Ethics and Trickle-Down Economics: A Case Study of Kansas

By: Daniel Moritz-Rabson

On June 16, 2015, Kansas Governor Sam Brownback signed two bills, enacting significant increases in the sales and cigarette taxes in an attempt to cover the $400 million budget deficit for the fiscal year July 1, 2015[i]. Legislative agreement to pass these bills came after the longest Congressional session in state history of 113 days, following a lengthy period of disagreement[ii]. In a state experiencing budget shortfalls and financial issues because of tax cuts advocated by Governor Brownback and the Republican State Legislature, the decision to increase taxes represents an unusual about face from lawmakers occurring because of Kansas’ dire economic situation.

After taking office in 2011, Governor Brownback started implementing a supply-side driven tax policy in an attempt to prove to the nation the superior efficacy of trickle-down economics. Despite receiving guidance from Arthur Laffer, recognized as the founder of Reagan era tax policies still championed by Republicans nationwide, Governor Brownback’s massive cuts to income taxes resulted in significant revenue losses for the state. The state’s economic policies have elicited national attention due to its spending cuts and their negative impact on Kansans. Through a consequentialist analysis of the actual, rather than projected, results of Governor Brownback’s tax policies, this article considers the ethics of both a specific case of failed application of trickle down economics and of the ideology in general.

Summary of the Brownback Tax Policy

Although a variety of figures assist in a complete analysis of the effects of the Brownback tax policy, a few main statistics, listed below, provide a basic understanding of the extent of the cuts implemented and their subsequent impact.

Income Tax:

- In 2012, the legislature passed bills cutting individual taxes by 25 percent[iii].

- This legislation divides Kansans into two categories: those earning above $30,000 annual income and those earning below this amount. For those above the $30,000 threshold, the new rate dropped to 4.9 percent, while for those making less than $30,000 a year, it decreased from 3.5 percent to 3.0 percent[iv].

- Again in 2013, Congress approved legislation to further reduce income taxes, albeit over a more extended period. This legislation gradually lowers tax rates until 2018, decreasing for the higher income bracket from the pre-Brownback rate of 6.45 percent to 3.9 percent, and from 3.5 percent to 2.3 percent for those with earning less than $30,000 annually.

- The two rounds of cuts completely eliminated taxes on non-wage income for 191,000 businesses[v].

Sales Tax:

- Although the tax cuts applied to members of all tax groups, the elimination of tax credits for low-income individuals included in the legislation actually increased the overall payment per year for the least wealthy members of society[vi].

- In July 2013, the state sales tax dropped from 6.3 percent to 6.15 percent, an amendment to the previously approved 5.7 percent[vii].

- In June 2015, sales tax increased from 6.15 percent to 6.5 percent, and cigarette taxes rose by 50 cents per pack.

Effects:

- Before the implementation of the first tax cuts, projections predicted losses of at least $4.5 billion over six years.

- Kansas lost an estimated $803 million in revenue in one year because of the 2012 cuts[viii].

- For the fourth quarter of 2013, while most states demonstrated an average 2 percent increase in tax revenue, Kansas’ declined 9.2 percent[ix].

- In the year between June 2013 and 2014, overall tax revenue decreased 11 percent[x].

- During the same period, income tax revenues declined by 20 percent, from $3.3 billion to $2.6 billion.

- Under Brownback, individuals in the bottom 20 percent of Kansas society witnessed overall tax increases, while those in the top 20 percent now pay less[xi].

- Along with the gradual decrease in taxes, spending is expected to similarly slow during the five-year period, averaging 2.6 percent annually[xii].

- Thus far, the tax cuts have caused an approximately 8 percent loss in Kansas’ general fund revenues, a number set to increase to at least 16 percent unless changes occur[xiii].

- These cuts decreased school spending to a level registering 16.5 percent below pre-recession levels as of last fall[xiv].

