Trade Adjustment Assistance and Game Theory

By: Kolbe Murray

Free trade gets a bad rap these days in stark contrast to 2001 when President George W. Bush said “Open trade is not just an economic opportunity, it is a moral imperative.”

Open or free trade is an ethical issue because it involves the freedom to use property as individuals see fit. Locke first made a case for property rights in “Of Property”. Locke states that working on an object from its natural state infuses property ownership into that object.

In simple terms, if Albert in America buys apples from Bob in Bosnia, can Eugene in America ethically enact any form of protectionism, thereby increasing the price of apples for Albert?

No, the trade does not affect Eugene’s property and therefore, he cannot stop other individuals engaging in consenting contracts. Otherwise, where would the logic stop? Should protectionism be imposed between states? Cities? Taken to the extreme, protectionism leads to individual subsistence living.

Negative Effects of Free Trade

But is this example an accurate simplification? We do not live in a world of zero externalities. While we should not be angry that someone else has gained a job, we must also consider the impact of free trade on individuals and communities in America. From an ethical perspective, we must value each human life equally. Thomas Jefferson’s famous line “All men are created equal” can be applied to humans in every country. A Mexican gaining a job is equivalent to an American gaining a job.

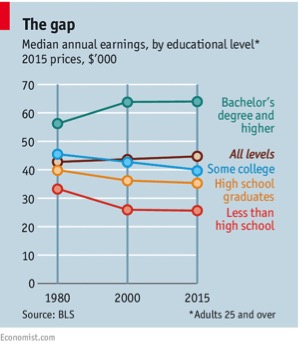

Some argue open trade has led to a rise in inequality, particularly for people with the lowest skills. Nicholas Birdsong elaborates on the consequences of inequality, with the upshot being inequality leads to an increase in crime, political inequality, decreases in health and education, and slower economic growth.

Source: The Economist

It seems unfair to ask some Americans to bear the acute consequences of globalism. The practice of free trade leads to greater inequality because capital and intellectual goods can easily move between markets, while physical goods cannot move as easily between markets. Free trade creates more total wealth, and as a whole we are better off than with no trade. But, some individuals in society actually fare worse because they must compete against more people.

One solution to the inequality problem is the free flow of labor. If Mexico is having a huge jobs boom, then Americans could simply move to Mexico to compete for these jobs. This type of behavior has worked within the US. Residents in Kansas can move to other states with few legal barriers and relatively low cultural barriers. The EU recognizes the importance of freedom of labor movement and this principal is one of its essential economic freedoms. However, both the US states and EU countries have shared histories and languages. It is unreasonable to expect Americans to move to developing and emerging economies, such as Brazil, Russia, India, and China, to compete for jobs because of the huge monetary costs as well as the social cost of uprooting families. Therefore, the free flow of labor is only a partial solution to addressing inequality caused by free trade.

Applying Game Theory to Trade

Using game theory, we observe that continued displacement of American workers leads to protectionism. When an outsourcing deal is agreed upon, there are three players: the company, potential employees, and current employees. In order for an outsourcing deal to occur the company and potential employees must agree on a mutually beneficial agreement. The current employees are affected by the terms of the negotiation, but they do not play a role in setting the terms.

Company owners, management, and new employees must come to agreeable terms on the cost of wages in the new location. Those costs are set by what the consumer is willing to pay. Current employees are bound and affected by the terms, but are not part of the negotiations.

Owners and management must arrive at a deal mutually beneficial to the company and to the new employees. The new employees will not agree to work for the company if their time is better rewarded elsewhere. Conversely, the company will not hire the employees if they receive more value elsewhere.

Current employees are not part of the negotiation process, but the result of the negotiation process affects them. These individuals therefore, have an incentive to prevent negotiations by pushing for tariffs and other forms of protectionism. Blocked trade means resources are being used less efficiently and those potential new employees are prevented from opportunities to better their lives.

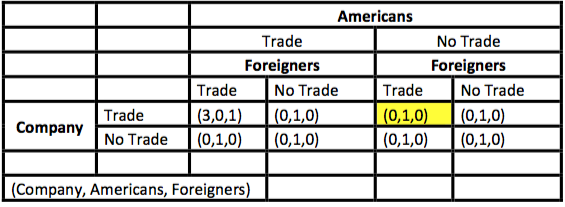

The following chart illustrates how the gains of trade are distributed with the yellow box being the Nash equilibrium. The Nash equilibrium is the state where no player can improve his outcome by changing his strategy on his own. The numbers in the chart represent utility gained from one of two strategies: trade or no trade. The first number is the utility gained by the company, the second number the utility gained by Americans, the third number the utility gained by foreigners.

Gains from trade and the Nash Equilibrium

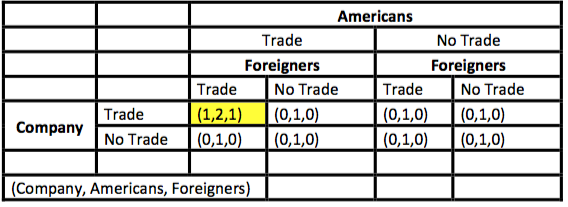

As illustrated above, continued games of open trade will lead to blocked trade. As a solution, I propose that we move two units of utility from the company to those who lose jobs. In this way a Nash equilibrium will arrive at the greatest utility of 4 instead of 1.

Nash Equilibrium with Trade Adjustment Assistance

Trade Adjustment Assistance

The U.S.’s trade adjustment assistance (TAA) is one potential solution for addressing the problem of the unequal distribution of gains and losses from trade.

Trade adjustment assistance appeals to our sense of compensatory and distributive justice and is similar to the concept of alimony in divorce. Workers sacrifice other more stable opportunities to work for a firm. In many cases, workers are led to believe their current job is stable and there are no risks of the firm relocating to lower cost manufacturing countries. The illusion of job stability could be caused by deceptive practices, or simply because change is inevitable and circumstances change.

A study by Mathematica Policy Research Inc. on trade adjustment assistance concluded: “Without considering the benefits of TAA stemming from the possibility that it promotes free trade, the net benefits of the TAA program as operated under the 2002 amendments were negative, whether calculated from the perspective of society as a whole, participants, or other members of society. However, if TAA made even a relatively modest contribution to the ease of enacting free-trade policies, the program’s benefits would outweigh its costs.” (emphasis added)

In 2015, 47,335 workers received trade adjusted assistance and $659 million was apportioned to the program.

The USITC report projects that U.S. annual real income would increase by 0.23% ($57.3 billion) by 2032 (), or over 80 times the trade adjustment assistance budget.

In 2013 the European Commission estimated an increase of 0.4% (€95 billion or roughly $70 billion) in U.S. GDP, or over 100 times the size of the trade adjustment assistance budget.

A possible reform measure would be only give the workers cash and let them decide if training is the best use of their time. The important factor is to attach the benefits of trade to the people that lose their jobs, so we achieve the Nash equilibrium.

Another solution is including current employees in negotiations when a company outsources. Since international trade affects employees in ways besides solely through outsourcing, it might also be advisable to give employees a larger presence on corporate boards and other governance positions.

From a utilitarianism perspective trade adjustment assistance achieves more utility than protectionism and splits the utility in a more equitable manner than trade without trade adjustment assistance. From a Kantian framework, trade adjustment assistance promotes the treatment of persons as ends rather than means. When designed properly, trade adjustment assistance would be an ethical way to create a win-win-win situation for companies, old and new employees, and consumers.

-x-