The Accumulation of Greek Debt

Introduction

In December 2009, what would become the Greek debt crisis began as investors and governments voiced concern over Greek deficit levels. The new Socialist government had increased its projected budget deficit to 12.7% from much lower estimates.[1] Over the course of 2010 ratings agencies downgraded Greek debt, and spreads between German bunds and Greek gilts grew ever wider. Aid packages by the IMF and the European Union have thus far failed to stem concerns about Greek debt, which threaten to spill over into a continent-wide crisis. The latest European plans for Greek debt put the nation into selective default, in which private investors holding bonds accept a partial reduction in the value of their holdings.

As the crisis unfolded, the Greek government faced scrutiny on the accrual of its debt, and how they managed to hide fantastic budget deficits from European authorities. The investment bank Goldman Sachs had entered into derivates contracts with the Greek government, which allowed the government to securitize part of its debt in ways that European rules did not require to be reported. Thus Greece could legally fudge its reported debt and deficit figures. This case-study will examine Goldman Sachs’ role in the accumulation of Greek debt, questioning whether the Greek government and the bank acted ethically.

Background

On June 19, 2000, Greece joined the Euro-zone. This meant it adopted the Euro (€) as its national currency, and agreed to abide by the Maastricht rules on debt and deficit ratios. These stipulate that no Euro-zone member may have a debt greater than 60% of its GDP or a budget deficit greater than 3% of it GDP.[2]

However, it is now generally acknowledged that the Greek debt and deficits far exceeded these goals set by the Maastricht treaty. Greek debt was about $131 billion, or 103.7% of GDP in 2001, far above the required 60%. However, the more important deficit ratio was held under 3% through various accounting tricks throughout the early 2000s. Only in late 2009 and early 2010 did it become apparent that Greece’s true budget deficit was about 12% of its GDP.[3] Among these “window dressings” were cross-currency swaps with Goldman Sachs. Although European governments commonly employ such derivates to hedge against changes in currency value, Goldman Sachs and the Greek government negotiated unusual terms that allowed the derivatives to function as a loan from Goldmans to the Greeks.

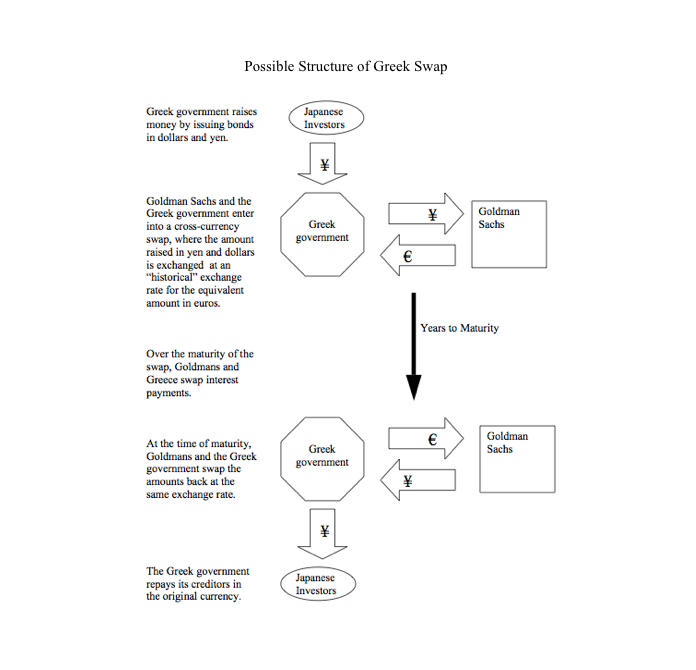

Nations often issue bonds denominated in other currencies to raise money in foreign markets. In the Greek case, its government had issued debt in Dollars ($) and Yen (¥) to tap markets outside of Europe. In similar cases, governments will enter into currency swaps to hedge against exchange rate fluctuations; in most swaps the two parties swap cash flows (the bond coupons) over the maturity of the swap, occasionally exchanging the notional amounts at maturity.[4]

Greece, though, negotiated a non-typical swap with Goldman, which used an “historical implied foreign exchange rate.”[5] In other words, the swap did not use the prevailing rate, but rather one with a weaker Euro, thus allowing Greece to exchange its Yen and Dollars for a greater number of Euros. This favorable exchange rate is estimated to have netted Greece approximately $1 billion at inception.[6] But because Greece would pay this amount back at the end of the swap, it resembled a loan on the part of Goldman Sachs (See figure below). But European accounting rules did not oblige Greece to report this credit as such, allowing its government to take $1 billion off of its balance sheets.[7] Politicians have therefore asserted that Goldman colluded with Greece to hide the true extent of its debt from European authorities and investors, exacerbating Greek debt and helping to spawn the European sovereign debt crisis.

Ethics

The two ethical questions that present themselves in this scenario are whether the Greek government acted ethically by entering into such currency swaps, and if Goldman Sachs acted ethically.

1. The question of whether the Greek government acted ethically is somewhat difficult. It seems reasonable to assert that it did so without great regard for the problems, which large deficits can cause, or international reactions once the swaps with Goldman Sachs became common knowledge. One can argue that by allowing such debt to accumulate, and by adding greater debt through the swaps with Goldman Sachs, the Greek government mortgaged the nation’s future, thus not acting for the greatest ‘good.’ From a utilitarian standpoint, it would seem that the Greek government acted unethically.