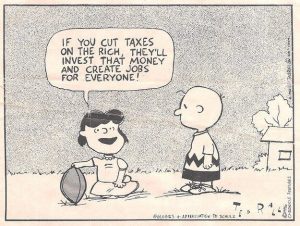

Trickle-Down Economics

While, economically, Democratic candidates and voters generally support a certain amount of progressive taxation to more equitably redistribute wealth and fund public services, trickle-down economic strategies are representative of Republican ideology[xv]. Supply-side economic policies seek to provide tax breaks for large businesses and wealthy individuals[xvi]. Opponents of trickle-down theory consider it an unfair economic policy that benefits the rich, enabling them to exponentially increase their wealth while harming the average worker. Proponents of this type of policy believe tax cuts stimulate the economy and by encouraging, rather than taxing success, the government catalyzes growth. The theory relies on the supposition that with the greater profit, businesses hire more workers, expand their services, and raise wages, thereby leading to overall economic growth that balances out the monetary losses created by tax cuts[xvii]. Conversely, these proponents argue, progressive taxation discourages economic growth since it lowers incentive for high performance and even punishes success by taking away earnings. Further, Republican lawmakers often seek to decrease the amount of government interference in big business. This stance connects their push for supply-side economic policies to their broader ideological views.

The data on successful tax policies provide support for the liberal stance on the issue. Even under the assumption that government meddles in business more than voters and politicians would like, tax cuts to the wealthy simply fail[xviii] to provide as much revenue to the state or nation. If implemented correctly, wealthier individuals gain economically and job growth increases, but the government still loses revenue to fund public services, thus disproportionately affecting the lower economic classes.

Political Climate in Kansas

On November 2, 2010, Kansans enthusiastically ushered conservative Sam Brownback into gubernatorial office with a vote of 63.3 percent[xix]. Campaigning with promises to cut taxes, decrease the size of government, and increase job growth, Brownback appealed to the typically Republican Kansas voters who voted for both John McCain[xx] and Mitt Romney.[xxi] But in the 2010 election, Brownback gained something much more important for the realization of his plans: Republican majorities in the state House and Senate.

Brownback hoped, through the success of his tax plan, to rise to the position of a national star as a Republican icon of supply-side success, potentially enabling him to run for president[xxii]. He needed radical success with growth outpacing that of other states and directly attributable to him. These objectives required significant change to policies. Accordingly, once elected, Brownback urged Congress to implement tax policies consistent with the economic restructuring promised during his campaign, pledging in 2012 that the success of his ‘“real life experiment’ would prove, once and for all, that the way to achieve prosperity was by eliminating government from economic life.[xxiii]” Basing his attempts to stimulate job growth and massively expand the Kansas economy on Reagan’s success[xxiv] with these same initiatives, Brownback relied on guidance from Arthur Laffer, Reagan’s economic genius. The new regime would definitively prove to the nation that supply-side economics offered a better means for recovery from the 2008 financial crisis than the solutions supported by Democrats in Washington.

Working with Republican majorities in the state legislature, Brownback possessed the ability to push aggressive policies. While neighboring states with Republican governors created state tax laws to reflect a similar economic ideology, Brownback’s efforts far surpassed anything previously attempted,[xxv] perhaps in part because the lack of resistance from Congress. Brownback prepared for unprecedented success with his policies without considering the risks involved if his policies failed. When the experiment failed to produce the expected results the blame fell directly on the governor. Thus, in 2014, the negative effects of Brownback’s policies on residents across Kansas provoked resistance[xxvi] to his rule in the 2014 gubernatorial race. In a state with a well-documented support of Republican candidates in recent history, the election yielded a tight race, with Brownback’s Democratic challenger earning over 46 percent[xxvii] of votes. The election demonstrated discontent with the actual results of the new economic agenda. Yet despite the significant shift in support levels, the Governor continued along the same path, unyielding and unprepared to concede defeat.

