not grounded in any specific ethical tradition, but rather can be applied within any culture that values human reason. Similarly, just because the ethical theories applied in this article are drawn from a Western philosophical tradition does not mean they lack universality. For these reasons, transparency still has ethical weight, even in situations like the case of Chinese investments in Africa, where the actors involved have their own ethical traditions.

Conclusion

Chinese export credit in Africa challenges many commonly held beliefs about how aid ought to be distributed. The transparency example throws up two key ethical questions analysed here; the ethical value of transparency itself and whether these values can be applied across different cultural settings. There is a strong case to be made that these projects should be seen within a specific cultural setting and judged solely by the good that they create, a case which would vindicate the current investment strategies of the Chinese government. However, arguments for cultural relativity should not be used to shield potentially corrupt financial agreements in an international setting, nor can the good that comes from these projects justify the manner with which it is achieved. By treating transparency as an assurance of ethical outcomes, it is possible to justify the value transparency brings to international development financing and in turn show how the status quo of Chinese investment is failing to guarantee the best ethical outcomes.

Bibliography

Alden, Chris (2007) China in Africa Zed books, London

Broadman, Harry G. (2007) Africa’s Silk Road, China and India’s new Economic Frontier World Bank, Washington D.C.

Business Ethics Perspectives on the Practice of Theory edited by Christopher Cowton and Roger Crisp (1998) Oxford University Press

Butterfield, William, Chen, Chuan, Foster, Vivien and Pushak, Nataliya (2009) “Building Bridges China’s Growing Role as Infrastructure Financier for Sub-Saharan Africa” Trends and Policy Options No. 5 World Bank, Washington DC.

Carmody, Pádraig ; Taylor, Ian (2010) ‘Flexigemony and Force in China’s Resource Diplomacy in Africa: Sudan and Zambia Compared’ Geopolitics, Vol.15(3), p.496-515

China Returns to Africa: A Rising Power and a Continent Embrace edited by: Alden, Chris, Large, Daniel and Soares De Oliveira, Ricardo (2008) Hurst and Company, London

Corkin, Lucy (2012) ‘Chinese construction companies in Angola: A local linkages perspective’ Resources Policy, Vol.37(4), pp.475-48

Corkin, Lucy (2011) ‘Redefining Foreign Policy Impulses toward Africa: The Roles of the MFA, the MOFCOM and China Exim Bank’ Journal of Current Chinese Affairs, 40, 4, pg. 61-90.

De George, Richard (2006) Business Ethics, Sixth Edition, Pearson

DesJardins, Joseph R. and McCall John J. (2005) Contemporary Issues in Business Ethics, Fifth Edition, Thompson Wadsworth

Jacoby, Ulrich (2007) “Getting together: the new partnership between China and Africa for aid and trade” Finance & Development. 44.2 p34

Lawson, Roxanne (2007) ‘Quid Pro Quo? Chinas Investment-for-Resource Swaps in Africa’ Development, 50, 3, 63-68(6)

Raine, Sarah (2009) China’s African Challenges International Institute for Strategic Studies, London

Turilli, Matteo ; Floridi, Luciano (2009) ‘The ethics of information transparency’ Ethics and Information Technology, Vol.11(2), pp.105-112

[1] See Alden (2007) for more on FOCAC’s role in Sino-African relations

[2] Carmody (2010) provides a fuller analysis of the factors underpinning China’s engagement with Authoritarian African states, specifically Sudan.

[3] This number has been growing at an almost exponential rate. See Corkin (2011) page 70, for a graph illustrating this growth.

[4] These figures were drawn from the China State Council information Office and the Vice President of China’s Export-Import Bank respectively and reflect total lending to Africa in 2010 (Corkin 2011, pages 68-69)

[5] De George (2006) pg. 70-71

[6] A fuller account of Kantian thought can be found here https://sevenpillarsinstitute.org/morality-101/kantian-duty-based-deontological-ethics?doing_wp_cron=1389326326.4283580780029296875000

[7] See Corkin (2012) for more on how Chinese firms have replicated a domestic business model in African markets.