However, there exist two problems with this reasoning. The argument sees the Greek government harming primarily its own citizens; yet because of the government’s legitimate, democratic nature it is false to distinguish between the Greek ‘people’ and their government. For all intents and purposes the regime implemented the will of the Greeks. By the same token, one can contend the government’s debt-fueled spending expanded the Greek economy, improving the lives of most Greek citizens. Similarly, there is no way to know how the debt crisis will play out. The crisis might convince future Greek governments of the need for fiscal austerity, making them, in a century’s time, one of the safest debtor nations on the planet. Any utilitarian argument in this case fails to satisfy close inspection.

Regarding the question of hiding the debt from European authorities, it is difficult to successfully argue that this was unethical. The means Greece used to do so were legal (although this does not always imply moral), and, it could be argued, prevented Greece from paying the enormous fines stipulated by the Maastricht treaty for those countries in violation of debt and deficit limits.[8] From this perspective, the government was acting in the best interests of its citizens. And despite the swaps’ role as ‘window dressings’ for Greek book keeping, they primarily acted as a hedge against exchange rate instability. Thus, while it seems as though the Greek regime proceeded recklessly with its debt, one cannot argue that it did so unethically.

2. The question of the ethics of Goldman’s actions requires a bit more nuance. It is easy to condemn Goldman’s actions, as German Chancellor Merkel did when she called its role in Greece’s debt “scandalous.”[9] However, in such a case, where Goldman Sachs functioned as a facilitator for its client – the Greek government – two pieces of information play a key role in determining ethicality: the morality of the object of facilitation; and, if that object were unethical, whether or not the facilitator knew or suspected it to be unethical.

The object of the cross-currency swap was first to hedge against exchange rate oscillations, and secondly to (allegedly) provide a covert loan of $1 billion to the Greek government. Given the discussion in 1. it is clear that this object, which increased Greek indebtedness and hid it from the European Union, was not unethical. Thus Goldman’s actions withstand the higher level of scrutiny mentioned above. It has nowhere been argued that Goldman Sachs acted illegally: “There is no doubt that Goldman Sachs’ deal with Greece was a completely legitimate transaction under Eurostat rules.”[10] Furthermore, the practice of engaging in such swaps was, as mentioned, quite common, and allowed those governments to guarantee their revenues from bond issues in foreign denominations. Given that these swaps were legal and their object not unethical, it need not have been a concern of Goldman Sachs that the swaps allowed Greece to hide debt from the European Union.

Conclusion

We thus find that while the Greek government may have acted unethically in allowing a great debt to amass, Goldman Sachs acted entirely ethically in designing cross-currency swaps tailored to their client’s requirements. While it may be popular to condemn the bank for allowing Greece to keep $1 billion of debt off their books, the swaps were completely legal at the time, and followed European Union procedures. To argue that Goldman acted unethically would be equivalent to arguing that a private tax accountant acts unethically when he or she seeks legal means to decrease his or her client’s tax burden. It may be contended that the Greek government acted recklessly or without great foresight; but intelligence cannot be a stipulation of morality. As for Goldman Sachs, it did not act recklessly, but as a private entity serving a client. Their derivatives did not facilitate the funding of anything illegal or unethical. We thus conclude that Goldman Sachs acted ethically in their sale of cross-currency swaps to the Greek government.

BY SAMUEL CLOWES HUNEKE

[1] “Greece’s budget deficit worse than first thought,” BBC News, April 22, 2010, http://news.bbc.co.uk/2/hi/8637270.stm, accessed August 14, 2011.

[2] Beat Balzli, “How Goldman Sachs helped Greece to Mask its true Debt,” Spiegel Online, February 8, 2010, http://www.spiegel.de/international/europe/0,1518,676634,00.html, accessed July 29, 2011.

[3] Emily Cadman and Rob Mento, “Interactive Timeline: Greek debt crisis,” Financial Times Online, June 16, 2011, http://www.ft.com/intl/cms/s/0/003cbb92-4e2d-11df-b48d-00144feab49a.html#axzz1TWyXd7oL, accessed July 29, 2011.

[4] Nick Dunbar, “Revealed: Goldman Sachs’ mega-deal for Greece,” Risk.net, July 1, 2003, http://www.risk.net/risk-magazine/feature/1498135/revealed-goldman-sachs-mega-deal-greece, accessed August 14, 2011.

[5] “Goldman Sachs Transactions with Greece,” Goldman Sachs Viewpoints, February 21, 2010, http://www2.goldmansachs.com/our-firm/on-the-issues/viewpoint/viewpoint-articles/greece.html, accessed August 13, 2011.

[6] Tracy Alloway, “Goldman’s Trojan currency Swap,” ft.com/alphaville, February 9, 2010, http://ftalphaville.ft.com/blog/2010/02/09/145201/goldmans-trojan-greek-currency-swap/, accessed August 7, 2011.

[7] Nick Dunbar, “Revealed: Goldman Sachs’ mega-deal for Greece.”

[8] Nick Dunbar, “Revealed: Goldman Sachs’ mega-deal for Greece.”

[9] Elisa Martinuzzi, “Goldman Sachs, Greece Didn’t Disclose Swap Contract (Update1),” Bloomberg, February 17, 2010, http://www.bloomberg.com/apps/news?pid=newsarchive&sid=asBNXSLtlN9E, accessed August 14, 2011.

[10] Nick Dunbar, “Revealed: Goldman Sachs’ mega-deal for Greece.”