Tax and Spending Cuts Under Brownback

The cuts began with a decrease in taxation rate, with legislation first passed in 2012 focusing particularly on the higher tax brackets. The rate for those with annual incomes greater than $30,000 initially dropped from 6.45 percent to 4.9 percent, and from 3.5 percent to 3.0 percent for those earning less than $30,000[xxviii]. Brownback wished to decrease government involvement in, and funding for, general economic life as much as possible. He sought to shrink the size of government support programs, thus enabling the private sector to step in and provide all the services cut and compressed by his new agenda. In addition to lowering income and sales tax rates and slashing spending for government job-creation programs, he also simultaneously cut funding from established programs directly unrelated to the supposed increase in employment resulting from his policies drastically. While initially eliminating 2,000 state jobs, he combined certain state agencies to reduce expenditures—or completely dissolved others he considered superfluous, such as the Kansas Art Commission[xxix]—and (predictably) denied federal Medicaid funding, instead deciding to privatize health care. Despite noting the reconfiguration of the economy needed time to begin functioning, he started dissolving and diminishing public programs needed by those unable to afford expensive private alternatives before they received any additional money. He ordered state agencies to reduce costs by 10 percent[xxx]. The results of the cuts clearly indicated the program needed more time to function, as predicted. According to data from the first year of Brownback’s tax overhaul, Kansas lost almost $688 million in revenue, a nearly 11 percent decline from the previous year[xxxi].

Despite the evident failure of the preliminary measures, Brownback pushed forward with his agenda, cutting income taxes further and, to compensate for the lost revenue, slashing funding again. In 2013, Brownback approved legislation lowering the income tax from 4.9 to 3.9 percent for the upper tax brackets by 2018, while dropping rates for the lower-level earners from 3.0 to 2.3 percent over the same period. After already decreasing state expenditures because of the revenue shortfall generated by the first round of legislation, in 2014 Brownback cut spending for state agencies four percent[xxxii] further, demanding they allocate money more efficiently. Rationalizing these general measures as a motivation for each agency to eliminate unnecessary costs, Brownback simultaneously began further slashing funds for programs he considered least important. Most notably, he focused on the Public Employees Retirement System, the Department for Aging and Disability Services, the Department for Children and Families, and the Department of Education, with the first agency witnessing the most cuts with a nearly $40.7 million dollar decrease [xxxiii].

These cuts to state spending and tax rates, while yielding unfortunate results for the citizens, only represented the beginning of the decline of economic order in Kansas. Brownback refused to make concessions, with his efforts particularly affecting education. In all, expenditures on education dropped about half a billion dollars during Brownback’s incumbency[xxxiv].

Although the education spending in many states still hovers below the rate prior to the recession, Kansas remains an exceptionally underfunded outlier, with, as of last fall, funding approximately 16.5 percent below pre-recession levels.

During the Great Recession, 34 states implemented certain cuts to K-12 education, portrayed at the time as unavoidable given the economic circumstances. But while these states started increasing spending as the economy yielded more favorable conditions, Kansas continued decreasing education funding, even though the initial cuts in this state were particularly harsh, at 14 percent per student. Although the education spending in many states still hovers below the rate prior to the recession, Kansas remains an exceptionally underfunded outlier, with, as of last fall, funding approximately 16.5 percent below pre-recession levels. [xxxv]As a result of the slashing of the education budget, schools rapidly appeared more underfunded, less equipped to suitably teach the students, and lacking of basic materials. Although class sizes have increased since 2009, growing by 19,000[xxxvi] students, 665 teachers lost their jobs, and extracurricular programs rapidly disappeared[xxxvii]. To further compensate for the losses, legislators began raising tuition for higher education, increasing yearly fees by 20 percent since 2008 and eight percent since just 2012[xxxviii].

In fact, the condition of public funding deteriorated so much that in 2013, “a three-judge panel determined that the Kansas Legislature violated its constitutional duty to provide suitable funding for public schools.” [xxxix] While the state responded by increasing funds, legislators sought to spend as little as possible in the process, only altering policy enough to satisfy the bare requirements set forth during by the panel. Accordingly, the bill passed to address the judicial findings did not meet the needs of students in Kansas’ public school system, especially considering the drastic cuts that occurred at the beginning of Brownback’s term[xl]. Somehow, while fulfilling the conditions required by the ruling, the legislation actually managed to damage public education in Kansas further by “[eliminating] tenure for teachers, [reducing] services for at-risk students, [allowing] people without teaching degrees to teach math and science, and [offering] a tax credit to any business offering a scholarship to a private school.”[xli]

While perhaps most blatantly obvious in terms of education, the comprehensive spending cuts ravaged various other public services as well. For local health departments, funds dropped 14 percent below the pre-recession amount; for Temporary Assistance for Needy Families, a poverty alleviation agency, the budget declined by 41[xlii] percent from 2012 levels, with other programs seeking to help those with financial struggles undergoing significant cuts as well; for the courts, battling political threats from Brownback and his Republican colleagues, new legislation actually threatens[xliii] to defund the judicial branch of government if justices choose to strike down a bill which challenges judicial autonomy, considered retaliation for the aforementioned education ruling. But even before this new provision, the budget for the courts decreased significantly. Whether health care or welfare, libraries or schools, Brownback’s economic policies affect services utilizing tax-generated revenue to fund public programs.

Levying new taxes

…despite the cuts to income taxes, the poorest 20 percent of Kansans now pay about 1.5 percent more per year in taxes than in 2012 while the wealthiest 1 percent will pay almost 2 percent less annually.

In order to make up for the massive losses in revenue accompanying the effort to eliminate the income tax, Brownback, still forging onward with his predetermined agenda, realized the need to somehow bolster state funds. Despite his declared opposition to taxes in general, after days of lobbying, he recently convinced Congress to increase certain rates. But, rather than targeting those with the most wealth because of their relative surplus, these new taxes primarily affect the average American. On June 16, 2015, Brownback ratified two bills disproportionately harmful to those in lower brackets, one that increases the sales tax from 6.15 percent to 6.5 percent, and the other a cigarette tax increase of 50 cents per pack[xliv]. The ideology behind a progressive income tax is that those with more income, after paying for their basic necessities, have more leftover than those earning less. Accordingly, paying a higher rate affects high earners less in terms of actual impact. But with the flat sales tax levied to compensate for losses deriving from a decreased income tax, those earning less suffer more, since a larger portion of their income pays for living expenses, now taxed at a higher rate. In fact, an analysis[xlv] published the same day Brownback signed the recent legislation revealed that, despite the cuts to income taxes, the poorest 20 percent of Kansans now pay about 1.5 percent more per year in taxes than in 2012 while the wealthiest 1 percent will pay almost 2 percent less annually.

Slow Job Growth

…average US growth rates as of last year…surpassed those in Kansas.

Under Reagan, job growth increased significantly as a result of the application of supply-side economics. Brownback promised similar economic growth as a product of his economic policies. Unfortunately, the expansion experienced by Reagan eluded Brownback. In fact, job growth in Kansas lagged in relation to the expansion occurring in surrounding states as they rebuilt and recovered from the economic crisis[xlvi]. Despite promising signs[xlvii] lately from the private sector, the expected economic expansion never materialized, and those left unemployed or with less income as a result of Brownback’s measures still fail to see the promised benefits of such policies, especially when considering average US growth rates[xlviii] as of last year, which surpassed those in Kansas. Additionally, just recently, despite yearly job growth, a report noted that Kansas actually lost 3,800 jobs between April and May of 2015, further adding to the negative legacy of Brownback’s implementations[xlix].

Social Contract Theory

According to Thomas Hobbes, the foremost thinker of social contract theory in its modern form[l], each individual is conceived into a vicious world naturally defined by savagery and governed only by the desire to survive. In this environment, there exists no right and wrong, no morality and injustice[li]. Hobbes viewed this so-called natural state as an unfortunate predecessor to society which all people seek to escape, for under these conditions, one lives in constant fear, perpetually consumed by the harsh reality of a world without guidelines for conduct between individuals. However, benefits accompany such a life, for in this state of nature, in which no moral rules, spiritual guidelines, or legal mandates bind a person to a set of principles with which she disagrees, each person possesses the capability to live as she pleases, independently dictating the code by which to survive as well as possible. But when one leaves this state by entering into civil society, she forfeits the theoretically unlimited freedom which characterizes existence without social contracts.

And yet, for Hobbes, despite this significant loss of freedom accompanying the entrance into civil society, exiting the lawless terror of the natural state presents a distinctly desirable option[lii]. The logic behind this stance postulates that by entering into a society regulated by established norms, while surrendering unregulated autonomy, one ostensibly gains more than one loses, thus rendering the sacrifice beneficial. The theories presented by major social contract thinkers such as Hobbes, John Locke, and Jean-Jacques Rousseau, despite notable variations, revolve around the same premise. Hobbes succinctly summarizes the underlying idea with the declaration that when “a man be willing, when others are so too, as far forth as for peace and [defense] of himself he shall think it necessary, to lay down this right to all things; and be contented with so much liberty against other men as he would allow other men against himself,” a beneficial and functioning is formed. But in order for this willful acceptance of such barriers to completely independent action to remain plausible and prevent the crumbling of civil society, individuals must perceive a benefit worthy of the sacrifice of their freedom. Following this logic—although it remains a largely unrealistic situation in the modern world—without receiving the impression that such benefits exist, individuals may plausibly reject the restrictions of the state and choose to reenter lawless society.

Analysis of Brownback’s Tax Policies Using Social Contract Theory

Social contract theory naturally complements the ideals of democratic government, for both seek, at least in definition, to provide the most benefit for the greatest amount of people. While the aforementioned theorists drafted and published their postulations about the benefits of civil society centuries ago, their concepts remain no less important today. Indeed, some of the arguments presented by Locke, such as his recurring defense of the right of each individual to own—and societal regulations to protect—“life, health, liberty, or possessions[liii]” appear more relevant to the contemporary world than to the society in which Locke lived[liv].

The legitimization of an elected official’s governance derives from the people. Since election for office requires a candidate to obtain a majority of votes, the people validate each individual’s rule. Accordingly, officials maintain a duty to serve the people who supported their occupation of office. This ideology coincides with the premises of social contract theory, for if government representatives promote policies that fail to serve society, instead harming the majority of citizens, the agreements holding citizens together begin to unravel as only certain select individuals gain benefits from a communal sacrifice.

In Kansas, Sam Brownback has promoted policies that benefit the wealthy elite at the expense of the rest of society. After guaranteeing widespread positive results, his agenda yielded negative outcomes. Despite recent improvements, for most of his time in office, job growth lagged behind the national average. The offerings of public services in society’s most important areas such as healthcare and education rapidly deteriorated. With 90 percent[lv] of students attending public schools, he slashed basic education funding again and again. He decreased the budgets across state agencies, instead prioritizing the private sector. But while these decisions yielded more yearly earnings for those with the highest incomes, they provided little benefit for the vast majority of Kansans.

The results of Brownback’s program have been shockingly evident, but not in the way he wanted. By sacrificing the welfare of the many, including those in poverty, for unnecessary benefits for the wealthy, Brownback violated his duty as governor to adhere to the underlying principles of social contract theory by providing for citizens. Straying from his responsibility to serve the people, he hardly acted in a way that showed a desire to preserve the public interest, as demonstrated by the statistics presented in the preceding sections. Rather than gaining from their loss of personal freedom and sacrifice of public services, most in Kansas lost in a material manner from Brownback’s agenda. Indeed, it is hard to point to the ways in which the rich have forsaken any rights to benefit those in need, both now and in 2011. But those earning the least annual income in fact currently pay more in taxes than when Brownback took office and receive fewer services. The refusal to reconsider his policies in light of their failures and obviously undesirable impact upon society indicates a departure from the foundation of the society outlined by Hobbes. Accordingly, Brownback’s clear violation of the tenets of social contract theory while in a position of unparalleled power renders his actions immoral.

A Consequentialist Analysis of Brownback’s Tax Policies

According to the philosophical theory of consequentialism[lvi], an action can be deemed moral or immoral, right or wrong, not by the intentions of the individual carrying out the action but by the actual results and consequences of the event. Evaluating the morality of the tax agenda implemented by Brownback with a consequentialist analysis yields a similar conclusion to that reached in the previous section, as such an approach reveals that these policies hardly fit in a supposedly Democratic society since they sacrifice the welfare of greater public for the unnecessary improvement of the elite few. Brownback’s policies implicitly ask how a policy that utilizes the limited income of those with less wealth to benefit those without a demonstrated need for any material support can be considered moral. Even proceeding under the assumption that Brownback truly sought to improve the financial status of each Kansas citizen, not only the wealthiest section of society through his tax reforms, his legislative efforts still fail to stand up to a consequentialist analysis as moral.

The cuts to public funding, seemingly originally a part of Brownback’s plan, yet a trend certainly exacerbated by the shortfalls of the expected revenue, further render the policies indefensible when considered through a consequentialist framework. Particularly in terms of, but not at all limited to, the area of education, the cuts sacrifice basic public services to add to the wealth of the rich. In a country in which the wealthiest one percent receives over 20[lvii] percent of the nation’s income, and in which that same tiny subsection of society owns 42 percent of the national wealth, policies that sacrifice basic services to increase the fortune of those in the the upper income bracket are simply misplaced and immoral. By diminishing the public services available, Brownback blatantly widens the gap between the rich and the poor, further entrenching the position of the elite. Rather than improving the ability of Americans from all backgrounds to work hard and elevate themselves to a higher social position, the recent tax policies repress the upward mobility of those except the wealthy, cutting out the most fundamental aspect of national progression: education.

Brownback’s efforts appear not only shortsighted; when considering their actual effects and his increasingly tenacious persistence in keeping them in place, they seem openly bigoted. Had the policies eliminating government from economic life proven successful—providing returns to both the taxpayer and the state—after enough time for them to mature and truly start functioning as planned, their implications would differ drastically. Similarly, if Brownback changed his agenda after realizing its lack of success, he would have demonstrated a genuine desire to benefit the overall population. However, Brownback’s complete disregard for his agenda’s detrimental effects on the average Kansas citizen implies that he simply holds the uncompromising view that the richest members of society attained their status for a reason, and those struggling to pay their bills similarly stay at an inferior societal level for a reason. He fails to realize that the reason, rather than deriving from some sort of inferiority of those in the lower classes, is precisely because of policies, such as his, that create barriers to economic success by crushing public programs enabling social upward movement. Thus, the consequentialist analysis provides a clear answer when considering whether Brownback’s actions possess any defense when scrutinized through this lens. As governor, Brownback must represent the people. Yet while claiming the presence—or future materialization—of nonexistent benefits deriving from his efforts, job growth lagged behind the national average, necessary services disappeared, and annual costs for the least wealthy individuals rose while only the rich benefitted. Considering these results, Brownback’s actions clearly fail a consequentialist evaluation and are thus immoral.

Conclusion

Sam Brownback started out with the aim to prove to those who doubted him within his state—and those who scoffed at the efficacy of trickle-down economics across America—completely wrong. Brownback’s promised effects, as of July 2015, failed to appear. His agenda hardly represents an anomalous attempt by a Republican governor to prove the efficacy of supply-side economics. But he pushed the ideology to its limit—in terms of both severity and persistence—rendering his failure particularly striking. His relentless promotion of a system whose success remains only as an elusive, almost mythical reality in Kansas represents a valiant effort to defend an economic theory that comprises an integral component of modern conservatism. But its damaging effects on Kansas’s society render his continued pursuit of this agenda unethical.

Perhaps Brownback truly sought to improve the welfare of citizens throughout Kansas. And perhaps he genuinely still believes that the best model for personal economic success derives from the promotion of the private sector and the downsizing of governmental assistance. Regardless of his true beliefs, Brownback, like others promoting supply-side economics, either ignore or disregard the simple reality that through tax cuts, a state inevitably creates a deficit. This deficit affects those utilizing public services, who, regardless of potentially-increased personal income levels, are now offered less assistance because of necessary budget cuts. As summarized by a Forbes writer, “one can argue whether cutting taxes is a good thing. One can argue about whether government is too big. One can even argue about whether low taxes increase business activity. But one cannot credibly argue that tax cuts increase revenue or even pay for themselves. They didn’t for Ronald Reagan. They don’t for Sam Brownback. [And] they won’t for the next politician who tries.”[lviii]

-x-

[i] Eligon, John. “Gridlock Over Deficit Is Broken in Kansas.” The New York Times. The New York Times, 12 June 2015. Web. 04 July 2015.

[ii] Ibid.

[iii] Gleckman, Howard. “What’s The Matter With Kansas And Its Tax Cuts? It Can’t Do Math.” Forbes. Forbes Magazine, 15 July 2014. Web. 04 July 2015.

[iv] Leachman, Michael, and Chris Mai. “Lessons for Other States from Kansas’ Massive Tax Cuts.” Center on Budget and Policy Priorities. N.p., 27 Mar. 2014. Web. 4 July 2015.

[v] Bade, Rachael. “GOP Learns Lessons from Sam Brownback’s Tax Scare.” POLITICO. N.p., 26 Dec. 2014. Web. 07 July 2015.

[vi] Ibid 4.

[vii] Celock, John. “Kansas Legislature Approves Higher Sales Tax, Lower Income Tax After Contentious Debate.” The Huffington Post. TheHuffingtonPost.com, 2 June 2013. Web. 04 July 2015.

[viii] Ibid 4.

[ix] Ibid 4.

[x] Gleckman, Howard. “What’s The Matter With Kansas And Its Tax Cuts? It Can’t Do Math.” Forbes. Forbes Magazine, 15 July 2014. Web. 04 July 2015.

[xi] Davis, Carl et. al. “Who Pays? A Distributional Analysis of the Tax Systems in All 50 States.” The Institute on Taxation and Economic Policy 5 (1997): n. pag. The Institute on Taxation and Economic Policy. Jan. 2015. Web. 5 July 2015.

[xii] Francis, Norton. “Kansas Sets the Stage for a Perpetual Budget Crisis.” TaxVox. Christian Science Monitor, 10 June 2013. Web. 04 July 2015.

[xiii] Ibid 4.

[xiv] Ventello, Gregg Primo. “Brownbackistan.” Thought & Action (2014): 75-82. Web. 24 June 2015

[xv] “Supply-Side Economics.” Laffer Center RSS. Pacific Research Institute, 10 Mar. 2011. Web. 04 July 2015.

[xvi] “Trickle Down Theory.” Investopedia. N.p., 25 Nov. 2003. Web. 24 June 2015.

[xvii] Rossman, Matthew J.1. Brooklyn Law Review 79.4 (2014): 1455-521. Web.

[xviii] Ibid 10.

[xix] “Election 2010.” New York Times. New York Times, n.d. Web. 24 June 2015.

[xx] “Kansas.” Election Results 2008. New York Times, n.d. Web. 24 June 2015.

[xxi] “2012 Kansas Presidential Results.” POLITICO. N.p., n.d. Web. 24 June 2015.

[xxii] Cooper, Brad. “Brownback Terminates Presidential Campaign.” The Kansas City Star. N.p., 15 Oct. 2015. Web. 05 July 2015.

[xxiii] Judis, John B. “What’s the Matter with Utopias?” New Republic 245.17 (2014): 12-17. Web. 24 June 2015.

[xxiv] Ferrera, Peter. “Reaganomics Vs. Obamanomics: Facts And Figures.” Forbes. Forbes Magazine, 5 May 2011. Web. 05 July 2015.

[xxv] Levy, Pema. “Trouble in Gop Paradise.” Newsweek Global 163.18 (2014): 12-17. Web. 24 June 2015.

[xxvi] “Kansas Election Results.” New York Times. New York Times, n.d. Web. 05 July 2015.

[xxvii] Ibid.

[xxviii] Ibid 4.

[xxix] Knight, Christopher. “Kansas Governor Eliminates State’s Arts Funding.” LA Times. N.p., 31 May 2011. Web. 06 July 2015.

[xxx] Celock, John. “Sam Brownback, Kansas Governor, Plans Budget Cuts, Calls For Agencies To Reduce By 10 Percent.” The Huffington Post. TheHuffingtonPost.com, 18 Aug. 2012. Web. 06 July 2015.

[xxxi] Ibid 23

[xxxii] Shorman, Jonathan. “Brownback to Cut State Agency Spending by 4 Percent in Response to Revenue Shortfall.” The Topeka Capital-Journal. N.p., 9 Dec. 2014. Web. 6 July 2015.

[xxxiii] Ibid.

[xxxiv] Ibid 14.

[xxxv] Ibid.

[xxxvi] Jones, Tim. “Brownback Faces Blowback as Kansas Tax Cuts Shutter Classrooms.” Bloomberg.com. Bloomberg, 3 Nov. 2013. Web. 06 July 2015.

[xxxvii] Ibid.

[xxxviii] Ibid 4.

[xxxix] Ibid 14.

[xl] Ibid.

[xli] Ibid.

[xlii] Ibid 4.

[xliii] Stern, Mark Joseph. “Kansas Gov. Sam Brownback Threatens to Defund Judiciary If It Rules Against Him.” Slate. N.p., 8 June 2015. Web. 06 July 2015.

[xliv] Hanna, John. “Kansas Gov. Brownback Says Sales and Cigarette Tax Rises Are Not Tax Increases.” US News. U.S.News & World Report, 16 June 2015. Web. 24 June 2015.

[xlv] Davis, Kelly. “And That’s a Wrap….the Failed Experiment in Kansas Continues.” Tax Justice Blog. Institute on Taxation and Economic Policy, 16 June 2015. Web. 06 July 2015.

[xlvi] Ibid 23.

[xlvii] Sinquefield, Rex. “Early Results Show Income Tax Cuts Making Kansas A More Prosperous State.” Forbes. Forbes Magazine, 2 Apr. 2015. Web. 07 July 2015.

[xlviii] Ingraham, Christopher. “Tax Cuts in Kansas Have Cost the State Money — and Job Creation’s Been Terrible.” Washington Post. The Washington Post, 27 June 2014. Web. 07 July 2015.

[xlix] “Kansas Job Growth.” Department of Numbers. N.p., n.d. Web. 24 June 2015. <http://www.deptofnumbers.com/employment/kansas/>.

[l] D’Agostino, Fred. “Contemporary Approaches to the Social Contract.” Stanford University. Stanford University, 03 Mar. 1996. Web. 22 June 2015.

[li] Hobbes, Thomas. “Of the Natural Condition of Mankind as Concerning Their Felicity and Misery.” Leviathan. London: n.p., 1651. 76-79. Print.

[lii] Hobbes, Thomas. “Of the First and Second Natural Laws, and Of Contracts.” Leviathan. London: n.p., 1651. 79-88. Print.

[liii] Locke, John. Second Treatise of Government. Indianapolis: Hackett, 1980. 9. Print.

[liv] U.S. Voting Rights Timeline.” KQED. PBS, 2004. Web. 23 June 2015. <http://www.kqed.org/assets/pdf/education/digitalmedia/us-voting-rights-timeline.pdf>.

[lv] Ibid 36.

[lvi] “Consequentialism.” Stanford University. Stanford University, 20 May 2003. Web. 24 June 2015.

[lvii] Stiglitz, Joseph. “The Origins of Inequality, and Policies to Contain It.” National Tax Journal 68.2 (2015): 425-48. Web. 25 June 2015.

[lviii] Ibid 10.

Cartoon courtesy of http://www.greekshares.com/supply_side_economics.php